Summary:

- Procter & Gamble has delivered a relatively strong 2024 amidst the economic uncertainty.

- PG’s recession-resistant business model makes it an excellent defensive investment, but not at today’s price.

- Management’s focus on stock buybacks over more aggressive dividend growth is less appealing, given the inflated share price.

- I recommend holding off on buying PG shares until the stock price drops to a more attractive range of $140-$150 per share.

RobsonPL

Procter & Gamble Company (NYSE:PG) has delivered a relatively strong performance on a 2024 year-to-date basis, but investors buying shares at today’s valuation may be set for disappointment in the future.

If investors think of a flight to a safe haven, there are few better alternatives than PG in the equity market. PG’s portfolio of consumer staple products, catering to over 5B customers across all continents, is built for defense, pushing up its share price in times of uncertainty, such as today.

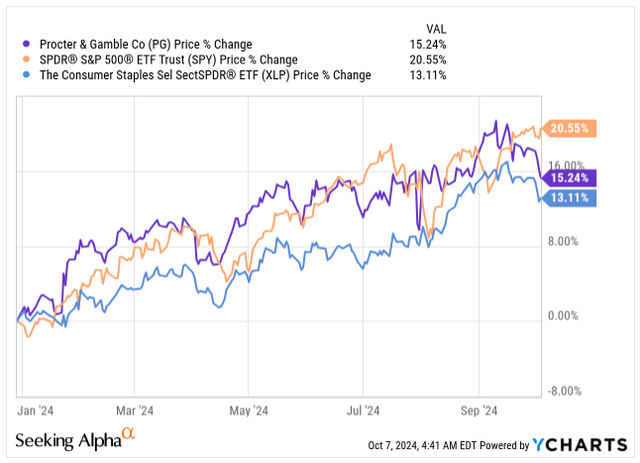

Despite not beating the tech-heavy broader market (SP500), defensive equities have done well in 2024 overall. The Fed’s pivot brought uncertainty, and investors will start flocking back into dividend-paying equities as the yields of short-term money market accounts start to fall.

Stock Price Change (Seeking Alpha)

If you aim to earn a competitive ROR, buying slower-growing stalwarts like PG is generally not a good idea when the stock is trading close to its all-time high of $178, but rather when defensive stocks are out of favor, such as we saw in 2023 when I previously covered PG with a “Buy” rating.

Since PG offers investors a recession-resistant business model, selling products bought no matter the economic cycle, I don’t expect PG’s stock to trade at a reasonable valuation anytime soon, particularly given the debate around soft or hard landing in 2025, which can keep PG’s share price inflated for a prolonged period.

Yet, if you are in the hard landing camp and find it difficult to park your cash, PG’s defensive and durable business model, alongside its 2.4% dividend yield, might be a good place to be. However, I would not expect outsized gains.

Let me show you why I like their business model but not the valuation.

Build For Defense

PG’s cleaning, hygiene, and health products are staples for households worldwide. Even as we started seeing cracks among the lower-income consumers in the US and slow-moving sales internationally, PG delivered 2% Net Sales growth in 2024, with Net Sales reaching $84B and Diluted EPS up 2% YoY.

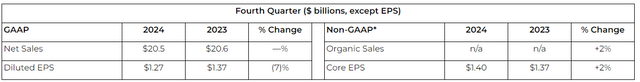

In Q4 FY24, PG reported $20.5B in Net Sales, roughly flat YoY, and 2% negatively impacted by inferior FX with USD continuous strength. Organic sales, which exclude the impacts of FX and acquisitions and divestitures, increased by 2%. The rise came from a 1% increase in volume and a 1% increase in pricing without any changes to the product mix.

Four of five business segments have experienced organic sales growth in Q4 FY24:

- Beauty up 3%

- Grooming and Fabric & Home Care up 7%

- Health Care up 4%

- Fabric & Home Care up 2%

- Baby, Feminine & Family Care down 1%

Diluted net earnings per share were $1.27, a decrease of 7% versus the prior year, negatively impacted by higher restructuring charges, increased marketing expenses, and 140 basis points contraction in operating margin.

Q4 Results (PG IR)

Stepping into the next fiscal year, PG expects Net Sales growth to range from 2% to 4% compared to the previous year. With the weakening of the USD against the basket of currencies, the FX headwind is expected to subside towards 1%. Hence, in terms of Organic Sales growth, PG expects to deliver 3-5% growth.

Thanks to its strong brands, pricing power, and favorable mix, PG expects Core EPS to grow 5% to 7% compared to full-FY24 Core EPS of $6.59.

This includes the net headwind of around $500M after-tax from unfavorable commodity costs and unfavorable FX, which equates to around $0.20/share, or a 3% drag on the Core EPS.

