Summary:

- Beijing’s new stimulus plan serves as a long-awaited catalyst for Chinese giant, Alibaba Group Holding Limited.

- We’re not bullish on this plan alone; we’re bullish because we expect longer-term growth implications and see Alibaba benefiting domestically with better consumer confidence and spending power.

- Alibaba’s Intelligence Cloud business also has a lot of room for growth, in our opinion, especially considering the synergies between cloud and AI products.

- The stock remains undervalued for its growth potential in a revived China, and we recommend investors add opportunistically for tailwinds in 2HFY25.

ASKA

Alibaba Group Holding Limited (NYSE:BABA) was among the stocks that shot higher late last week after Beijing announced a new Stimulus plan in hopes of reaccelerating growth in the world’s second-largest economy. Other Chinese stocks, including Baidu, Inc. (BIDU), Bilibili Inc. (BILI), and PDD Holdings Inc. (PDD), all of which operate across China’s search, online entertainment, and shopping industries, traded higher on the news, too.

We remain buy-rated on Alibaba, expecting outperformance to reaccelerate in 2HFY25 on the arrival of a long-awaited catalyst to revive China’s economy. Alibaba should be in a prime position to consolidate the boost in consumer spending power created by Beijing’s stimulus plan and turn it into profitable growth.

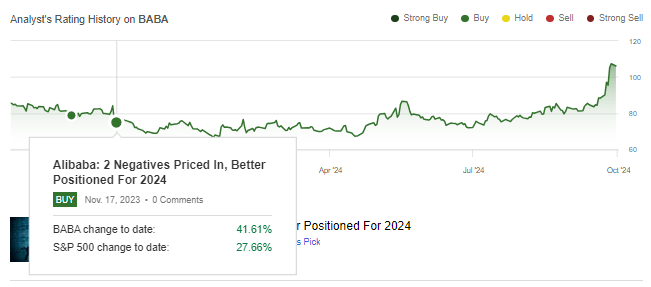

The stock is up roughly 42% since our last article in mid-November, outperforming the S&P 500 (SP500) on its late September rally, with the S&P 500 up ~28% during the same period. Alibaba has been a slippery stock to pin a bottom on; even when we called the negatives being priced in back in November, there were no near-term catalysts at play to reverse the situation, i.e., support momentum for recovery. China was dealt a very bad hand by their COVID-Zero restrictions, causing a prolonged economic slowdown, deflationary risks, a deepening property crisis, and a weak outlook for demand.

The nature of Alibaba’s business, particularly on the retail front with Tmall and Taobao Group, makes the company specifically vulnerable to China’s economic performance, specifically cautious spending from Chinese consumers. The “weak property market and high job insecurity levels” have weighed heavily on consumer spending confidence. Beijing tried to boost the economy the same year the pandemic restrictions were lifted, but the efforts failed. A report from January stated, “Any true acceleration (this year) will require either a major global upside surprise or more active government policy.” And that’s what we’re seeing with the new Beijing stimulus plan.

The following chart outlines our rating history on BABA.

YCharts

The nation’s central bank lowered interest rates on Friday and injected more liquidity into the banking system in an attempt to achieve the year’s economic growth target of 5% after the economy grew 5.2% in 2023, slightly ahead of the official target. Chinese data reported in July showed that the nation was falling behind the government’s GPD growth target, and this is supposedly the plan to save the year. Some sources say that “megacities Shanghai and Shenzhen are planning to lift key home purchase restrictions in coming weeks, joining a long list of smaller cities that have done so to ease a years-long property crisis.” China also plans to issue special sovereign bonds worth $284.43B (2T yuan) this year.

China’s coming in with this “Hail Mary” plan late into the year, but economists and policymakers alike think it’ll have enough time to allow for the 5% growth target to be attained, and we agree. We think the plan has already lifted consumer and investor confidence, with Chinese stocks on track for their best week since 2008.

We’re not bullish on this plan alone; we’re bullish because we expect it to have longer-term growth implications that could spur more stimulus in 2025 and further benefit Alibaba domestically. China implemented a stimulus plan back in 2016, with the government announcing a stimulus package worth $278B to boost GPD after reporting its slowest growth in 25 years in 2015. The move positively impacted names like Alibaba; in FY2016, Alibaba reported a revenue surge of 33% Y/Y and EBITDA up 28% for FY2016.

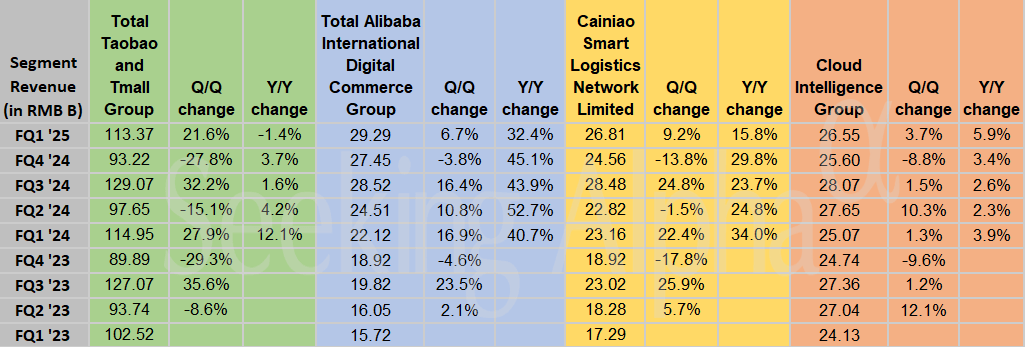

Alibaba is vulnerable to China’s consumer confidence and spending power. The company derives the bulk of its revenue by geography domestically, i.e., from China through its Taobao and Tmall Group. This, as shown below, accounted for 113.37B RMB of total revenue in 1Q25 compared to Alibaba International Digital Commerce Group, adding 29.29B RMB for the quarter and Cainiao Smart Logistics Network adding 26.81B RMB and Cloud Intelligence Group adding 26.55B RMB. Alibaba’s revenue distribution for 2QCY24 shows China commerce retail business making up +40% of the company’s total sales; revenue from Alibaba’s China commerce retail business declined 2% Y/Y in Q1 to $14.78B with China commerce wholesale business growing 16% Y/Y.

