Summary:

- PayPal disappoints investors with earnings in line with expectations.

- Concerns over user count dropping and negative impact on free cash flow.

- Despite the drop, it presents a buying opportunity for long-term investors and short-term traders.

Kevin Winter/Hulton Archive via Getty Images

Thesis Summary

PayPal Holdings, Inc. (NASDAQ:PYPL) has disappointed investors after pretty much reporting earnings in line with expectations.

There are reasons to be worried about user count dropping and FCF taking a hit.

Despite these headwinds, I believe the recent post-earnings drop makes for a compelling buying opportunity for long-term investors and also short-term traders.

There’s still a lot to like about this company fundamentally. In my last article on PYPL, in May, I rated it as a Buy and I maintain this rating following these earnings.

Both the stock price and fundamentals haven’t changed too much since then.

Q2 Overview

PayPal’s stock price is down over 10% following earnings. This may seem strange on the surface. EPS was in-line with expectations, at $1.16, and revenue came in at $7.3 billion, beating by $30 million.

How come the stock price is down? Let’s have a look at the investor slides to understand yesterday’s results better:

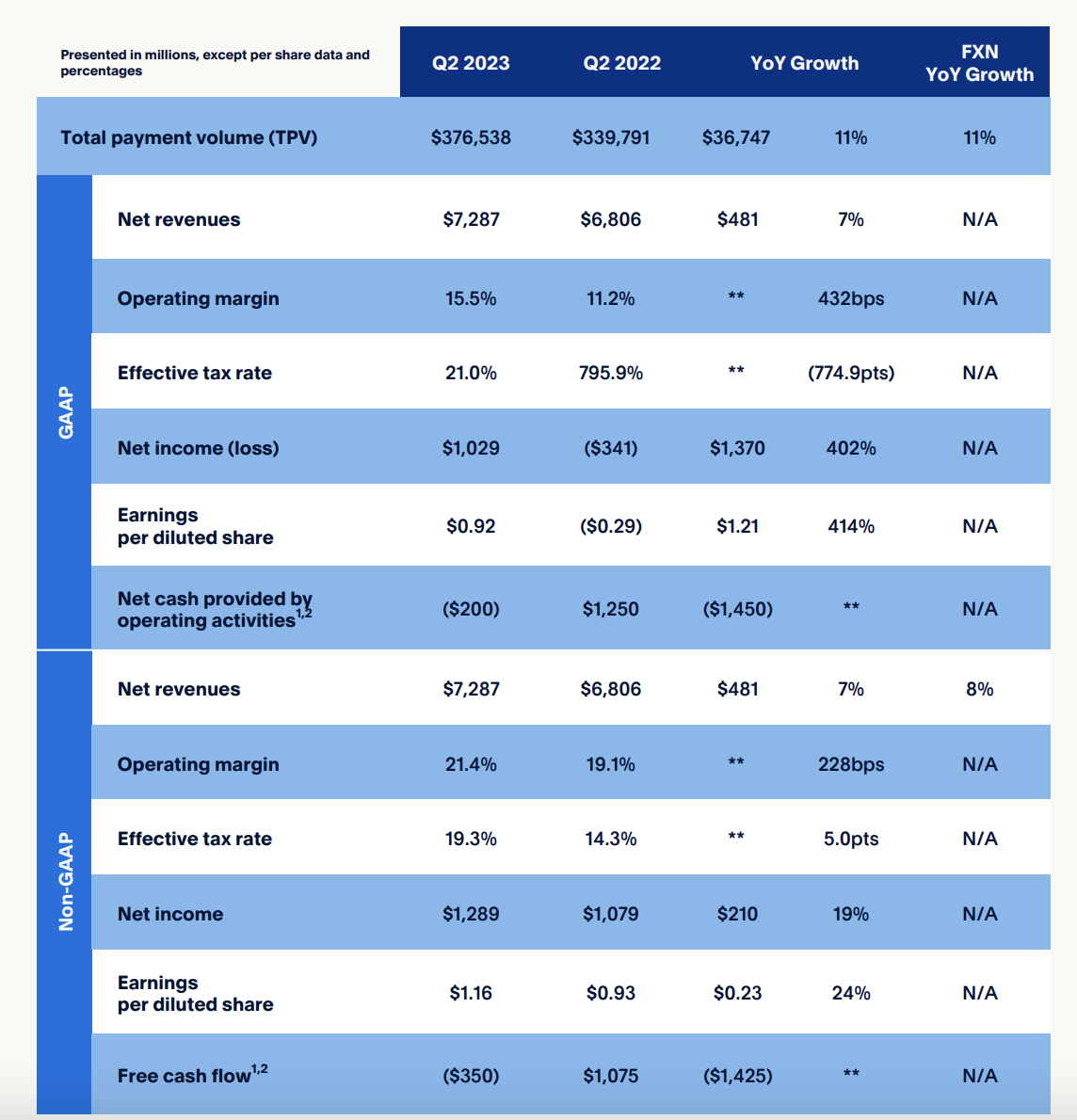

Q2 Overview (Investor Slides)

