Summary:

- Plug Power Inc. promises a strategic shift towards profitability and shareholder rewards in the hydrogen fuel revolution.

- The company finally started production at the Georgia plant and reopened the Tennessee plant to help drastically cut costs from supplying hydrogen fuel to customers via 3rd-party purchases.

- The stock isn’t appealing, even at $3, due to the bleeding edge nature of the business trying to build up the hydrogen market with money-losing contracts and minimal cost optimization moves.

Petmal

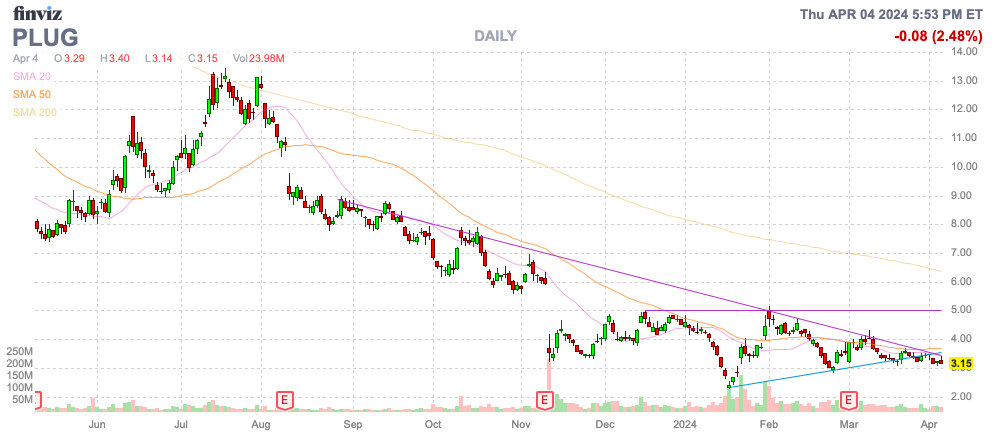

After another dismal year, Plug Power Inc. (NASDAQ:PLUG) has promised the market to enter a strategic shift in the hydrogen fuel revolution with a move towards a profitable and shareholder rewarding business. The hydrogen solutions company continues wild spending an a plethora of projects going in the wrong direction. My investment thesis remains Bearish on the stock despite Plug Power now trading down at only $3.

Source: Finviz

Horrible Business

While green hydrogen has a lot of promise as a sustainable fuel, Plug Power has never figured out how to turn hydrogen into anywhere close to a profitable business. The company has struggled so much at generating positive results inspire of having large key customers like Walmart (WMT) and Amazon (AMZN) leading management to issue a Q4 ’23 earnings release promoting new business and completely skimming over the quarterly financials.

At the JPMorgan 2024 Industrials conference, CFO Paul Middleton highlighted some major reasons Plug Power is running into so many financial problems as follows when discussing green hydrogen fuel (emphasis added):

..so out of the gate, we’re — we were realizing what we thought we would realize, which is the variable cost is significantly lower than what the market rate is to buy hydrogen. So that’s very positive. That’s before tax incentives, by the way, and for those of you may know, or that you don’t know, the government’s put out an investment tax credit, and a PTC production tax credit associated with green hydrogen. We — last year, we paid somewhere in the range of $12 to $14 per kilogram for fuel in the market.

And, historically, we’ve only been able to sell it to our customers for about $6 to $7. So that’s not an equation that works very long, right. And as I said, we would kind of invest into that, because we knew we could produce it for, call it, $4 to $5 a kilogram and even work towards driving that cost down. In fact, in Texas, we’re pretty confident we’ll be gone in the $3 a kilogram range. So that’s a substantial cost reduction. And then in addition to that, you can get up to as much as $3 a kilogram credit with the production tax credit.

In essence, Plug Power has been subsidizing the hydrogen fuel market with plans to get their own production plants on line. The Georgia plant finally came on line in January designed to produce 15 tons per day (TPD) of liquid electrolytic hydrogen.

The hydrogen solutions company should now be able to produce hydrogen fuel at 30% of the costs to purchase from the market. Plug Power suggests the company can now produce 50% of customer requirements with the Tennessee plant back online with 10 TPD.

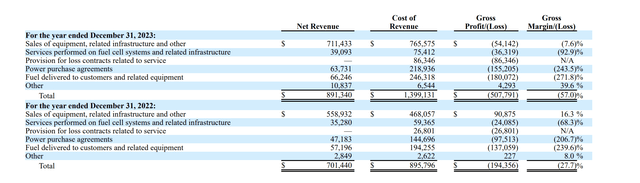

Plug Power doesn’t make positive gross margins with any of their divisions, but the Power purchase agreements and Fuel delivery segments are where the major loses pile up. The Fuel delivery business only produced 2023 revenues of $66 million, while the cost of revenue is $246 million for a gross loss of $180 million.

