Summary:

- Plug Power stock slumped after Trump’s election win, signaling a tougher environment for green economy stocks due to potential policy changes.

- Analysts predict modest Q3 revenue growth for Plug Power, but the company has a history of missing estimates and remains unprofitable.

- Despite a significant drop in valuation, Plug Power’s track record of losses, cash burn, and shareholder dilution makes it a risky investment.

- Given the uncertain political climate and PLUG’s weak performance history, I recommend staying on the sidelines for now.

onurdongel

Article Thesis

Plug Power Inc. (NASDAQ:PLUG) saw its share price slump on the news of a Donald Trump presidency win, which makes sense, as the environment could get tougher for green economy stocks such as Plug Power. The company also will report its next earnings results early next week — let’s take a look at what we can expect from the company.

Past Coverage

I have written about Plug Power Inc. in the past, most recently in July in this article, in which I argued that it could be a good idea to avoid Plug Power. Since then, shares dropped by around 40%, thus staying on the sidelines would have worked fine (shorting would have worked even better, I didn’t recommend that). With Plug Power reporting its next earnings results soon and with close to half a year having passed since my last update, it is time to take another look at the hydrogen player.

What Happened?

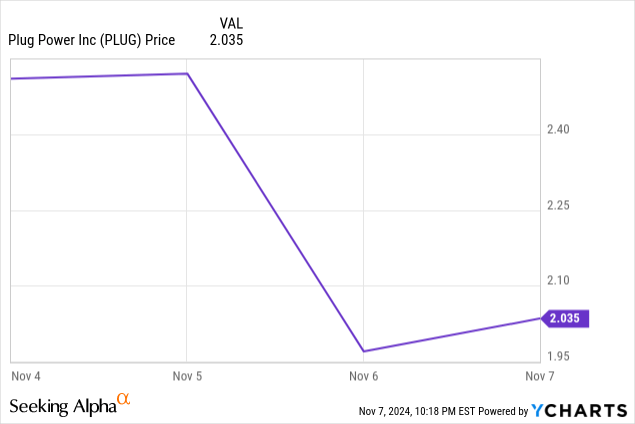

As we all know, President Donald Trump has won the 2024 election, with the GOP also winning the Senate. At the time of writing, the House race is still not decided, but it looks like it was a pretty good election day for the GOP and future president Donald Trump. This naturally has implications for many companies and their shares, with many profiting — the broad market jumped around 3% on the day of the election news — but with some sectors seeing a tougher environment. This includes green energy and green economy companies such as hydrogen player Plug Power. On Wednesday, shares slumped:

Shares traded even lower in September, so this wasn’t an all-time low for Plug Power, but shares are still down around 20% from November 4, before the market got the election’s results, which is a very pronounced decline. Of course, relative to PLUG’s all-time highs of more than $1,000 per share, it does not really make a big difference, as those that have held from those highs have lost almost everything anyways. For more recent investors, the share price reaction is noteworthy, though, which brings up the question of whether it is justified.

While we don’t have any specifics yet on what President Donald Trump will do over the next four years, and since it also (possibly) depends on who wins the House majority, it seems likely that the environment for “green” companies will get tougher. Many of them benefit from subsidies in one way or another, be it tax credits, direct cash subsidies, and so on. Tax credits that were awarded under President Joe Biden’s Inflation Reduction Act could be taken back or reduced, for example, and items such as a carbon tax, which could theoretically have helped PLUG as it would have incentivized hydrogen power usage, will be pretty unlikely for the next four years, I believe. Not surprisingly, PLUG was not the only stock that experienced losses on the day following the election — many other “green” stocks tanked as well, including solar (TAN) and wind power (FAN) stocks. We don’t know yet how large these headwinds will be for PLUG and other green energy stocks going forward, and we don’t even know whether these headwinds will actually materialize — but it seems clear that the environment is worse and that risks are higher for PLUG and co. with this election outcome compared to a Kamala Harris presidency.

Plug Power: What’s The Outlook?

On Tuesday, November 12, Plug Power will hold its earnings call and release its earnings results. Let’s take a look at what we can expect from the company’s Q3 report.

Analysts are currently forecasting that the company will showcase revenues of $210 million, which would be an improvement of 6% compared to one year earlier. A 6% revenue growth rate for an unprofitable company that needs to grow massively in order to break even in the future is far from inspiring, of course, but it is important to note that Plug Power’s revenues can be lumpy. The fact that revenues are forecasted to have grown only slightly during the third quarter does not mean that growth will be this slow during the following quarters, too. In fact, analysts are predicting that the revenue growth rate will be deep in the double-digits in the fourth quarter of 2024 and in all of 2025 (see link above). Analysts can be wrong, of course, and when it comes to Plug Power, they unfortunately have a tendency to overestimate the company. Plug Power’s real performance oftentimes is worse compared to what Wall Street analysts have been forecasting, with PLUG missing the revenue estimate in three out of the last four quarters. Based on this historic trend, a revenue miss seems more likely than not, but it is still possible (although not very likely) that PLUG beats the odds and delivers a better-than-expected result with the upcoming report.

While revenues are forecasted to improve slightly, the company is expected to lose $0.24 per share during the third quarter. Annualized, that’s almost $1 per share, which seems like quite a lot, considering the share price is just above $2 — this would mean that PLUG’s loss during a single quarter was roughly as large as one-eight of the company’s market capitalization. On the other hand, a $0.24 loss per share would mean a huge improvement versus the previous year’s quarter, when PLUG lost twice as much. Looking at the track record of Wall Street analysts, we see that they have overestimated PLUG’s profitability very reliably — PLUG has missed the earnings per share consensus for a hefty 16 quarters in a row. This unfortunately suggests that there is a pretty good chance of another earnings miss, thus the loss per share could be larger than $0.24. Nevertheless, I believe that there is a good chance of PLUG being able to narrow down its loss — revenues could be a little higher than during the previous year’s quarter, and inflationary pressures have eased, with energy costs, for example, being down from the highs seen in 2022 and 2023.

Is PLUG Stock A Good Investment?

Plug Power’s valuation definitely has come down substantially over the last year, with shares declining by close to 70%. But even though PLUG is cheaper now, compared to one year ago, it is not necessarily a good investment.

Plug Power’s track record is far from compelling, as the company continues to miss estimates while also continuing to lose money and burn cash. This is made possible by ongoing share issuance that dilutes shareholders massively over time. In 2021, analysts were expecting PLUG to be profitable this year, but this has clearly not happened. Management has made optimistic estimates about the company’s ability to break even in the past as well, with the company not being able to deliver on its forecasts in several cases.

In the long run, the hydrogen market should grow nicely, and PLUG’s customers include strong players with deep pockets, such as Amazon (AMZN). On the other hand, Plug Power also faces competition in the hydrogen market, including from companies such as Air Products & Chemicals (APD), which has strong cash generation and a global sales footprint and could thus be advantaged versus Plug Power.

With some pros (growth market, customers) and more cons (competition, weak track record, no profits, cash burn, dilution), the outlook for Plug Power is murky, I believe. The company could be able to deliver on its goals in the future, but I wouldn’t bet on it. With the political environment getting tougher as well, due to President Donald Trump winning the election, I’m not convinced that PLUG is an attractive investment at current prices. While the valuation is a lot lower than it was over the last couple of years — PLUG is now valued at “only” $2 billion — I still don’t want to go long here, but more enterprising investors may disagree. Overall, I continue to rate Plug Power a “stay on the sidelines” for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!