We think a recovery in China’s economy will create positive ripple effects for Alibaba.

SeekingAlpha

Alibaba plays a dominating and defining role within China’s e-commerce market with a 42% market share as of 2023; Alibaba’s actually lost some share since 2021 to other competitors in the market, including PDD, down from a share of 52% in 2021. The share loss isn’t great at face value, but we don’t think investors should be spooked. We think Alibaba is now in a better position to gain back share through Tmall and Taobao Group with the economic recovery, its revamp strategy for the Group, and its technological edge when it comes to generative AI capabilities.

The AI & cloud compute growth story

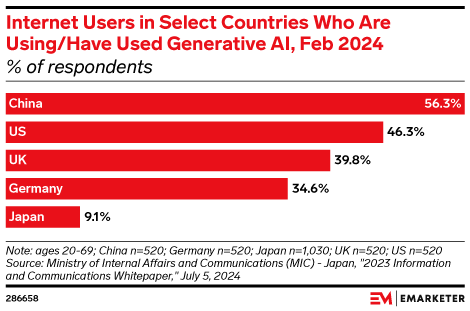

Investors should remember that Alibaba is much more than a retail company-it’s a tech company. It’s using its technological capabilities to increase engagement and its broader position; the best and most straightforward example of this is Alibaba’s own chatbot, Tongyi Qianwen, nick-named “Qwen,” which is described as a “one-stop generative AI platform to build intelligent applications that understand your business.” Alibaba’s exposure to China in this regard is positive with data from the Ministry of Internal Affairs and Communications (MIC) – Japan found that 56.3% of internet users in China are using or have generative AI access; although this data is from February 2024, we think it continues to be relevant to highlight the potential of China being the largest market for generative AI, matching its position as the largest smartphone, PC and EV market worldwide.

EMARKETER

Alibaba’s cloud computing business is also worth examining; we agree with fellow SA contributor Lillian Cheung’s thesis that Alibaba should see improving unit economics from its main operating segments and an enhanced “mix of higher-margin cloud revenues driven by AI innovations.” Alibaba’s Intelligent Cloud business hasn’t had an easy year. While facing its set of hurdles with a canceled spin-off, regulatory concerns, and high competition, Alibaba’s Intelligence Cloud business still has a lot of room for growth, especially considering the synergies between cloud and AI products. Cloud intelligence grew 6% Y/Y and 4% Q/Q in Q1 to around $3.65B, with growth driven by “core public cloud and AI demand,” according to the earnings call. Management also noted on the call, “AI-related product revenues sustained a triple-digit growth, continuing to increase its share of public cloud revenue.” We think there is more room for upside surprise supported by AI and Cloud as Alibaba’s China commerce business stabilizes.

Valuation & Word on Wall Street

Alibaba is trading well below the peer group, and hence, we consider Alibaba to be a value stock at current levels. The stock’s EPS for TTM, which ended in Jun. 2024, was $3.82, lower than it was when we last wrote on the stock in November, where EPS for TTM ending June 2023 was $4.46. The stock’s P/E ratio today is 29.51 compared to a P/E ratio of 17.09x in November. On an EV/Sales ratio, today, the stock’s ratio is 1.92x, compared to 1.47x in our last note. Alibaba’s valuation expansion since the last time we covered the stock is not surprising considering the upward revision in tech valuations and AI exposure, but we still think Alibaba’s valuation remains all the more attractive considering the catalyst at play.

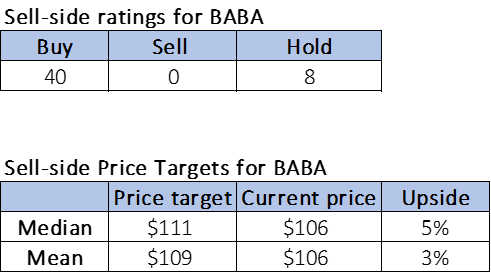

Wall Street leans heavily towards a bullish sentiment on the stock. Of the 48 analysts covering the stock, 40 are buy-rated, and the remaining eight are hold-rated. The stock is currently priced at $106, a boost from $87 per share when we last wrote on the stock. The median sell-side price target is $111, while the mean is $109 for a 3% to 5% potential upside.

The following outlines BABA’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

Alibaba shares surged +35% in September versus the S&P 500, up ~3%. We think investors priced in a lot of the positives from the Beijing stimulus plan into the month’s close. We expect the outperformance to moderate again as investors realize the impact won’t be immediate, but it’s the catalyst is here nonetheless.

Chinese tech stocks remain at a higher risk than U.S. tech stocks, but we think the risk-reward profile for Alibaba leans more towards the latter. The stock remains undervalued for its growth potential in a revived China, and we recommend investors add opportunistically for tailwinds in 2025.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.