Net revenues grew by 7% YoY, while TPV was up 11%. Operating margins increased to 21.4% YoY, and the company’s EPS is up 24% YoY. All of this looks pretty good on the surface. The only notable negative point from this slide is the fall in FCF, and we’ll get to that in a minute.

Firstly though, let’s talk about profitability. Operating margins came in at 21.4%; this was actually a decline sequentially from last year.

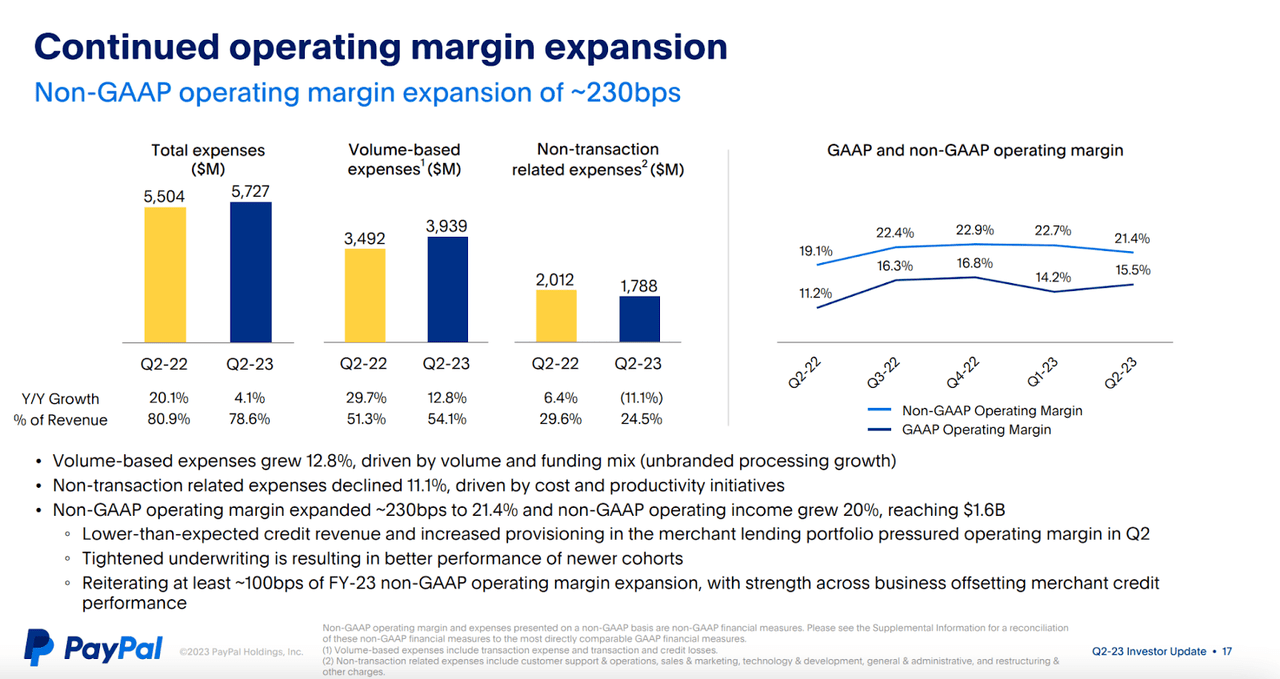

Operating margin (Investor Slides)

Interestingly, GAAP operating margin was higher, while non-GAAP came in lower. While PayPal has been able to reduce non-transaction expenses, total expenses and volume-based expenses have been climbing up.

As we can see in the slides, this increase has been due to the higher funding mix of “unbranded processing growth”. In other words, handling transactions for third parties produce lower fees for PayPal.

Another key note here is that the merchant lending portfolio has had a negative effect on PayPal’s profitability.

