Summary:

- PFE’s fundamental performance has been decent despite the COVID-19 headwinds, with bullish support seemingly found at the $26s level.

- Despite a deteriorating balance sheet and upcoming patent cliff, the management continues to prioritize dividend safety and payout growth in the FQ1’24 earnings call.

- The market has also priced in improved Free Cash Flow generation from 2025 onwards, with rich yields of 6.05%, making PFE’s dividend investment thesis compelling.

- Combined with its inherent undervaluation, opportunistic investors may look forward to a potential capital appreciation ahead.

- It goes without saying that anyone adding here must size their portfolios accordingly, since it is undeniable that PFE’s debt load is immense, worsened by elevated R&D efforts and margin dilution from M&A activities.

DNY59

We previously covered Pfizer (NYSE:PFE) (NEOE:PFE:CA) in December 2023, discussing its pessimistic performance as the decelerating COVID-19 portfolio and underperforming bolt-on acquisitions had contributed to its mixed FY2024 guidance post-Seagen acquisition.

While the pharmaceutical company’s fundamental performance remained somewhat decent, it was apparent that bullish support had fled for greener pastures, such as generative-AI and weight loss stocks, with it remaining to be seen when a floor might materialize.

Since then, PFE has managed to trade sideways at +3.4% compared to the wider market at +9.7%, with bullish support seemingly found in the $26s.

Despite the deteriorating balance sheet, uncertain profitability, and upcoming patent cliff from 2025 onwards, the management has reiterated the safety of its dividends/ payout growth as its number one priority.

With the market pricing in improved Free Cash Flow generation from 2025 onwards, PFE’s dividend investment thesis appears to be compelling indeed, with the rich yields and recently raised payouts warranting an upgrade to an opportunistic Buy rating.

PFE’s Investment Thesis Appears To Be Tempting Now, Thanks To The Potential Bottoming

For now, PFE has reported a top/ bottom line beat FQ1’24 earnings call, with total revenues of $14.87B (+4.4% QoQ/ -19.5% YoY) and adj EPS of $0.82 (+720% QoQ/ -33.3% YoY).

Its COVID-19 pipeline continues to be accretive to its top-line, at $354M in sales for Comirnaty (-88.4% YoY) and $2.03B in sales for Paxlovid (-50% YoY), despite the over much pessimism embedded in its stock prices and valuations.

However, with the pandemic already well behind us, we believe that it is more prudent to refer to PFE’s core portfolio (excluding contributions from Comirnaty and Paxlovid), which continues to grow to $12.49B (+11.7% YoY) by the latest quarter, partly aided by the recently closed Seagen acquisition.

With Eliquis continuing to be a top-line driver at annualized revenues of $8.16B (+26.7% QoQ/ +9% YoY), Prevnar at $6.76B (+4.9% QoQ/ +5.6% YoY), and Vyndaqel family at $4.52B (+18.4% QoQ/ +65.7% YoY), with a smaller extent for Ibrance at $4.2B (-6.2% QoQ/ -7.8% YoY), we believe that PFE’s core portfolio continues to execute relatively well.

Lastly, the management has reaffirmed its FY2024 revenue guidance of $60B (+2.5% YoY) and adj EPS of $2.25 (+22.2% YoY) at the midpoint, implying its ability to move beyond the pandemic headwinds, significantly aided by the softer YoY comps.

However, given its patent cliff from 2025 to 2030 potentially resulting in an approximate $22B impact to its top-line, it is unsurprising that PFE has gone on multiple M&A and partnership sprees in an effort to boost its pipeline, as discussed in my previous article here and here.

These efforts have naturally resulted in the pharmaceutical giant’s deteriorating balance sheet, with higher long-term debts of $61.3B (inline QoQ/ +93.3% YoY/ +70.5% from FY2019 levels of $35.95B) and cash/ short-term investments of $11.92B (-5.9% QoQ/ -40.2% YoY/ +21.3% from FY2019 levels of $9.82B), indicating a growing net debt of $49.38B by FQ1’24.

This is compared to $48.85B in FQ4’23, $11.74B in FQ1’23, and $26.13B in FY2019.

With PFE’s net-debt-to-EBITDA ratio also bloated at 5.23x, compared to 1.1x in FY2019 and the General Drug Manufacturers average of 2.27x, it is apparent that there remains a great distance to its leverage target of 3.25x.

This has also directly contributed to its hefty annualized interest expense of $2.64B (+726.2% QoQ/ +368.7% YoY), triggering headwinds to its bottom lines ahead, worsened by the intensified annualized R&D expenses of $9.96B (inline YoY/ +29% from FY2019 levels of $7.72B).

Despite the well-laddered long-term debts, PFE’s ability to considerably grow its dividends is worrying indeed, based on the approximate LTM Free Cash Flow generation of $5.1B and annualized dividend obligations of $9.48B.