These losses are far in excess of the prices listed above where Plug Power pays about double the price of the cost customers pay the company. The company now producing ~50% of customer fuel versus purchasing from the market should drastically reduce costs, but Plug Power won’t eliminate the losses yet.

While the 2023 losses were horrible, one only has to look at the financials for the last 3 years to see the hydrogen company headed in the wrong direction. Over the period, Plug Power grew revenues nearly 80% while the cost of revenues more than doubled.

Any business is the growth phase will have less than impressive margins and the goal is usually not to maximize earnings in the growth phase, but Plug Power is one of the rare companies that actually turned negative gross margins into larger negatives. And don’t forget, operating expenses soared during this period.

Plug Power turned $266 million in opex in 2021 into $836 million in spending last year. Even excluding the impairment of goodwill charge of nearly $250 million in 2023, the company still spent $421 million in additional opex during a period where gross margins got worse. The company managed to add over $2 in spending for each $1 in revenues during a period where revenues grew nearly $400 million.

More Share Dilution

Plug Power just ended a year where the company burned $1.8 billion in cash and the stock has fallen to $3. The hydrogen solutions company grew revenues by 27%, yet the loses mounted with the Georgia facility failing to open on time and the business vastly outspending demand.

The company ended 2023 with working capital of $822 million with just $135 million in unrestricted cash. Plug Power had $1 billion in restricted cash and is working on obtaining a $1.6 billion DoE loan.

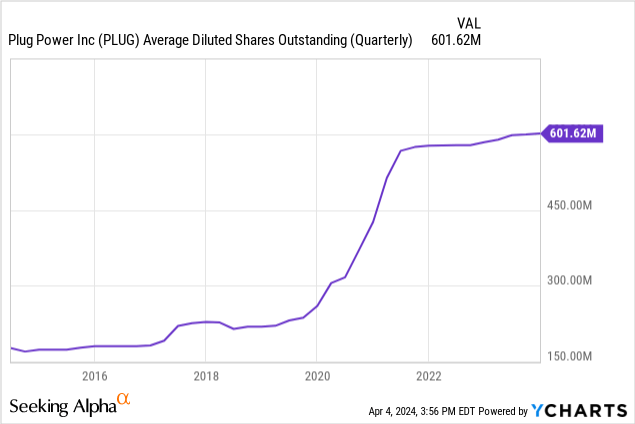

The problem is that the cash balance got too low and management took too long to start cost cuts. Plug Power had sold 77,417,069 shares of common stock having an aggregate offering price of approximately $302 million under the ATM agreement due to the lack of cash and the length to when the DoE loan could be funded.

Plug Power has historically added millions of shares annually via dilution. The company just ended 2023 with 601 million diluted shares outstanding, and the amount should already jump to 678 million based on aggressively hitting the ATM in early 2024.

The CFO promises a year of cost optimization, though the plans only involve $75 million in initial cost saving via cutting jobs and removing duplicative costs. Investors really need to see how Plug Power can reduce up to 50% of the cost structure in order to turn cash flows around and the current plans involve limited cost reductions along with fuel cost savings from internal hydrogen production.

The company saw inventory balloon to $961 million at the end of 2023 and one source of funds is clearly limiting new production and turning these products into cash. At the same time, Plug Power plans to limit capital spending that hit $665 million last year.

A normal company turning 20% growth into substantial leverage could be a strong catalyst for buying the stock on cost optimization plans. The problem with Plug Power is that the company has to cut costs dramatically while still growing sales 20% in order to turn away from the historical dilution game.

Takeaway

The key investor takeaway is that Plug Power has finally decided to implement some cost optimization to cut runaway spending, but the plans don’t appear aggressive enough. The hydrogen solutions company finally has hydrogen fuel plants online to cut some of the bleeding edge costs to get the hydrogen fuel market growing before the internal production was ready, but the costs were excessive for Plug Power leading to massive shareholder dilution over time.

Investors should avoid the stock until Plug Power can provide a much clearer path to positive cash flows and execute on operating plans versus the unconstrained spending of the last few years. The path to just positive gross margins appears insurmountable in the near term and shareholder won’t ever be rewarded until these margins turn very positive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q2, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.