Summary:

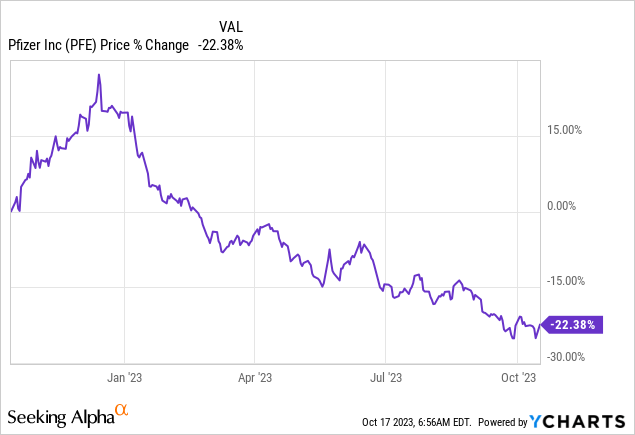

- Pfizer’s shares are trading near 1-year lows due to a reduced earnings and revenue forecast for FY 2023.

- Pfizer is still a very profitable drug enterprise with very good dividend coverage.

- Despite short-term issues, Pfizer remains a long-term capital return play with strong earnings and dividend growth potential.

- Shares trade at a P/E ratio of only 10X.

Michael M. Santiago

Shares of Pfizer (NYSE:PFE) are at risk of dropping to new selling pressure after the drug manufacturer cut its earnings and revenue forecast for FY 2023 last week due to plunging COVID-19 vaccine sales. The warning also highlighted Pfizer’s need to realign its cost structure with lower expected levels of profitability going forward.

In response to shrinking sales as well as COVID-19 product inventory write-downs, Pfizer has said that it is going to focus on implementing $3.5B in cost savings (on an enterprise basis) which could boost Pfizer’s earnings growth in the coming quarters. While top line growth is slowing, I see Pfizer chiefly as a long term capital return play, driven by strong free cash flows. Pfizer is also set, in my opinion, to continue to grow its dividend and has a strong product pipeline which could offset declining vaccine sales going forward.

COVID-19 driven earnings boom is coming to an end

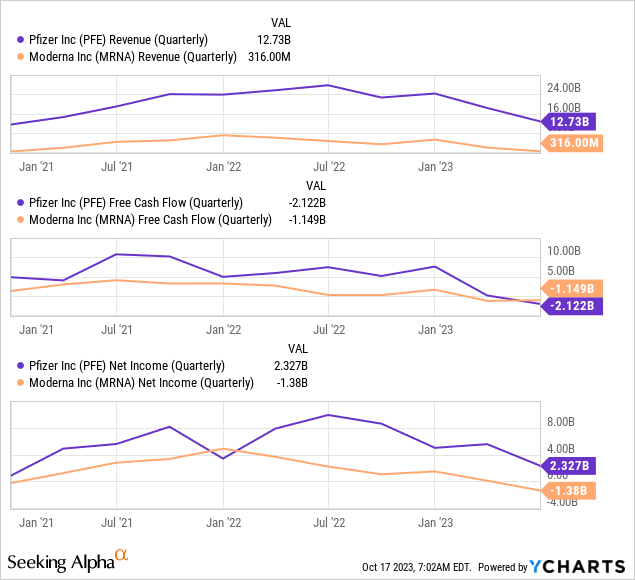

Pfizer-BioNTech’s and Moderna’s MRNA COVID-19 vaccines were the two most-widely dispersed vaccines during the pandemic which led to an unprecedented earnings boom at the two drug manufacturers. Both companies succeeded in getting a vaccine out of the door the fastest at the beginning of the pandemic, allowing both Pfizer and Moderna to capture billions of dollars in pandemic-driven earnings.

Pfizer’s as well as Moderna’s revenues, earnings and free cash flow boomed during the 2020-2022 years, but growth is slowing as pandemic-driven demand is falling, resulting in a top line/EPS guidance down-grade for Pfizer on Friday.

Pfizer said on Friday that it now expects $58-61B in full-year consolidated revenues (Source), showing a significant decline from a previous range of $67-70B. The issue is the company is facing is that demand for its COVID products is waning which unfortunately also led to Pfizer writing down the value of its inventory: the drug company said that it took a $5.5B charge (non-cash) in the third-quarter, citing “lower-than-expected demand.” Pfizer confirmed that it was still looking to achieve 6-8% top line growth in the non-COVID product category.

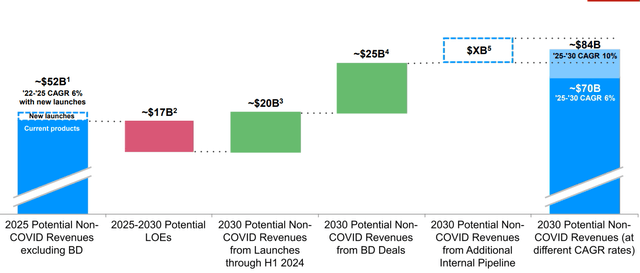

Going forward, however, Pfizer’s growth is set to come from non-COVID products. According to Pfizer’s long term financial framework, the firm anticipates to generate $84B in non-COVID revenues by FY 2030.

