Summary:

- Shares of Prudential have become a more compelling buy since my last article.

- The financial services company is well-positioned to cash in on massive retirement opportunities in the U.S. and Japan.

- Prudential’s liquidity is on the high end of its targeted range of between $3 billion and $5 billion as of June 30.

- Shares appear to be priced at an 11% discount to fair value.

- Prudential could be primed to deliver nearly 40% cumulative total returns through 2026.

A shot of the Mediterranean Sea with the Rock of Gibraltar in the background. swilmor

Few if any things in life are a straight line up. Just like in life, investing is rarely linear.

In an entirely rational world devoid of human emotions, there would be no market sentiment. Stocks would move perfectly in line with earnings growth at all times.

The good news is that human emotions like fear and greed can create buying opportunities for smart investors to leverage to their advantage.

One recent example of this is Prudential Financial (NYSE:PRU). When I last covered the stock with a buy rating in May, I liked the durability that its 149-year operating history conveyed. The dividend was easily covered by after-tax adjusted operating income per share and had room to keep growing. Shares of Prudential were also modestly undervalued.

Now that the company released its financial results for the second quarter earlier this month, I’m maintaining my buy rating. Prudential’s after-tax adjusted operating income per share surged higher. The company’s balance sheet is retaining ample liquidity and enjoys excellent credit ratings from the major rating agencies. Shares are flat as the S&P 500 (SP500) index has gained 8% in that time. Thus, shares look to be a moderate value here.

Substantial Growth Opportunities Ahead

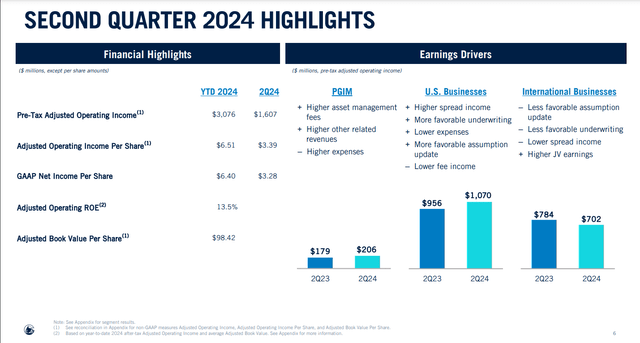

Prudential Q2 2024 Earnings Presentation

On August 1st, Prudential shared its financial results for the second quarter ended June 30. The company’s after-tax adjusted operating income per share grew by 9.7% over the year-ago period to $3.39 in the quarter. For perspective, that was $0.06 short of the Seeking Alpha analyst consensus.

Even with this marginal bottom-line miss, it’s clear from my view that Prudential’s fundamentals are trending positively. This is because the company’s after-tax adjusted operating income per share was also up 8.7% sequentially.

Prudential’s global investment management business, PGIM, recorded strong growth during the second quarter. The segment’s pre-tax adjusted operating income rose by 15.1% over the year-ago period to $206 million for the quarter. That was driven by $17.1 billion in year-to-date net inflows, which helped assets under management increase by 5% year-over-year to top $1.3 trillion in the quarter. This led to Prudential’s asset management fees and other related revenue being higher during the quarter. That was only partially countered by higher expenses.

Prudential’s U.S. Businesses segment also put up a robust second quarter. The segment recorded almost $1.1 billion in pre-tax adjusted operating income, which was an 11.9% jump over the year-ago period. These results were powered by improved underwriting results, greater investment spreads, and lower expenses. That more than made up for the headwind of lower fee income for the quarter.

The strength of these two businesses adequately compensated for challenges in the International Businesses segment. The segment’s pre-tax adjusted operating income fell by 10.5% year-over-year to $702 million in the second quarter. This was caused by less favorable underwriting results due to policyholder behavior per Vice Chairman Rob Falzon’s remarks during the Q2 2024 Earnings Call and lower investment spread income.

Prudential has a reputation for being a buyback-friendly company. The company has continued on this in recent quarters, with its share count falling by 1.5% to 360.5 million during the second quarter. Prudential’s adjusted book value per common share also edged 1.1% higher over the year-ago period to $98.42 during the second quarter.

Looking ahead, there are reasons to believe in Prudential’s growth story.

Chairman and CEO Charlie Lowrey noted in his opening remarks that historic levels of Americans will turn 65 this year. There are also many 55-year-olds entering the last decade of work before retirement. These demographics are expected to result in a $137 trillion retirement opportunity in the U.S. and a $26 trillion opportunity abroad in Japan by 2050.

So, there’s a massive piece of pie up for grabs in the years and decades to come. What makes me think that Prudential can seize a big slice of it?

The company is trusted in an industry where trust is everything. Prudential is trusted for good reason as well: The vast majority of Prudential’s AUM have beat their public benchmarks in the last five years (80%) and 10 years (91%). As more people in the U.S., Japan, and throughout the world’s economically developed markets prepare for retirement, Prudential is in a prime position to serve millions more.

This is why I agree with the FAST Graphs analyst consensus for the next few years. In 2024, analysts anticipate that Prudential’s after-tax adjusted operating income per share will rise by 14.8% to $13.34. For 2025, another 9.6% growth to $14.62 in after-tax adjusted operating income per share is projected. In 2026, the analyst consensus is that after-tax adjusted operating income per share will increase by 7% to $15.64.

