Summary:

- The EV market is displaying characteristics of a Bertrand game.

- Tesla, Inc. price cuts, although compressing short-term margins, should be good in the long run.

- Tesla is more than a traditional car company.

Sakorn Sukkasemsakorn

Thesis

Prices for both new and used Tesla, Inc. (NASDAQ:TSLA) vehicles have been falling. This has led to a growing rhetoric of margin compression and bad economics as material headwinds for Tesla’s future growth prospects. In this article, I’d like to offer a drastically different viewpoint: these price cuts are good for Tesla in the long run.

Price Discrimination

Price discrimination is the concept of offering different prices to different customers. In economics jargon, the idea is to offer prices based on where a customer falls on the demand curve. This is a strategy businesses use to move more units, namely by offering lower prices to customers with higher price elasticity of demand and vice versa. Common methods to achieve this are bundling, student discounts, bulk order discounts, added feature options, and loyalty programs. The auto market has always utilized price discrimination by offering features on top of the MSRP price.

Tesla utilizes price discrimination with over-the-air upgrades such as Autopilot, Full-Self Driving, Premium Connectivity, and Acceleration Boost. They also offer this with the initial purchase; for example, the Model 3 comes cheapest with Rear-Wheel Drive, but customers can optionally add Dual Motor All-Wheel Drive with the Performance or Long Range offerings. The Performance offering adds about $11,000 to the ticket price. Customers can also add 19″ tires for $1,500, different exterior and interior colors, and charging accessories. All of these offerings are a way for Tesla to extract more revenue from higher-budget customers and enthusiasts who are willing to spend more to get more.

Tesla took it a step further by pioneering over-the-air price discrimination in the auto market. Other major competitors have similar offerings, but Tesla is innovating existing features and offering new features at a rate that exceeds all competitors, in my opinion. This is why I believe the “good business, bad economics” model does not fit Tesla in the way it fits traditional car companies. The breadth of cross-selling and relationship-deepening opportunities for Tesla actually make price cuts a really good strategy. Tesla benefits more than traditional car companies because it is developing an entire product ecosystem that will ultimately be much more than just cars. Without low-cost options, Tesla will have trouble driving further growth and adoption of this ecosystem.

The EV market is in the throes of a Bertrand price war. In the Bertrand model, companies undercut each other’s prices to gain market share. The winner of a Bertrand game is the company with the lowest marginal cost. Tesla’s economies of scale have driven average unit costs down from $84,000 in 2017 to $36,000 in recent quarters, according to management. This is a promising trend and coupled with Tesla’s intense focus on decreasing the total cost of ownership, the EV price wars look like they will actually benefit Tesla in the long run.

A Bertrand game cuts out less focused competitors and rewards those with scale, focus, and lower marginal cost. Although the EV price wars will compress Tesla’s margins in the short run, they will also drive out a lot of competition in the long run, which Tesla should benefit from.

Strengthening Ecosystem

The concept of a product ecosystem is not new. Primary examples are Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), and other big tech companies. This is the concept of one company offering a variety of products that are interconnected. Owning additional products within the ecosystem increases the marginal benefit of owning each individual product. For most companies, there is one core product, which serves as the gateway to the ecosystem: the iPhone, a Facebook account, or the Windows operating system.

Product ecosystems are mostly foreign to the auto industry, as most car manufacturers look just to sell new cars. Tesla is changing this. The core product in the Tesla ecosystem is a Tesla car, so widening the total addressable market by cutting prices will expedite the growth and adoption of the Tesla ecosystem. Not only do Tesla vehicles present ongoing revenue generation opportunities with over-the-air upgrades, but there are cross-sell opportunities for both new and used units with Tesla Insurance, Solar solutions, batteries, and more products in the pipeline like heat pumps.

Tesla is very vertically integrated, meaning it will be cheaper to incorporate innovations in other products in the future. For example, Tesla already offers heat pumps in the Model Y, meaning they have begun scaling their heat pump manufacturing capabilities, so the production of heat pumps en masse won’t be as costly or inefficient as it would’ve been otherwise. This will make it easier and cheaper to implement heat pumps in future Tesla models, increasing efficiency and driving a better customer experience.

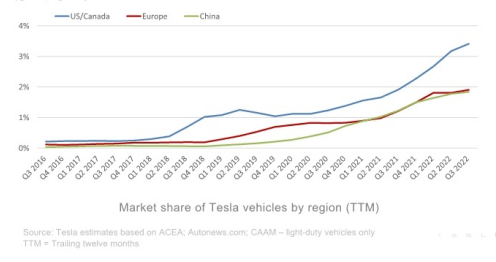

The most important metric for ecosystem growth is obviously the demand for the core product. Tesla has a growing market share in the overall auto industry in all of its major reportable regional segments:

Tesla January 2nd, 2023 8k

Another important metric to measure demand is the used Tesla turnover rate. Tesla Model 3, which is one of the two high-volume units for Tesla (Model 3 and Model Y), shows a much higher turnover rate than other EVs:

The used Tesla turnover rate of 5.5X current inventory in 90 days is actually inflated by Model 3 popularity. Used Model 3s sell even faster: 6.6X sales per vehicle in inventory. For all other used Teslas, it’s 4X and not as much of an outlier compared to other popular models from Chevy and BMW.

The turnover rate shows how many cars move off the used car market in a 90-day period compared to inflows of used cars. A 6.6x turnover rate means that for every Model 3 that enters the used market, 6.6 Model 3s will sell in an average 90-day period. This clearly shows robust demand for Tesla vehicles despite a slowing in first-time EV buyers opting for Tesla, as shown below.