As a result of the demand slowdown for COVID-19 products, Pfizer also lowered its EPS expectations for FY 2023 drastically: the firm now projects $1.45 to $1.65 per share in adjusted diluted earnings… which is down from a previous range of $3.25 to $3.45 per share.

Pfizer is a capital return play with a growing dividend and a near-5% yield…

Pfizer remains a free cash flow and capital return play that is set for long term dividend growth. Pfizer achieved record free cash during the pandemic years and while the drug maker’s earnings prospects have faded due to shrinking demand for the company’s blockbuster COVID-19 vaccine, Pfizer has considerable earnings power.

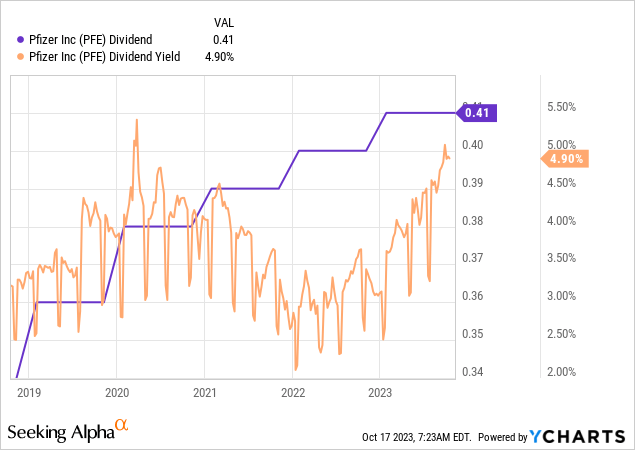

In the first six months of the year, Pfizer made $7.9B in profits and paid $4.6B in cash dividends, implying a dividend coverage ratio of 172%. The firm also had $3.3B on its buyback authorization outstanding, meaning investors could see even higher capital returns going forward. Since Pfizer’s dividend is still growing, shareholders may want to see Pfizer trading near 1-year lows as a contrarian buying opportunity, in my opinion.

Pfizer’s valuation vs. other drug makers

Analysts expect $2.56 per-share in earnings this year and $3.24 per-share next year, implying 26% year over year growth. While growth is dropping off this year as key COVID-19 product prospects decline, Pfizer is expected to see a strong EPS rebound next year… which could potentially even be larger if the firm’s cost restructuring pays dividends.

As a result, I see a contrarian investment opportunity here as Pfizer does have an opportunity to reinvest its record pandemic earnings into new winning products and should emerge a leaner company once the cost-savings program bears fruit.

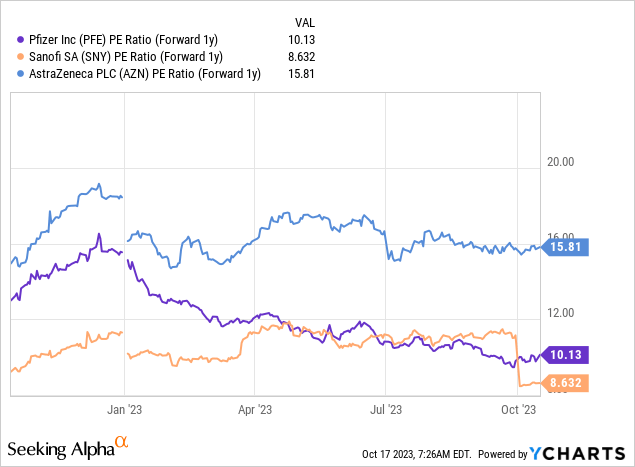

Pfizer is currently trading near 1-year lows and at a very attractive 10 P/E ratio (earnings yields of 10%. Drug rivals AstraZeneca (AZN) and Sanofi (SNY) sell at both higher and lower earnings multiplier factors, but considering that Pfizer pays a near-5% dividend, I consider PFE to be an especially interesting bargain for dividend investors.

Risks with Pfizer

Pfizer is currently out of favor, but not for very good reasons, in my opinion. Pfizer cashed in during the pandemic and has a non-COVID-19 portfolio to fall back on to generate growth and Pfizer has said that it plans to grow its non-COVID revenues to $84B by the end of the decade. If Pfizer fails to achieve this or fails to implement an effective cost cutting program, this would likely hurt the shares’ prospects for an upside revaluation. A consecutive guidance down-grade would also be a negative event for shareholders.

Final thoughts

I believe Pfizer’s earnings and top line warning from last week represents a speculative buying opportunity. Shares are close to trading at new 1-year lows which I believe offers contrarian investors a chance to buy at a truly compelling valuation. Investors are currently under the influence of the guidance revision, driven by COVID-19 product inventory write-offs and slowing demand for pandemic-area winning products, but Pfizer remains a very profitable drug enterprise with very good dividend coverage. The dividend is also set to grow going forward and shares are trading at just 10X forward earnings, implying a very favorable risk profile for investors, in my opinion. Dividend investors can currently grab a near-5% yield that is set to grow!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.