Summary:

- Plug Power will report its Q4 2023 and full year results on March 1.

- Any information about the use of the ATM facility, the DOE loan, and Plug’s cash burn has the potential to set the stock in motion.

- Also, Plug’s outlook for 2024 will be very interesting for investors.

- At the same time, Plug Power’s stock continues to be diluted by the share issuance, and the company feels the urgency in reducing its cash burn.

- On March 1, we will likely know more about the progress. This financial report could have great impact on the short-term share price movement of Plug Power.

ByoungJoo/iStock via Getty Images

On March 1, Plug Power (NASDAQ:PLUG) will release its Q4 and year-end 2023 financial results. Plug Power has been a very volatile stock lately as the company started selling more of its own stock using an ATM facility with B. Riley. Shortly after announcing this, Plug held its annual business update during which the company mentioned being very close to reaching agreement with the Department Of Energy (DOE) on a $1.6B loan which would alleviate some of the company’s trouble with obtaining more financial striking power for new production facilities.

Plug Power seems to be holding on for now, but if the March 1 report gives any reason for pessimism (or simply a lack of optimism), I believe Plug’s stock could suffer dramatically as a result. In this article, I will try to explain why.

Good news time

There have been some news releases of Plug during the last couple of weeks, almost all of which were positive:

- The first customer fill was completed at Plug’s Georgia plant.

- Also, Plug’s Tennessee plant is actively supplying customers with liquid hydrogen.

- Very recently, Plug mentioned that it finalized a contract to support a major U.S. automobile manufacturer’s material handling operations.

- Plug also unveiled a plan to reduce annual operational expenses by more than $75M.

Of these news releases, only the last one was not unambiguously positive, since it might involve a slowdown of growth. I still consider the reduction of annual operational expenses as a positive, since the main problem with which Plug is currently coping is the large cash burn. And although Plug did not disclose which other company is the ‘major U.S. automobile manufacturer’, finalizing a new contract is (almost) always good news. We might hear in the upcoming report who the customer is.

What to watch for in Plug’s Q4 2023 report?

Some topics that have barely been mentioned by Plug since the annual business update could be some of the most important ones for Plug on the short term:

- Is there any progress on the DOE loan? And is it likely that Plug will obtain this loan?

- How much of the ATM facility has Plug already used, and how much cash is Plug likely to extract from the market during the next couple of months?

Two other things I am interested in from Plug’s upcoming Q4 financial results will be the following:

- Plug’s cash burn, has it been reduced and can we realistically expect that it is going to be reduced in 2024?

- The company’s outlook for 2024.

Of course, with regard to the outlook, one has to take into account that Plug has often underdelivered compared with its outlook. Just a brief check on Seeking Alpha’s earnings history page of Plug confirms this, as is illustrated by the screenshot below:

Plug Power earnings history (Seeking Alpha)

The last time Plug reported a positive earnings surprise was in Q2 2020. In my opinion, it would be unrealistic for investors to not take any outlook Plug provides with a very large grain of salt. But still, Plug’s outlook for 2024 can be used to get an impression on the state of the company’s operations and financials when appropriately discounted by an intelligent observer.

Fluctuating stock, influenced by ATM facility?

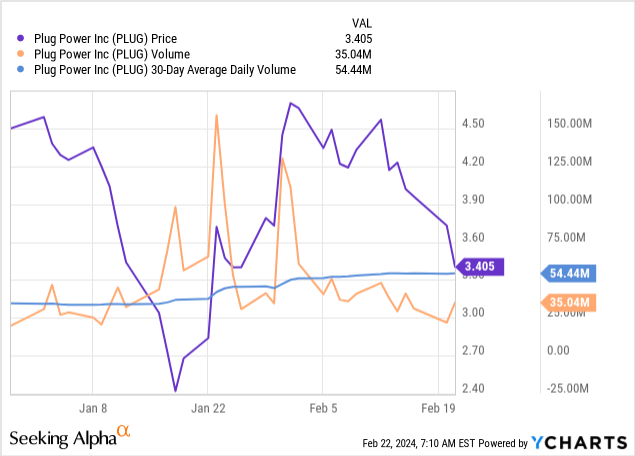

In the graph from YCharts below, I plotted the YTD performance of Plug Power, with the volume and 30-day average daily volume also depicted:

Let us briefly go through the strong movements lately. On the 17th of January, Plug announced its ATM facility, and the stock sharply dropped, likely impacted by investors expecting to be heavily diluted. After this, Plug’s stock experienced some nice recoveries, likely spurred on by the 23 January annual business update during which the company mentioned positive developments regarding the possible DOE loan (among others).

