Summary:

- Shares of struggling fuel cell systems, electrolyzer solutions, and green hydrogen provider Plug Power have shown signs of life in recent weeks.

- However, Thursday’s proposed $200 million common stock offering right ahead of the company’s Q2 report in early August is a major red flag.

- Based on numbers provided in the prospectus, even under a best-case scenario, the company’s Q2 cash burn appears to have been close to $300 million, higher than in Q1.

- At the current rate of cash usage, Plug Power would be required to raise additional funds toward the end of the quarter at the latest point.

- Given the apparent lack of operational progress at the company, elevated cash burn, and the high likelihood of another abysmal quarterly report in early August, I am downgrading the company’s shares from “Hold” to “Sell”.

audioundwerbung

Note:

I have covered Plug Power Inc. or “Plug Power” (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

Shares of struggling fuel cell systems, electrolyzer solutions, and green hydrogen provider Plug Power have shown signs of life in recent weeks:

In the absence of major company-specific news, I would attribute the move mostly to increased risk appetite among market participants, with some investors likely betting on improved second-quarter results.

However, Thursday’s proposed $200 million common stock offering is a red flag for two main reasons:

- While management has preliminary Q2 numbers at hand, the prospectus only states the amount of cash and cash equivalents at quarter-end (62.4 million of unrestricted and $956.5 million of restricted cash). If the Q2 numbers would show positive developments, management wouldn’t have hesitated to highlight the progress.

- The prospectus does not update on the number of shares sold into the open market and resulting proceeds since the company filed its most recent quarterly report on form 10-Q in early May.

Please note that between March 31 and May 9, the company had already raised $145 million in net proceeds from the sale of 55.8 million additional shares into the open market.

Adding these funds to the reported $173 million in unrestricted cash and cash equivalents at the end of Q1 would result in pro forma cash and cash equivalents of $318 million.

In addition, the company managed to free up $39 million in previously restricted cash during the quarter.

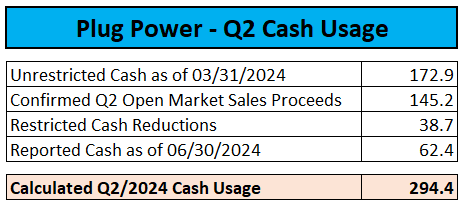

Even in the unlikely case that the company abstained from selling additional shares into the open market since May 9, Plug Power’s Q2 cash burn would calculate to almost $300 million, even higher than in Q1:

Regulatory Filings

Given this issue, we can safely assume that H1 cash usage exceeded the $500 million target outlined by management for the full year 2024.

That said, I fully expect the company to have sold additional shares into the open market during Q2, which would indicate an even higher cash burn.

Please note that these developments are in stark contrast to statements made by management on the Q1 conference call.

Assuming no additional open market sales since the filing of the 10-Q in early May and an offering price of $2.50, outstanding shares would increase by approximately 11% to 822.6 million.

However, at the current rate of cash usage, Plug Power would be required to raise additional funds towards the end of the quarter at the latest point.

With Plug Power apparently falling way short of its stated full-year targets again, I am downgrading the company’s shares from “Hold” to “Sell” and would advise investors to consider disposing of existing positions going into the company’s Q2 earnings release next month.

Risks

With Plug Power’s management well known for pie-in-the-sky projections, an optimistic outlook on the second half of the year would likely be met with renewed buying interest. I will update investors on the company once the Q2 earnings report has been released.

Bottom Line

Plug Power is running out of funds again but rather than further utilizing its $1 billion “At Market Issuance Sales Agreement” with a division of B. Riley (RILY), the company opted for an underwritten offering with Morgan Stanley (MS) acting as the sole book-running manager.

At least in my opinion, the common stock offering right ahead of the company’s Q2 results is a major red flag, particularly as management has decided against providing preliminary Q2 revenue and earnings numbers.

However, based on the company’s stated cash balances at the end of Q2, we can extrapolate a quarterly cash burn of at least $294.4 million and this number already represents the best-case scenario.

At the current rate of cash usage, Plug Power would have to raise additional funds before the end of the current quarter.

Given the apparent lack of operational progress at the company, elevated cash burn, and the high likelihood of another abysmal quarterly report in early August, I am downgrading Plug Power’s shares from “Hold” to “Sell“.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.