Summary:

- Prudential recently reported their Q2 earnings that reinforced solid segment growth in US and International markets.

- PRU has a dividend yield of about 4.5% and manages to maintain a high rate of dividend growth. The payout ratio remains healthy and can support future raises.

- There will soon be an influx of retirees from Gen Z. This can be an opportunity for PRU to continue growing their base assets under management and increase segment revenues.

- Valuation suggests upside potential, supported by Wall St’s price target and a dividend discount calculation.

APCortizasJr

Overview

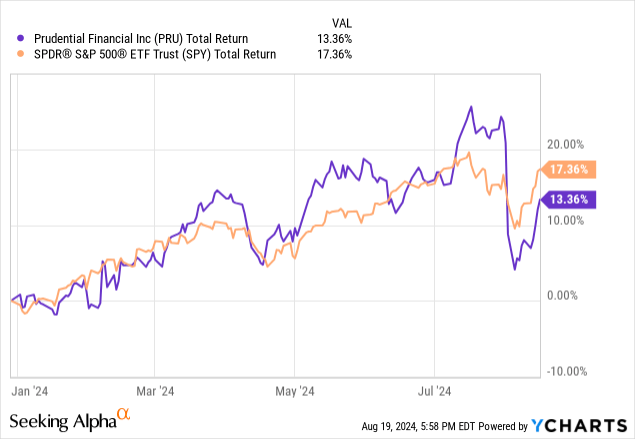

I previously covered Prudential (NYSE:PRU) earlier this year in April and issued a buy rating. Since then, the total return has remained nearly flat after recently falling from the $125 per share level. This recent crash presents an opportunity to continue accumulating shares, as I still believe PRU to be a solid buy at this price point. The company recently reported their Q2 results and this prompted me to come back and reassess the performance and outlook. We can see that on a YTD basis, the total return lags behind the S&P 500 (SPY) a bit due to the recent drop. However, there have been several points throughout the year where the total return was actually outperforming the SPY.

I always liked the fact that PRU has historically maintained an above-average dividend yield. The dividend currently sits at about 4.5%, which sits above the sector median yield of 3.3%. Not only is the starting dividend yield high, but the consistent growth rate of the dividend has made this a great choice for investors that also value income. PRU should also benefit from future interest rate cuts, which can boost operation profitability. Using the new earnings, I will also conduct an updated valuation estimate to see what the potential upside looks like.

For some brief context, Prudential generates its earnings by providing insurance services, investment management, and a portfolio of other financial products to its customer base. However, PRU operates through three main segments: US business, International business, and PGIM. Let’s first start by assessing the mixed results reported from their Q2 earnings and see how it will affect their outlook going forward.

Q2 Earnings

PRU reported their Q2 earnings at the beginning of August and the results were a bit mixed. On one hand, earnings per share missed expectations by a slight $0.06 and landed at $3.39 per share for the quarter. In addition, book value per share decreased down to $77.51 from the prior amount of $77.65 per share a year prior. Despite this, total assets under management grew up to $1.48T from the prior year’s total of $1.41T. In addition, we can also see that each respective segment saw its own set of positives.

The US business segment is their largest slice of revenue accounting for $3.98B, which is equivalent to 50% of their earnings. This segment experienced the highest sales growth in individual retirement strategies since Q1 of 2013, totaling $3.5B. This was the largest contributing factor that helped the segment see growth totaling 27% YTD over the prior year. The segment is seeing a shift towards ‘Individual Life’ which has helped sales and creates more capital efficient products. The earnings from this segment come from a combination of their net spread, net fees, and underwriting. Group insurance sales are up 13% compared to the year prior and the company continues to prioritize growth in international markets like Brazil, which can drive additional sales.