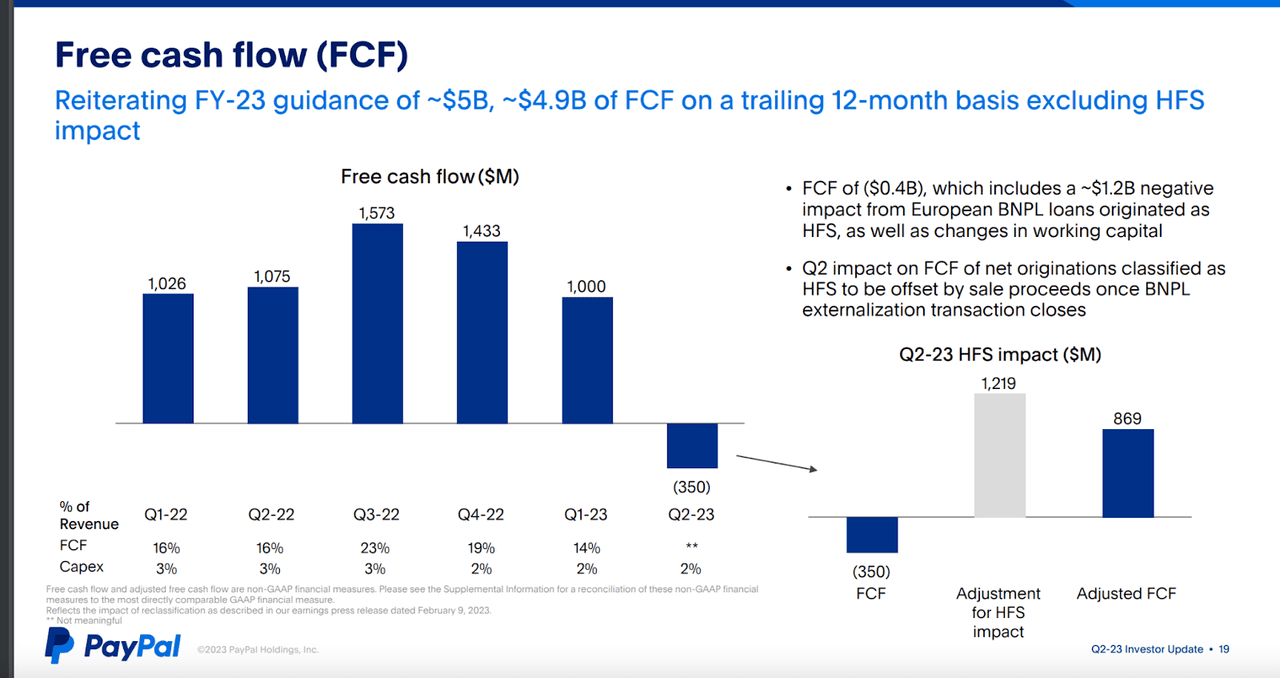

PayPal’s lending practices have also set back its FCF:

FCF was negative $0.4 billion due to the impact of $1.2 billion from European BNPL loans originated as held for sale (HFS). These are expected to be sold in the second half of the year. Excluding this charge, FCF would have been close to $4.9 billion on a trailing 12-month basis.

FCF (Investor slides)

Lastly, it’s important to note that, although transaction volumes were higher, the user count was lower:

