Summary:

- I am now neutral on Plug Power, upgrading it to Hold due to progressive electrolyzer agreements and potential future returns despite recent volatility.

- Key developments include strong electrolyzer installations, strategic investments, and partnerships aimed at boosting hydrogen production and reducing carbon emissions.

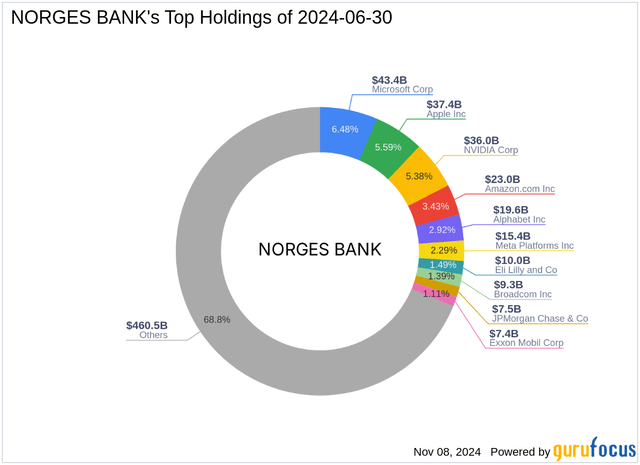

- Norges Bank’s increased stake signals confidence, but financial strain and uncertainties around the Inflation Reduction Act pose significant risks.

- Q3’24 financials show slight improvements with reduced cash burn and increased revenues, but the company remains in a distress zone with a negative Altman Z-score.

Alexander Koerner/Getty Images News

Investment Thesis

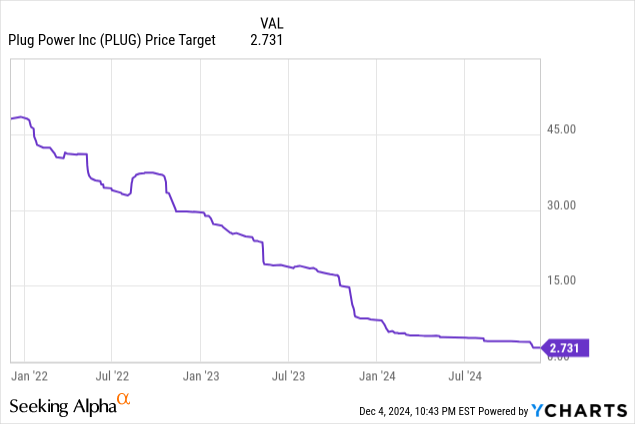

I am now neutral on Plug Power (NASDAQ: NASDAQ:PLUG) and upgrade it as a Hold. In May and September 2024, I published two sell-rating articles based on increased cash burn and rapid expansion with limited returns. The stock responded to the analysis as expected, fell 16.8% and 6.8% respectively and underperformed the market.

Since then, the company has made progressive electrolyzer agreements boosting its future returns, as revealed in its stock gains from $1.97 to $2.52. However, taking a keen eye on stock reaction after Republican presidential Candidate Donald Trump was declared the winner of the US presidential election in 2024, Plug Power has fallen by 25%. Its strong electrolyzer installations have shielded its stock level from surpassing $1.92 and has since started to gain, currently retailing at $2.06.

The volatility experienced by the stock after the US presidential elections expresses hydrogen uncertainties. However, the company’s electrolyzer products and applications remain strong, which reveals its potential for growth. Based on these observations, I am rating the company as a Hold. My optimism about Plug Power is in 2025 when most of the cash burn investments made in 2024 are projected to start making returns. I also expect the uncertainty around the Republican Party policy on the Inflation Reduction Act (“IRA”) as pledges start taking shape.

Key development: electrolyzer installations continue, a step closer to commercialization

The delivery of ArcelorMittal’s Bremen electrolyzer in Germany is expected to produce 5MW of power, with 2.5MW from Plug Power, which meets the company’s projection of continuous electrolyzer installation.

For example, the company is projecting to start the generation of liquid hydrogen in Q4’24 in the hydrogen plant joint venture with Olin Corporation in Louisiana. Plug Power aims to accelerate the adoption of hydrogen by completing these developments in time. The plant is planned to have a 15-ton-per-day hydrogen plant.

