Summary:

- Pfizer’s stock has dropped due to a decline in revenues post-COVID, presenting a value investment opportunity.

- The company still generates significant gross profit and has a strong revenue growth rate.

- Pfizer’s low Price-to-Earnings ratio and impressive cash flow make it an attractive investment, especially considering its pending acquisition of Seagen.

- As such, we believe Pfizer is currently a buy.

Dan Kitwood

Introduction

Over the last few months, the indexes have been carried by the big tech stocks. While the rest of the market has struggled and many stocks have been struggling. As such, some interesting value opportunities are now arising.

You might be thinking, “The economy is struggling, the market outlook isn’t great, and inflation will be higher for longer”. We agree with you, these are all valid concerns, but one can’t be afraid to bite the bullet once deep value opportunities arise.

While the ‘Fear & Greed’ index is in extreme fear territory, many investors remain afraid to buy stocks they have been waiting on for a long time. We discussed the fear and greed index and its components in-depth on X.

In this article, we will take a look at Pfizer’s (NYSE:PFE) current valuation and what to expect for the future. We will compare them to competitors, take a look at the charts, take a look at the risks, and much more. In addition, we will look at how you can amplify your returns and protect your position in times of declining markets.

We believe Pfizer is a compelling opportunity to invest in one of the world’s leading pharmaceutical companies with cutting-edge research and development capabilities.

Why Has The Stock Dropped So Much?

After the COVID-19 crisis, it was hugely beneficial for Pfizer because their vaccines were considered the best. As such, Pfizer’s revenues soared. In more recent years, COVID-19 is becoming less of an issue.

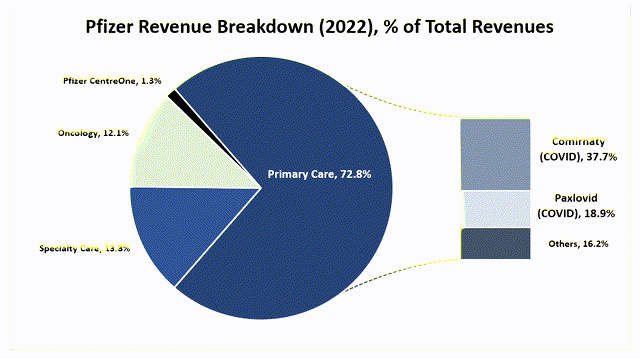

The revenue decline can easily be understood when we look at Pfizer’s revenue in 2022. As can be seen below, COVID-19 treatments made up over 56% of the company’s revenues.

Fortunately, COVID-19 hasn’t been a serious threat anymore over the last year. As such, PFE’s revenues took a big hit, as one could have expected.

Unless we see a huge surge in infections, these revenues will never return. As such, a big part of the price decline can be attributed to the decrease in revenue. Nevertheless, we believe Pfizer’s stock has simply fallen too much, and now Pfizer might be too cheap to ignore.

Valuation: Deserved Beating?

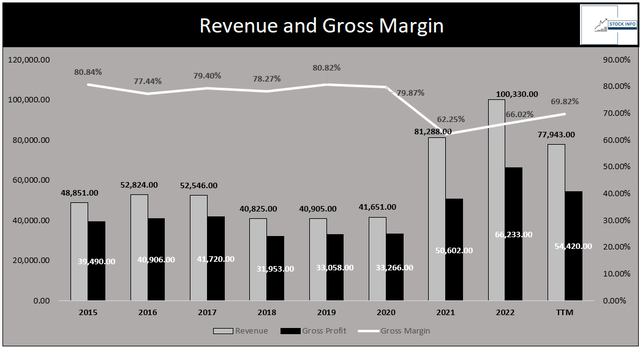

Looking at the significant downfall the stock had over the last few months, we would almost think the company has lost its ability to make money. Nevertheless, the company is still a gross profit machine, generating $54.42B on a trailing twelve-month basis.

Important to mention is that the 5Y Revenue CAGR of PFE is simply amazing which is currently standing at 19.70% (2022). Nonetheless, this will have a serious slump once 2023 numbers are fully known.

