Summary:

- Qifu Technology is a profitable Chinese digital lending firm utilizing AI and big data, showing significant earnings growth and a 97.85% stock price surge.

- Q2 2024 results highlight a 6.3% revenue increase and a 23% rise in non-GAAP net income, driven by a growing user base.

- QFIN’s valuation metrics, including a low P/E GAAP ratio and high dividend yield, indicate that the company is undervalued with strong growth and income potential.

- Despite risks like borrower defaults and cybersecurity threats, the Company’s robust profitability and operational efficiency make it a compelling buy in the consumer finance sector.

courtneyk

Thesis Summary

Qifu Technology, Inc. (NASDAQ:QFIN) is a Chinese digital lending firm for young urban Chinese professionals and came into my notice last year and honestly, when I looked at its fundamentals, I liked it. The valuation was pretty solid and earnings were decent. Qifu has turned to be a profitable company over the time and I guess it offers pretty decent value and I think it’s a buy at the moment.

This Chinese-based credit tech firm utilizes machine learning, artificial intelligence and big data to evaluate the borrowers and help them in their decision-making process.

Its Q2 2024 results showed robust performance since I last checked, its earnings have significantly increased in this quarter. What caught my attention is that QFIN stock has surged significantly over the last year. The stock price has surged by 108% but is still slightly shy of its all-time high. This underrated tech stock offers great value and I would definitely recommend including it in your tech portfolio.

Q2 2024 Highlights

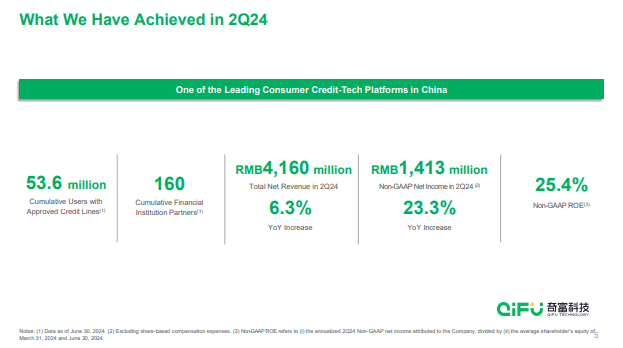

In the second quarter, the company reported total net revenue of RMB 4,160 million, a 6.3% increase compared to the same quarter last year. Their non-GAAP net incomes surged by 23% and were RMB 1,413 million. This significant surged in the earnings could be attributed to the increase in the users, which surged to 53.6 million. Last year, in the same quarter, its user base was around 47.4 million.

Qifu Investor Presentation

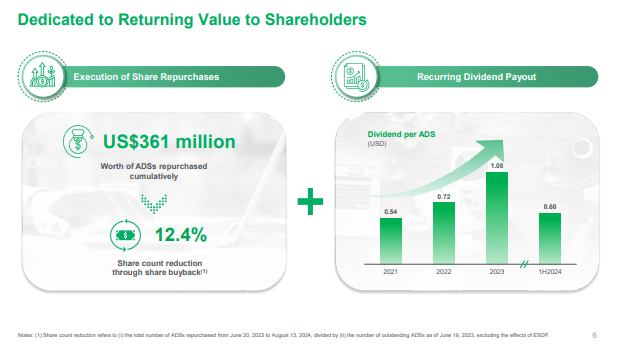

Qifu is poised to deliver value to its shareholders not only in-terms of capital gains but also through dividends and stock buybacks. The company announced a semi-annual dividend of $0.60, an increase of 3.4% from the $0.58 earlier. QFIN also spent US$361 million on stock buybacks.

Qifu Investor Presentation

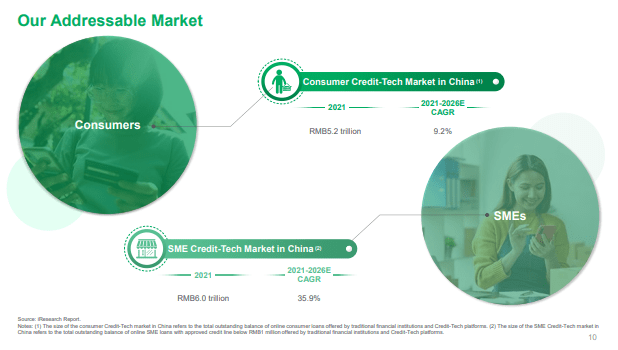

Growth prospects also look pretty solid. According to Qifu, its total addressable market, or specifically the consumer credit-tech market in China in 2021, was around RMB5.2 trillion and is expected to grow with a CAGR of 9.2% between 2021 and 2026. The total Chinese SME credit-tech market in 2021 was RMB 6 trillion, and between the years 2021 and 2026, it’s expected to grow at a CAGR of 35.9%. In my opinion, Qifu’s growth in the consumer base and earnings is proof of these estimations, which can be seen in its latest earning report.

