Summary:

- According to CBOE sentiment data, over eight times more money is going into Tesla, Inc. puts than Tesla calls.

- There is a similar high ratio for the entire consumer discretionary sector, represented by the Consumer Discretionary Select Sector SPDR ETF.

- This is important because it’s occurring concurrent with the highest equity put to call ratio in over twenty years.

Pgiam/iStock via Getty Images

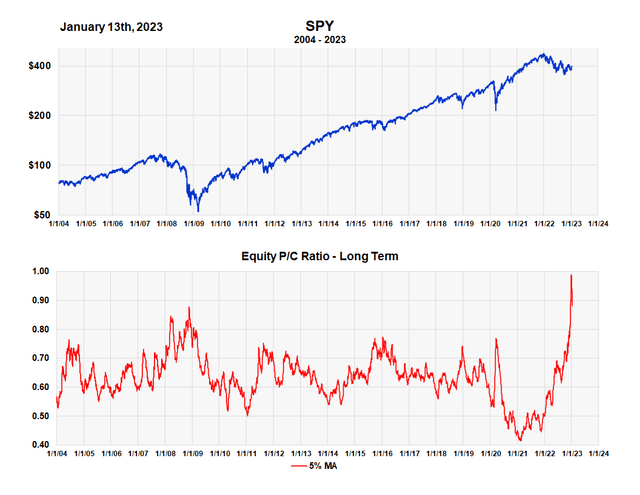

The equity put to call ratio a week ago went to the highest level in the last 20 years, even higher than the levels reached during the 2007 and 2008 financial crisis. This classic options indicator of investor sentiment is very useful, since the Put/Call Ratio measures not only what investors are thinking but what they’re doing.

It acts as a contrary opinion indicator. When too many speculators are buying put options expecting the market to decline, the price decline is usually over and higher prices lie ahead. The current high Put/Call ratio of .9 in my contrarian view strongly points to higher stock prices.

Equity Puts to Calls Ratio versus the SPY (Michael McDonald)

Put buying in individual stocks and market sectors can be just as insightful. While earnings and economic factors determine stock values, it’s what individual investors are “thinking” and “doing” that moves markets.

As a reminder, sentiment analysis is not intended to replace fundamental data but to act in a complimentary manner by helping investors determine whether “investor sentiment” currently supports a positive or negative economic picture.

Heavy put buying in Tesla

There is heavy put buying in Tesla, Inc., just like there is in the overall stock market. We are also seeing large amounts of put buying in the 800+ consumer discretionary stocks, which is Tesla’s market sector. From a contrary opinion perspective, this points to higher prices for both Tesla and the overall sector.

We measure the put to call ratio for stocks and sectors in two different ways.

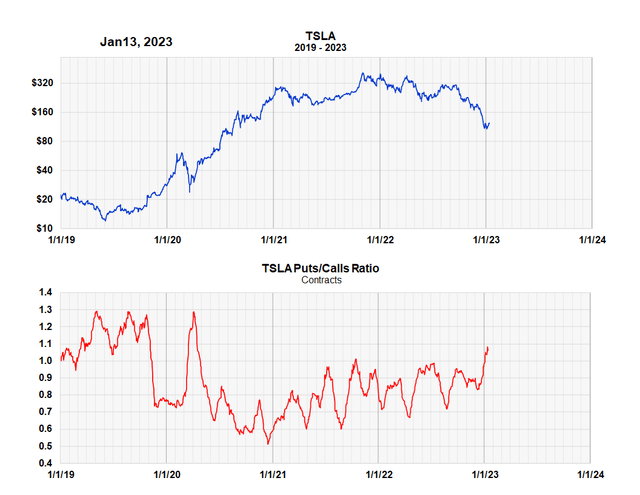

We form a ratio of the number of put contracts divided by the number of call contracts over a 20-day period. This is the standard way of measuring the puts to calls ratio.

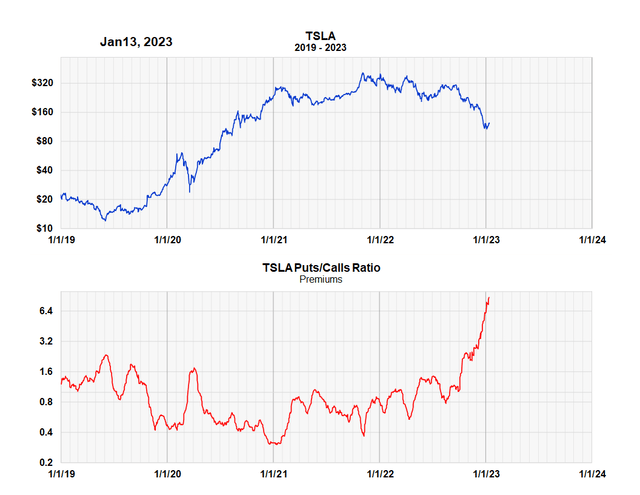

But this method doesn’t account for how much money is going into these contracts. So, it’s also important to calculate the ratio of the amount of money going into put contracts divided by the amount going into calls. This ratio is called the puts to calls premium ratio. Sometimes, but not always, this second method provides greater insight. We’ll show you these ratios for both Tesla and the consumer discretionary sector.

