Summary:

- Prudential Financial, Inc. has delivered strong total returns and continues to show strong operating performance and business growth.

- The company has a strong focus on shareholder returns through dividends and share repurchases, with a track record of dividend increases for 15 years.

- Prudential Financial’s current valuation is relatively low, making it a solid investment opportunity.

JamesBrey

Article Thesis

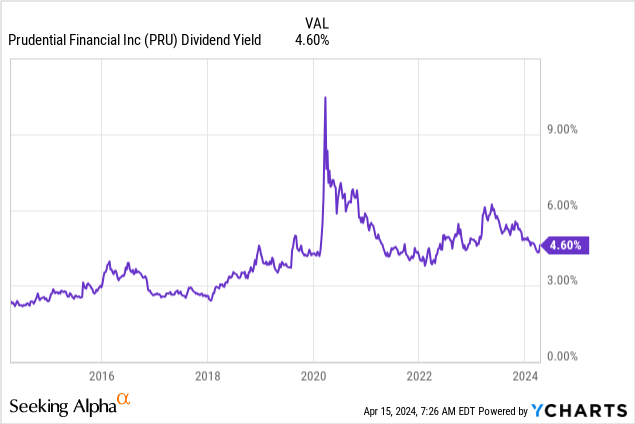

Prudential Financial, Inc. (NYSE:PRU) is an insurance company that has delivered compelling total returns in the recent past. But while the dividend yield is not as high as it was at times in the past, Prudential Financial is still far from an expensive stock.

Past Coverage

I have covered Prudential Financial several times in the past here on Seeking Alpha. In my most recent article, titled “Prudential Financial: Price Slump and Dividend Increase Make This High-Yielder Attractive,” I gave the company a bullish rating, arguing that the underlying performance of the company was positive and that the inexpensive valuation and high shareholder yield would be beneficial.

Since this article was released in March 2023, around a year ago, Prudential Financial has generated a total return of 43%, beating the broad market’s 33% return over the same time frame. Today, it is time to update my thesis, as a little more than a year has passed, and since company-specific news over the last year and valuation and dividend yield changes have to be considered.

Prudential Financial: Strong Operating Performance Continues

Prudential Financial’s business model isn’t especially exciting, but its recent performance is highly compelling for investors. The company continues to deliver strong results, both when it comes to profitability and when it comes to overall business growth.

During the fourth quarter and the full year, Prudential Financial has seen its business perform well, which includes its assets under management growing nicely in the PGIM business unit. The company ended the year with $1.45 trillion in assets under management, or AUM, which was up more than $70 billion compared to the previous year. Rising equity markets played a role in that, which is why Prudential Financial will likely also report a rising AUM number for the first quarter of 2024, as equity markets continued their climb during the first couple of months of the current year.

Reported (GAAP) profits were up nicely versus the previous year, which was not a complicated task — the company generated a GAAP net loss during 2022. This number includes one-off items such as realized gains and losses, however, which is why the operating or adjusted profit number is more telling when it comes to the underlying profitability of the business and longer-term trends. These adjusted profits rose in 2023 as well, although not as dramatically as the GAAP profit, which had expanded by more than $4 billion. Adjusted earnings rose by a little less than $400 million or around 10%, which is a nice growth rate for an established player with a history dating back way more than 100 years in the financial industry, which generally isn’t growing overly fast. On a per-share basis, Prudential Financial showed even better profit growth, thanks to the impact of buybacks: Adjusted earnings per share rose from $10.31 to $11.62, for a low-teens growth rate throughout 2023.

While assets under management growth was one contributor to the company’s improved results, insurance operations also helped boost Prudential Financial’s profitability. The company benefitted from higher underwriting results, which is not a surprise, as many other insurers also have been reporting improved results in the recent past — many consumers are seeing their insurance premiums rise at a substantial pace.

Shareholder Return Framework

While Prudential Financial has grown its profits nicely in 2023, that largely wasn’t the result of hefty investments in its operations. Capital expenditures aren’t high for companies in the financial industry in general, and that also holds true for Prudential Financial. The company doesn’t need to invest in new production plants or other high-cost items, for example. Its employees and brands are the core of the operation, and no heavy capital expenditures are needed for these. This is why Prudential Financial generates substantial surplus cash flows that can be used for other things, apart from being reinvested in the business. M&A is one option, but management has not been overly aggressive with takeovers in the past.