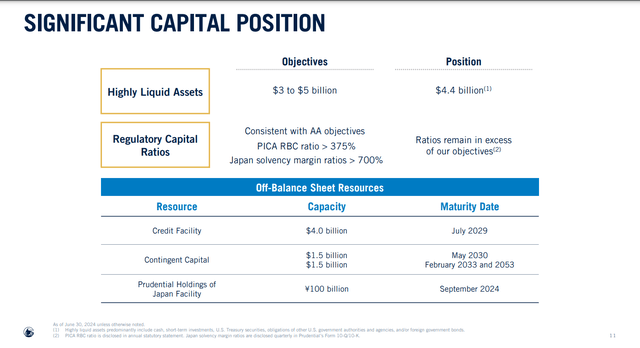

Prudential Q2 2024 Earnings Presentation

Prudential’s growth forecast in the next few years isn’t the only appealing attribute. The company’s financial positioning is admirable as well. As of June 30, Prudential’s total liquidity stood at $4.4 billion. This was in the upper range of its $3 billion to $5 billion target for liquidity.

Additionally, Prudential also has billions more in capital that it could tap if needed via credit facilities and contingent capital. As I communicated in my prior article, this leaves the company with the dry powder for bolt-on acquisitions to improve its competitive positioning. Prudential also has room for more share buybacks and a buffer against potential recessions. This explains the A credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Prudential’s Q2 2024 Earnings Press Release and Prudential’s Q2 2024 Earnings Presentation).

Fair Value Has Surpassed $125 A Share

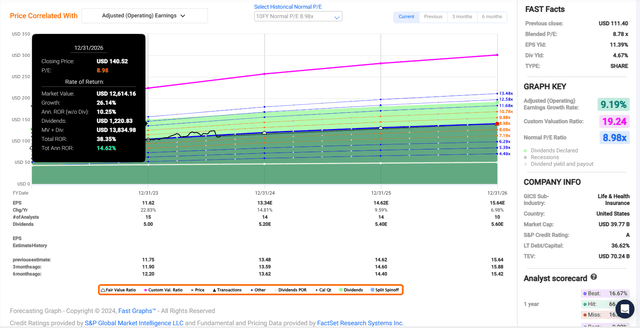

FAST Graphs, FactSet

Prudential’s flat share price in the last few months has made it more intriguing to me. This is because more of my fair value estimate is now being influenced by the 2025 analyst consensus than the current-year consensus.

Prudential’s current-year multiple of 8.5 is less than the 10-year normal multiple of 9 per FAST Graphs. Moving forward, I believe that a valuation multiple of 9 remains a rational estimate for fair value. Prudential’s forward annual growth outlook of 9.2% suggests the investment thesis is intact.

The calendar year 2024 is nearly 64% complete. So, that leaves another 36% of 2024 and 64% of 2025 to come in the next 12 months. This is how I get a 12-month forward after-tax adjusted operating income per share input of $14.15.

Applying my fair value multiple to this input, I compute a fair value of $127 a share. Compared to the current $114 share price (as of August 15th, 2024), this works out to an 11% discount to fair value. If Prudential matches the growth consensus and returns to my fair value, it could have a 38% upside ahead by the end of 2026.

Prudential Is A Free Cash Flow Machine

The Dividend Kings’ Zen Research Terminal

Prudential’s 4.6% forward dividend yield is well above the financial sector median forward yield of 3.4%. This is enough to garner a B grade from Seeking Alpha’s Quant System for the metric.

Prudential’s above-average starting income is also backed up by solid dividend growth in recent years. In the past five years, the company’s dividend per share has compounded by 6.1% annually. This is just ahead of the sector median of 6%. That’s sufficient to receive a C+ grade from the Quant System for its 5-year dividend CAGR.

Dividend growth should remain respectable in the future as well. This is because Prudential’s after-tax adjusted income payout ratio should be in the high 30% range in 2024. That’s below the 50% that rating agencies like to see from the industry per The Dividend Kings’ Zen Research Terminal.

Prudential is also a free cash flow monster. In the first half of 2024, the company generated over $5 billion in free cash flow. Against the $955 million in dividends paid in that time, this is a free cash flow payout ratio of just 18.8% (info sourced from page 13 of 182 of Prudential’s Q2 2024 10-Q Filing).

That’s why I’d be surprised if Prudential didn’t extend its 15-year dividend growth streak from here. For what it’s worth, that’s much more established than the sector median dividend growth streak of 2.2 years. This is sufficient for an A- grade for dividend consistency from the Quant System.

Risks To Consider

Prudential is a business with a bright future, but its investment profile isn’t free from risk, either.

One risk to the company is that 40% of the company’s International Businesses segment after-tax adjusted operating income is derived in currencies other than the U.S. Dollar. This could result in unfavorable foreign currency translation over extended periods for Prudential. That could somewhat weigh on the company’s financial results.

Another risk to Prudential is that black swan events like a major cyber breach could compromise sensitive customer data and lead to a loss in client trust. If this happened, major litigation could occur. Clients could also take their business elsewhere, which could harm the fundamentals.

One last risk to be aware of is the general risks of the insurance industry. The company needs to appropriately price its insurance policies in a Goldilocks zone. Premiums can’t be too high to dissuade customers, but they must be high enough to account for risk. Otherwise, the company could lose market share to competitors or suffer from a decline in underwriting profitability.

Summary: A Blue Chip With An Attractive Total Return Outlook

Paraphrasing famed economist Paul Samuelson, investing should be like watching paint dry or grass grow. Well, Prudential is a boring and reliable pick for my money.

The company’s century-and-a-half operating record puts it in a position to win the $100 trillion-plus retirement bonanza of the present and the future. Prudential’s free cash flow easily covers its dividend obligation and provides it with capital for acquisitions and share repurchases. The stock is also a decent deal from the current share price. That’s why I’m reiterating my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PRU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.