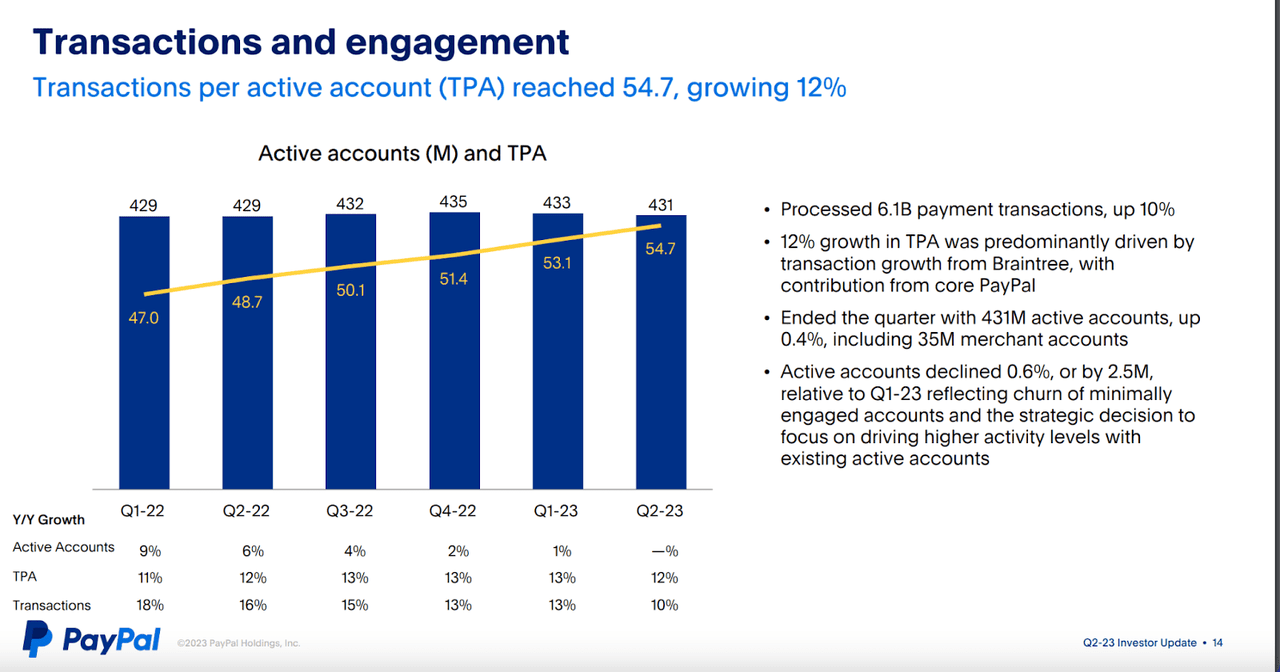

Transactions and engagement (Investor slides)

Active accounts declined by 0.6%, but the company notes that this is part of a strategic decision to focus on higher activity accounts.

All in all, PayPal’s quarter gave us an unpleasant surprise, with the BNPL loans, but other than that, I’d say it was pretty much in line with expectations. Yes, margins could be a bit better, and active accounts have fallen by less than 1%.

But does this justify the sell-off?

Why I Still Like PayPal

PayPal is the unloved child of fintech. Investors in this segment expect companies to deliver high rates of growth just because of the sector they are in. On the other hand, more traditional investors stay away from PayPal because it’s focus isn’t solely on profitability.

Personally, I see the best of both worlds. PayPal is a solidly profitable company with a lot of growth potential ahead of it.

Case and point, PPCP;

PPCP, which was a really important introduction for us for numerous reasons, could not have had a better reception in the market. We’ve got tremendous momentum there. Braintree continues to go from strength to strength, and we’re seeing a lot of our value-added services now start to take hold. I can talk about some of that later in the call. Somebody wants to ask about that. And obviously, branded checkout is accelerating.

That 8% is the highest we’ve seen since the end of the pandemic.

-Source: Earnings Call

PayPal Commerce Platform is a one stop-shop for handling payments, and falls under the category of “branded checkout”, which has a higher margin as we saw from the investor slides and growth in this segment is accelerating at its fastest rate since the pandemic.

This means both more future growth and higher profitability.

When it comes to growth, the short-answer is that, as e-commerce thrives, something few would put into question, so will PayPal.

And I say, look, first of all, as e-commerce is growing, we’re going to grow with it because we are clearly one of the market leaders, if not the market leader in digital payments around that. We do have a scale advantage over anybody in terms of the 30 million-plus merchants that we have out there, 80% of the top 1,500 Internet retailers. We have a performance advantage in checkout up to 600 basis points better in auto rates than the industry average.

-Source: Earnings Call

Brand recognition, competitive pricing and market leadership. That’s what I call a moat.

And for those that like a strong company that gives back to investors and is reasonably priced, PayPal is also a great pick.

