Summary:

- Plug Power reported another set of disappointing quarterly results, with revenues missing consensus expectations by a mile again.

- Sales were down by 45% on a year-over-year basis, with the company’s core fuel cell systems and hydrogen infrastructure business taking a particularly large hit.

- Plug Power used more than $400 million in cash for the quarter, thus resulting in the requirement to dilute common shareholders even further.

- That said, not everything was bad, as the company made progress on the margin front. Particularly, the substantial improvement in Plug Power’s hydrogen fueling segment was encouraging.

- While I fully expect Plug Power to miss full-year projections by a mile again, I am upgrading the company’s shares from “Sell” to “Hold” based on the quarter’s improved margin trends.

Scharfsinn86

Note:

I have covered Plug Power Inc. or “Plug Power” (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

Two weeks ago, Plug Power reported another set of disappointing quarterly results, with revenues missing consensus expectations by a mile again.

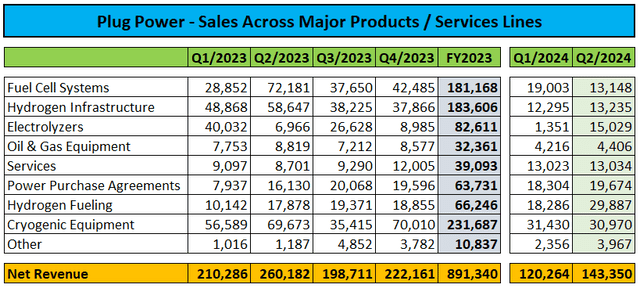

Sales were down by 45% on a year-over-year basis, with the company’s core fuel cell systems and hydrogen infrastructure business taking a particularly large hit after Plug Power raised prices for its product and service offerings and essentially stopped providing lease financing to customers.

While up sequentially and year-over-year, the company’s electrolyzer segment continued to struggle as Plug Power deployed over $70 million of electrolyzer systems during the quarter, but it wasn’t able to recognize the majority of revenues due to “final commissioning and testing requirements“.

The segment has been a major drag on the company’s financial results for a number of years already, with electrolyzer demand nowhere near management’s initial expectations and projects in backlog experiencing delays or even cancellations. In addition, management had priced initial deals well below costs, thus resulting in heavily negative product margins.

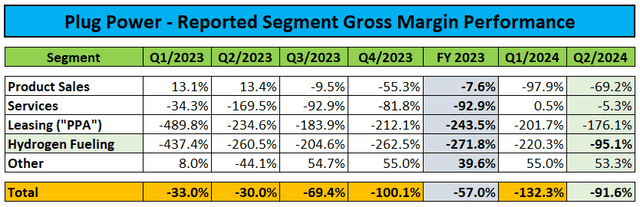

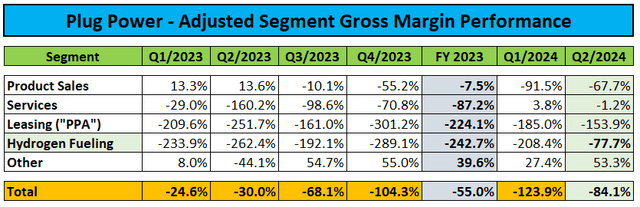

However, Plug Power’s hydrogen fueling segment was a major positive surprise as revenues were boosted by price increases and, to a lesser extent, the recognition of assumed production tax credits in the company’s financial results. With Plug Power’s first green hydrogen plant in Georgia ramping up production, the company’s overall hydrogen cost basis was reduced. Fueling revenues were up by more than 60% sequentially, with a corresponding increase in gross margin.

Adjusted for the accounting impact of warrants issued to key customers Amazon (AMZN) and Walmart (WMT), segment margin improved from -208.4% in the first quarter to -77.7% in Q2.

Recent price increases for the company’s product and service offerings in combination with recent restructuring activities resulted in adjusted consolidated gross margin improving from -123.9% to -84.1% on a sequential basis.

On the conference call, management stated expectations for further progress in the second half of the year:

Since January 1, we’ve reduced the global workforce by over 15% through the Q1 restructuring and ongoing attrition where we’ve not backfilled. We’ve adjusted pricing across many equipment, fuel and service platforms which the impact can be seen in our Q2 results, particularly for fuel and service, and these pricing impacts will be even greater as the year progresses, as we get full periods under these structures and launch additional pricing measures.