Although Tesla may not directly benefit from used car transactions that they don’t directly facilitate (about 5% of Tesla’s are leases, so Tesla can also directly participate in the Used market with previously-leased vehicles), they can still sell over-the-air upgrades to new customers in used vehicles. Some of these upgrades are not tied to the vehicle, but tied to the Tesla user’s account. For example, Tesla could sell the FSD product to the initial purchaser and the used purchaser. The used car market further exacerbates the price-cutting effect. Some consumers may opt to buy a used Tesla because they cannot afford a new Tesla, but as I said earlier the important part for Tesla is more people in Tesla cars. Used Tesla transactions strengthen the Tesla ecosystem.

Tesla also has a fiercely loyal customer base, which provides really robust demand. Tesla has outstanding retention and an astronomical net promoter score of 96. Customer loyalty has been really sticky, despite Elon’s non-Tesla-related activities (controversies?):

…“I’m not equating Tesla with Apple, but you can see similarities,” Palomarez (product management principal at S&P Global Mobility) said. “Someone who’s going to be a Tesla family, they’re going to have the Model 3, they’re going to have a charging station, they’re going to come back and get a Model Y, similar to how someone who has an iPhone probably also has an iPad or a MacBook.”

One area where Tesla is slipping, at least to some degree, is in attracting first-time EV buyers. Historically, more than 70% of US consumers acquiring their first electric car bought a Tesla. “In the last year or two, as more EV models are being introduced, we’re starting to see some of that share decline,” Palomarez said.

This quote also mentions a key risk for Tesla, which is a decline in first-time EV buyers choosing Tesla.

Growth of Margins and Earnings

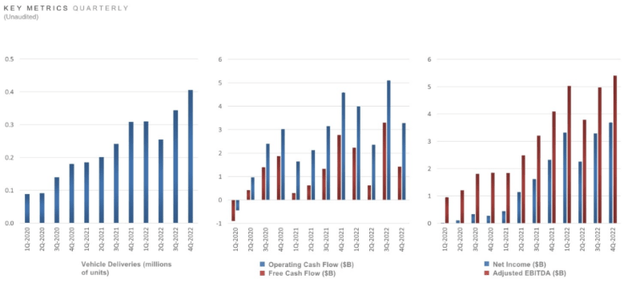

Tesla has shown particularly strong growth recently, proving that major investments in Gigafactories are paying off:

|

Year |

Gross Margin |

Operating Margin |

Net Margin |

|

2015 |

22.8% |

-8.9% |

-8.9% |

|

2016 |

21.6% |

-5.4% |

-6.9% |

|

2017 |

18.9% |

-13.9% |

-16.7% |

|

2018 |

15.0% |

-4.3% |

-4.1% |

|

2019 |

16.5% |

-0.7% |

-0.5% |

|

2020 |

21.0% |

6.3% |

6.2% |

|

2021 |

26.3% |

12.1% |

11.8% |

|

2022 |

29.7% |

14.6% |

15.4% |

They also have really strong growth with vehicle delivery and production, showing really strong results for Gigafactory investment:

|

Year |

Deliveries |

Production |

YoY Growth Rate (Deliveries) |

YoY Growth Rate (Production) |

Notes |

|

2015 |

50,580 |

50,658 |

N/A |

N/A |

|

|

2016 |

76,230 |

83,922 |

50.7% |

65.7% |

Gigafactory Nevada opened in July 2016 |

|

2017 |

101,312 |

103,097 |

32.9% |

22.8% |

|

|

2018 |

245,240 |

254,530 |

142.1% |

146.8% |

|

|

2019 |

367,500 |

365,300 |

49.8% |

43.5% |

Gigafactory Shanghai opened in December 2019 |

|

2020 |

499,550 |

509,737 |

35.9% |

39.5% |

|

|

2021 |

936,172 |

936,172 |

87.4% |

83.7% |

Gigafactories Berlin and Texas opened in October 2021 and December 2021, respectively |

|

2022 |

1,313,851 |

1,369,611 |

40.3% |

46.3% |

This growth has only solidified management’s resolve to continue dominating, with additional Gigafactories already being planned.

Tesla has seen cash flows and earnings grow alongside vehicle deliveries:

All of this reinforces one central theme: expansion of production capabilities and growth in deliveries continue to be the most important metrics for Tesla’s valuation. An increasingly competitive landscape is the major headwind for Tesla, but its vertical integration should allow for cost leadership and strategic margin compression to continue delivering new vehicles and deepening relationships with owners.

This brings me to my final point, and the core of my bull case for Tesla: excellence in engineering. Phil Fisher, a famous value investor who greatly influenced Warren Buffett said “It is the constant leadership in engineering, not patents, that is the fundamental source of protection” in his famous book Common Stocks and Uncommon Profits. Tesla sees itself as a technology company first and a car company second. Tesla cars have had their share of issues in the past, but that is expected in any high-growth company offering revolutionary products. The Tesla of today is dramatically different than only 10 years ago since they now have the capability to fund, not finance, much of their R&D efforts and continue to focus on the engineering of their products and innovation in manufacturing capabilities and business strategies.

But is now the right time to buy?

Tesla’s fundamentals are sound. They have a very strong balance sheet and consistent strong growth in all major financial metrics. However, investors need to pay a hefty premium to take part in this journey. At a valuation of around $618B at the time of writing, I believe Tesla, Inc. stock is overvalued and does not present a sufficient margin of safety. I retain my previously stated valuation and target price of $142.35/share. With only $4.2B in free cash flow, they are trading at a ridiculous multiple.

With the future looking bright, I can see the road to Tesla, Inc. becoming the world’s most valuable company, but they have a lot of catching up to do and it is certainly not devoid of risk. Tesla looks built to last and should continue showing very robust growth in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.