Summary:

- Plug Power is an unprofitable company with margins in the deep red that has missed earnings estimates for years.

- Its years of negative ratios such as EPS and PEG and Net Income per share prove the company has both top-line and bottom-line weakness.

- The green hydrogen market is one of the hottest places to be in the clean industry, yet PLUG has not grown their earnings and revenue at a fast enough pace.

- Despite a decent financial position, if the margins do not improve, the company’s balance sheet could potentially be eroded.

Just_Super/E+ via Getty Images

Investment Thesis

Plug Power Inc. (NASDAQ:PLUG) is an unprofitable company with lousy margins and years of negative EPS. While positioned in a market of excitingly rapid growth, it still has years of losses ahead. Their decent financial situation and future projects are some of the company’s saving points, yet not enough to make it a worthy risk.

Plug Power Inc., A Company In The Hydrogen Fuel Cell Industry

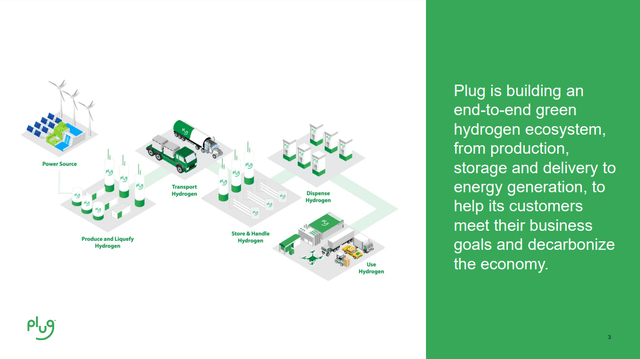

Plug aims to build an ecosystem with end-to-end, green hydrogen, from production to storage and, finally, distribution. Their products range from electrolyzers necessary to separate hydrogen from water to fuel cells that convert hydrogen into electricity to fuel stations that store hydrogen.

Most of the hydrogen produced now is not entirely green, as it’s produced from methane; Plug’s objective is to be a leader in producing green hydrogen, made from splitting hydrogen from water, thus becoming a leading company in the clean energy industry.

They produce both the energy cell and the fuel that powers it, in my opinion, a good business model with some space to create a moat around it if enough market and business advantages are piled upon each other.

Plug Power opened this year a green hydrogen production facility in Georgia, another in Tennessee, several fueling stations in Europe, and a hefty $125 million fuel cell factory in Vista Tech.

PLUG’s Georgia Plant (Plugpower.com)

Last week, on September 9, a new green hydrogen plant in Hungary was opened, with the electrolysis unit provided by PLUG.

Sales of equipment such as fuel cells have been the main driver of revenues, with $76,788 million out of the $143,350 million of revenue in Q2, or 53.56% of the total.

Fuel delivered $29,887 million or 20.84% of the total; meanwhile, servicing the sold cells and infrastructure and power agreements provided the remaining 25.60% of revenue.

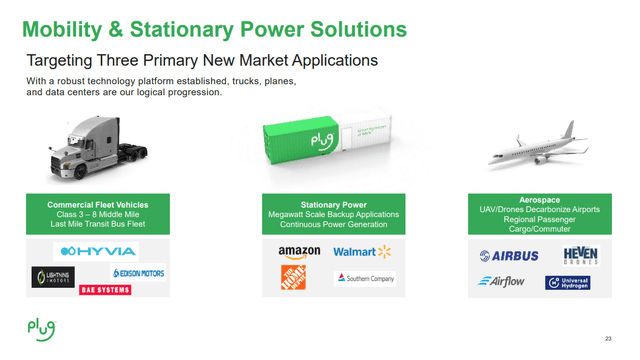

Plug Power Investor Presentation 2023

Amazon is one of the key clients of Plug Power Inc. The giant company has acquired 17,000 hydrogen fuel cells for their forklifts in several fulfillment centers. The selling point for hydrogen-fueled forklifts is their faster recharge time against conventional batteries (minutes instead of hours) and consistent lifting speeds the whole time (electric forklifts lose lift speed as their battery depletes).

They also have a distinct advantage in closed spaces such as depots and fulfillment centers, as they only emit water, there are no emissions indoors, and they don’t require the more complex electric infrastructure that electric batteries need.

