Summary:

- Pfizer’s transition from COVID revenue faces skepticism, as PFE underperformed its healthcare peers recently.

- Successful integration of Seagen is crucial for Pfizer’s oncology portfolio, potentially lifting investor sentiment.

- Pfizer’s cautious approach to weight loss drugs suggests success is far from certain, raising its execution risks to disrupt the market.

- Significant cost-cutting efforts targeting over $4B in savings are critical for near-term profitability and improving earnings outlook.

- I explain why PFE’s growth-adjusted valuation bolsters its bullish thesis, as the market seems to have reflected significant pessimism.

no_limit_pictures

Pfizer: Moving On From COVID Is Easier Said Than Done

Pfizer’s (NYSE:PFE) stock has underperformed its healthcare (XLV) peers since PFE topped out in late July 2024. As a result, the market is likely still concerned with the revenue outlook uncertainties emanating from its COVID franchise. The company believes it has made significant progress from its reliance on its COVID revenue. Despite that, I assess that the market will likely view the progress with a healthy dose of skepticism, as the developments are still nascent.

In my previous bullish PFE article, I highlighted my confidence in the company’s ability to “move on” to other growth drivers. However, the stock’s relative underperformance has dampened investor sentiment, suggesting execution risks are expected to remain.

Pfizer: Integrating Seagen Well Is Critical

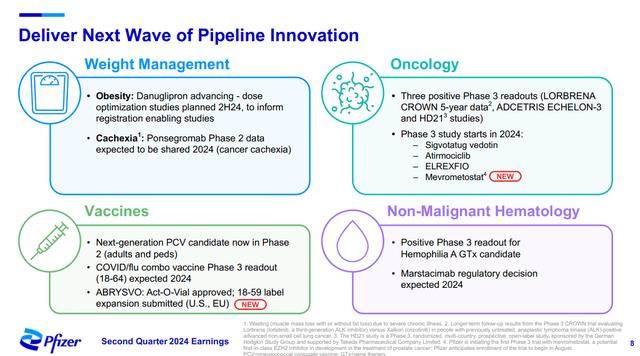

Pfizer Q2 earnings presentation (Pfizer filings)

Notwithstanding Pfizer’s improved guidance at its Q2 earnings release, the market will likely want more proof points from its Seagen integration. Executing the Seagen integration well is fundamental to the success of its oncology portfolio. It presents one of Pfizer’s four underpinnings in its bid to convince the market of its ability to move on from its COVID success.

Notably, its potential success with ADCs must be scrutinized, as they could significantly enhance the operational improvement in Pfizer’s oncology portfolio. Several milestones are aligned with the ongoing late-stage trials. In addition, its overall oncology revenue rose by 27% YoY in Q2, demonstrating its solid execution in its key growth driver. Therefore, I urge Pfizer investors to continue paying close attention to its pipeline progress, given its critical role in reestablishing its growth recovery.

Pfizer’s Success In Weight Loss Drugs Not Automatic

In addition, Pfizer is increasingly confident in penetrating the blockbuster weight loss drug category. The success of market leaders Eli Lilly (LLY) and Novo Nordisk (NVO) has spurred a wave of R&D innovations aimed at potentially disrupting the weight loss drug market. However, Wall Street is confident that the first-mover advantage embedded in the leadership of LLY and NVO could be sustained, potentially increasing the execution risks for Pfizer.

Pfizer expects to position Danuglipron favorably against the market leaders and peers. It believes that the cautious approach undertaken in preparation for a “large-scale phase III study” is apt, given its ability to disrupt the market with its once-daily formulation. As a result, investors must monitor the studies carefully as they could significantly impact their launch timeline, even as Lilly and Novo Nordisk seek additional indications to enlarge their TAM. Hence, I assess that the market has likely determined that Pfizer isn’t close to developing a breakthrough product, notwithstanding its potential. With that in mind, the focus has likely turned to its cost-cutting initiatives to bolster near-term performance.

Critical to Pfizer’s near-term profitability growth inflection is its significant cost-cutting efforts to achieve more than $4B in net savings. As a result, the program aims to “realign its cost base” in the post-COVID era, potentially helping to improve its earnings outlook. In addition, leveraging its manufacturing optimization program through 2027 could shave off another $1.5B from its OpEx base. The company anticipates a favorable impact on its operating efficiencies from 2025. Therefore, I believe that the market is likely assessing the tailwinds of its cost-cutting efforts while balancing them against the headwinds of its portfolio transition from its COVID franchise.

PFE Stock: Growth Outlook Remains Challenging

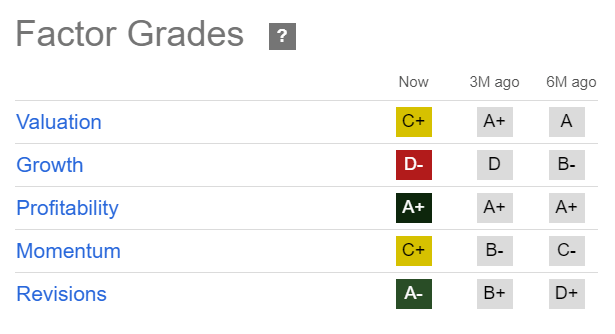

PFE Quant Grades (Seeking Alpha)

PFE’s “D-” growth grade underscores the inherent challenges of its transformation. Wall Street estimates on Pfizer have been upgraded, providing more support as the company revised its outlook. However, I assess that the stock’s recent underperformance suggests investors likely expect increased execution risks in its attempt to penetrate the weight loss drug market. In addition, the market will likely prefer a more robust outlook for its oncology portfolio before lifting its valuation higher.

As seen above, PFE’s buying momentum has waned over the past three months (it declined from “B-” to “C+”). However, the selling intensity that dominated its decline over the past year seems to have dissipated, providing a more constructive basis for investors to buy into its pullbacks.

Is PFE Stock A Buy, Sell, Or Hold?

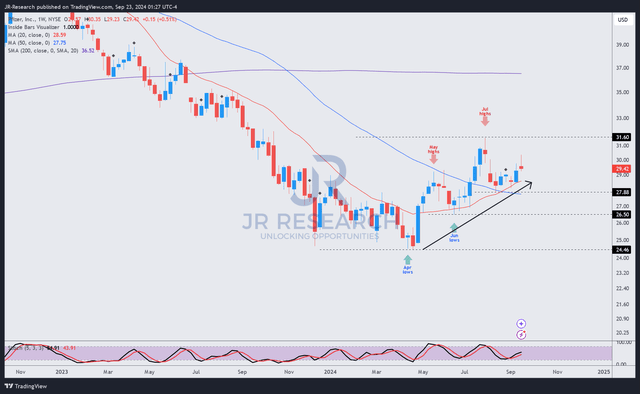

PFE price chart (weekly, medium-term, adjusted for dividends) (TradingView)

PFE price action is increasingly bullish, notwithstanding the pullback from its July 2024 highs. As seen above, it has consistently recorded higher lows and higher highs since its long-term bottom in April 2024.

Hence, the stock’s performance over the past five to six months has corroborated its bullish thesis. In addition, PFE’s forward adjusted PEG ratio of 1.16 (more than 40% below its sector median) corroborates its relative undervaluation. In other words, the market seems to have factored significant execution risks against its portfolio transformation from its COVID franchise. A better-than-anticipated forward outlook could spur a valuation re-rating, improving the long-term outlook for high-conviction investors.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!