Summary:

- Pfizer’s stock has declined by -44.6% in 2023, but there may be an opportunity for long-term investors due to its current valuation.

- Pfizer’s financials show that it is still profitable and has a strong balance sheet, despite a decline in revenue and profitability.

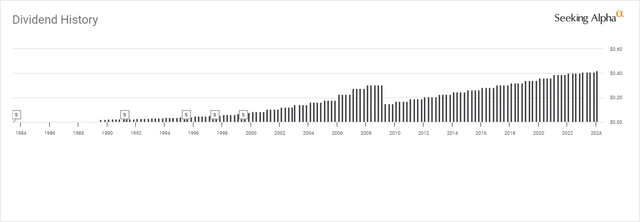

- Pfizer backstopped its dividend with a 2.4% increase, indicating confidence in its ability to maintain dividend payments.

PM Images

I am not a trader, and my preference is to invest in companies that I think will do well over a long period of time. Timing the markets is extremely difficult, and I know it’s something I don’t excel at. I prefer to take a data-driven approach and make investments based on valuations and the future relevance of the business. Pfizer (NYSE:PFE) has declined by -44.6% in 2023, and 52-week lows were just established after its 2024 outlook came in below expectations. I am a long-term investor and have time on my side. Pfizer’s chart is horrible, but there is a chance shares may have bottomed as Pfizer sent a message by backstopping the dividend with a 2.4% increase on December 15th. Shares of Pfizer can certainly decline further, but the current valuation is making me believe there is an opportunity to put capital to work here. While I am a shareholder of Pfizer in my Dividend Harvesting Portfolio series on Seeking Alpha (can be read here), Pfizer hasn’t made it into my real dividend account. I am planning on starting a position and writing covered calls against the shares I purchase to generate additional income. If the shares of Pfizer start to sell off again, I will dollar cost average into the position as I believe in 2025 or 2026, investors will look back on these prices and wish they bought the panic.

Following up on my previous article about Pfizer

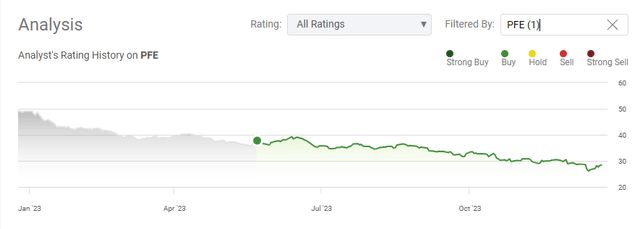

I had written an article in May on Pfizer (can be read here) where I discussed why I was starting a position in my Dividend Harvesting Series and that I was considering adding Pfizer to my main dividend account. Since the article, shares of Pfizer have declined by -22.95%, and when the dividend is factored in, the total return has been -21.04%. Over this period, the S&P 500 has appreciated by 13.48%. I have dollar cost averaged into my Pfizer position, but I didn’t add it to my main dividend account as shares have continued to fall. I am now ready to pull the trigger and take a much larger position in Pfizer, as shares may have found a bottom around the $26 level. I am following up on my previous article to discuss why I am adding Pfizer to my main dividend account and why I think Pfizer can be an opportunity for long-term investors.

I was early with this call, but I think Pfizer is now more compelling under $30 for long-term investors

There are many reasons why Pfizer shares have declined in 2023, from a negative stigma about the COVID-19 vaccine to declining profitability and lower guidance than anticipated for their 2024 fiscal year. Before diving into the financials or anything else, I think about two things when it comes to Pfizer. What is the probability that Pfizer goes out of business, and would anyone really be shocked if Pfizer was trading at $40 or $50 per share in the future? I think it’s unlikely that Pfizer will go under, and if shares are traded at $40 or $50 in the future, it won’t look like an anomaly.