I consider hydrogen-powered forklifts to have a strong and very real competitive advantage over electric forklifts, and one of the strong points for Plug.

We also need to mention Ballard Power systems, as Plug Power Inc. integrates fuel cells produced by them into their own products, which makes for an interesting case of collaboration instead of head-on competition.

The Growing Market Of Fuel Cell Companies

Hydrogen, when consumed inside a fuel cell, only produces water, which is one of the key drivers behind the push for hydrogen fuel cells as a clean energy source. Clean energy is also one of the fastest-growing industries, with some estimates placing the total size of its future market at $1.4 trillion by 2032. It’s also a market that enjoys very good international support by governments around the world and massive public investing. This puts the clean energy industry in a very attractive position, as its mixture of public and private funding, excellent PR, and fast growth makes it a very hot market indeed.

Plug Power Investor Presentation Q2 2024

Hydrogen fuel cells as a sector of this enormous market is also growing, with some estimates placing it at nearly $40 billion by 2032. Currently, the biggest drawbacks of hydrogen fuel cells are their high costs compared with other power sources, both in the production of the fuel cells (they contain platinum) and the cost of its fuel: hydrogen in its production, storage, transportation, and dispensing.

These problems were recognized by the DOE, whose strategic plan aims to slash costs in those areas and make hydrogen fuel cells more attractive and efficient.

Of course, there is the risk that these strategic plans are slashed away by a change in the administration.

Plug: Negative Earnings

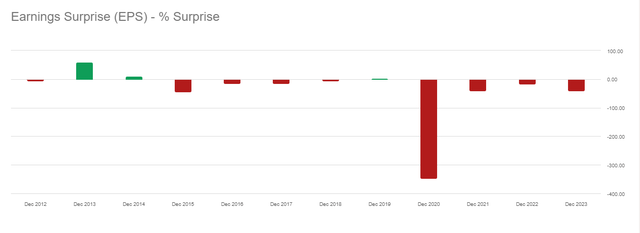

Plug Power Inc. has issues with its top line, particularly with earnings misses; in fact, it has repeatedly underperformed against analysts’ expectations. You would have to look back a decade ago for a good earnings beat, way back in Dec 2013.

These consistent misses paint a picture of a company where analysts’ expectations, considering the speed at which the market grows, are not met by a similar speed at growing earnings by PLUG.

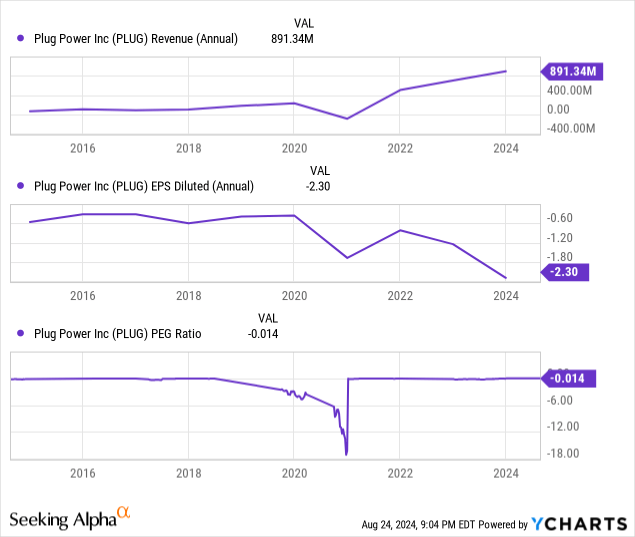

Annual Revenue has shown growth since 2021 and is one of the strong points here, something the company should continue to improve.

It gets particularly bearish for this year when the expected consensus EPS was $-1.63, and Plug actually got $-2.30.

Years of Negative EPS is very bearish for any company and, in my opinion, one of the worst things about PLUG, turning a company in an exciting and growing industry into an eternal turnaround hopeful, makes me think there are more efficient places to allocate capital.

The worst one was in Dec 2020, a staggering -347.30%; it is understandable that in the context of the global pandemic and the international supply chain crisis, a company would have some negative misses, yet a shortcoming of such size probably shows a lack of risk management and damage control for Plug Power.

The secret of crisis management is not good vs. bad, it’s preventing the bad from getting worse.”