TSLA Contract Puts to Calls (Michael McDonald)

The current put to call contract ratio for Tesla is 1.1. It’s the highest ratio in two years, but, as the chart clearly shows, it’s less than the 1.3 ratio reached during the pandemic and during the Tesla price lows of 2019. To us, this contract ratio is inconclusive.

TSLA Premium Puts to Calls (Michael McDonald)

The ratio of money going into puts versus calls tells a different story. This ratio takes into account the fact that most Tesla puts are currently higher priced than most calls because of the price decline. This graph of this ratio indicates that over eight times more money is going into Tesla puts than calls. The ratio far exceeds that reached during the 2020 pandemic and the 2019 price lows.

To us, this indicates too much money is going into the bearish side of Tesla. This is confirmed by the put and call ratios for the entire consumer discretionary sector.

Large dollar amounts of put buying in the consumer discretionary sector

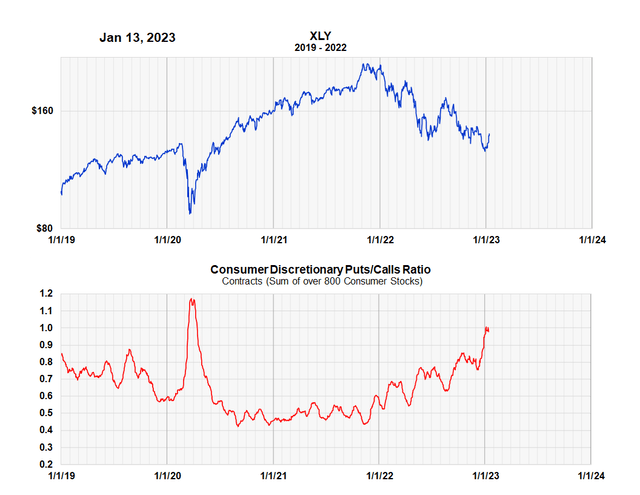

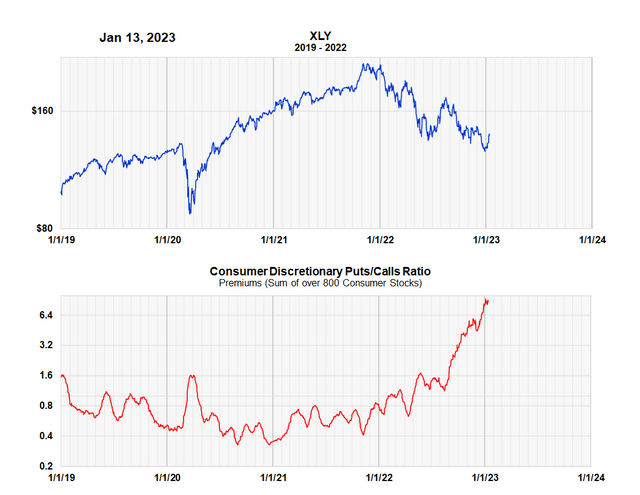

To measure the price performance of the consumer discretionary sector, we use the Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY). To measure put and call buying in the sector, we add all the contract and dollar data of over 800 consumer discretionary stocks.

Consumer Discretionary Contract Puts to Calls (Michael McDonald)

It is clear that the classic contract put to call ratio in this sector is approaching the high during the March pandemic lows of 2020. The ratio of put to call buying in all 800 stocks is about 1 to 1. The next chart shows how much money is going into consumer discretionary puts versus calls, as represented by the XLY exchange-traded fund (“ETF”).

Consumer Discretionary Premium Puts to Calls Ratio (Michael McDonald)

This chart for the entire sector looks very similar to that of Tesla and indicates that about 8 times more money is going into puts than calls.

Takeaway

The large amount of money going into puts versus calls in both the consumer discretionary sector, as represented by the XLY ETF, and Tesla, Inc. stock in particular, seems to confirm that investor expectations are overwhelmingly for lower prices. History suggests that expectations of this degree may occur near a major market low prior to higher prices.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.