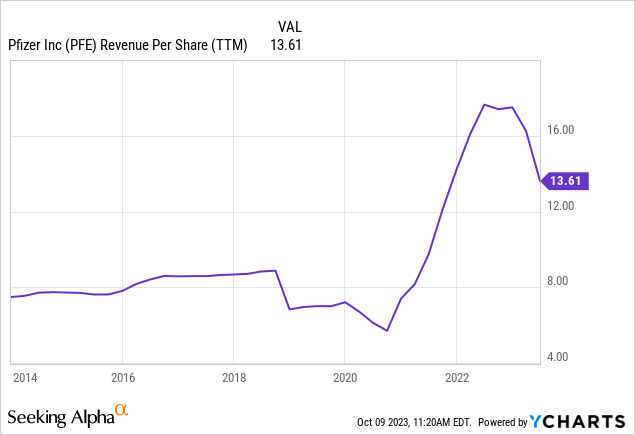

Nonetheless, it is clear that Pfizer is still a behemoth with strong revenues and a close to 70% gross margin. When we take a look at the chart below, we can see that Pfizer’s revenue per share is sitting at $13.61, which is significantly higher than in December of 2021 when the stock reached its all-time high at almost double the price the stock is at today.

YCharts

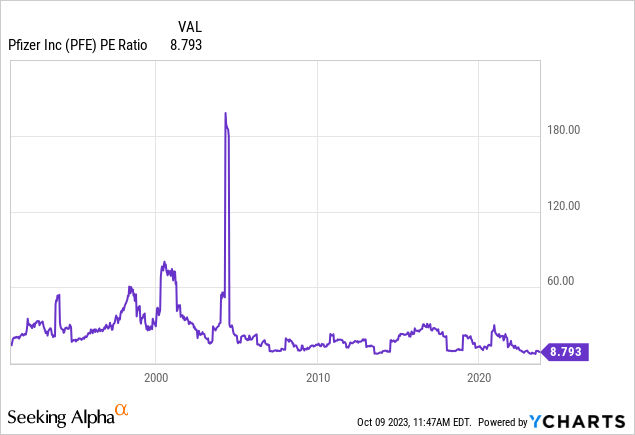

In addition, when looking at PFE’s historical P/E ratio, we can see the company is currently trading near its all-time low at just 8.793.

YCharts

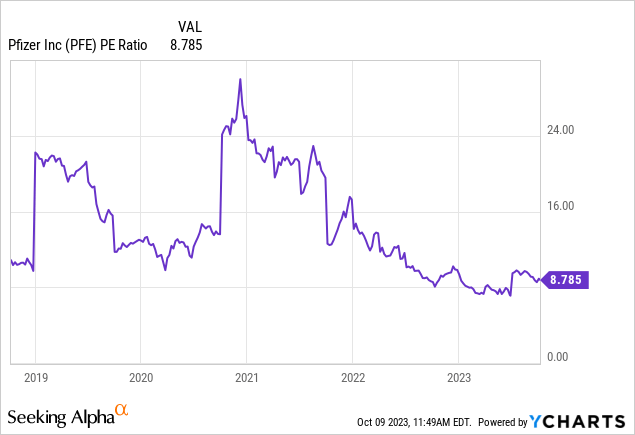

When we look at the 5Y chart, we can see the current situation more clearly. When the stock was trading at its ATH in December 2021, the company’s P/E was close to 30.

YCharts

Even if we use a rather conservative P/E valuation between 12x and 15x, this would provide significant upside, and this suggests the current pricing is extremely attractive and significantly below the historical average.

Furthermore, Pfizer is still a cash flow machine. The company generated over $26B in FCF in 2022. When looking at this number, the company currently has an FCF Yield of 13.92%, which is incredible for a large cap like Pfizer. When looking at a TTM basis, the company has an FCF yield of 5.70%, which is still impressive. This indicates that the company is able to buy itself back in 17.5 years.

In addition, the company has a ROIC of 18.01% (‘TTM’), which indicates that for every $100 the company invests in its business, it can generate an additional $18.01 in operating income.

M&A And Spin-Offs

In recent years, the “Big Pharma” companies seem to be refocusing on their core business and even reinventing their business. Just like their competitors, Pfizer decided to spin-out of its Upjohn business and combine it with Mylan, which is now forming a listed entity in Viatris (VTRS).

For investors, this seemed like a weird move; some of Pfizer’s strongest revenue-generating products, like Viagra and Lyrica, were spun off. While the revenues of these products were falling, they still accounted for $10B in revenues in 2019. So when the spin-off was announced in late 2020, investors were questioning this move of the management team.

Nonetheless, we have seen that spin-offs are not a rare occurrence in today’s world. For example, recently, Johnson & Johnson (JNJ) spun out its consumer health division and formed a new entity named Kenvue (KVUE), which is publicly listed and currently is valued at $37.5B at the moment of writing. Another spin-off we saw in Big Pharma was the formation of Organon (OGN) in 2020, and this was the previous women’s health and legacy brand division from Merck & Co. (MRK).