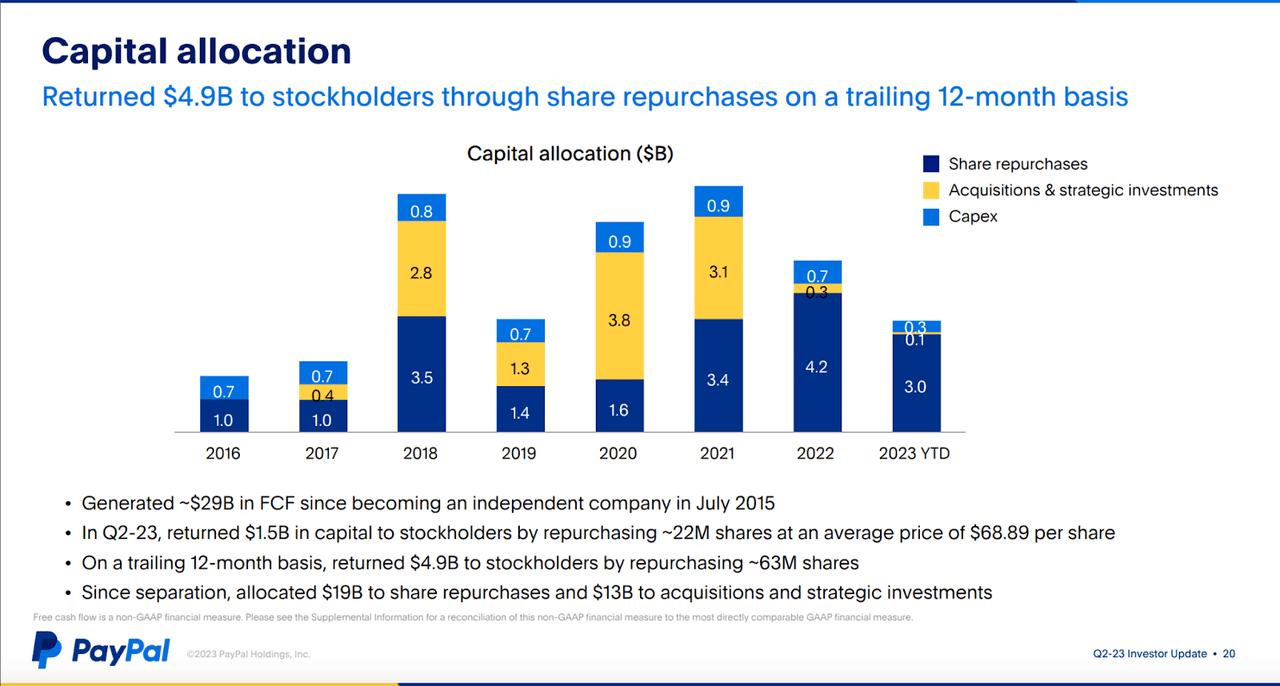

Capital allocation (Investor slides)

PayPal has a great history of buy-backs, and will continue

In the quarter, we completed $1.5 million in share repurchases. For the full year, we now expect to allocate approximately $5 billion to our buyback program. Our recently announced credit externalization will help optimize our balance sheet and improve our capital efficiency. Given our desire to return capital to shareholders and the confidence we have in our business, we’ve taken a more aggressive approach to share repurchases. Since the end of 2021, our diluted share count has declined 6%.

Source: Earnings Call

You have to love a company with a constantly declining share count.

PayPal knows how to give back to investors, and the company, at this point, is still quite cheap.

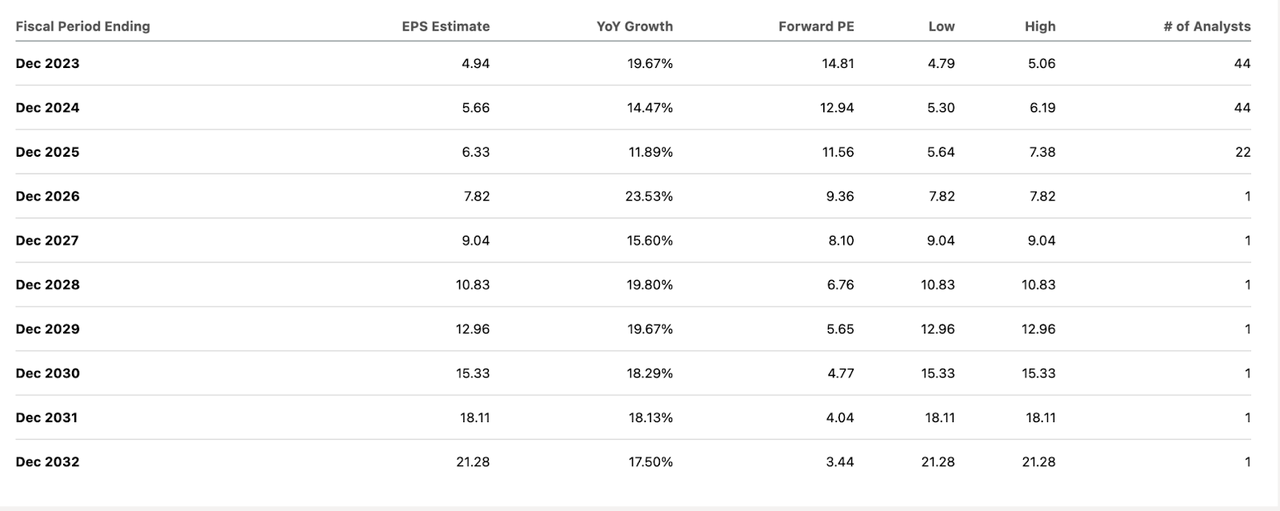

EPS forecast (SA)

PayPal trades at just above 11x 2025 EPS, and this is based on quite a large consensus of analysts. Compare this to Block, Inc (SQ), which trades at over 23x its 2025 EPS.

