Summary:

- Prudential Financial, Inc. has shown solid operating performance in H1 2024, with strong sales growth and good cost control, but its shares are fairly valued.

- The company’s growth prospects are limited, making it more attractive for income-oriented investors due to its 4.30% dividend yield and share repurchase program.

- Prudential’s valuation is at a premium to its historical averages, trading at 1.5x book value and 8.5x earnings, reflecting limited re-rating potential.

- The investment case for Prudential remains highly reliant on income, supported by its strong capitalization, profitability, and consistent dividend growth since 2008.

sommart

Prudential Financial, Inc. (NYSE:PRU) operating performance was positive in recent quarters, but its shares aren’t undervalued, and growth prospects are limited, making its investment case quite reliant on income.

As I’ve covered in a previous analysis, while Prudential had an interesting dividend yield, I saw its valuation as somewhat fair some months ago. Not surprisingly, its shares have performed very close to the overall stock market and the financial sector since my previous coverage, as shown in the next graph.

In this article, I update its most recent financial performance and investment case, to see whether it offers more value now or not for long-term investors.

Financial Performance

Prudential released its earnings related to the second quarter and first-half of 2024 some weeks ago. They were mixed, as the company reported revenues above consensus, but its earnings were below expectations.

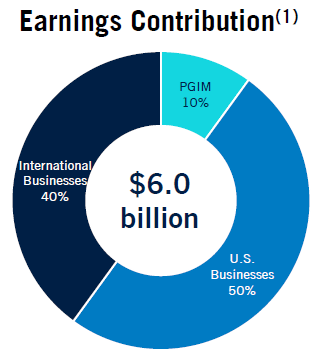

Its top-line momentum was supported by the U.S. and international operations, while in the asset management business it reported positive originations in its private alternatives platform. Its business profile has not changed much compared to the previous quarters, with about 50% of its earnings being generated by the domestic business, while international operations accounted for some 40% of earnings, and the rest comes from asset management.

Earnings mix (Prudential Financial)

This profile is not expected to change much for the foreseeable future, as Prudential’s growth strategy is mainly organic, pushing for retirement product solutions and financial advice across its markets. Supporting the company’s structural growth prospects is aging population in developed countries, boding well for its operations both in the U.S. and Japan, which are its most important markets.

During H1 2024, its operations reported an excellent operating momentum, especially regarding retirement products, which increased sales by 67% YoY. This was also supported in pension risk and longevity risk transfer sales, leading to total premiums of $23.3 billion in H1 2024, compared to $16.2 billion in the same period of 2023.

However, despite the strong boost in sales, given that its business is geared to spread-based products, its benefit costs also increased significantly, to close to $25.5 billion in the first half of 2024, compared to nearly $18 billion in H1 2023.

Regarding other significant revenue lines, its net investment income amounted to $9.6 billion in H1 2024, representing an increase of 9.3% YoY, boosted by higher interest rates over the past few quarters. Asset management fees were also up, by 9% YoY to $2 billion, justified by positive capital markets and positive inflows, especially in alternative investments.

A few months ago, Prudential reached agreement to acquire a majority position in Deerpath Capital. This will increase its assets under management by about $5 billion in the private credit markets and direct lending. It indicates that Prudential is seeking to grow in areas where it usually can charge higher fees, which is positive for its revenue growth ahead.

Regarding costs, due to the inflationary environment, its general and administrative expenses were $6.7 billion in H1 2024, up by 5.9% YoY, which was a lower growth rate than revenue growth, leading to positive operating leverage in recent quarters.

Due to this backdrop, its operating income was $2.8 billion in the first half of 2024 (+13.6% YoY), and its net income amounted to $2.3 billion, or $6.43 per share (+20% YoY). This shows that Prudential’s operating momentum was quite positive recently, supported by strong sales growth and good cost control. Its profitability in the period, measured by the return on equity (ROE) ratio, improved to 13.5% in H1 2024, which is a relatively good level even though it is not among the companies with the highest ROEs in the life insurance industry.

Regarding its balance sheet and liquidity position, Prudential has maintained a strong position given that, at the end of last June, it had about $4.4 billion of liquid assets at the holding level, which is within its target range of $3-5 billion. While it did not disclose its capital ratio in Q2 2024, Prudential says its ratio is well above the target of having an RBC capital ratio above 375%. Thus, Prudential’s financial position is quite solid and is a strong support for an attractive capital return policy over the long term.

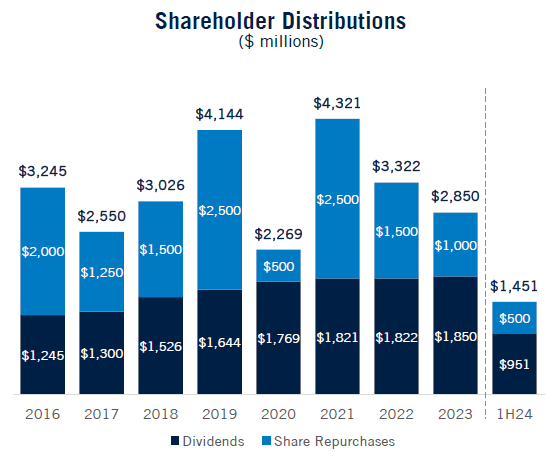

Indeed, its dividend history is excellent, given that Prudential has delivered a growing history since 2008, a trend that was maintained in recent quarters. Its current quarterly dividend is $1.30 per share, which represents an increase of 4% from its previous quarterly dividend, leading to an annual dividend of $5.20 per share. At its current share price, this leads to a forward dividend yield of about 4.30%. This is attractive to income-oriented investors, even though it’s a little lower than compared to the last time I analyzed the company (it was yielding more than 4.8% at the time), reducing somewhat its income appeal.

In addition to dividends, the company is also repurchasing its shares, enhancing its capital returns to shareholders. During the first half of 2024, Prudential has allocated about $500 million to share repurchases, which is about one third of its total capital returns, a profile that is expected to be maintained over the coming quarters.

Capital returns (Prudential Financial)

Regarding its valuation, Prudential is currently trading at about 1.5x book value, which is at a premium to its historical valuation over the past five years of about book value. However, investors should consider that Prudential’s asset allocation is highly geared to fixed-income securities, as usual in the insurance industry. The rising interest rate environment over the past couple of years has been negative for the valuation of these securities, leading to book value declines that don’t reflect its operational performance and growth prospects.

Indeed, as the Federal Reserve has recently started to cut rates, the background is now much different compared to the past couple of years, with the expected declining interest rate environment being positive for Prudential’s fixed-income holdings. Therefore, its book value multiple should gradually return to its “normal” range, due to a higher book value, even if its share price doesn’t change much.

Thus, I think a multiple based on earnings makes more sense to analyze how its shares are being currently valued by the market. Based on its forward earnings for the next twelve months, Prudential is currently trading at 8.5x earnings, which is nevertheless at a premium to its historical valuation of about 7.7x over the past five years. This multiple is also close to the average of its peers, including Voya Financial (VOYA) or Metlife (MET). In addition, Prudential is a mature company that operates in markets with limited growth prospects, and therefore I don’t think a re-rating of its shares is likely ahead and its shares seem to be fairly valued right now.

Conclusion

Prudential Financial, Inc. has reported a solid operating performance during the first half of 2024, but its growth prospects over the long term aren’t impressive, and its valuation appears to be currently only fair. Therefore, I think its investment case remains highly geared to income, as the company offers an interesting dividend yield that is supported by its good capitalization and profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.