Summary:

- I invested in Plug Power a year ago, attracted by its disruptive potential, but the stock is now down almost 70%.

- Recent developments, including potential opportunities in the AI sector and partnerships with big tech, offer hope despite regulatory and financial challenges.

- The election of Donald Trump poses significant risks to the renewable energy sector, potentially impacting Plug Power’s growth plans.

- Given the company’s dwindling cash balance and regulatory uncertainties, I am changing my stance from Buy to Hold but not divesting my shares.

gchutka

I invested in Plug Power Inc. (NASDAQ:PLUG) almost exactly a year ago. As I revealed in an article back then, I allocated approximately just 3% of my portfolio to PLUG as I thought a lot could go wrong for the company. Over the past 12 months, a lot has indeed gone wrong for Plug Power, both from a financial and market performance perspective. My investment in Plug Power stock is deeply in the red – down almost 70% – but I have so far been patient as I knew all along that my patience would be tested.

When I invested in Plug Power, I was attracted to the company’s disruptive potential. As a long-term-oriented growth investor, I love companies with disruptive potential, especially when they are valued reasonably. Since I have been proven decisively wrong in my judgment so far, I thought of revisiting Plug Power to determine whether I need to change my stance on the company. In this analysis, I will discuss several recent developments to gauge a measure of Plug Power’s positioning in the hydrogen economy.

The AWS Opportunity Sparked A Rally On Monday

Plug Power stock surged 20% higher last Monday as investors cheered the company’s potential to enter a new market. This new opportunity involves catering to the power-hungry AI sector.

First, let’s take a look at what happened a few months ago. Earlier this year, Talen Energy Corporation (TLN), an energy company with a focus on nuclear energy, sold its Pennsylvania data center campus to Amazon Web Services. Talen was looking to strike a deal to supply the required power to run the Artificial Intelligence servers, amounting to 960 megawatts of electricity. This move was seen as a turning point for the nuclear energy sector with investors hoping that similar arrangements would be duplicated at other data centers with growing power demand. Moreover, data center operators have been considering modular reactors and other nuclear energy facilities to power their facilities for quite some time.

Talen was waiting for regulatory approval to increase the load capacity from 300 MW to 480 MW for the interconnection between its nuclear power plant and the AWS data center. However, last week, the Federal Energy Regulatory Commission decided to block this plan. Following this news, Plug Power stock surged higher with Mr. Market rewarding alternative energy companies with the potential to fill this gap.

For those who are not familiar with Plug Power, the company develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally. The company has a wide range of offerings.

|

Company Offerings |

Description |

|

GenDrive |

Hydrogen-fueled proton exchange membrane fuel cell system that provides power to material-handling EVs. |

|

GenSure |

Stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements. |

|

ProGen |

Fuel cell stack and engine technology are used in mobility and stationary fuel cell systems and as engines in electric delivery vans. |

|

GenFuel |

A liquid hydrogen fueling delivery, generation, storage, and dispensing system. |

|

GenCare |

Ongoing Internet of Things-based maintenance and on-site service program. |

|

GenKey |

Integrated turn-key solution for transitioning to fuel cell power. |

Source: Company filings

The company aims to establish a hydrogen ecosystem that utilizes electrolyzers to provide clean power for industrial power needs—the electrolyzers use electricity to split water molecules into hydrogen and oxygen. Hydrogen fuel is expected to play a key role in the global push toward net-zero emissions.

It would not be true to claim that investor enthusiasm was misplaced last Monday. When it comes to hydrogen for data centers, Plug Power has already achieved a few milestones. Microsoft Corporation (MSFT) successfully ran a pilot project that powered server racks for 48 consecutive hours using a hydrogen fuel cell system. Plug Power has collaborated with Microsoft on a 3 MW fuel cell designed for data center use, demonstrating the viability of hydrogen as a backup power source. In 2022, Plug Power signed an agreement with Amazon.com, Inc.’s (AMZN) e-commerce division to supply hydrogen for its operations, with Amazon committing to invest in Plug Power for 7 years. Alphabet Inc. (GOOG) is also exploring the use of hydrogen fuel cells to achieve carbon neutrality.