As you can see, on the ‘up’ days, the daily volume of Plug has been quite high, with sometimes over 100M of shares being traded. On the down days though, the volume has usually been lower. I will explain why I think this could be very relevant.

I believe it is almost certain that the ATM facility of Plug is already being used. Let us make a brief back-of-the-envelope calculation of how this ATM facility is able to influence Plug’s share price on the short term, with the following assumptions and limitations:

- Plug’s agent B. Riley has the incentive to short Plug’s shares as soon as Plug provides a ‘commitment advance notice’, leading to selling pressure on Plug’s stock

- Plug power is allowed to sell up to $10M of shares of its common stock per day

- Plug is not allowed to do a principal sale on two consecutive days, unless agreed to by B. Riley

- Plug is allowed to sell up to $30M of shares of its common stock per week (which is logical when connecting both previous prerequisites)

Let us be optimistic and take an average share price of $4 for the shares Plug has already sold since this ATM facility went into action. Let us also optimistically ignore the 5% commission that B. Riley makes from providing its services. Also, let us assume that from the 17th of January, this ATM facility was immediately used by Plug. That means that in my model, it would be operational since 5 weeks and 3 working days, counting from the 17th of January to the 23rd of February. And last but not least, let us assume that B. Riley has not agreed to let Plug use the ATM facility on two consecutive days.

| Scenario | $ sales | Volume from Plug’s sales | Dilution |

| Plug maxed its ATM facility (30M per week) | $168M | 42M | 6.5% |

| Plug sold 20M per week | $112M | 28M | 4.4% |

| Plug sold 10M per week | $56M | 14M | 2.3% |

Since Plug Power has burned a lot of cash in 2023 (free cash flow in Q3 2023 was negative more than $400M), and because the company simply has little cash left, I would expect that Plug is using the ATM facility extensively. It has been operational for very roughly half a quarter (almost 6 weeks, while a quarter lasts 13 weeks), and if Plug would need to extract $400M per quarter from the market, the company should almost max out its ATM facility. As such, I believe that my highest scenario (using the ATM facility for $30M per week) is most realistic. This would mean that investors already experienced a dilution of 6.5 percent, considering an average sales price of $4 per share and ignoring B. Riley’s cut.

The reason why I also listed the daily volume of Plug’s stock is that in order to sell $10M of stocks at an average price of $4, Plug needs the market to buy 2.5M of its stock every day it does this. Note that B. Riley does not necessarily short Plug’s stocks on the day of Plug’s sales, but for the sake of simplicity, let us ignore this.

With an average daily volume of 54.44M and 27 trading days since the 17th of January, this gives us a total volume of 1,470M. So in our scenario of a maxed-out facility, this means that Plug’s sales could be a percentage of 2.9% of the total volume during the time when the ATM facility was active. This does not look like a big deal, but mind you that this 2.9 percent is sales only, while the market is balanced by definition (if there are more shares offered for sale than there are demanded for purchase, the price simply drops). Adding insult to injury is that Plug is a seller at literally any price, comparable with a no-limit order. As such, the recovery of Plug Power’s share price since the 23rd of January has been a double blessing for its shareholders, as the company needs to sell double the amount of stock at a $2 share price than it needs to do at $4.

As I already mentioned earlier, on ‘up’ days, Plug’s volume of number of shares traded has often been high since the 17th of January, but on ‘down’ days it has been relatively low. This could be heavily influenced by the ATM facility. If Plug sells $10M of its shares on an ‘up’ day with a volume of 100M, its 4M of volume is only 4 percent. But if Plug sells $10M of its shares on a down day with only 40M of volume, its share of daily volume is as high as 10 percent. This makes fluctuations on low volume days likely as a result of the ATM facility, and could aggravate share price drops.