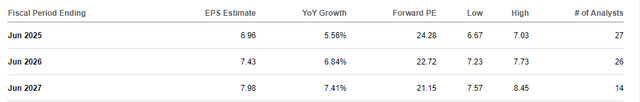

Management’s forecast falls in line with analysts’ forecast for Fiscal 2024, with continuous single-digit growth expected in the subsequent years.

Forecasted EPS (Seeking Alpha)

5% to 7% annual growth for such a defensive stock as PG is indeed an appetizing prospect, but priced at 22.7x its FY25 earnings, the stock is overpriced, and even though I would like to add shares of a high-quality name like P&G into my portfolio, the valuation is far too restrictive.

Given that the Net Sales growth rate is expected to fall below the EPS growth in subsequent years, the EPS is achieved through enhanced margins as PG has focused on productivity and cost-saving measures. Implementing the supply chain 3.0 program enabled PG to improve capacity, flexibility, and productivity with a $900M after-tax benefit each year.

PG can still drive further optimization and expansion of its margins via pricing and further narrowing its product mix to invest in the highest-return areas, implementing R&D optimization to streamline innovations at lower cost and the ongoing productivity initiatives aimed at $1.5B annual cost of goods savings via improved and digitalized supply chain.

PG’s LT Debt/Capital ratio of 31% suggests the company is conservatively financed, giving it the flexibility to raise additional capital through debt if needed. This earned PG an “AA-” ratio from S&P Global, making it one of the safest companies to invest in today.

134 Years Of Consecutive Dividends

If you are buying PG’s shares, your objectives are most likely twofold:

- Own a Defensive Business in Your Portfolio

- Benefit From The Reliable Distribution

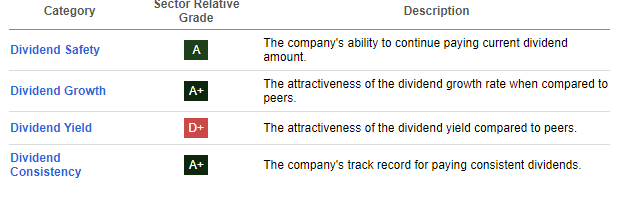

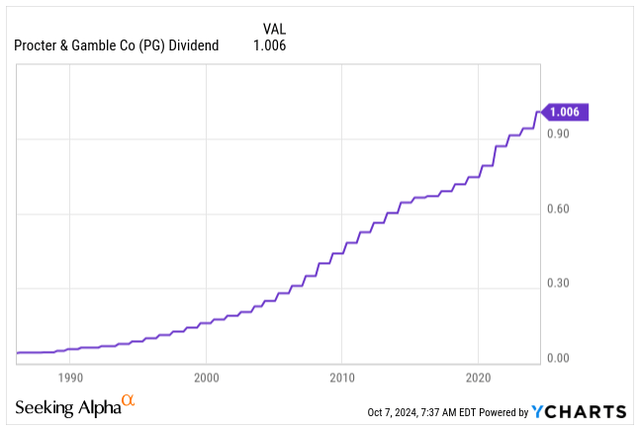

PG has paid its dividends for 134 consecutive years and increased its dividend for 68 straight years, making it one of the longest-paying dividend streaks in the US.

The company remains laser-focused on its commitment to keep rewarding shareholders both via dividends and buyback programs.

That’s one reason PG’s Seeking Alpha dividend scorecard continuously scores As, with the exception of the yield, which is indeed on the lower end.

Dividend Scorecard (Seeking Alpha)

In Fiscal Year 2024, PG has returned over $14B of value to shareholders via $9.3B in dividends and $5B in share repurchases.

With the last dividend increase of 7%, back in April 2024, the quarterly dividend currently sits at $1.006/share, or roughly a yield of 2.38%, which is indeed on the lower end of the attractive range, pressured by the stock appreciation.

PG’s dividend has grown at a compounded rate of 7.32% in the last 20 years, but the growth has slowed down to 6.04% in the last five years, and I expect it will remain around a similar level moving forward.

This fiscal year, management expects to pay out $10B in dividends, $1.3B more than last year, implying we could expect another 7.5% dividend hike around April 2025.

Given the low yield, the payout ratio sits at a very comfortable 58%.

PG Dividend (Seeking Alpha)

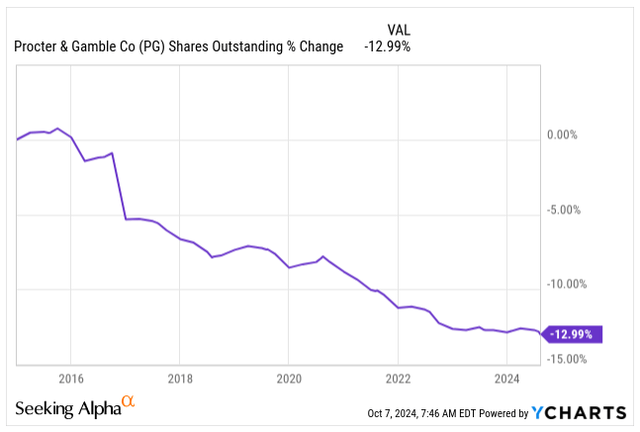

What’s interesting, though, is that the management is starting to prioritize a stock buyback program over stronger dividend growth, a more tax-efficient strategy that resonates well with me often, but not this time.