Technical Analysis

As you probably know, I like to carry out TA on most stocks I buy to support the fundamental story.

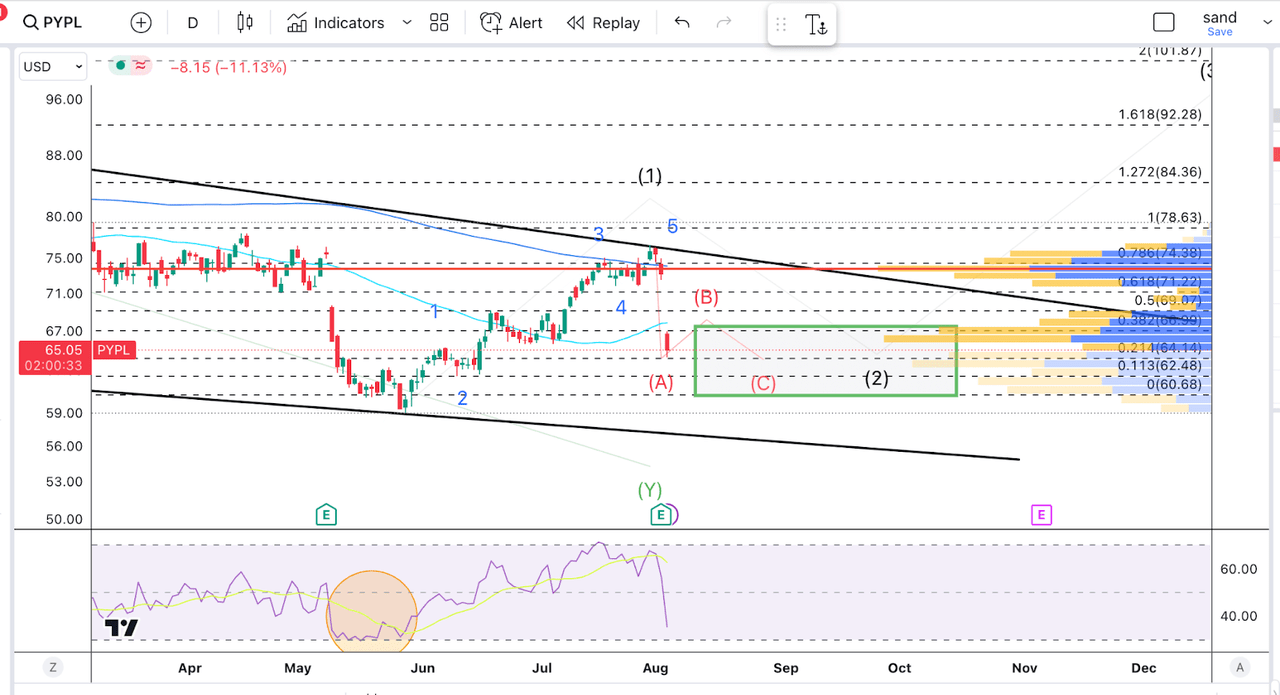

PayPal TA (Author’s work)

While I won’t necessarily claim that TA moves markets and events like earnings don’t matter, it is interesting to see how PayPal reversed exactly at the top of the resistance provided by the descending wedge structure we have been forming since last August.

The way I see it, we have completed an impulse off the lows struck in June, following the previous earnings. We are now at the 61.8& retracement, and I’d expect us to find support around this area and the next fib level at $64. We have some support coming in here from the VRVP, and the RSI is already nearing oversold.

In fact, notice how last time after earnings, we got a very similar sell-off, a small rebound, a final swipe and then a juicy +15% rally. Conditions are now getting very similar to those, and I think we might see history repeat itself.

Takeaway

PayPal’s stock has been hammered after earnings, and it’s now close to where I last issued a buy rating. Not much has changed for me after these earnings. The stock is still cheap, fundamentals are strong and the technical outlook suggests a rebound.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

– Access to our Portfolio, which features “value tech stocks”.

– Deep dive reports on tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!