Summary:

- Tesla, Inc.’s EBIT margin has declined from nearly 20% to 12% in the past year, and the company has been overtaken by Mercedes-Benz, BMW, and Kia.

- The decline in margins is due to aggressive price cutting and increasing competition in the EV space.

- Tesla’s current valuation of 50x EBIT is still significantly higher than that of competitors, making it less attractive at current prices.

steved_np3/iStock via Getty Images

Article Thesis

For a long time, Tesla, Inc. (NASDAQ:TSLA) was the margin king in the automobile space, at least when we exclude low-volume high-end players such as Ferrari N.V. (RACE). This has changed, as Tesla has been overtaken margin-wise by other premium manufacturers. That’s the result of a price war in the electric vehicle (“EV”) space and does not bode well for Tesla’s future profitability, nor for its resilience or brand value.

What Happened?

For a long time, Tesla bulls have argued that Tesla deserves a premium valuation due to generating the highest margins in the automobile industry, at least when luxury players with low volumes are excluded. And while I did not believe that the high margins justify a premium of hundreds of percent, relative to other automobile companies, it undoubtedly is true that a higher margin justifies a higher valuation, all else equal. There are several reasons for that:

- – A higher margin makes an automobile company more profitable and results in higher cash flows, all else equal.

- – A higher margin makes an automobile company — a notoriously cyclical industry — more resilient versus downturns. When a company with a 15% margin has to offer rebates to move its production, that will be less dramatic than when a company with a 5% margin has to offer rebates to move its production.

- – A higher margin can be the result of a strong brand that consumers love to buy. In that regard, a high margin can be seen as a sign of brand power and admirability.

Due to ongoing price increases during the pandemic and thanks to supply constraints in the electric vehicle space, Tesla generated very appealing margins not too long ago, at least for an automobile company (healthcare or tech companies oftentimes generate way higher margins, however):

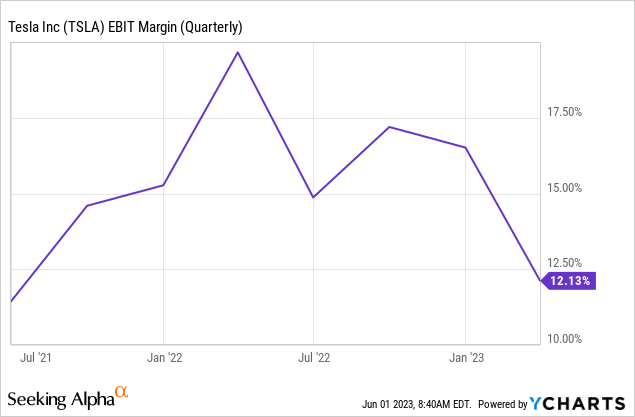

Around a year ago, Tesla’s EBIT margin, or operating margin, as the impact of taxes and interest is excluded, peaked at almost 20%. For an automobile company, that’s very strong. Since then, however, things have clearly been moving in the wrong direction — during the most recent quarter, Tesla’s EBIT margin was just 12%, or down close to 40% from the peak of almost 20% [12/20 = 0.60].

Several factors are at play here, including input costs. Lithium prices have been very volatile and have pressured EV maker margins, for example. In Tesla’s case, the most important factor was the aggressive price cutting, however. We see this in the above chart, as Q1, when most of the price cuts were in place, was the quarter with the steepest margin decline. And there is little to argue — when you cut the price of a product, while production costs do not decline dramatically, then margins will inevitably compress. Tesla still generates a margin that is solid for an automobile company, but that’s about it — the margin isn’t great any longer, and, importantly, the bull thesis of ever-growing margins has clearly not played out as expected. Instead, it looks like some of the bears have been right — increasing competition in the EV space results in less favorable pricing, and margins are coming back down to earth from the higher levels seen in the past.

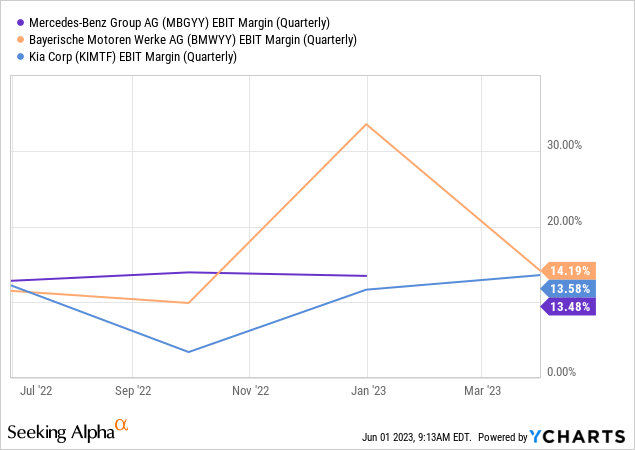

Importantly, Tesla has also been overtaken margin-wise by some other major automobile companies — and we’re not talking about the small-volume luxury Ferraris of the world. Instead, even some companies with higher production volumes and sales numbers than Tesla have overtaken Tesla margin-wise in the recent past:

Both Mercedes-Benz Group (OTCPK:MBGYY) and BMW (OTCPK:BMWYY) have generated higher EBIT margins during the most recent quarter, and their average margin over the last year is also higher than Tesla’s current margin, indicating that the most recent quarter was not an outlier. Both Mercedes and BMW sell more vehicles than Tesla, thus these aren’t niche players — instead, they are large premium players like Tesla. Somewhat surprisingly, Kia Motors Corp (OTCPK:KIMTF) has also generated a higher operating margin than Tesla in the most recent quarter, at almost 14. Kia is not a premium manufacturer, but thanks to efficient operations and tight cost controls, it nevertheless outperforms Tesla on a profit-per-revenue basis. Kia also has a strong EV lineup, with successful models such as the EV6 that are both well-designed and well-received by consumers. Both Mercedes and BMW are growing their EV sales rapidly as well, with annual sales of 320,000 and 430,000 in 2022, respectively, which was up by 19% and 32%.