Qifu Investor Presentation

Peer Comparison

When I look at Qifu Technology and compare it to its peers in consumer finance like FirstCash Holdings (FCFS), SLM Corporation (SLM), OneMain Holdings (OMF), Credit Acceptance (CACC), and Upstart Holdings (UPST), I think QFIN offers better value than all. First of all, QFIN’s P/E GAAP (FWD) ratio of 6.44 is lower than all of its peers. This means QFIN is extremely undervalued and offers great growth potential. Even on the trailing P/E basis, QFIN’s 8.0 is lower than most of the competitors, and in my opinion, it indicates that the stock is not priced relative to its earning potential.

|

QFIN |

FCFS |

SLM |

OMF |

CACC |

UPST |

|

|

P/E GAAP (FWD) |

6.44 |

19.92 |

8.16 |

11.14 |

25.61 |

NM |

|

P/E GAAP (TTM) |

8 |

21.71 |

7.21 |

9.53 |

32.16 |

NM |

|

PEG Non-GAAP (FWD) |

0.35 |

– |

NM |

0.74 |

– |

– |

|

PEG GAAP (TTM) |

0.31 |

4.72 |

0.06 |

NM |

NM |

– |

|

Price/Sales (TTM) |

2.2 |

1.55 |

3.04 |

2.21 |

7.1 |

8.11 |

|

Revenue 3 Years (CAGR) |

5.29% |

28.73% |

-10.55% |

-9.75% |

-19.54% |

6.83% |

|

Revenue 5 Years (CAGR) |

19.19% |

12.62% |

6.73% |

0.39% |

-6.80% |

34.24% |

|

Levered FCF Margin |

12.62% |

17.64% |

– |

– |

– |

-13.93% |

|

Return on Equity |

21.98% |

12.24% |

36.18% |

18.81% |

11.00% |

-32.73% |

QFIN’s PEG ratio is another key highlight. Qifu’s PEG Non-GAAP (FWD) ratio of 0.35 again reflects that it is undervalued, and you’ll pay less for each unit of the earnings, making it an attractive option in the consumer finance sector. Revenue growth is also pretty decent, in my opinion, with a 3-year CAGR of 5.29% and a 5-year CAGR of 19.19%. I think that in a sector where most of its peers are struggling, QFIN’s revenue potential reflects its healthy growth, and it is a positive sign of its viability in the long run.

What I like about QFIN is its solid levered FCF margin of 12.62%, which is higher than the majority of its peers. Also, its return on equity of 21.98% further demonstrates operational efficiency, showcasing growth and profitability.

Overall, I believe QFIN offers a solid growth opportunity at a much lower price point, making it a strong buy.

Valuation

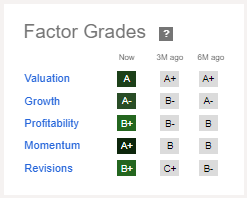

QFIN stock has surged significantly in the past one year and the reasons are obvious, its strong fundamentals. Due to this, the market has respond with great enthusiasm, taking the stock to $31.33 with an increase of 108% over the past one year.

Seeking Alpha

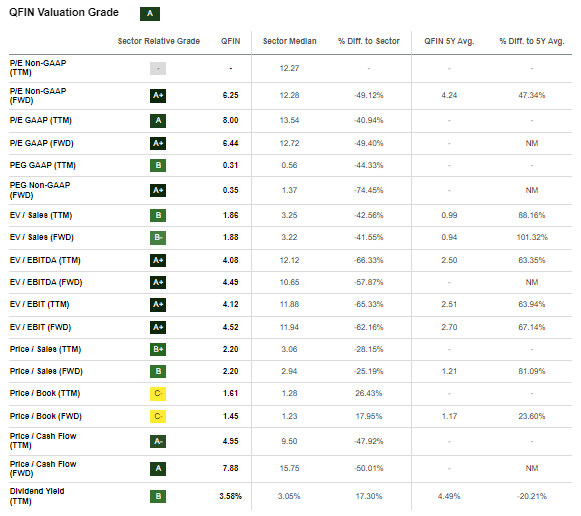

In my opinion, QFIN is undervalued based on valuation metrics. It has a P/E GAAP (TTM) ratio of 8.00 which is nearly 40% lower than the sector median and strengthens my bullish case. This, combined with its P/E GAAP(FWD) of 6.25, reflects that the market has not fully recognized QFIN’s future earnings potential. I think PEG GAAP (TTM) of 0.31 further indicates that QFIN is priced attractively relative to its growth prospects, with a 44% discount compared to the sector.

Seeking Alpha

The forward EV/EBITDA and forward EV/EBIT ratios show that QFIN is trading low relative to its sector, with values of 4.49 and 4.52, respectively, both more than 65% lower than sector medians. In my opinion, QFIN is delivering strong earnings with efficient capital allocation; hence the ratios speak for themselves. Its price/sales (FWD) ratio of 2.20 is also 25% lower than that of the sector, showing that the market is not adequately pricing its revenue potential.