The same has been observed in the Seeking Alpha Quant, with TTM Interest Coverage ratio of 1.15x and TTM Dividend Coverage ratio of 1.40x, compared to the sector median of 6.94x/ 3.77x and PFE’s 5Y average of 15.28x/ 2.38x, respectively.

While we are not so bearish as to suggest a dividend suspension and the end of its 34Y consecutive payouts, based on the recent hike by +2.4% to $1.68, we may see PFE report a very slow deleveraging process ahead.

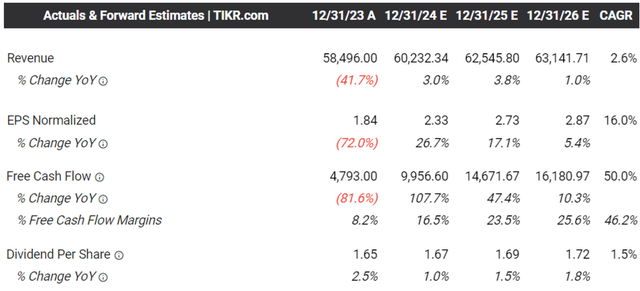

The Consensus Forward Estimates

The same has been observed in the consensus forward estimates, with PFE expected to report minimal growth in FCF generation in 2024.

Then again, with things expected to improve from 2025 onwards, it appears that the market is increasingly optimistic about its intermediate term prospects, likely attributed to the management’s ongoing cost-realignment program with $4B in expected savings and eventually, profit margin expansions.

Most importantly, the PFE’s CFO has reiterated the safety of its dividends in the FQ1’24 earnings call, lending further credibility to its dividend investment thesis:

And then finally, as we think about the balance sheet, first and foremost, I just want to reiterate that our number one priority from a capital allocation perspective is both supporting and growing our dividend over time, and that is not at risk. (Seeking Alpha)

So, Is PFE Stock A Buy, Sell, or Hold?

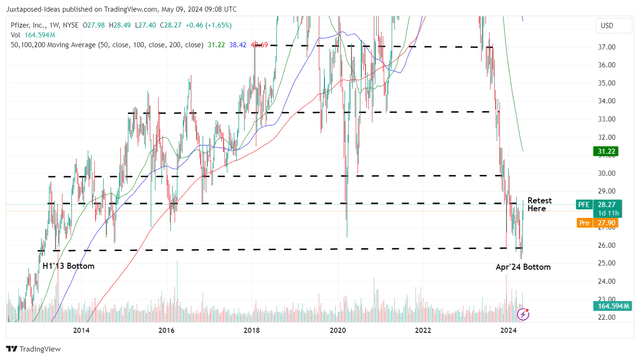

PFE 12Y Stock Price

And it is for this reason that we believe that PFE has been well-supported at the April 2024 and H1 2013 bottom of $26s, with the stock also recovering to $28s at the time of writing, reversing the steep decline thus far.

As with most dividend stocks, its forward yields appear to be tempting at 6.05% as well, compared to the sector median of 1.55% and the US Treasury Yields at between 4.5% and 5.4%.

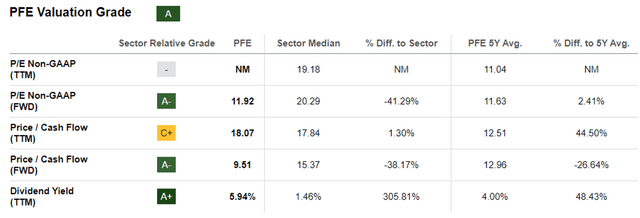

PFE Valuations

At the same time, PFE is trading rather attractively at FWD P/E valuations of 11.92x, nearer to its 5Y average of 11.63x and notably discounted compared to its direct peers, such as Merck (MRK) at 15.08x, AbbVie (ABBV) at 14.48x, and Amgen (AMGN) at 15.38x.

Based on the consensus FY2026 adj EPS estimates of $2.87 and the FWD P/E of 11.92x, there seems to be a decent upside potential of +20.9% to our long-term price target of $34.20 as well.

In the event of a future upward re-rating closer to its peers’ P/E of 15x, we may also see a bullish upside potential of +52.1% to our aggressive long-term price target of $43.

As a result of the attractive dual pronged return prospects through capital appreciation and dividend payouts, we are cautiously re-rating the PFE stock as a Buy here.

It goes without saying that anyone adding here must also size their portfolios accordingly, since it is undeniable that the debt load is immense worsened by elevated R&D efforts, the margin dilution from its numerous M&A activities, hefty dividend payouts, the patent cliff for Prevnar/ Eliquis from 2026 onwards, and Ibrance from 2027 onwards.

This is also why PFE is only suitable for investors with a well-diversified dividend portfolio for an improved margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.