Summary:

- Plug Power’s stock is at a low point despite sales and business growth.

- The company struggles to make money due to high costs and inability to scale revenues.

- Plug Power relies on debt, equity financing, and government support, posing risks of further dilution and dependence on favorable financing.

- As such, I think it’s better to wait for the fundamentals to improve, even if it means a higher cost basis.

Vanit Janthra/iStock via Getty Images

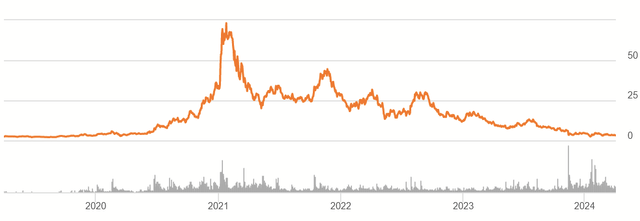

Plug Power (NASDAQ:PLUG) is another example of a mission-driven company where the mission and the economics have a hard time lining up. Consequently, the stock is some of the lowest it’s been in recent years.

PLUG 5Y Price History (Seeking Alpha)

During this time, however, their sales and underlying business have grown quite a bit. The decline after their short squeeze in 2021 may leave folks wondering if this is a time to get back in, but I’ll give some thoughts about changes I’d want to see before buying, as I consider PLUG to be what Peter Lynch has labeled a “longshot” stock.

Revenue Growth (and the Cost Thereof)

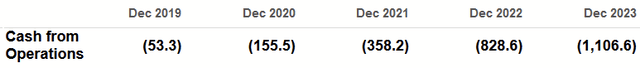

One of the long challenges of Plug has been its inability to make money. Below are their cash flows from operations from the time covered in the price chart:

Cash Flows From Operations (Seeking Alpha)

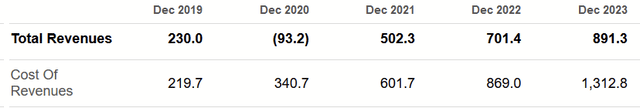

Much of this owes to the fact that, while revenues have grown during this time, it’s almost impossible for them to scale it and even turn a gross profit.

Revenues in Millions (Seeking Alpha)

As the company has grown, it has not managed to increase revenues faster than costs. If one looks at the income statements, we’ll see an interesting feature.

Revenues, Income Statement (2023 Form 10K)

If we look at 2021 and 2022, most of their revenue is from sales of actual equipment; there’s actually a gross profit with this. It’s the services they sell alongside it that come with the bloated cost of revenues. Now, this does hint at some of the science behind what Plug does and why it’s hard to make economical.

Hydrogen is the most abundant element in the universe. It’s also highly flammable (this is why we can use it as an energy source). This means most of it is found in compounds with other elements, and we need to separate it from those compounds. This requires energy. We also need to create very strong containers to store hydrogen and transport it safely (otherwise we risk another Hindenburg disaster). This also requires energy. Energy means costs.

Plug Power Official YouTube

It’s conceivable that we (whether Plug or somebody else) could eventually develop the infrastructure and systems to make this energy-efficient and profitable. This is why Plug has continually focused on customers with energy needs at with large, fixed locations and why the vehicles perhaps best known for using their fuel cells are forklifts.

2023’s unusually higher costs were largely a supply issue, as management explained in Q4 earnings:

There were many challenges in 2023 as well, and some of these certainly impacted our Q4 2023 results. The chaos in the hydrogen fuel market in ’23 with an unprecedented number of industry fuel facility shutdowns culminated in the third quarter and has since abated, but defects continued into the fourth quarter.

Thus, 2023 may not be a “normal year” for Plug, but even the normal ones are a major challenge. I am looking for a normal year that shows these different revenue streams creating synergies, not additional costs.

Financing and Balance Sheet

To make up the difference, Plug has had to raise capital via debt and new equity.

Cash Flows from Financing Activities (Seeking Alpha)

First, I will applaud the intelligence use of equity financing in 2021, taking advantage of the price offered by the short squeeze at that time. Yet, there is a history of diluting shareholders before that. Most of their outstanding debt is in convertible senior notes (2023 Form 10K, pg. F-38). Being convertible, there is room for further dilution. The company is also seeking support from the government, with CFO Paul Middleton mentioning this in Q4 earnings:

And the capacity of that facility, not to say we will use it all, but it’s something that we can use ongoing as we move through the year to continue to address future liquidity solutions, while we chase and develop things like the DOE loan and other things.

While there aren’t immediate concerns of bankruptcy, PLUG shareholders are going to be in a situation of going to somebody else with their hats in their hands and asking for money. I personally would be worried about owning such a business and risking further dilution.

Similarly, I wouldn’t want my business model to depend on favorable financing from the government. Every election cycle could change what is even doable, and this is a huge risk for investors.

Transition to Positive Free Cash Flow

Yet, we all know that gross profit is not the only threshold to cross. Even after operating cash flows turn positive, capital expenditures and operating expenses need to be low enough to create positive free cash flow. Otherwise, Plug is still a net burner of cash for shareholders.

We’ve seen capex grow as well as the business has scaled. Could it decline? Well, management believes its capital investments will have long-term value:

Property, Plants, and Equipment (2023 Form 10K)

Thus, as they scale it, they should be able to use existing assets without as much expense going forward. Similarly, when challenged on how much more they could lower OpEx by an analyst in Q4 earnings, CEO Andy Marsh had to say.

I think, Kashy, because it may look good for some folks in 2024, but it will be a huge mistake in 2028. Those same folks are critical for us to achieving the gross margin targets. Those same folks are critical for improving our customer experience. Those same folks are important to building out plants like Texas. We modeled this so that the company can become operationally cash flow positive in ’25. But chainsaw — what was that [indiscernible], I don’t think he built great businesses. And business is much more than the Excel spreadsheet that you put in front of yourself.

So the goal is still to be a net-burner of cash to fuel growth for the foreseeable future. That’s a fair enough point, and some businesses have to do that for a while. This also gets to the heart of what kind of stock I think PLUG is, a longshot.

Longshots

In a 1997 press conference with C-SPAN, famous investor Peter Lynch discussed the “longshot” (he’s also called these “unicorns”). These are the companies that have bad financials but have this amazing story that, if they make it, will produce huge returns. What does he recommend on those?

Don’t do the longshot, guys. They don’t work…and again, if a stock’s $3, and it has huge potential, write down the story, take the stock symbol. If it’s going to $300, it’s okay to buy it at $15. Check in later. Check a year later. See if it’s still listed. See if you can still get a quote on it.

Interestingly, Plug was founded in 1997, and today its shares trade for just over $3. As a market cap, this is just over $2 billion. Management is telling us that it will be a few years before we could hope to see lucrative profits from this company. In the meantime, what’s wrong with waiting? If PLUG can reach a $20B or $30B market cap, what’s wrong with getting in at $8B if it starts actually making money?

Conclusion

Long-term, I am undecided on whether Plug Power will reach its goal of making its hydrogen power model profitable and sustainable. Until then, there’s nothing I can use for a valuation. It’s in that weird, middle area. Consequently, there is potential for huge returns at this current price, along with huge disappointment if there is a financing issue or a disaster with their supply like in 2023.

To that I say (and agree with Lynch): It’s okay to wait. There are other companies to buy right now, and we can always hold our cash and wait for when there’s a clearer future of positive cash flows.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.