Finally, the dividend yield of 3.58% is above the sector median, which is a nice bonus if you are an income-focused investor. Given these undervaluation metrics, QFIN is a clear buy, in my opinion, with both growth and income potential.

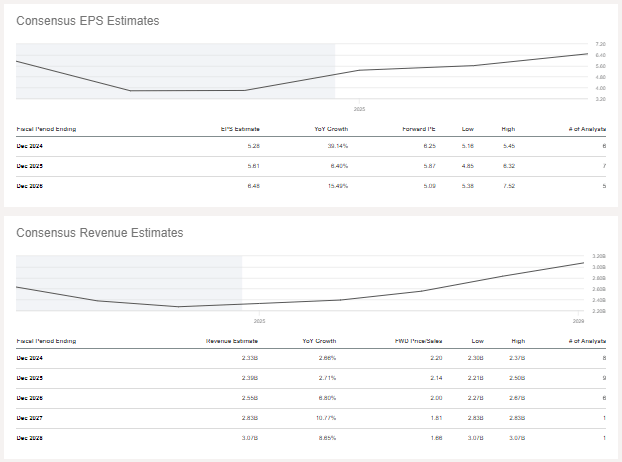

EPS estimates for the full year are expected to be around $5.28 reflecting a significant growth of 39.14%. Next year’s estimate is $5.61 with a modest increase of 6.4%. Similarly, revenue estimates for FY24 are $2.33 billion and with YoY growth of 2.66%. Next year, it is expected to increase at 2.71% to reach $2.39 billion.

Seeking Alpha

Why am I Bullish on QFIN?

So, here is what my verdict on QFIN, yes, it’s the right time to buy. Not only its valuation but also the company’s business model and macroeconomic changes drive my bullish case.

The company is in the digital lending business, targeting young urban Chinese with white collar corporate jobs. The company is poised to increase its market share and customer base in China, and we can see that efforts in the earnings growth in Q2 and hopefully Q3 and Q4 will follow the same. I think this will boost its FCFs and will help the company to deliver value to its shareholders with strong dividends and stock buybacks.

Also, I think that on the macroeconomic scale, the recent changes in Chinese policies will help the business to take advantage of it.

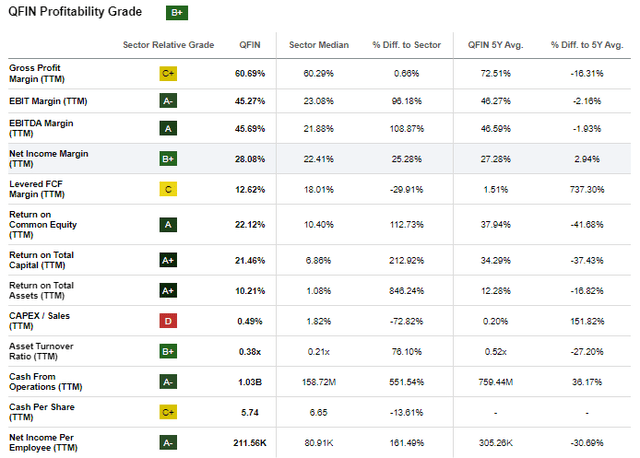

QFIN’s profitability metrics are another reason why I am bullish on the stock. Its EBIT margin of 45.27% and EBITDA margin of 45.69% are more than double the sector median, which shows the operating efficiency of the company, meaning it is efficient in converting revenues into profits. The net income margin of 28.08% is also a standout, outperforming competitors by 25%, highlighting solid profitability in a sector that has extreme volatility. This means that the company is efficient in recovering the cash it lends to people, thus increasing its profits. While the gross profit margin of 60.69% is slightly ahead of the sector, the return on equity (22.12%) and return on total capital (21.46%) are excellent. Despite a slightly lower free cash flow margin, QFIN’s profitability makes it a compelling buy, in my opinion.

Risks

Being a digital lending company, QFIN has several risks. Some risks are related to the tech side, but one risk that any lending company (digital or conventional) will have is its borrowers not being able to pay the money borrowed. And especially in a digital lending business where they lend money without any collateral, it is a serious risk. As we have discussed, the company uses AI, ML, and big data to study its customers, but life is still unpredictable, and any change in the customers’ lives, like losing a job, etc., could affect Qifu’s revenues.

Another threat is that any tech business would have cybersecurity threats, and any breach could be a serious blow in terms of compromising customers’ data, etc.

A policy change on the state level is another risk that could affect Qifu’s business.

Conclusion

Qifu Technology, in my opinion, is an underrated stock in the consumer finance sector. The company has a strong balance sheet, steady growth, maintains profitability, and offers consistent dividends. It has all the qualities one could ask for in a stock. Though the risks are significant, QFIN, being a solid credit-tech company, knows how to take calculated risks with its robust system. If you want to diversify your portfolio and looking for an attractive investment in the consumer finance sector, QFIN is the best stock for you.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.