Note: of course, this exercise is purely theoretical. B. Riley is likely already shorting Plug’s stock before Plug uses the ATM facility, but B. Riley also has to initiate its short position sometime, which the company has likely done in a professional manner. So the average daily volume matters much more than the volume on a single day during which Plug exercises the ATM facility to the max, even if this is a day with low volume. B. Riley will likely spread out its sales (or the initiation of a short position) over the week. Both B. Riley and Plug Power have an incentive to create high liquidity and high volume, as this will make it easier to get a bunch of sell orders filled on the open market for a predictable price. I also expect B. Riley to be more willing to allow Plug to use the facility on multiple consecutive days if the market volume is high.

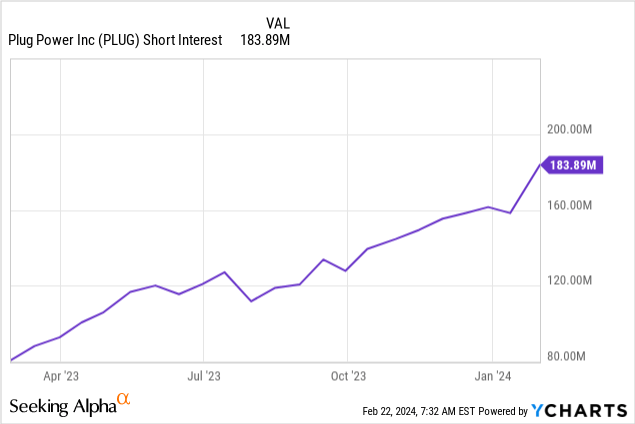

Short interest

Plug Power’s short interest was already high, but after the announcement of the ATM facility it took a sharp turn upwards, as you can see in the graph below. It could be that this was because B. Riley opened short positions in Plug’s stock, which it would likely be wise to do, but it could also be that other investors opened new short positions or started hedging.

At the 31st of January, Plug Power’s short interest was 183.88M. Assuming the company made full use of its ATM facility between the 17th and the 31st of January, the total number of shares of Plug in existence would be about 623M. This would mean that Plug Power’s short interest as a percentage of its total number of shares was almost 30 percent. I suspect that the next time it is reported (on the 15th of February, published on the 27th of February) Plug Power’s short interest will not have gone down, due to the ATM facility and the volatile market conditions for Plug.

Takeaway

Plug Power will report Q4 and full year 2023 earnings on upcoming March 1. There are a couple of very interesting things investors could possibly learn from this financial report. First off, any progress on the huge possible DOE (Department Of Energy) loan is likely to be positively received. A lack of progress here could be a sign that finalizing the loan could be a problem. Also, any information about the extent to which Plug has used its new ATM facility is interesting. The number of shares already issued using the facility and a comparison with the theoretical maximum that Plug has reveals some interesting aspects about the urgency of Plug to find more cash.

Related to all of this, Plug Power will (of course) also report cash burn, free cash flow and regular earnings of Q4 2024. If there are improvements visible here this would be a positive sign. Things to watch for: less cash burn, better margins, especially on the fuel sales side.

Last but not least, the outlook of Plug can be very interesting. As I argued previously, history has shown that Plug’s outlook has almost always been (much) more optimistic than its final results. As such, it is important to compare Plug Power’s outlook to its own previous outlooks. Also, if market dynamics and economic expectations become more positive for the hydrogen market, this could be positive catalysts for Plug during the coming year.

At the moment, I remain very skeptic of the abilities of Plug to dig itself out of the financial hole the company created. Plug is quickly diluting its own stock by using the ATM facility, and the urgent cash burn problem has not been solved, although in all fairness the company is showing willingness to take steps in this direction. But Plug is still burning enormous amounts of cash every quarter and I’m curious how much it was in Q4 2023. Also, as I showed above, the ATM facility creates the risk of quick share price drops which will aggravate dilution, as share price drops will not influence Plug’s need to raise cash.

Even if Plug will be able to obtain the DOE loan, improve its margins and continue growth, I can not see a way in which Plug will become a prudent investment on the short term in my book. Even with all these new insights, no matter what the company reports in its Q4/FY financial report (unless it will be a huge positive surprise), my rating on the stock remains a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.