Buying back its own shares is perhaps the best strategy for returning money to shareholders, but only if done at the right price. PG’s shares, in my opinion, trade at a significant premium to their historical valuation; hence, I would prefer to see less buyback and more aggressive dividend growth instead.

In this fiscal year, management is planning on repurchasing $6B to $7B of its shares, significantly higher than the $5B allocated to stock buybacks last fiscal year.

While last year’s stock buyback represented around 35% of the total value returned to shareholders, this year, it might increase to 39% at the midpoint of its guidance.

Altogether, PG repurchased 13% of its float in the last 10 years.

Shares Outstanding (Seeking Alpha)

Valuation

All of PG’s desirable attributes:

- Recession-resistant business model

- Reasonable mid-single-digit EPS Growth

- Non-cyclical business

- 134 years of consecutive dividends

… come at a price.

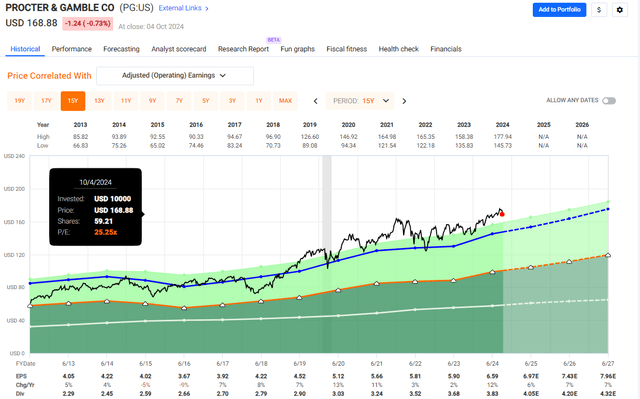

PG’s stock is not cheap by any means, trading at 25.25x its Blended P/E:

- In the last 20 years, PG’s stock traded on average at 20.35x its earnings.

- In the last 15 years, PG’s stock traded on average at 22.01x its earnings.

This implies that today’s share price is inflated by at least 15-20% without any margin of safety left for investors.

PG Valuation (Fast Graphs)

In terms of EPS growth, PG delivered roughly a 5% annual growth rate over the past 15 years.

Moving forward, according to FactSet, the growth is expected to slightly increase to an average of 6.6%, which could justify a slight premium to its historical valuation, given the 84% accuracy of the analyst scorecard:

- FY25: Expected EPS of $6.97, 6% YoY Growth

- FY26: Expected EPS of $7.43, 7% YoY Growth

- FY27: Expected EPS of $7.96, 7% YoY Growth

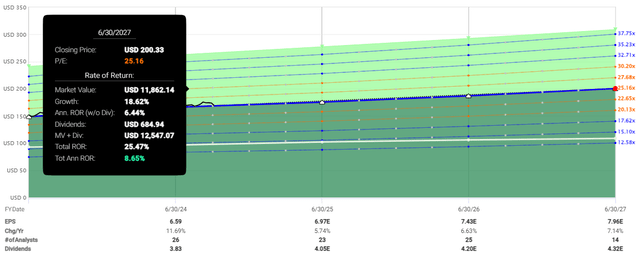

However, even if the valuation multiple would increase, let’s say to 25x its earnings, on the backbone of the faster-than-historical growth, investors would be set to earn 8.7% at best, including the dividends, which is far too low to justify the risk of if either the growth does not materialize or the valuation simply contracts towards its historical multiples.

Potential Returns (Fast Graphs)

Historically, buying PG’s shares above 22x its earnings has not proven to be the correct decision to earn a competitive ROR and that’s why I am recommending investors to stay on the sidelines, as long as the fundamentals do not catch up to its premium valuation or the stock price moves lower, potentially presenting a good buying opportunity around $140-$150/share.

Investor’s Takeaway

Procter & Gamble is one of the few durable businesses globally with its non-cyclical, recession-proof business model.

I always wanted to own the company in my portfolio, but never really managed to buy the shares at a fair price, which would unlock competitive ROR prospects as the stock price kept marching higher.

With its low financial gearing and “AA-” credit rating, the company presents a compelling prospect, particularly for defensive investors.

Its 2.4% dividend yield is certainly not the most attractive, but given its 134 years of paying dividends with 68 years of consecutive increases, this is precisely the sleep-well-at-night pick for many.

Yet, given the inferior share price, I am not keen on management prioritizing its stock buyback program over more aggressive dividend increases.

Overall, while the business is rock-solid, I downgraded PG’s stock to “Hold” due to its unattractive valuation and expected lackluster returns down the road.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.