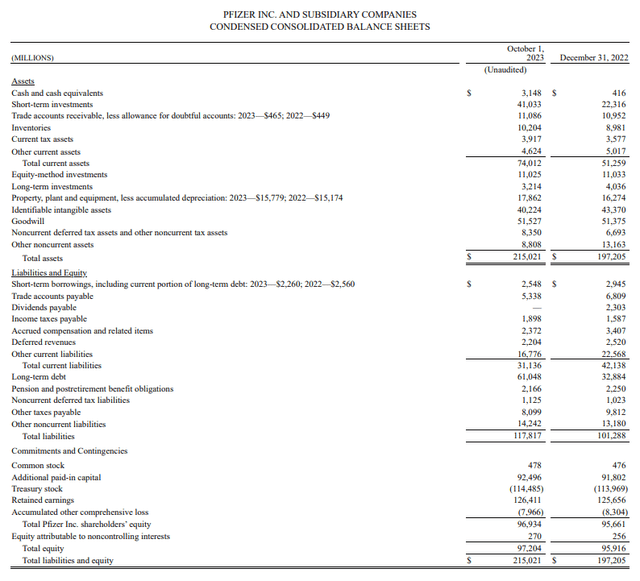

I am not a biochemist or a medical professional, so when I look into Pfizer, I am looking at it from a business standpoint. I am buying shares of Pfizer, which has $44,18 billion in cash on hand between actual cash and short-term investments that can be liquidated, and another $14.24 billion in long-term investments. Pfizer looks to have raised around $30 billion from issuing debt between Q1 and Q2 as its long-term debt increased from $31.98 billion to $61.67 billion. Pfizer just announced that they completed the acquisition of Seagen for a total enterprise value of $43 billion. Pfizer will finance the deal from new long-term debt that has been issued and a combination of short-term financing and existing cash.

While revenue and profitability have declined sharply from the surge during the pandemic, Pfizer is still extremely profitable. Utilizing Pfizer’s 2022 fiscal year and the current trailing twelve months (ttm), Pfizer’s revenue has declined by -31.69% YoY. This has caused its gross profits to decline -43.47%, net income to decline -66.59%, EBITDA to decline -58.85%, and its free cash flow (fcf) to decline -68.58%. Despite the large drop in revenue and profitability, Pfizer still has a strong balance sheet and is extremely profitable. In the TTM, Pfizer has generated $68.54 billion in revenue, and has a gross profit margin of 54.63%, having produced $37.44 billion in gross profit. In the TTM, Pfizer has generated $10.48 billion in net income for a 15.29% profit margin and $8.18 billion in FCF for an FCF yield of 11.93%. Even though Pfizer has seen a large YoY decline, it’s still operating at attractive margins and generating billions in pure profits.

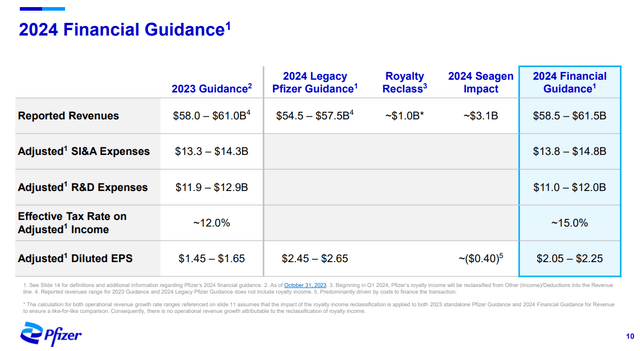

At the December investor conference, Pfizer delivered 2024 guidance, which came in below expectations. Pfizer had guided to generate $58-61 billion in revenue and $1.45 – $1.65 of adjusted diluted EPS in 2023. Its 2024 legacy Pfizer guidance declined to $54.5 – $57.5 billion in revenue, and the adjusted diluted EPS increased to $2.45 – $2.65. The Seagen acquisition is projected to add $3.1 billion to top-line revenue in 2024, but has a -$0.40 impact on adjusted diluted EPS, bringing the range down to $2.05 to $2.25.

