Summary:

- Since my last article, shares of Prudential Financial have moderately outperformed the S&P 500 index.

- The financial services giant has growth catalysts for the future.

- Prudential boasts A-rated corporate credit ratings from the major rating agencies.

- PRU stock is arguably fully valued from the current share price.

- Prudential could be set up to generate an 18% cumulative total return by the end of 2026.

A view of Prudential’s corporate headquarters in Newark, New Jersey.

JHVEPhoto

In investing, I insist on both quality and valuation. Regarding the former, I believe in Warren Buffett’s principle of buying a stock you’d be perfectly happy to hold if the market shut down for 10 years.

However, I’ll only buy on the right terms. That is if the price is right. Buying a good business can only lead to outsized total returns if it is done so at an attractive valuation.

Prudential Financial (NYSE:PRU) is one such business that I would argue is qualitative. As I noted in my August buy article, I liked the fact that Prudential’s operating history dates back to 1875. The company also had room to grow in the future. Financially, Prudential was sound. At the time, I also thought shares were still a decent value.

Now, I believe Prudential’s rally in recent months has limited further upside too much to continue justifying a buy rating. Thus, I’m downgrading the stock to a hold. To be clear, Prudential’s growth story looks to be holding up. The dividend remains viable and positioned for future growth. Prudential’s situation with liquidity is also enviable.

Growth Is On The Horizon For Prudential

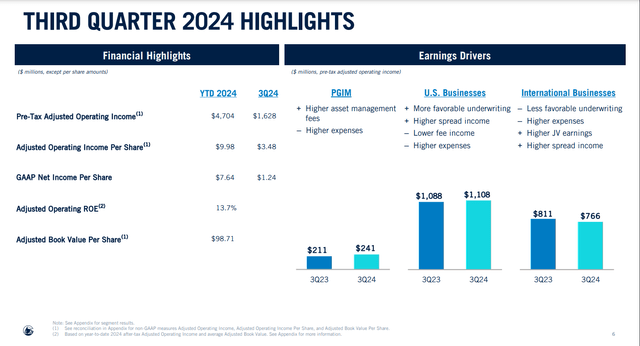

Prudential Q3 2024 Earnings Presentation

On October 30th, Prudential released its third-quarter earnings report. The company’s after-tax adjusted operating income per share fell 3.9% year-over-year to $3.48 in the quarter. This matched Seeking Alpha’s analyst consensus for the quarter. Additionally, Prudential’s after-tax adjusted operating income per share was up 2.7% sequentially from the Q2 figure of $3.39.

The company’s modest decline bottom line decline was driven by the International Businesses segment. The segment’s pre-tax adjusted operating income decreased by 5.5% over the year-ago period to $766 million during the third quarter. VP of Investor Relations Bob McLaughlin attributed this to weakness in the Japanese Yen and greater expenses to support business growth in his opening remarks during the Q3 2024 Earnings Call. Those elements more than offset higher joint venture earnings driven by Encaje’s performance in Chile and higher spread income stemming from greater yields from the reinvestment of the portfolio.

Prudential’s global investment management or PGIM segment performed well in the third quarter. The segment’s pre-tax adjusted operating income grew by 14.1% year-over-year to $241 million. Higher asset management fees from $29 billion in year-to-date net flows and market appreciation made up for higher expenses.

Prudential’s U.S. Businesses segment also turned out growth for the third quarter. The company’s pre-tax adjusted operating income increased by 1.8% over the year-ago period to surpass $1.1 billion. Improved underwriting and greater spread income more than canceled out lower fee income and higher expenses.

Prudential’s adjusted book value per share increased by 4.8% year-over-year to $98.71. The company’s efforts to shift to more capital-efficient and higher-growth products also appear to be paying off. That is evidenced by a 50 basis point improvement in year-to-date operating return on equity to 13.7%.

Prudential remains well-positioned in the years ahead. This is because 79% of funds have outperformed their public benchmarks in the past five years, and 85% have done so in the last 10 years. That demonstrates Prudential is a capable asset manager, with more and more offerings in high-margin areas like private credit. This outperformance should continue to attract new clients and retain existing ones.

The global retirement opportunity that I referenced in my previous article is still ongoing and in the very early innings. Institutionally, Prudential just completed a second transaction with International Business Machines to reinsure $6 billion of pension liabilities. This latest transaction means that Prudential has closed seven out of the 10 largest pension risk transfer deals in the U.S. Individually, five of Prudential’s annuity products have topped $1 billion in year-to-date sales.

For these reasons, the FAST Graphs analyst consensus is that the company’s after-tax adjusted operating income per share will rise by 14.9% in 2024 to $13.35. Another 10.1% growth in after-tax adjusted operating income per share to $14.70 is anticipated for 2025. In 2026, an additional 5.5% increase in after-tax adjusted operating income per share is being predicted.