Due to the large profits Pfizer generated over the last three years, the company was able to hoard a large amount of cash on its balance sheet, which it then used to spend on M&A. This resulted in a spending spree of over $27B in just two years. In addition, the biggest deal of them all is still on the table, with Pfizer offering $229 per share or $43B in total for Seagen (SGEN). This deal is expected to close somewhere at the end of the year or at the beginning of next year.

We expect that this deal is likely to be approved by the Federal Trade Commission’s (FTC). This would be a huge boost for Pfizer’s pipeline as Seagen can be considered a powerhouse in the oncology realm, with a specialization in ADCs, also known as antibody-drug conjugates.

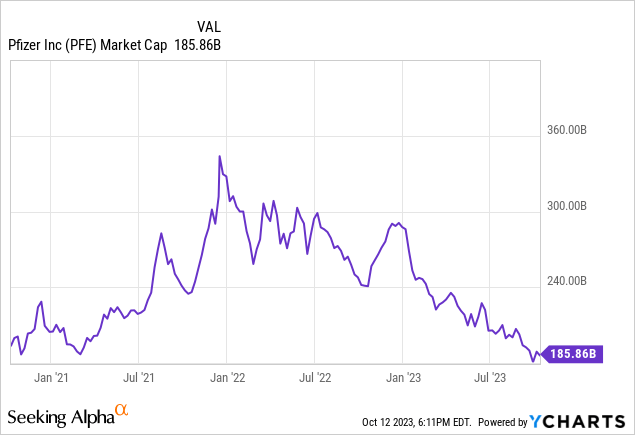

This would bring Pfizer’s total M&A spending to an enormous $70B, considering that Pfizer is currently trading at around $185B in market cap. This means that they spend close to 40M of their market cap on M&A over the last few years. Nonetheless, Pfizer was valued at around $350B at its peak at the end of 2021, as can be seen in the chart below, so this puts this number in a better perspective.

YCharts

Peers and Valuation Model

In this paragraph, we will be looking at Pfizer and how it compares to some of its peers and others in the industry. In addition, we will look at a valuation model for Pfizer.

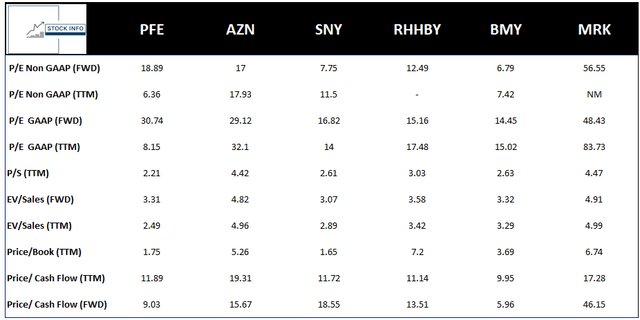

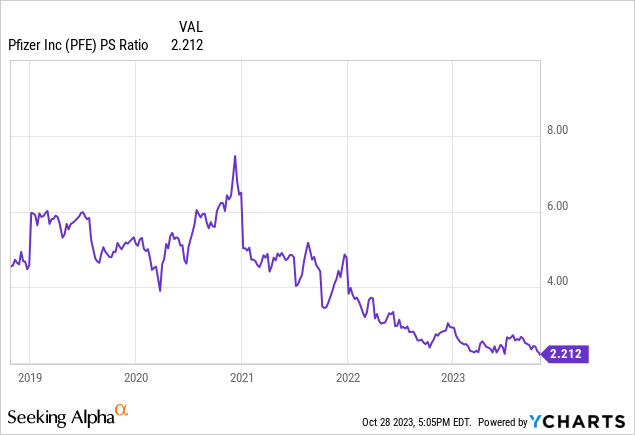

In the image below, you can see that Pfizer can be considered the cheapest out of the bunch based on multiple metrics. For example, on a P/S ratio, Pfizer is trading at 2.21x while other vaccine makers like Merck and AstraZeneca (AZN) are trading at much higher multiples with 4.47x and 4.42x, respectively.

Furthermore, you can see that only Bristol-Myers (BMY) is trading cheaper than PFE based on price-to-cash flow. In addition, Pfizer’s 1.75 price-to-book value is only beaten by Sanofi’s (SNY) 1.65 price/book value.

For the valuation model, we need to take the acquisition of Seagen into account. Seagen currently brings in $2B in revenue but is expected to bring in $10B in revenue by 2030. Again, we need to keep in mind that this acquisition is a step in the right direction for Pfizer and that this will be a big revenue driver in the years to come.