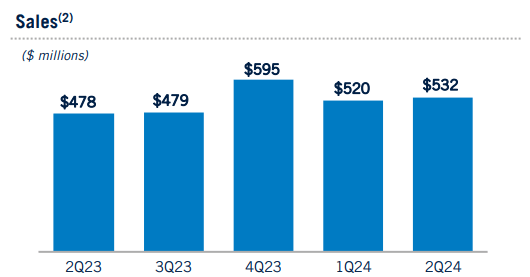

The international segment also saw slight growth with sales amounting to $532M for the quarter. This was a slight increase from both the prior Q1 amount of $520M as well as the prior year’s Q2 total of $478M. This was driven by an increase in sales in both Japan and Brazil. Management seems to be focused on the emerging markets as they continue to refine their product mix and maintain a level of appeal to continue growing the business. We also received the following confirmation on the last earnings call:

As we look ahead, we are well-positioned across our businesses to be a global leader in expanding access to investing, insurance and retirement security. We continue to focus on investing in growth businesses and markets, delivering industry-leading customer experiences and creating the next generation of financial solutions to serve the diverse needs of a broad range of customers. – Rob Falzon, Vice Chairman

PRU Q2 Presentation

Lastly, PRU’s global investment manager PGIM saw total assets under management increase by 5%. This segment is the smallest revenue source for PRU since it only brings in about 10% of their revenue, amounting to $758M over the last twelve months. However, the PGIM segment experienced a decrease in third party net outflows totaling $9.5B, which was mostly driven by institutional dollars. In more positive news, 83% of their AUM exceeded their benchmarks over the past year.

PRU’s liquidity also remains solid with cash and liquid assets totaling $4.4B, which is boosted by the available credit facility of $4B. Thankfully, this falls between management’s stated target liquidity between $3B to $5B. This can help ensure that the amount of capital return to shareholders can continue growing through share repurchases. For instance, PRU committed to $250M in share repurchases and paid out $475M in dividends during Q2.

Dividend

As of the most recently declared quarterly dividend of $1.30 per share, the current yield sits at 4.5%. PRU has been able to maintain over 15 years of consecutive dividend increases and slowly makes it way towards the dividend aristocrat status. As long as the company can maintain its very healthy payout ratio of about 40.7%, I do not see any current threats to the dividend being reduced or cut. PRU has remained very consistent as their five-year average payout ratio sits aligned at 40.6%.

Not only is the dividend secure, but the growth level has made long-term shareholders very happy. For instance, the dividend has managed to increase at a CAGR (compound annual growth rate) of 9.28% over the last ten-year period. Even on a smaller time frame of five years, the dividend has increased at a CAGR of 5.72% which is still great for a stock already yielding near 5%. This level of consistent growth has enabled long-term shareholders to be rewarded with a growing yield on cost. For example, shareholders for a period of five years would now be sitting on a yield on cost above 6%.

This level of growth makes PRU a great option for investors that are also looking for a growing stream of income to be produced from their portfolio. In order to better visualize this, I ran a back test of an original $10,000 investment at the start of 2015 to present day. This graph assumes that all dividends received were reinvested back into PRU and helped accumulate more shares. In addition, this also assumes a fixed monthly contribution of $500 per month throughout the entire holding period. We can see that through continuous investment and a long-term outlook, the income levels grow at a pretty consistent level.

In year 1 of your investment, you would have only received $360 in annual dividend income. Fast forward to 2023, and you can see that the annual dividend income received would have grown to $4,553. This would represent more than a 12x growth in your dividend income over a nine-year period. The best part about the income received from PRU is that the dividends are classified as qualified dividends. Therefore, you would be getting the absolute best tax treatment on this income, and this makes PRU a suitable holding for most account types.