Given the recent progress Plug Power has made by partnering with big tech companies and its existing relationship with Amazon, it’s plausible to believe that Plug Power will make an effort to capture the new market opportunity arising from the Federal Energy Regulatory Commission’s decision to block Talen’s offering.

For use in AI data centers, however, hydrogen fuel may need to achieve much higher production efficiencies. Nuclear energy’s levelized cost of electricity (LCOE) typically falls between $112 and $189 per MWh, or $0.11 to $0.19 per kWh. In contrast, the cost of producing hydrogen by electrolysis typically ranges from $4 to $6 per kg. While hydrogen contains 33.33 kWh to 39.39 kWh of energy per kg, the usable energy produced through fuel cells from 1 KG of hydrogen ranges between 16 and 19.7 kWh. This translates to $0.25 to $0.30 per kWh of energy produced using hydrogen, which is nearly double the expense of nuclear energy. Therefore, currently, hydrogen cannot replace nuclear power’s efficiency.

The Trump Threat

With Donald Trump being elected as the 47th President of the United States, there is a risk of policy rollbacks given Trump’s supportive stance for the fossil fuel industry. PLUG stock fell sharply on November 6 when the market digested the risk of President Trump rescinding unspent funds allocated toward the renewable energy sector through the Inflation Reduction Act. There is also the risk of a reversal in green energy tax credits which may directly impact the hydrogen fuel sector during this transitionary period.

At a broad level, the regulatory environment for clean energy companies may change dramatically under President Trump given that there is a risk of the U.S. withdrawing from international climate agreements as well, in addition to rolling back the regulatory support toward emission reduction.

Below are some of the potential negative developments under Trump’s presidency that may dampen the sentiment toward Plug Power and renewable energy companies.

- Withdrawal from the Paris Climate Agreement.

- Exit from the United Nations Framework Convention on Climate Change.

- Increased regulatory support for the fossil fuel industry at the expense of renewable energies.

- Approval of new LNG export terminals.

As a Plug Power investor, I am planning to keep a close eye on regulatory changes that may adversely impact the company’s growth plans.

Plug Power Faces Several Other Headwinds

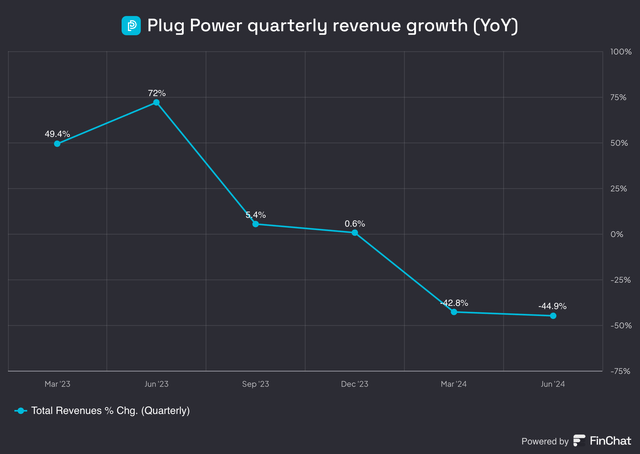

The green hydrogen industry, despite its promising characteristics, is struggling with delayed projects, lower-than-expected demand, regulatory uncertainties, and growing investor skepticism. When I turned bullish on PLUG a year ago, the company was growing in leaps and bounds despite being unprofitable. In the last few quarters, things have changed dramatically with Plug Power reporting massive YoY revenue declines.

FinChat

McKinsey recently slashed its 2030 U.S. green hydrogen production forecast by 70%. The report noted the U.S. would fail to meet the Biden administration’s set target of 10 million metric tons of clean hydrogen production. Mark Lacey, head of thematic equities at Schroders, recently said:

Green hydrogen is still not investable. It’s rubbish in terms of investment.