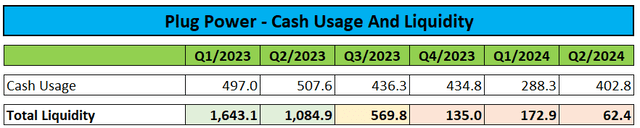

However, elevated cash burn remains a cause for concern.

During the quarter, the company used $402.7 million in cash. In combination with the Q1 cash burn of $288.3 million, Plug Power has already eclipsed management’s implied $500 million cash burn target for the full year by almost 40%.

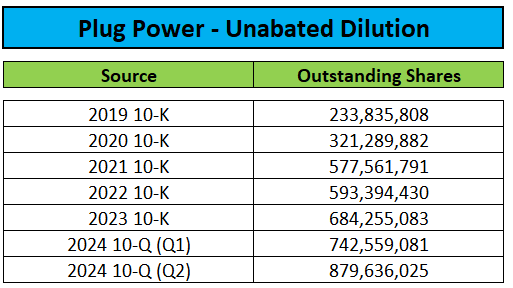

To replenish its dwindling cash reserves, the company continued to aggressively sell new shares into the open market. During Q2, the company raised an additional $266.8 million under its ATM agreement with a division of B. Riley Financial (RILY) and ended the quarter with unrestricted cash and cash equivalents of just $62.4 million.

Subsequent to quarter-end, the company sold additional shares into the open market for estimated net proceeds of $29.8 million. Moreover, Plug Power raised $191 million in net proceeds from an underwritten public offering last month.

As a result, common equity holders have experienced massive dilution since the beginning of the year.

Regulatory Filings

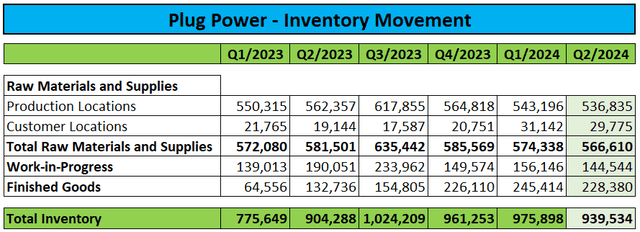

On the conference call, management stated expectations for substantially reduced cash usage in the second half of the year, mostly due to an anticipated up to $250 million working capital release from reduced inventory requirements.

However, judging by inventory movements in recent quarters, I do not expect the company to come anywhere close to its stated target.

Not surprisingly, management remained optimistic on the company’s ability to close on the Department of Energy’s (“DoE”) conditional $1.66 billion loan guarantee:

We’ve made tremendous progress. We meet with them regularly and are meeting again in two weeks to continue their final due diligence and move the process along. We’re extremely clear on the actions and the processes to successfully close this facility. And equally important, the DOE are clear in their interest and support to get this closed quickly. This facility is anticipated to provide immediate liquidity and enable us to accelerate the Texas green hydrogen facility build out.

For my part, I do not expect the loan facility to close anytime soon as the DoE is likely to impose harsh conditions in order to protect taxpayers’ money, particularly given management’s abysmal track record.

Looking ahead, management projected full-year revenues in a range of $825 million to $925 million, which would require second-half revenues to more than double over H1/2024 just to meet the low end of guidance.

Taking into account persistent business headwinds and the company’s decade-long pattern of overpromising and underdelivering, I would expect Plug Power to miss the low end of the range by a wide margin, very similar to previous years.

Bottom Line

As usual, Plug Power’s Q2/2024 results missed consensus expectations by a wide margin. Even worse, the company continues to burn cash at a rapid pace, thus resulting in persistent dilution for common shareholders.

That said, not everything was bad, as the company made progress on the margin front. Particularly, the substantial improvement in Plug Power’s hydrogen fueling segment was encouraging.

Unfortunately, management hasn’t learned of past mistakes and provided overly ambitious full-year revenue guidance once again, thus likely resulting in the company’s decade-long pattern of overpromising and underdelivering to continue unabatedly.

While I fully expect Plug Power to miss full-year projections by a mile once again, I am upgrading the company’s shares from “Sell” to “Hold” based on the quarter’s encouraging margin trends.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared toward investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.