Summary:

- Plug Power faces significant financial challenges, with large losses, cash burn, and delays in key projects, despite a favorable market environment.

- The company struggles with overpromising and underdelivering, exemplified by costly contracts and delayed plant openings, impacting profitability.

- The stock has seen some positive momentum due to either AI data center power hype or a favorable analyst note, but structural issues persist.

onurdongel

Plug Power, Inc. (NASDAQ:PLUG) finds the company in a very precarious position entering 2025. The alternative energy company hasn’t thrived during a more friendly U.S. presidential administration and the new Trump administration appears focused on cutting government subsidies for clean energy. My investment thesis is more Neutral on the stock, though the current trading has a more positive setup.

Horrible Financials

Last month, Plug Power did what the company has done for years now. The hydrogen fuel business missed Q3 financial targets by a wide margin, reporting revenues that not only missed estimates by a rather large $36 million, but also revenues fell nearly 13% YoY.

The last 4 years were likely the most favorable period in the company’s history towards alternative fuels, like green hydrogen. Plug Power just reported another quarter of large losses, cash burn and revenues slipping.

A big part of the weak financials is how Plug Power over promises and under delivers. The company spends at a rate to reach the promised plans causing the financials to constantly result in large losses.

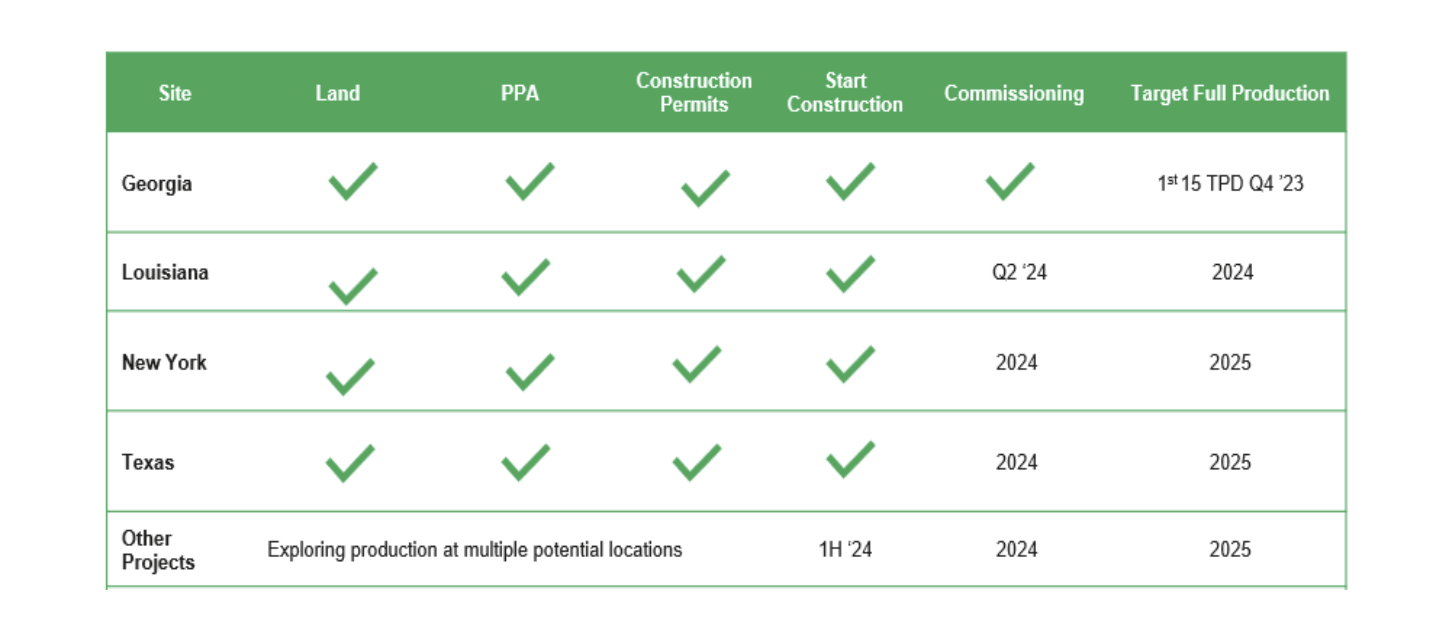

A prime example of this issue remains in the hydrogen fuel business. Plug Power has now pushed the Louisiana plant opening to Q1’25. Plug Power will have around 40 tons/d of capacity to start 2025, but total sales will quickly reach 60 tpd.