Valuation & Outlook

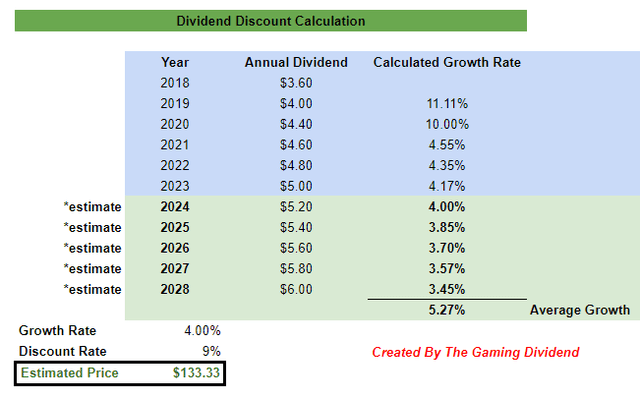

The last time I covered PRU, I ran a dividend discount calculation to get an estimated fair value of about $130 per share. Now that we are approaching that price estimate, I wanted to run an updated valuation method that also includes estimates for future distribution increases. I first compiled all of the annual payout amounts dating back to 2018 and then also used an estimated annual payout of $5.20 per share for 2024 since it aligns with the prior year’s increase of $0.20 per share. I also wanted to keep this streamlined, so I estimated that PRU would be able to maintain the same rate of increases over the next 4 years through 2028.

PRU currently has averaged an EPS diluted forward growth rate of 3.5% over the last five-year period. Similarly, the sector median growth here equals about 4%. Assuming that PRU can maintain a diluted EPS growth rate of 4% over the next 4 years, there is some sizeable upside potential that can be captured. With these inputs, I come to an estimated fair value of $133 per share. This would represent an upside potential of approximately 17.6% from the current price level.

Current undervaluation is also reinforced by the fact that PRU currently trades at a price to earnings ratio of about 9.24x. This undercuts the sector median price to earnings ratio of about 11.6x. However, the current price to book ratio of 1.48x is currently greater than the sector median of 1.22x, so it is a bit of a mixed outlook. Wall St. estimates do seem to be more positive and optimistic with their price targets, however.

Just as a reference point, Wall St. has an average price target at $119.50 per share. This represents a potential upside of about 5.5%. The higher price target sits at $132 per share and the lowest sits at $108 per share. I believe that PRU’s US-based business will be a huge catalyst for the company’s future growth. As many Gen Z’ers begin to approach the retirement age, PRU will be able to capitalize on this by increasing the sales of their retirement strategies and varying insurance policies. The majority of Gen Z says that are on track for retirement, which means that the market will be hit with an influx of new retirees that may need assistance.

Risk Profile

The most relevant source of uncertainty in today’s market would be how the fluctuations in interest rates would affect PRU. For example, their life insurance-based products are sensitive to interest rate changes and a lower rate could translate to lower profitability. PRU has been able to benefit from rising interest rates, but this can change when rates are cut in the future. This was briefly addressed on the most recent earnings call by the CFO.

Let me also address long-term rates since we’ve seen some recent movement. With respect to long-term rates, we have benefited from the rise in rates over the past few years. We have been at levels that are significantly higher than over the past decade and this has increased our portfolio yields in both domestic and international. So higher rates are good for us and it has been a tailwind. If rates were to decline, it would reduce our new money rates, but we do have a healthy spread between our new money rates and portfolio yields. And lastly, I would point out that we have a very disciplined ALM approach which significantly reduces future spread volatility of the in force. – Yanela Frias, Chief Financial Officer

I believe that interest rate cuts are on the horizon and may happen before the year-end. Factors like a consistently rising unemployment rate that now sits at 4.3% and inflation levels that continually decline near the Fed’s 2% target would serve as influences of the decision. We also have the US Presidential elections upcoming, and this could create a market environment of higher volatility and uncertainty. Since PRU is exposed to a large amount of fixed income securities, lower interest rates could potentially result in lower yields and reduce profitability and appeal.

Takeaway

In conclusion, I maintain my buy rating on PRU, as I believe that the recent drop presents an opportunity to continue accumulating more shares. From a valuation perspective, I believe there to be a sizeable double-digit upside potential, as reinforced by my dividend discount calculation. In addition, segment growth was solid over the last quarter, with the US segment seeing retirement strategies sales increasing by 67%. PRU may be a solid long-term holding as the Gen Z population gets ready for retirement. An influx of potential customers would be a great opportunity for PRU to continue building their total assets under management. In addition, the well-supported dividend makes PRU a great choice for investors looking to also have a stable source of high-yielding dividend income. The dividend growth has rewarded long-term shareholders, and the healthy payout ratio increases the likelihood of future raises.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PRU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.