— Andy Gilman, president & CEO of Comm Core Consulting Group

I consider great companies with superior management not only those that can outperform the market during long periods of favorable conditions, but also those who can avoid the worst outcomes during difficult times.

So far, Plug Power Inc. has not shown the qualities an excellent company should have.

Debt For Plug Power

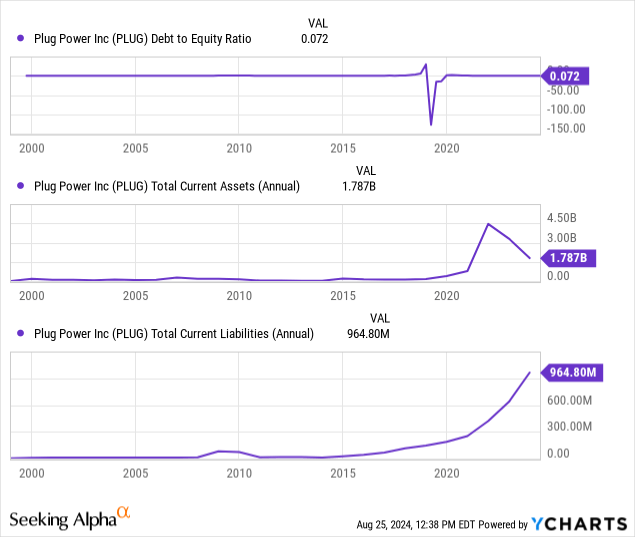

Here is one of the strong points for the company: Plug’s financial position appears quite decent.

The current assets outweigh the current liabilities, with 1,672.4 million vs. 809.6 million; cash is a little low considering the size of obligations, with only 62.4 million in cash and cash equivalents.

The short-term solvency for Plug Power Inc. does bring some hope to any bullish thesis, yet the trend shows current assets on a downtrend with current liabilities growing. This is something to monitor, and it is doubly so for a company that remains unprofitable.

Debt-to-Equity remains at a very conservative 0.072, proving that Plug is mostly being financed by its own resources. A company should strive to find its optimal mix of debt and own funds to better leverage its capacity to create value. Plug is not leveraging many external resources. In my opinion, this is something to watch for, and while the company has $208M of Convertible senior notes, considering the total assets of $1.787B, it could probably use a higher percentage of external financing into their operations, especially if those investments would help bump up the margins.

I rate this overall section as positive for the company. Not being crippled by debt is always a good thing, but the evolution of assets and liabilities should still be closely watched as the continued capacity for Plug Power Inc. to obtain external financing.

These two last things are crucial to the capacity of the company to continue operating.

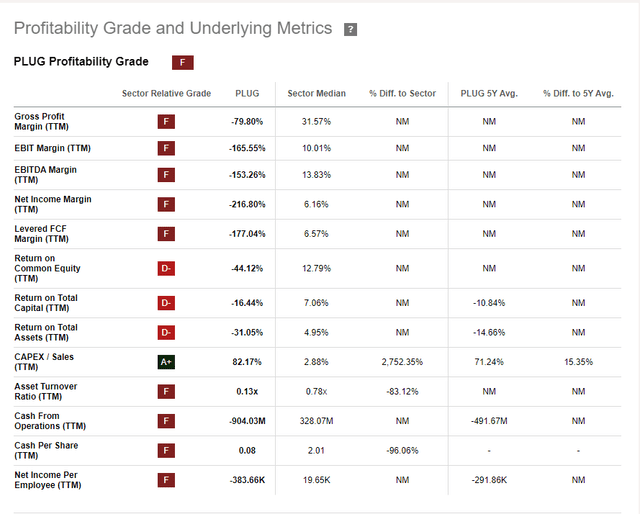

Plug Power Inc. No Profits

It is a normal and expected part of a business to have a few unprofitable years, particularly at the beginning; however, Plug Power is not a young company; it has been operating since 1997, and the last track record shows ten consecutive years of negative cash flow.

If we dig into the margins, the situation is terrible; there is no way to sugarcoat it.

A gross margin of -79.80% shows a really thin top line, with very little capacity for capturing revenue, but then the net income of -216.80% makes the money going into the company even thinner.

Cash per share sits at $0.08, but you are buying the Plug Power stock at $1.97, so shareholders would get very little cash left in the event of bankruptcy.