The project is called the Hidrogenii Venture. Substantial advancements are continuing with Plug Power’s hydrogen production capacity expected to achieve 150,000 metric tonnes annually. Olin Chairman and President Scott Sutton states, “We are excited to partner with Plug, a leader in sustainable hydrogen, to serve the growing demand for Hydrogen.” The two companies are committed to meeting the projected production threshold by 2028.

Plug power is expected to generate 500 tons per day of liquid green hydrogen by 2025. This strategic investment will reduce carbon dioxide emissions by 4.3 million metric tons in North America. The scalable electrolyzers are expected to produce 1,000 tons of liquid green hydrogen by 2028, which reveals a strong potential for future growth.

The 3GW contract between the Allied Green Ammonia (“AGA”) project and Plug Power seals its electrolyzer position in the hydrogen adoption. The contract is intended to build one of the largest global green ammonia plants in Australia. Plug’s electrolyzer system is expected to complete its delivery between 2026 and early 2027.

Norway’s increased stake is a de-risk signal

The recently announced the acquisition a prominent investment firm (Norges Bank) of Plug’s 78,740 157 common shares at $2.54 per share. The firm added its shares from 850,934,662 shares to 879,636,025 shares. The transaction was executed at $2.26 per share, leading to a modest impact on its portfolio at 0.29%, increasing Norges Bank’s percentage to 7.95% of the Plug Power shares.

At a time when Plaug Power is facing financial strain and huge investments, increasing Norges Bank’s shareholding is a strategic move. The firm has a portfolio of $669.35B from top-performing technological and financial companies, such as Microsoft Corp (NASDAQ: MSFT), Amazon Inc (NASDAQ: AMZN), and Apple (NASDAQ: AAPL).

Plug Power is still grappling with a depressing financial situation, with low Return on Equity (“ROE”) and Return on Assets (“ROA”) -44.12% and 31.05%, respectively. Recognizing that Plug Power stock has plummeted by 53% since January 2024, Norges Bank’s strategic acquisition is driven by substantial investment by the firm. The company has a strong investment portfolio that capitalizes on its future growth in the green energy sector.

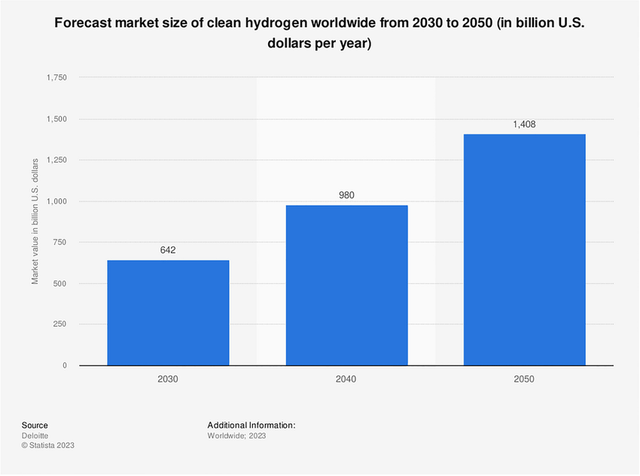

The Plug turnaround strategy to scale down on its cash burn by 70% positions the company for more cash available. Norges Bank’s acquisition of Plug Power IPO is timely and strategic, driven by the company’s potential from its substantive investment and the forecasted global hydrogen sector by 2050.

However, uncertain loan process means potential financial strain

The latest Republican presidential candidate assertion on hydrogen fuel cell vehicles creates skepticism about whether the Inflation Reduction Act may be repealed. The Act benefitted Plug Power with $10M grants from the DOE in decarbonization efforts to fund its 250 refueling stations. Plug Energy is still in the process with DOE to release more grants to support the expansion development of its green hydrogen infrastructure up to 6 sites.

The estimated tax credit of around $34 billion in the next decade to support clean energy initiatives faces disbursement uncertainties after Donald Trump alluded that he would rescind unspent money from the IRA, terming it “The Green New Scam.”.

