Summary:

- On Tuesday, Plug Power Inc. reported disappointing Q3 2024 results with revenues missing analyst expectations by a mile.

- With overall backlog at multi-year lows, management lowered full-year expectations substantially and provided initial 2025 guidance well below consensus expectations.

- Persistent cash usage remains a cause for concern. While Tuesday’s convertible debt deal should carry the company into Q1/2025, investors will likely have to prepare for additional dilution next year.

- While management expects a proposed $1.66 billion DOE loan to fund soon, I don’t expect the company to comply with anticipated harsh funding conditions anytime soon, if ever.

- However, should the company indeed achieve funding ahead of the upcoming administration change, I would likely become more constructive on the stock. For now, I am reiterating my “Hold” rating on Plug Power’s shares.

Olemedia

Note:

I have covered Plug Power Inc. or “Plug Power” (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

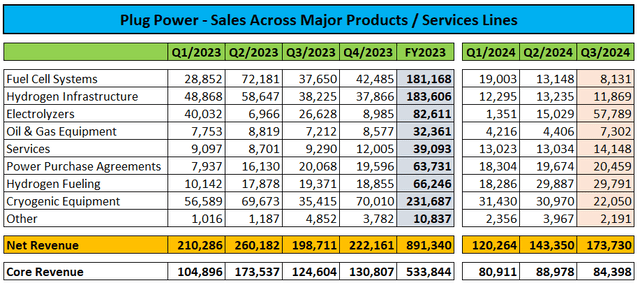

On Tuesday, Plug Power reported another set of disappointing quarterly results, with revenues missing consensus expectations by a mile again:

Sales were down by 13% on a year-over-year basis. The company’s core fuel cell systems and hydrogen infrastructure business took a particularly large hit after Plug Power raised prices for its product and service offerings and essentially stopped providing lease financing to customers.

On the flip side, electrolyzer sales were up substantially both on a quarter-over-quarter and year-over-year basis as the company managed to recognize revenues on equipment deployed in previous quarters.

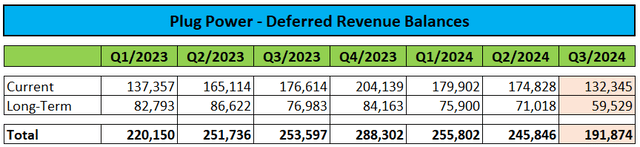

The issue is also reflected in a substantial quarter-over-quarter reduction in deferred revenues:

Please note that the electrolyzer segment has been a major drag on the company’s financial results for several years already, with customer demand nowhere near management’s initial expectations and projects in backlog experiencing delays or even cancellations. In addition, Plug Power had priced initial deals well below costs, thus resulting in substantially negative product margins.

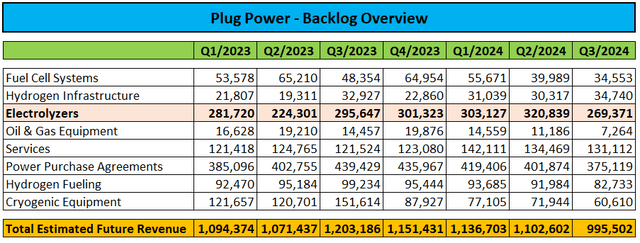

On the conference call, management projected a further increase in electrolyzer revenues in the current quarter. However, segment backlog of $269.4 million represented a new 18-month low:

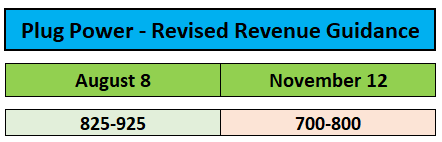

With overall backlog at multi-year lows and down by approximately 10% quarter-over-quarter, management lowered full-year expectations (which had been provided just three months ago) substantially:

Company Press Releases

However, even achieving the low end of the revised guidance range would require revenues to increase by 55% on a sequential basis.

Please note that Plug Power has yet to meet a financial forecast provided by management, despite CEO Andy Marsh having been in charge for more than 15 years already.

Given these issues, I wouldn’t be surprised to see the company report full-year 2024 revenues well below $700 million.