The worst offender here is probably the Net Income Margin, with a very poor -216.80%; this shows how the company loses money after all costs and taxes are paid.

Any bullish thesis needs the company to approach levels of profitability; in this regard, I believe, here lies the biggest danger for the company’s future. If outside capital flow were to cease, then at the current margins, it would be a matter of time before bankruptcy.

Hydrogen Competition

For Plug Power Inc., one of the biggest threats to the future of the company is to either grow too slowly in this industry compared to its peers or be left out of the hydrogen race.

Or not be able to find and keep its niche.

Smaller competitors in the hydrogen fuel cell industry, such as FuelCell Energy (NASDAQ:FCEL), SFC Energy from Germany, and Doosan Fuel Cell Co. from South Korea compete in the same league of newcomers trying to build their brand in the fuel cell business, as smaller companies they have a capacity to maneuver and innovate that larger companies do not have.

They present a mixed threat, with fewer resources but more space for innovation, and the risk they can present to PLUG is really uncertain.

On the other hand, massive companies such as the international chemical giant Linde plc. or automakers like Hyundai or Toyota have colossal resources compared to the PLUG and decades of experience in expanding their business operations.

In my opinion, the current lack of profitability for PLUG could be an obstacle to future returns and thus cause potential external investments to avoid the company.

As such, I consider the competition to be extremely fierce, as befitting a rapidly growing market with plenty of government financial support and public interest.

Problems With The SEC

Plug Power Inc. has a history with the SEC, with the most recent charges in August 2023

August 30, 2023 – The Securities and Exchange Commission today charged Plug Power Inc., a provider of green hydrogen and hydrogen-fuel-cell systems, for financial reporting, accounting, and controls failures that required a multi-year restatement of the company’s prior financial statements. Plug Power has agreed to settle the SEC’s charges.

This was settled with PLUG paying $1.25 million, but had to restate two years of financial results.

In my opinion, this is a serious issue, and it should not be overlooked when analyzing Plug Power Inc.

On the plus side, PLUG has recently completed and concluded the undertaking with the SEC.

A Possible Future Upside

Not everything is bleak for Plug Power Inc.

The company does hold some merits, with a strong customer base comprised of solid companies, and has a few projects with a geographically well-diversified portfolio.

Their strong presence in the key markets for renewable energy, such as Europe and North America, is a vital strength that the company should continue leveraging for growth.

Plug Power Investor Presentation Q2 2024

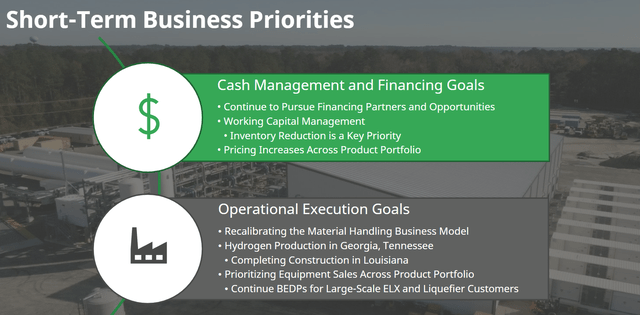

There also appears to be efforts made to improve the financial efficiency of the company as well as the operational efficiency.

With new plans in Georgia, Tennessee, and Louisiana, PLUG could very well enjoy strong tailwinds in the future If macro conditions for Hydrogen improve.

Plug Power Investor Presentation Q2 2024

In fact, here lies the biggest point for a bullish thesis: PLUG is well-placed in an industry that is expected to grow for years or decades to come. If Plug Power Inc. becomes profitable and secures a place among the top clean hydrogen companies, then it could become a great stock to buy and hold.

Valuation For Plug Power Inc.

Currently, I don’t think a valuation for a company that is unprofitable is a productive approach. With a comparative valuation, I find many of the most interesting companies are private or outside the USA, making it a very unfair comparison.

Still, I don’t believe the company is undervalued, considering the lack of profits and negative ratios.

Conclusion

Plug Power Inc. has all-around margins in the deep red, produces minimal cash per share, and continuously underperforms against analysts’ expectations. Their solid financial situation is not enough to offset a company that has shown itself so far to be a losing venture. The lack of sufficient earnings growth and profits, despite being in a quick-growth industry, makes me rate it as a SELL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in PLUG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.