The hydrogen fuel company will continue to pay excessive prices for the fuel to supply these contracts, previously estimated at $12 to $14 per kg from third party suppliers. Plug Power made these deals in order to build up the market despite only selling hydrogen fuel for $6 to $7 per kg, but the end result are contracts bleeding the company dry while the current incentives could disappear.

Even worse, the Texas plant has run into permitting issues. The plant is expected to add 45 tpd of hydrogen fuel capacity at costs of only $3 per kg to close the gap on sales and production, but the Texas plant won’t be completed for a long time.

At the Jefferies Renewables & Clean Energy Conference, CRO Jose Luis Crespo has the following to say:

Obviously the DOE loan makes it more attractive, but at the end of the day, I think we can make it quite attractive even without the DOE loan. Regarding other plans, we’ll have to see right now. We’ll have to see. If we do Texas, we will be adding 45 tons a day to the 40 that we have. By that time, we will be at 85. This is probably in the 2027 time range.

Last year, the Texas plant was targeted at reaching production in 2025 after commissioning in 2024. The mayor New York plant project has already been shelved due to regulatory and financing issues.

Source: Plug Power Q3’23 shareholder letter

For Q3, Plug Power only reported fuel delivery revenues of $30 million versus costs of $56 million. The company did cut the gross loss of ~$40 million down to $27 million, but the stock won’t improve much until the Texas plans reaches production years from now.

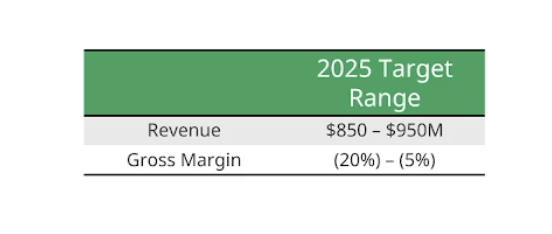

The company only has a forecast of being gross margin positive by the end of 2025, but the full year estimate is for a gross margin loss of up to 20%. Plug Power is only targeting revenues of $850 to $950 million now, only up from $700 to $800 million in 2024.

Source: Plug Power

The story is similar in other sectors where equipment sales, like electrolyzers, always take longer to be commissioned and counted as sales. Not to mention, Plug Power regularly announces projects that never even get the green light.

Positive Momentum

Oddly, the stock appears to have some positive momentum with the recent jump to the highest levels since the September lows. The previous work with Microsoft (MSFT) on a 3MW backup power system for data centers could be a catalyst for more positive sentiment, but the AI data center focus is clearly on nuclear fuel options, not hydrogen.

Roth MKM reiterated a Buy rating on the stock with a $5 price target, partially contributing to the stock jump. The analyst sees some positive developments with the NEPA act on the Texas plant, but Plug Power needs the plant built now, not 2027.

Analyst Andrew Scutt uses a 5x sales multiple for the price target based on sales of $900 million in 2025. Plug Power is still forecast to produce an EBITDA loss of $211 million next year, even with a belief the green hydrogen company will hit on goals of improving margins in the 2H25.

Plug Power has to show far more momentum on reducing losses via hitting production targets. The company is burning too much cash, including over $850 million YTD.

The company has the potential to get a $1.7 billion loan from the DoE. While this is seen as a positive, the loan only helps Plug Power build up to 6 hydrogen fuel plants, presumably including the current Texas plant partially constructed. The loan doesn’t solve the problems with the business producing large losses or generating the economics to repay the loans.

The company can presumably attract financial partners for the Texas plant and future hydrogen fuel plants. The real question is generating the returns to reward shareholders.

The stock has turned more positive after hitting lows below $2 on several occasions. Whether due to AI data center energy hype or the Roth MKM positive note, Plug Power appears set to make a run.

Takeaway

The key investor takeaway is that Plug Power still appears to have major structural problems with the business. In the short term, the stock might trade higher where investors will likely want to unload shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start December, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.