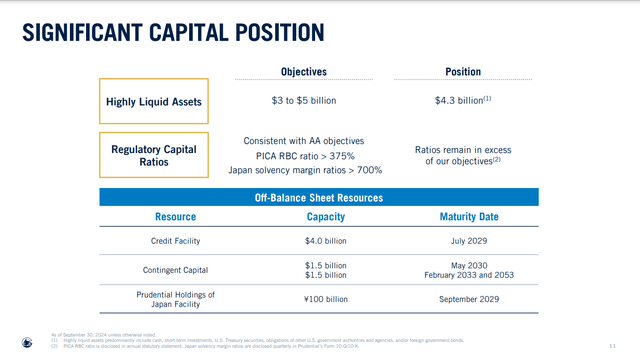

Prudential Q3 2024 Earnings Presentation

Prudential also has plenty of liquidity that can be used for a variety of purposes. These include managing insurance risk, completing bolt-on acquisitions to drive further growth, and executing share repurchases. As of September 30th, 2024, Prudential’s liquidity position stood at $4.3 billion. That’s on the conservative end of the $3 billion to $5 billion range that the company targets. If necessary, Prudential has billions more in off-balance sheet resources that could be accessed, such as a $4 billion credit facility and $3 billion of contingent capital. Thanks to these resources, the company enjoys A, A3 (A- equivalent), and A- credit ratings from S&P, Moody’s, and Fitch, respectively (unless otherwise sourced or hyperlinked, all details in this subhead were according to Prudential’s Q3 2024 Earnings Press Release and Prudential’s Q3 2024 Earnings Presentation).

Fair Value Has Breached $130 A Share

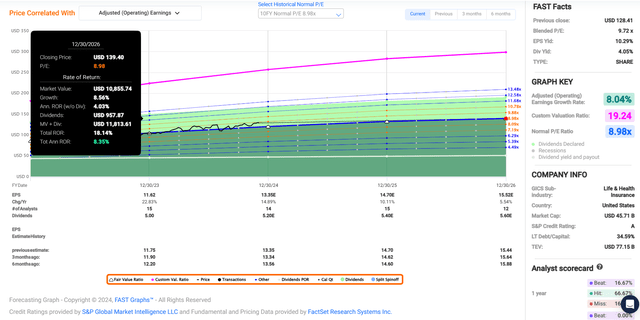

FAST Graphs, FactSet

Since my article in August, Prudential has posted 14% total returns to the 10% returns of the S&P 500 index (SP500). From my perspective, these outsized gains have pushed the stock rather close to fair value.

Prudential’s forward P/E ratio of 8.7 is marginally less than its 10-year average P/E ratio of 9 per FAST Graphs. The company’s annual after-tax adjusted operating income per share growth consensus of 8% suggests that growth is holding up. This is why I believe that Prudential continues to be worthy of a valuation multiple of approximately 9.

The calendar year 2024 is about 92% complete, which leaves another 8% of 2024 and 92% of 2025 ahead in the coming 12 months. This is how I get a forward 12-month after-tax adjusted operating income per share input of $14.60.

Applying my fair value multiple of 9, I arrive at a fair value of $131 a share. Relative to the current $127 share price (as of December 3rd, 2024), this is a 3% discount to fair value. If Prudential reverts to fair value and meets growth forecasts, it would have an 18% cumulative upside through 2026.

Since I already hold a 0.8% weight in Prudential, I would be looking to add to my position closer to a multiple of 7 (or approximately $105 a share). That would more easily position the stock for the firmly double-digit annual total returns that I desire.

Expect Dividend Growth To Persist

The Dividend Kings’ Zen Research Terminal

Prudential’s 4.1% forward dividend yield is meaningfully above the financial sector median forward yield of 2.8%. That’s sufficient for Seeking Alpha’s Quant System to award B+ grades for overall dividend yield and forward dividend yield, respectively.

Prudential’s dividend is also supported by a manageable payout ratio. The company’s payout ratio is expected to be in the high 30% range in 2024. For perspective, that’s better than the 50% payout ratio that rating agencies prefer from the industry, per The Dividend Kings’ Zen Research Terminal. This explains the A- grade from the Quant System for overall dividend safety.

That’s why I anticipate dividend growth will continue to be around 4% to 5% annually. This gives Prudential a decent mix of starting income and dividend growth potential. Overall, the company should have no issue building on its 16-year dividend growth streak for the foreseeable future. This itself is already much higher than the financial sector median of 2 years. That earns Prudential an A- grade from the Quant System for overall dividend consistency.

Risks To Consider

Prudential is a well-established company, but it still faces risks that should be monitored. Thus, I’ll briefly touch on a few risks.

As an insurer, Prudential faces insurance risk. That’s the possibility that actual insurance claims materially differ from insurance assumptions. This can arise from the materialization of events like pandemics, disasters, or acts of terror.

That puts insurers like Prudential in a spot where they must make sure they’re charging enough for policies. At the same time, they can’t charge too much or competitors could steal market share.

If any major black swan events happen, Prudential could also face liquidity risk. That means the company may not have enough capital on hand to meet unexpected cash demands from such an incident. Sudden changes in the global interest rate, equity, or currency markets could also cause a liquidity issue for Prudential in a worst-case scenario.

Running a business in the 21st century, Prudential also has quite a bit of sensitive data that could be valuable to hackers. If any cyber breaches are successful, that data could be compromised. The implications of such an event could include major legal settlements and a diminished reputation among clients.

Summary: The Right Entry Point Will Eventually Come Along

I view Prudential as a quality business. The company has tailwinds that could work in its favor, including an admirable reputation and encouraging demographic trends. Prudential’s dividend is secure, and the company maintains an abundance of liquidity.

As is the case with anything else in life, patience is key in investing. Even quality businesses at the wrong valuation don’t make for great investments. I believe gains in recent months have led Prudential to just about reach fair value. Until I see a correction to around $105 a share, fair value rises, or a combination of these two elements happen, I’m comfortable holding my shares rather than adding more right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PRU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.