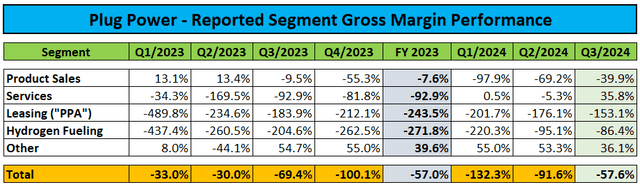

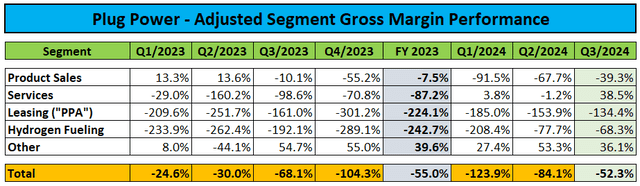

That said, it wasn’t all bad. The company’s gross margin recovery continued during the quarter, mostly as a result of recent price increases for Plug Power’s product and service offerings in combination with ongoing cost reduction activities:

Adjusted for the accounting impact of warrants issued to key customers Amazon (AMZN) and Walmart (WMT), consolidated gross margin improved from -84.1% in the second quarter to -52.3% in Q3:

With the new hydrogen plant in Louisiana expected to come online within the next couple of months, fueling margins should improve further.

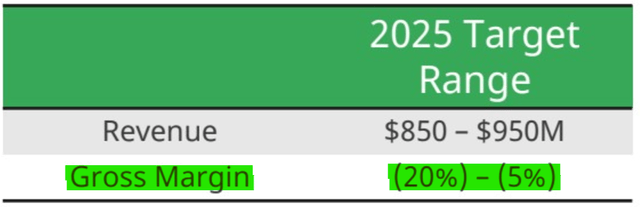

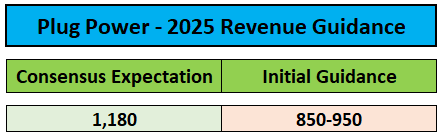

However, business conditions remain weak as very much evidenced by the company’s initial 2025 revenue guidance, which is a far cry from current consensus expectations:

Yahoo Finance / Company Presentation

Please note that management’s expectations for substantial year-over-year revenue growth aren’t backed by recent backlog and deferred revenue trends. Consequently, I would expect Plug Power to miss management’s projections by a mile again next year.

Without assumed benefits from increased scale, management’s 2025 gross margin target range of (20%) to (5%) might also be at risk:

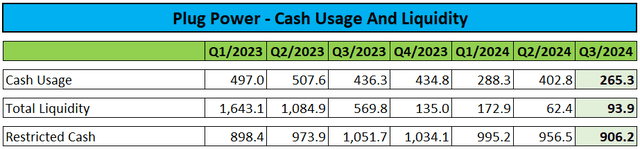

While reduced substantially on a quarter-over-quarter basis, persistent cash usage remains a cause for concern:

The company finished Q3 with 93.9 million in unrestricted cash, $906.2 million in restricted cash as well as approximately $200 million in debt.

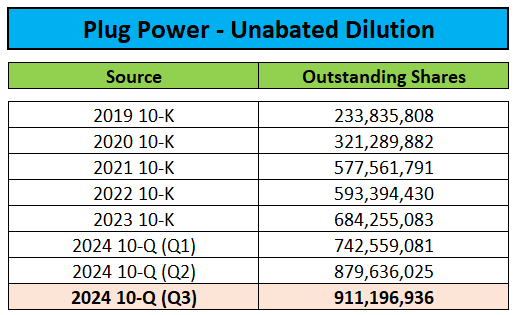

Plug Power’s share count continues to increase as the company sold additional shares into the open market and raised $191 million in net proceeds from an underwritten common stock offering in July:

Regulatory Filings

Even worse, management has turned to toxic financing, as disclosed in a regulatory filing this week:

On November 11, 2024, the Company entered into a Debenture Purchase Agreement with YA II PN, Ltd. (the “Investor”) under which the Company agreed to sell and issue to the Investor an unsecured convertible debenture in aggregate principal amount of $200.0 million (the “Convertible Debenture”) in exchange for the payment by the Investor to the Company of $190.0 million. (…)

The Convertible Debenture bears interest at a rate of 6.00% per annum and is payable on the second year anniversary of the issuance date of the Convertible Debenture (the “Maturity Date”) or earlier redemption date.

The Convertible Debenture provides that the Investor may convert all or any portion of the principal amount of the Convertible Debenture, together with any accrued and unpaid interest thereon, at an initial conversion price of $2.90 (the “Fixed Price”), representing a conversion premium of 146% to the last reported sale price of the Company’s Common Stock on November 11, 2024. In certain circumstances, the Investor will be permitted to convert up to $22.5 million aggregate principal amount of the Convertible Debenture plus accrued and unpaid interest thereon, each calendar month beginning with December 2024, at a conversion price equal to the lower of the (1) Fixed Price and (2) 97.25% of the lowest daily volume-weighted average price for the Common Stock during the three trading days immediately preceding the applicable conversion date (the “Market Price”);

Please note that YA II PN, Ltd. or “YA II” is a division of Yorkville Advisors, a well-known lender of last resort. It has entered into similar transactions with other cash-strapped companies like Canoo Inc. (GOEV), VinFast Auto Limited (VFS) and Ideanomics (OTC:IDEX) in the past, just to name a few.