Many Tesla bulls claim that legacy automobile companies are losing money on each EV sold. While not all of them break out their profits on an ICE and EV basis, we know that this is true for at least some legacy auto players, such as Ford Motor Company (F), which is breaking out profits by tech. Assuming this statement is true and all, or at least most, legacy players are losing money in their EV divisions right now, this brings up the following question: Why are Mercedes, BMW, and Kia still more profitable than Tesla, despite their EV sales being a drag on profits for now? As they ramp up their EV businesses, these will become more profitable over time — the same happened to Tesla. Will they ultimately be even more profitable compared to Tesla, when they already have higher margins today? That would indicate that Tesla does not really deserve a huge premium valuation-wise. Alternatively, is it possible that internal combustion engine (“ICE”) vehicle sales could be structurally more profitable than EV sales? At least for now, that seems to be the case, as the most profitable automobile companies are legacy players. If that holds true in the future, too, it’s bad news for the entire industry — moving to EVs could then be an overall margin headwind for every automobile company (including EV pure plays such as Tesla).

Of course, it is also possible that Q1 was an outlier, and that profits at Mercedes, BMW, and Kia pull back. Alternatively, it’s possible that Tesla’s profits soar in the coming quarters, and that it will retake its margin leadership — but at least for now, I don’t see this happening, as there are no large-scale price increases. With a recession in the United States being possible in the coming quarters, and with China’s economic rebound being somewhat underwhelming for now, Tesla also faces major macro headwinds in its most important markets, which makes it somewhat unlikely that we will see a huge margin rebound in the near term, I believe.

Why It Matters For Tesla

Tesla’s margins are declining, and it is being overtaken margin-wise by other automobile companies. Both of these are headwinds, I believe. Lower margins obviously make TSLA less profitable, all else equal. Lower margins also make Tesla less resilient in a market downturn. With declining margins prior to a potential recession, there is a meaningful risk that margins could dive further in case the economic slowdown in the U.S. and/or China accelerates (a recession would be bad news for other automobile companies as well, of course).

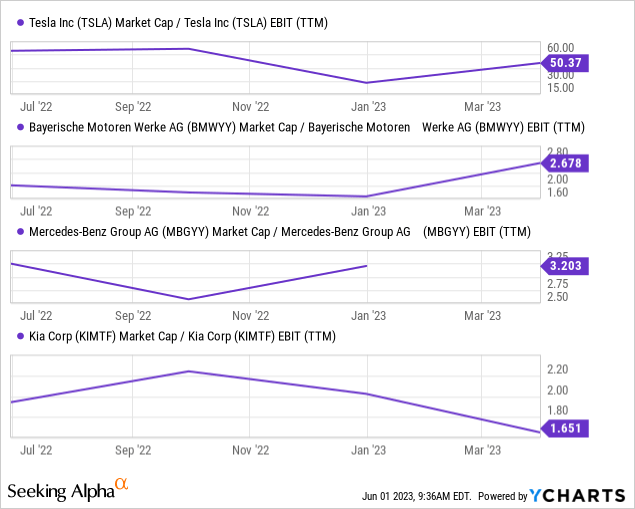

The fact that Tesla lost its leadership position in the margin war could also be a headwind. As legacy players are increasingly moving into the EV space, investors that want EV exposure could increasingly opt for shares of legacy players. Especially when these are more profitable than Tesla they could attract investors’ funds. With TSLA now being more of an average automobile company margin-wise, instead of an outstandingly profitable automobile company, the premium versus other automobile companies could decline. While TSLA’s valuation has come down over the last year, it still is quite pricy both in absolute and relative terms:

Tesla trades at 50x EBIT, which is a pretty high valuation in absolute terms. Compared to its higher-margin competitors, it makes for an incredibly high valuation — BMW, Mercedes, and KIA are trading at 2-3x EBIT. In other words, Tesla trades at a 1,500%+ premium to these on a price-to-EBIT basis.

While a premium valuation seems justified due to its higher volume growth (although that does not necessarily result in profit growth of the same magnitude, as we have seen in Q1), I doubt that the premium should be this high. If TSLA eventually were to solve self-driving vehicles before anyone else, things would be different, and the current valuation could be justified, but at least for now, Tesla solving AVs is not the case — despite huge promises in the past.

Takeaway

Tesla, Inc. is becoming more of a “normal” automobile company as it matures. Volume growth is coming down, margins are compressing, and the company is facing increasing competition that can result in price wars, as we have seen in the recent past. Tesla has now been overtaken margin-wise by several other automobile companies.

As Tesla, Inc. stock still trades at an extraordinarily high valuation, I believe it’s not attractive at current prices.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

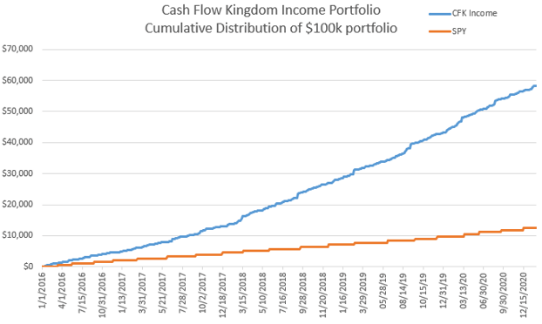

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!