Summary:

- Plug Power Inc. investors saw their substantial gains in May nearly dissipate fully in June.

- The optimism over the DOE’s loan guarantee shouldn’t be expected to mask Plug Power’s fundamentally weak business.

- The threat of a potential return of the Trump Administration could intensify uncertainties over PLUG’s long-term future.

- PLUG has consolidated above the $2.25 level since January 2024. Hence, short-covering might follow.

- I argue why investors shouldn’t allow the allure of PLUG’s green hydrogen story to distract them from its weak thesis. Read on.

audioundwerbung

Plug Power: Hope Isn’t An Investment Strategy

Plug Power Inc. (NASDAQ:PLUG) investors have endured a roller-coaster ride over the past two months. After witnessing an incredible surge in mid-May 2024 as PLUG investors reacted positively to the DOE’s “$1.66 billion conditional commitment loan guarantee.” Plug Power had provided constructive commentary at PLUG’s Q1 earnings call in early May. Given the size of the loan guarantee, it should strengthen Plug Power’s ability to continue scaling up its green hydrogen production capacity. I cautioned PLUG investors in my February 2024 article that relying on hope isn’t a viable investment strategy. Given the inherent uncertainties in the DOE’s loan guarantee, investors should focus on PLUG’s fundamentals.

Accordingly, DOE’s commitment is conditional. As a result, Plug Power must meet the required “technical, legal, environmental, and financial conditions.” Despite that, analysts highlighted that PLUG should benefit significantly. Wall Street believes the move “represents a significant step towards achieving the company’s long-term hydrogen ambitions.” As a reminder, the loan guarantee is expected to be targeted to scale up the capacity of “up to six green hydrogen production facilities across the United States.” These are expected to bolster the demand dynamics for Plug Power’s growth opportunities into “material handling, transportation, and industrial” applications.

Plug Power aims to scale up and diversify its revenue base through 2025. Accordingly, PLUG anticipates more clarity and potential in the “material handling and electrolyzers as core segments.” As a result, it should also underpin the company’s “continued diversification into liquefaction and other cryogenic applications.”

PLUG: Given Up Most Of Its May Gains

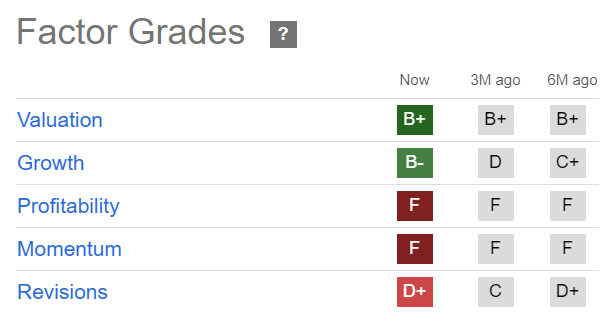

PLUG Quant Grades (Seeking Alpha)

Notwithstanding the initial optimism about the DOE’s conditional loan guarantee, PLUG has given most of its gains from May. Consequently, it has fallen back toward its 2024 lows, close to the $2.25 level.

I assess market pessimism on PLUG is justified, given its weak fundamentals and poor execution record, as I highlighted previously. Investors have likely baked in higher execution risks, as the recent Biden-Trump debate has opened up the possibility of a return of a second Trump Administration. Increased Republican scrutiny in the Senate Energy Committee could lower the market’s confidence in the DOE’s loan guarantee. However, the IRA has provided significant financial clout to the Biden Administration in its climate initiatives.

Despite that, the market has likely assessed the increased scrutiny on the DOE’s conditional loan guarantee. Worsened by a potentially higher possibility of the return of the Trump Administration, it would likely encourage bearish PLUG investors to try and hammer PLUG harder.

PLUG’s short-interest ratio of almost 28% in mid-June is relatively high. Therefore, a short squeeze is still possible, as PLUG has dropped close to its critical support zone.

Plug Power endeavors to continue progress in green hydrogen production to lower production costs and improve margins. However, Plug Power is not expected to deliver positive free cash flow profitability through the 2026 forecast period.

With unrestricted cash of about $173M as of Q1, Plug Power investors could face potentially significant dilution risks. Coupled with the uncertainties relating to the DOE’s loan guarantee and a return of the Trump Administration, I find it very challenging to be optimistic about PLUG’s thesis.

Is PLUG Stock A Buy, Sell, Or Hold?

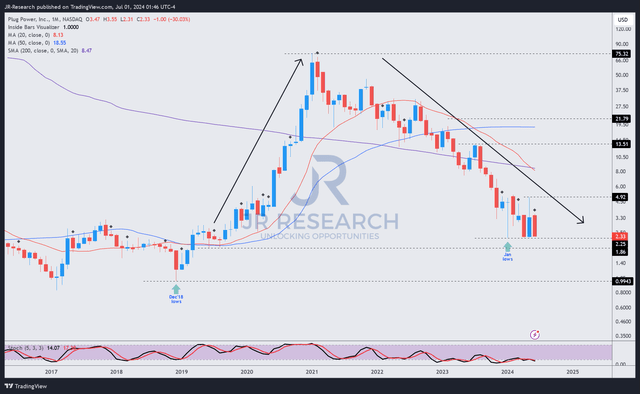

PLUG price chart (monthly, long-term) (TradingView)

As seen above, PLUG has consolidated above the $2.25 level since January 2024. It has halted the downtrend bias (at least for now) since PLUG topped in early 2021. However, PLUG’s downtrend bias hasn’t reversed, although selling sentiments have not gained traction below the $2.25 level.

Therefore, PLUG’s risk/reward at the current levels remains well-balanced. Potentially constructive developments from the DOE’s loan guarantee could spur another sharp spike as bearish investors seek cover.

Rating: Maintain Hold.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!