Summary:

- We recap Qifu Technologies Q1 earnings report.

- The company is managing to drive profitability higher even as consumer credit conditions in the Chinese economy remain volatile.

- Shares offer a compelling 5.5% dividend yield.

owngarden

Qifu Technology Inc (NASDAQ:QFIN) reported its first-quarter results highlighted by solid growth and firming profitability. The China-based fintech is managing mixed economic indicators in the region and ongoing consumer credit headwinds by tightening lending standards and streamlining the business. The latest results suggest the strategy is working.

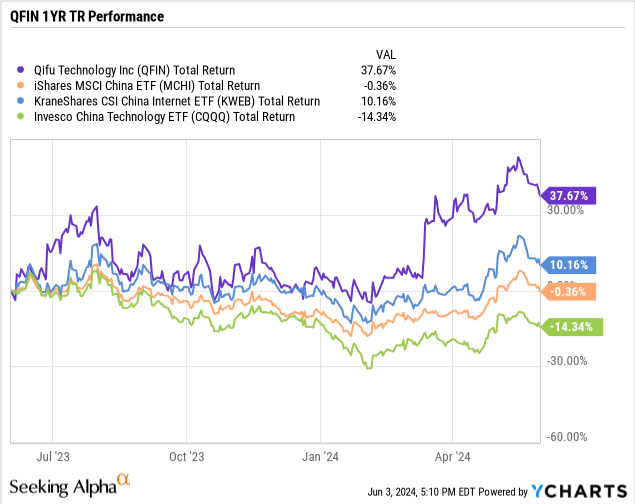

We last covered the stock in late 2022 when the company was still known as “360 DigiTech” before a corporate name change in March of last year. While shares were volatile through 2023, the stock has gained momentum more recently and is outperforming Chinese equity benchmarks.

In many ways, the operating and financial trends have evolved better than we expected, and we can reaffirm a bullish outlook. The attraction here is the company’s strong fundamentals, which include a generous share buyback program and dividend policy. We see room for more upside going forward.

QFIN Q1 Earnings Recap

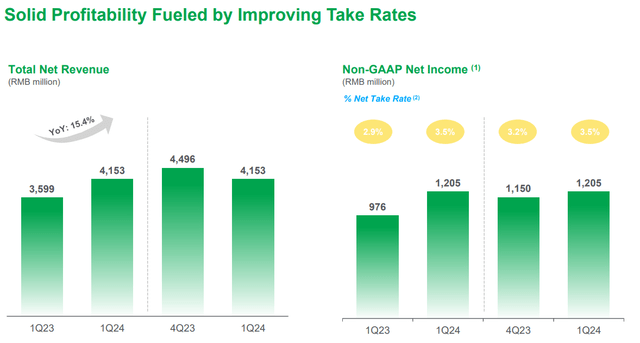

QFIN Q1 earnings per American depositary shares (EPADS) of $1.05 climbed by 28% year over year from $0.86 in Q1 2023. The result this quarter represented an adjusted net income of RMB 1.2 billion or approximately $167 million, also climbing sequentially from Q4. Revenue of $575 million was up 15% y/y.

Even as the total volume of loan originations was down by -9.3% from the period last year, the take rate as a measure of profit per transaction increased by 54 basis points to 3.5%.

Management explains that amid the shifting macro backdrop over the past year, lending standards have gotten tighter, but borrowers are willing to pay higher spreads.

source: company IR

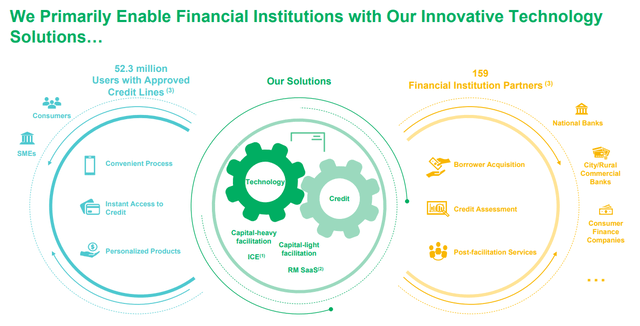

The number of cumulative users with approved credit lines reached 52.3 million, up 13.8% y/y. Within that amount, the actual number of borrowers at 31.2 million is up 12.6% y/y.