To be perfectly clear, the convertholder has the option to demand monthly conversions in an amount of up to $22.5 million at a 2.75% discount to the lowest VWAP during the three days preceding the conversion date.

The conversion option is essentially a license to print free money for YA II by shorting the company’s shares ahead of conversion dates and subsequently covering the short position with discounted conversion shares.

In contrast to management’s statements on the conference call, Yorkville Advisors is not likely to become a long-term investor in Plug Power. It also will not be precluded from shorting the company’s common stock ahead of conversion dates, as clearly stated in the Debenture Purchase Agreement (emphasis added by author):

Except as expressly set forth below, the Buyer covenants that from and after the date hereof through and ending when the Convertible Debenture is no longer outstanding (the “Restricted Period”), no Buyer or any of its officers, or any entity managed or controlled by the Buyer (collectively, the “Restricted Persons” and each of the foregoing is referred to herein as a “Restricted Person”) shall, directly or indirectly, engage in any “short sale” (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of the Common Shares or any securities or loans that are exercisable or convertible for Common Shares, either for its own principal account or for the principal account of any other Restricted Person.

Notwithstanding the foregoing, it is expressly understood and agreed that nothing contained herein shall (without implication that the contrary would otherwise be true) prohibit any Restricted Person during the Restricted Period from: (1) selling “long” (as defined under Rule 200 promulgated under Regulation SHO) Common Shares or (2) selling a number of Common Shares equal to the number of Underlying Securities that such Restricted Person is entitled to receive, but has not yet received from the Company or the transfer agent, upon the completion of a pending conversion of the Convertible Debenture for which a valid Conversion Notice (as defined in the Convertible Debenture) has been submitted to the Company pursuant to Section 4(b) of the Convertible Debenture.

For my part, I firmly expect YA II to make use of their monthly conversion option and pocket safe gains by shorting the company’s common shares ahead of the conversion date. As a result, the convertible debenture should be repaid by the end of Q3/2025.

At current share price levels, dilution from the convertible debenture would calculate to approximately 11%. However, with the number of issued shares being dependent on prevailing market prices at the time of conversion, dilution could end up being lower or substantially higher.

This form of convertible debt is also known as “Death Spiral Financing”. However, considering the amount of the YA II convertible debenture in relation to Plug Power’s market capitalization and average daily trading volume, the negative impact on the share price should be manageable.

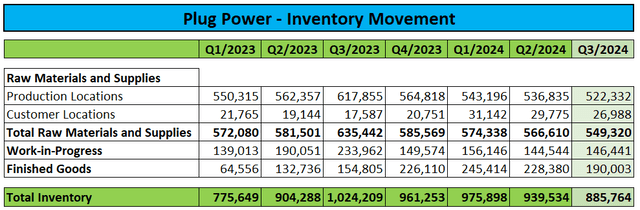

Going forward, management expects cash usage to decline as the company benefits from improved margins, releases of restricted cash and lower working capital requirements. Indeed, inventory levels have been trending down in recent quarters:

On the conference call, management also made questionable statements regarding an anticipated near-term funding of the Department of Energy’s (“DOE”) conditional loan guarantee. At least in my opinion, this appears to be highly unlikely, particularly after the outcome of the recent U.S. elections.

Given Plug Power’s abysmal track record, I still expect the DOE to impose harsh conditions to protect taxpayers’ money and as a result, I would be very surprised to see a near-term funding announcement.

However, should the company indeed achieve funding before the upcoming administration change, I would likely become more constructive on the stock.

Bottom Line

As usual, Plug Power’s Q3/2024 results missed consensus expectations by a wide margin. With backlog at multi-year lows, management reduced full-year projections substantially and provided initial 2025 guidance way below analyst expectations.

However, given persistent business headwinds and considering management’s track record, I fully expect the company to miss both the revised 2024 and initial 2025 guidance by a mile.

The company continues to burn large amounts of cash. While Tuesday’s convertible debt transaction with a division of Yorkville Advisors should provide a cash runway to carry the company into Q1/2025, investors will likely have to prepare for additional dilution next year.

While management expressed confidence in getting the DOE loan over the finish line before the upcoming change in administration, I doubt that the company will be able to comply with anticipated harsh funding conditions anytime soon, if ever.

However, should the company indeed achieve funding ahead of the upcoming administration change, I would likely become more constructive on the stock.

For now, I am reiterating my “Hold” rating on Plug Power’s shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.