Summary:

- Plug Power continues to miss forecasts and faces significant financial stress, making it an unattractive investment despite potential in hydrogen products.

- The company reported improved fuel margins, but the business still has negative gross margins.

- The stock faces significant dilution risks, with the company reliant on restricted cash and inventory reductions to fund operations.

Petmal

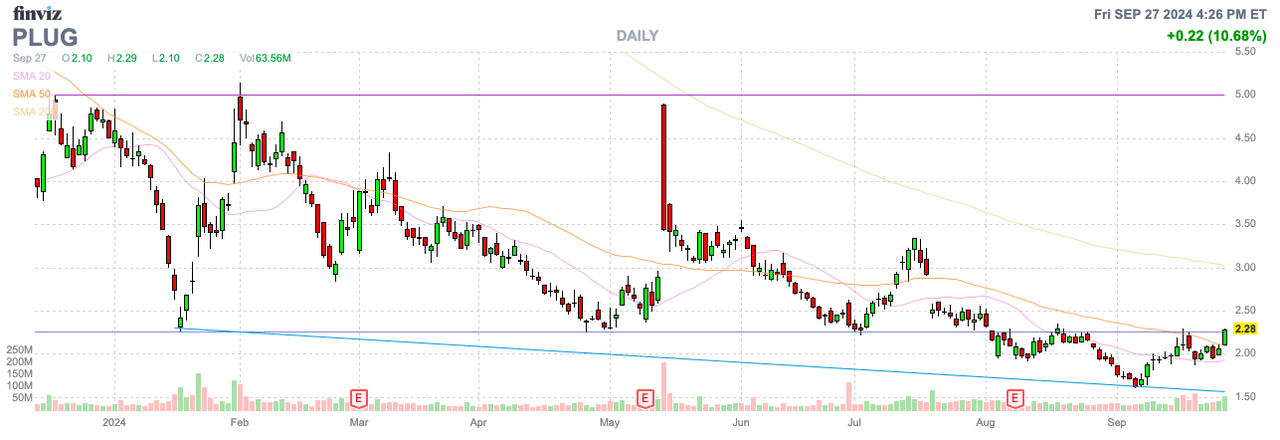

Plug Plower Inc. (NASDAQ:PLUG) is back to old games of missing forecasts by a wide margin while guiding to huge future potential sales in a burgeoning hydrogen product portfolio. The stock has collapsed to just $2, but the company has too many financial problems to make buying the dip appealing. My investment thesis remains Bearish on Plug Power with the company still far away from being profitable or producing positive cash flows to warrant an investment.

Fuel Margins

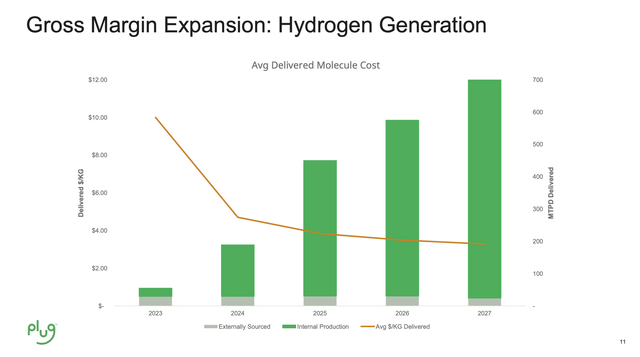

The big promise for the year was Plug Power turning on green hydrogen plants. The internal hydrogen fuel production from the Georgia plant and potential other plants were to boost fuel margins.

Plug Power has long decided to sign fuel supply agreements requiring the company to buy hydrogen fuel from 3rd-party suppliers at much higher prices to meet demands before internal production started. Management has suggested purchases from third parties cost $12 to $14 per kg versus sales at only $6 to $7 per kg.