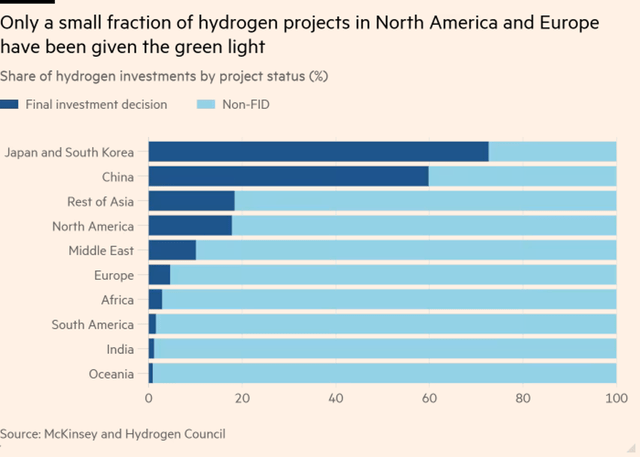

Two years ago, when President Joe Biden approved the Inflation Reduction Act which promised lucrative tax credits, the U.S. was seen as a frontrunner for hydrogen production. However, due to many delays and inefficiencies, only 18% of North America’s clean hydrogen projects expected to be completed by 2030 have reached a final investment decision, according to a report by McKinsey and the Hydrogen Council.

Financial Times

The lackluster progress made so far suggests the hydrogen economy that we once envisioned may take a long while to become a reality. This can be further confirmed by recent corporate actions.

The CEO of Plug Power, Andy Marsh, said it’s been a painful journey for the company. The company said it had to pause the development of its $290 million project in New York, which was set to be the largest in North America, as the company’s cash is depleting. Marsh said they had unrealistic expectations about how fast things could move forward. Reflecting the same sentiment, in September, Hy Stor terminated its 1GW contract with Norwegian manufacturer Nel for a high-profile hydrogen project in Mississippi. Biden’s $7 billion hydrogen hubs program has faced further setbacks as Marathon Petroleum (MPC), CNX Resources Corporation (CNX), and other corporate developers pulled out their commitments.

The slow rollout of tax credit rules and low demand have hit clean energy companies across the U.S. and Europe. Compared to diversified energy companies, smaller companies that are focusing only on hydrogen energy-related products have been affected severely. Arguments have been going on for the past two years over how strictly the Biden administration should define green hydrogen in its tax credit standards, stifling investment and causing entrepreneurs to burn cash.

Changing My Stance From Buy To Hold

As I have highlighted in my previous articles, I still believe Plug Power has the potential to capture a meaningful market share in the growing hydrogen market in the long run. Despite recent setbacks, Markets and Markets projects the green hydrogen market to grow at a CAGR of 61% through 2030, reaching a value of $30.6 billion in contrast to just $1.1 billion in 2023. Although the industry may face regulatory challenges in the short run, the long-term outlook remains stable given the unified global effort to bring carbon emissions under control. The expected increase in fuel-cell-powered EVs and strong demand from the power sector are expected to drive this stellar growth.

Given the high initial investments required to produce green hydrogen, first-mover advantages are likely to come in handy for Plug Power in the long term. As a leading player in the hydrogen production sector with strong roots in the fuel cell sector, I believe Plug Power’s integrated product suite will attract high-value customers in the long run. Partnerships with industry leaders such as Amazon and Walmart, Inc. (WMT) will also pave the way for Plug Power to monetize its technology in the future while mitigating the threat of competition.

All that said, the company’s dwindling cash balance (down to just $62 million from more than $1 billion a year ago) will force Plug Power to tap into capital markets, which brings the risk of ownership dilution in the foreseeable future. This, coupled with the potential for an unfavorable policy environment, is likely to keep PLUG stock under pressure for quite some time. Taking these risks into consideration, I no longer feel comfortable investing in Plug Power stock today, but I am not planning to divest my holdings either as the few shares I own have the potential to deliver alpha returns if things go to plan.

Takeaway

A lot has gone wrong for Plug Power in recent times, and Donald Trump’s victory may add salt to the wound. Although I am not bearish on the prospects for Plug Power, I believe investors need to be cautious today given the many challenges looming on the horizon. It may take longer than initially expected for Plug Power to reach its full potential, creating more room for things to go wrong.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLUG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.