Instead, shareholder returns are a key focus for the company, via both dividends and share repurchases. The company has a strong dividend growth track record, having increased its dividend for 15 years in a row, which doesn’t quite make for Dividend Aristocrat status, but which is a strong feat nevertheless. With ongoing dividend increases even during the pandemic, Prudential Financial has proven to be quite reliable when it comes to offering a growing income stream to the company’s owners.

This strong track record continued in early 2024 when Prudential Financial declared the most recent dividend increase. A 4% payout hike lifted the dividend to $1.30 per share, or $5.20 on an annualized basis — which makes for a dividend yield of 4.7%. That’s not as high as the yield was during some times in the past, but a yield of close to 5%, combined with reliable dividend growth, is still a quite solid investment opportunity, I believe.

Looking at the last ten years, we see that the initial COVID panic made for an excellent buying opportunity where investors could lock in a yield of more than 10%. Last year, investors also were able to buy shares with a yield of 6% for a short time. But apart from these short-term yield spikes that were caused by short-term share price drops, Prudential Financial has mostly traded with a yield of 3% to 5%. Compared to that range, the current yield implies a better-than-average buying opportunity, although there have been even better buying opportunities in the past.

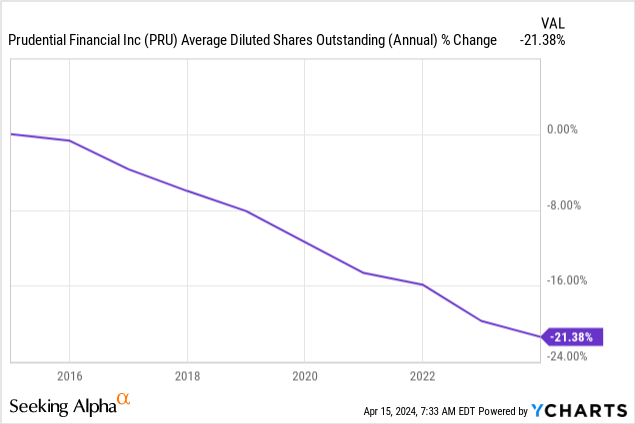

On top of returning cash to its owners via dividends, Prudential Financial also pays out cash to its owners via share repurchases. Those reduce the share count over time, which has two main advantages. First, a declining share count means that profits and cash flow per share are growing more quickly compared to the company-wide growth rate. Second, Prudential Financial’s total dividend payments decline over time, even when the per-share dividend is held constant, as long as the share count keeps declining. This makes the dividend safer over time as the payout ratio is being reduced thanks to the company’s s buybacks.

Prudential Financial recently announced a new $1 billion buyback authorization, which covers around 2.5% of the company’s current market capitalization. Investors should thus expect that the share count will continue to head lower in the future, as it has done in the past:

Over the last decade, Prudential Financial has reduced its diluted share count by a little more than 20%. Shares being issued to management and employees are already accounted for here, as this is the actual net reduction. A 21% share count decline makes for an earnings per share boost of 27%, all else equal [1/0.79], which is not dramatic but a nice little total return booster for sure.

Prudential Financial: Valuation And Outlook

Prudential Financial is forecasted to earn $13.46 per share this year, according to the current analyst consensus estimate. The company has beaten earnings per share estimates five times throughout the last ten quarters, with five misses over the same time frame. PRU’s results were thus, on average, relatively in line with what analysts had been forecasting. Taking the $13.46 estimate at face value, Prudential Financial is currently trading at just above 8x forward net profits, which is a rather low valuation. For 2025, earnings per share are forecasted to climb by another 7%, thus 2024 is not a one-off year. Higher interest rates are beneficial for Prudential Financial, and rising equity markets that boost its assets under management help as well. Finally, rising insurance costs boost PRU’s revenues, all else equal, meaning the macro picture is relatively positive for Prudential Financial right now.

Of course, no investment is risk-free, and if interest rates were to drop dramatically, Prudential Financial would be hurt. That could happen in a major recession, although that seems like an unlikely scenario right now. A major equity market downturn would likely take PRU stock down itself and would also hurt its assets under management and thus its asset management fees. I doubt that a market crash is particularly likely in the foreseeable future, but it can’t be ruled out — if conflicts in Ukraine or the Middle East were to escalate, that could cause a major market downturn, for example.

While Prudential Financial is not risk-free, its payout ratio is undemanding, at just 39%, and the fact that Prudential Financial has more than $4 billion in liquidity and a strong balance sheet means that risks aren’t overly high. With positive business growth, a nice shareholder return pace, and an undemanding valuation, Prudential Financial looks like a good investment, despite the strong share price gains over the last year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!