From the too many interested groups with green hydrogen, for example, the Norges Bank and its core big market cap shareholders, the intention of Republicans to repeal the IRA in the House and Senate may not materialise. As such, in case the House and the Senate successfully repeal the IRA, Plug Power is likely to experience financial strain in developing the necessary infrastructure for its green hydrogen. The company secured 10M from IRA to fund its refueling station installations and needs more to fund its pipeline and storage facilities that together improve the availability and accessibility of green hydrogen. I do not recommend either buying or selling Plug Power stock at negative Altman Z-Score as it depicts a high risk stock at the moment.

My neutral thought

Building on my previous bearish rating, informed by increased cash burn in Q2’24, substantial investments have been achieved, and production has increased to over 25 tonnes of green hydrogen per day in its existing facilities. The company is currently in a turnaround stage, as seen in scaling down Capital expenditure by 30% in the second quarter of 2024. This has prompted a strategic investor, Norges Bank, to increase its shares, looking forward to the company’s investment returns.

However, I remain skeptical, looking at the stock liquidity reaction following Donald Trump’s stand on IRA and the overall clean energy sector. As such, taking a different angle using Altman Z-Score on Plug Power, as of November 11, 2024, the company is still in a distress zone at -1.51. This implies that the company could go bankrupt in the next two years if its revenues do not increase as intended. Currently, following the uncertainties in the hydrogen sector post-US-election, and a negative Altman Z-score, it is uncertain whether the company turnaround and substantial investment will have a positive impact on its revenues in the short-term, a reason for my Hold rating.

Valuation

Q3’24 financial highlights: signs of positive turnaround

A slight improvement was reported in Q3’24 following a 70% reduction in cash burn. Net loss reduced slightly by 19.48% from $262.3M in Q2’24 to $211.2 in Q3’24. This is a gain for its shareholders, with Earnings per share loss in the quarter reducing from $0.36 in Q2’24 to $0.25 in Q3’24. Following significant investments in 2024, the net loss relates to strategic investments and new product deployments. The net loss recorded is based on a 37% decreased gross margin Quarter-over-Quarter (QoQ). As such, the company has multiple streams of revenue from its investments that have started to record improvements. The service segment has improved by 776%, equipment business is up by 42%, fuel sales have improved by 8%, and Power Purchase Agreements are up by 13%. These increases reported a revenue increase of 21.13%, an increase of $173.7 M in Q3’24 to $143.4M in Q2’24. The company is leveraging its electrolyzer deployments that have remained resilient amid hydrogen uncertainties. .

Operating cash flow improved by 31% QoQ, indicating the company’s working capital efficiency and improving margins. Following the turnaround strategies, positive results and imminent improvements will be recorded in Q4 2024, with a favorable political landscape, such as the continuous implementation of the IRA. However, the company projects to use fixed manufacturing costs and existing inventory to continue is revenue growth projection.

As iterated in my last articles on Plug, it is difficult to rate a company at this very early stage of refining its product offering and deep in negative profit margin and cash flow – only when there is meaningful profit being made and reduced cash flow, the share price can be less volatile.

My last article listed out four key events that will lead to a significant drop in share price:

| Negative events | Current situations |

| Additional financing and action, which will historically lead to a 20+% drop | This has been slightly de-risked with the equity financing happened and with higher institutional investments. The current cash position, according to the 10Q, should be sufficient for another 6 months or longer. |

| Actions to relieve the financial distress like selling off assets, laying off and cutting business units | With the improved financial situations in the short-term and the better market condition with rates expected to be lower and Trump’s victory that will benefit the (small) business sector, this event is now less likely to happen |

|

Potential de-listing risks if the share price is too low |

Not imminent |

|

Downgrade by analysts |

A continuous impact factor to the stock price, but it is higher than the current stock price nonetheless |

Investment Risks

- Policy change: Plug faces financial strain in completing its hydrogen refueling station installations if the DOE slows down its loan process on climate programs following Trump’s deriding of the Biden-Harris climate program Inflation Reduction Act, citing it as “The Green New Scam.”

- Change of public perception– After Donald Trump’s inaccurate assertion that Hydrogen cars could blow, the statement has the potential to reduce the demand from 18,300 passenger hydrogen vehicles already existing on US roads.

- Financial strain – Plus Power may face financial strain in completing its infrastructure development as IRA grants may be repealed by possible Oil and Gas pro policies in the next four years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.