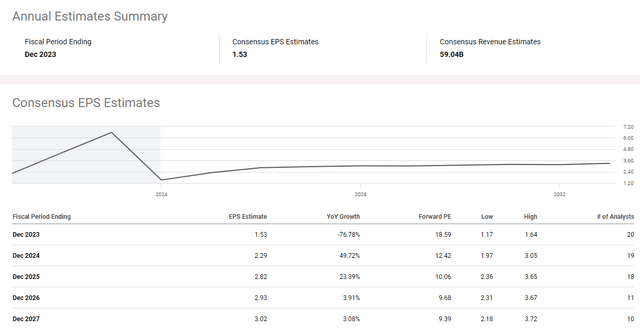

At the low end of the 2024 EPS range of $2.05, I am now paying 13.85x 2024 earnings with shares at $28.40. Citigroup (C) recently reduced its price target on Pfizer to $28 from $35 but indicated that it sees Pfizer generating $2.49 of EPS in 2024 as it feels Pfizer is being conservative to rebuild investor confidence. Even if Pfizer only hits the low end of $2.05 I am still paying less than 15x its 2024 earnings for them today. The Street is also projecting that there will be roughly 23.39% in YoY EPS growth in 2025 as 19 analysts have Pfizer generating $2.29 of earnings in 2024, and 18 analysts have EPS coming in at $2.82 in 2025. Pfizer is trading around 10x 2025 earnings, and I am not sure if these analyst estimates include the fact that in 2026 Pfizer expects to achieve nearly $1 billion in cost efficiencies from the Seagen acquisition. These efficiencies are likely to be felt over the next three years and could be more impactful to the bottom line than some may be anticipating.

Pfizer backstopped the dividend and took away fears of a cut

The safest dividend is typically one that has just been raised. After Pfizer released its 2024 guidance, some speculated that the dividend could come under pressure. Pfizer backstopped the dividend by providing investors with a 2.4% increase to the quarterly dividend, taking it to $0.42 from $0.41. This marks the 13th year of consecutive dividend increases, and Pfizer will now have 34 years of consecutive dividend payments being made. This takes the annualized dividend payment to $1.68, which would place its dividend payout ratio at 81.95% if Pfizer only makes the low end of their 2024 EPS projections.

It’s hard for me to envision a dividend cut when management just increased the dividend. The other factor I am considering is that the analyst projection for Pfizer’s EPS in 2025 is $2.82 per share. If Pfizer were to increase the dividend by 2% in 2025 and these EPS projections occur, they would be paying $1.71 per share on $2.82 EPS, which would be a 60.77% payout ratio. I am more than happy to get paid 6% to own Pfizer with a growing EPS that should support future dividend growth.

Risks of investing in Pfizer

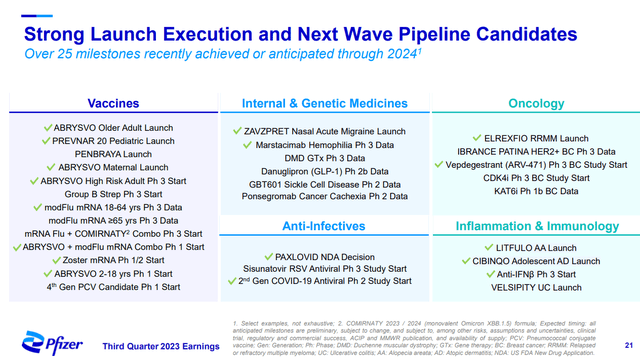

While Pfizer may look compelling, there are certainly risks to the investment thesis. R&D and clinical trials are expensive. There is no guarantee that the pipeline of drugs that Pfizer is working on will get approval from the FDA, and even if they do, there is still a risk that widespread adoption won’t occur. The chart is ugly, and just because shares bounced off the dividend news, it doesn’t mean that a reversal is guaranteed, as shares can still decline further. If the Seagen acquisition isn’t successful, then Pfizer could be forced to reduce the dividend to help deleverage the balance sheet after taking on $31 billion in debt to help finance the deal. Investing in Pfizer comes with risks, and it’s going to take some time to see how things play out.

Conclusion

I think that Pfizer has declined so much that it’s going to look appealing to investors in 2024. As the risk-free rate of return declines and a Fed Pivot approaches, Pfizer’s yield of 5.92% could look very enticing. There is over $6.1 trillion in money market accounts, and there will be less of a reason to stay in risk-free assets as yields decline. I think Pfizer will attract investors as it trades at less than 15 times the low end of 2024 earnings and roughly 10 times the projected earnings for 2025. I am planning on building a long-term position in Pfizer and reinvesting all the dividends along the way. I think Pfizer could be a prime candidate for capital appreciation and modest yield in 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.