Because Pfizer buys SGEN in an all-cash deal, this will affect the balance sheet. Nonetheless, Pfizer shareholders should be happy with this deal.

When we take a look at the price-to-sales (P/S) ratio in the chart below, you can see that it has been on a serious decline since the COVID-19 crisis reached its peak.

YCharts

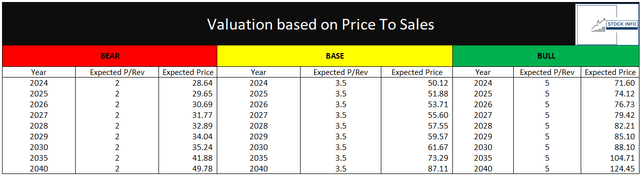

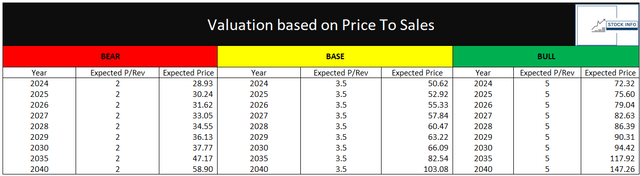

Nevertheless, we can see that the P/S ratio has been significantly higher in prior years. As such, we have made a bear, base, and bull case for the stock based on a P/S ratio.

Some other assumptions we made are a 3% revenue growth CAGR, which is relatively low in comparison to their 10 revenue growth CAGR of 4.09%. In addition, we considered a decrease in shares outstanding of 0.50% each year.

We used a P/S of 2, 3.5, and 5 in the bear, bull, and bull cases, respectively. This gives the following results:

It is important to keep in mind that these models obviously require a lot of assumptions, and no one can look into the future. Nevertheless, valuation models are great to get a perspective on the possibilities of your investment.

In case PFE decides to start buying back shares much more aggressively, for example, with 1.5% per year, and we keep all of the other assumptions the same, we would get the following results:

As you can see, this makes a big difference in the long run. But management plays a big part in this, and unfortunately, I’m not convinced the management team has what it takes to turn this company around.

Furthermore, the company now has a 5.50% dividend yield, which would make it a solid investment for income-seeking investors. Nevertheless, I believe the company should now focus on buybacks instead of paying dividends, as this will be more beneficial for long-term investors.

Conclusion

In a market characterized by turbulence and uncertainty, Pfizer is emerging as a compelling opportunity for value-minded investors. This pharmaceutical giant, renowned for its cutting-edge research and development capabilities, has faced headwinds recently, primarily due to the post-COVID-19 decline in revenues. The pandemic had significantly boosted Pfizer’s revenues, especially through vaccine sales, but as the global health situation stabilized, this revenue stream naturally receded.

While this decline was expected, it resulted in a sharp reduction in Pfizer’s stock price, arguably beyond what was warranted. The company is far from losing its capacity to generate profit. In fact, it’s still a gross profit machine, with a trailing twelve-month gross profit of $54.42 billion.

Pfizer’s 5-year Revenue Compound Annual Growth Rate (CAGR) has been impressive, standing at 19.70% in 2022. This rate will naturally dip as post-pandemic revenues stabilize. However, the company’s fundamental strength remains intact, with a gross margin close to 70%. Despite the recent dip, the revenue per share remains significantly higher than in December 2021, when the stock hit its all-time high.

The current Price-to-Earnings (P/E) ratio for Pfizer is historically low, and when compared to its all-time high, it’s evident that the stock is trading at a substantial discount. Moreover, Pfizer continues to be a cash flow powerhouse. It generated over $26 billion in Free Cash Flow (FCF) in 2022, with a remarkable FCF yield of 13.92%. This strength in FCF implies the company can repurchase its own shares in just 17.5 years based on its current cash flow.

Pfizer’s recent mergers and acquisitions, particularly the pending acquisition of Seagen, have the potential to boost the company’s pipeline, especially in the field of oncology. Although Pfizer has invested heavily in M&A, it’s important to consider this in the context of the company’s historical market capitalization.

Comparing Pfizer to its peers and analyzing various valuation models, it becomes evident that the stock offers a compelling investment opportunity. It trades at attractive multiples when compared to similar companies in the industry. With a dividend yield of 5.50%, Pfizer stands as a sound investment for income-seeking investors.

In conclusion, Pfizer’s recent stock price decline, while driven by changes in the company’s revenue mix post-COVID, presents a compelling investment opportunity. The company’s strong fundamentals, low valuation metrics, and strategic initiatives, including mergers and acquisitions, make it an attractive prospect in a market marked by uncertainties.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.