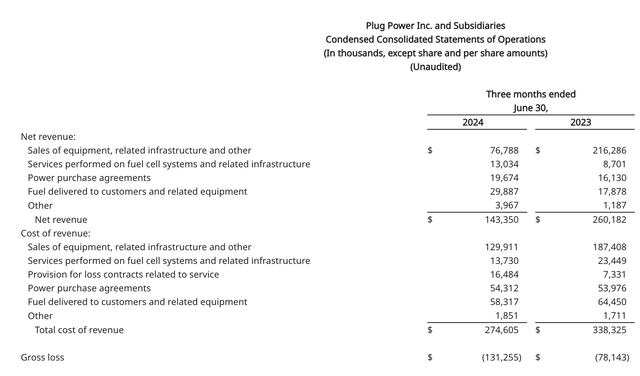

The company saw fuel delivery sales ramp to nearly $30 million in Q2, up from only $18 million last Q2 and the prior quarter. The big key is that fuel costs were $58 million, down from $64 million last Q2, but the costs were still much higher than sales.

Source: Plug Power Q2’24 earnings release

While the fuel margins did improve as Plug Power recorded higher sales at similar costs, the company saw the rest of the business collapse. The Georgia plant was suppose to usher in a new era for the hydrogen fuel company, yet the business actually reported an even larger loss due to limited equipment sales.

Numbers should improve the rest of the year with $70 million worth of electrolyzers apparently commissioned during Q3. Plug Power has double the electrolyzers to commission by the end of the year amounting to a combined 155 megawatts of power to turn on.

For Q2, total revenues were down $117 million YoY due to the dip in equipment sales. Plug Power again has plans for fuel sales to ramp with the opening up of these future hydrogen plants as follows:

- Tennessee (active) – 10 tons-per-day (TPD)

- Georgia (active) – 15 TPD

- Louisiana (Q4 target) – 15 TPD

- Texas (late 2025) – 45 TPD

- New York – 74 TPD

Just a year ago at the Plus Symposium, the company was still targeting up to 200 TPD per day in hydrogen generation with the majority internally produced. The goal was to top 400 TPD by next year, yet Plug Power is only at 25 TPD internally now and looking to just hit 40 TPD by year end.

Source: Plug Power Symposium ’23 presentation

The company hired Dean Fullerton, former Vice President of Global Engineering and Security Services at Amazon, to work on the cost equation to improve margins. The biggest issue here is that Plug Power has a culture of wildly spending beyond revenues making this job difficult and sometimes impossible when requiring a change in corporate culture, especially considering this new hire is only the COO and not the top executive.

Plug Power already cut 15% of the workforce and is apparently not backfilling positions when employees leave. An investor can’t visibly see the difference when the Q2 loss actually soared YoY due to lower revenues.

Operating expenses were down ~$26 million YoY in Q2. Naturally, the problem is that Plug Power isn’t anywhere close to producing positive gross margins, so every dollar of operating expenses adds directly to losses. The SG&A costs are still at an incredibly high $85 million for a business constantly missing targets.

Cash Crunch

The company still guided to 2024 revenues of $825 to $925 million. Plug Power didn’t even reach 1H sales of $250 million, so sales will probably jump due to the electrolyzer sales ramp in the 2H, but the company will likely miss targets yet again.

The consensus estimates have revenues reaching $224 million for Q3 and jumping to $342 million in Q4. Analysts barely forecast sales reaching the low end target this year.

A big focus will be future dilution with the ongoing losses. Plug Power has 2 major assets to help with cash flows: $956 million in restricted cash and an inventory balance of $940 million.

The green hydrogen company entered July with nearly $2 billion in cash tied up in these assets. Plug Power plans to reduce these assets in the 2H by ~$200 million each freeing up cash to fund operations until the possibility of the $1.7 billion DoE loan.

If not, Plug Power shareholders face major dilution with the stock at only $2 and the company only having an unrestricted cash balance of $62 million. The share count has already soared in the last year from 598 million to 737 million shares or Q2’24.

Takeaway

The key investor takeaway is that while green hydrogen is a promising fuel of the future, Plug Power constantly fails to execute. The company has to dramatically improve the quarterly losses in Q3 in order to make the stock more appealing and revenues at just $224 million aren’t likely enough to change the equation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end Q3, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.