The company is finding that repeat customers contributed to nearly 92% of total loan volumes in Q1. This measure suggests some level of brand loyalty and customer satisfaction, while also pointing to a growth tailwind as a new cohort of new borrowers enters the platform.

The delinquency rate at 4.9% this quarter ticked up 4.1% in the period last year, but for context remains well below levels above 6% in 2019 as a pre-pandemic benchmark. The risk metric did tick down from 5.0% in the prior Q4. Management sees the current range as expected and otherwise a normal part of the business.

In terms of guidance, the company is targeting Q2 adjusted net income between RMB1.22 billion and RMB1.28 billion, representing a year-on-year growth between 6.4% and 11.6%.

The effort is to continue prioritizing risk performance and operational efficiency. This was a point covered by translated comments during the earnings conference call from Qifu Technology CEO Haisheng Wu:

Since the second half of last year, we have made adjustments to our business strategies, emphasizing more on the overall profitability of our business and have achieved good results…

Next, we expect the take rate in Q2 to be further optimized with the main driving factors being: the first one is the risk optimization. By cutting back businesses with lower or negative margins, we enhance the profitability of the overall loan portfolio. In addition, we will continue to improve the efficiency of the collection process, and we expect further optimization of risk indicators in Q2.

What’s Next for Qifu?

The Chinese economy and related equities have been a closely watched story in the first half of 2024. Despite some deep pessimism to start the year, recent economic indicators have provided some sense of stability in the region. Reports suggest the authorities are moving forward with an all-in approach toward stimulus efforts to both avert a recession and also support capital markets.

In our view, Qifu Technologies is well-positioned to benefit from this potential macro turnaround. The company proved it was capable of navigating a challenging operating backdrop last year, while a tailwind of new credit demand could be a catalyst for results to outperform expectations.

At its core, the expanding credit platform with more borrowers and partner financial institutions has significant room for growth in the world’s largest economy. In many ways, there is a case to be made that the growth story for Qifu is just getting started.

source: company IR

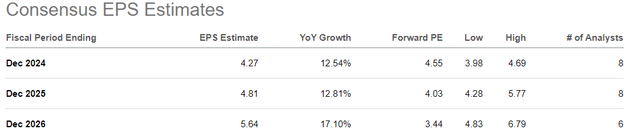

According to consensus, Qifu’s 2024 EPS is forecast to reach $4.27, up 12.5% from 2023, as a continuation of the Q1 trends and Q2 guidance. The market sees earnings growth averaging around 15% between 2025 and 2026.

Naturally, this trajectory will depend on how economic conditions evolve in China over the period, but we’d say there is a path for growth to even outperform expectations in a scenario where consumer credit picks up.

The stock’s valuation, trading at just 5x forward earnings, appears depressed given those same China uncertainties and risk toward the region. On the upside, the ability to keep executing on the strategy should allow the earnings multiple to expand as an incremental catalyst for the stock.

source: company IR

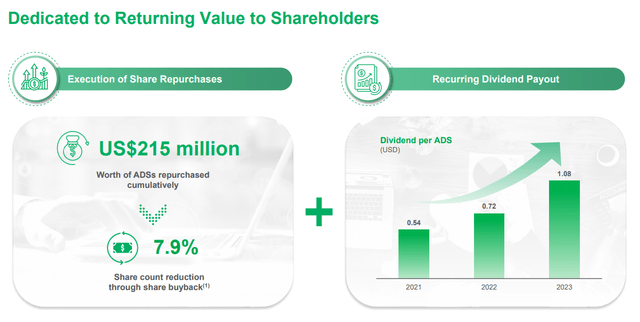

We mentioned the company’s share repurchases and dividend payout. According to the 2023 annual report, Qifu intends to declare a semi-annual dividend representing between 20% and 30% of net income as a payout ratio.

For context, the $1.08 distributed to ADS QIFU holders over the past 12 months corresponds to 28% of 2023 EPADS. With the last payment in May, investors can expect the next payout possibly by November, following the trend from last year, although nothing has been confirmed. Based on the earnings trend, we can estimate a forward dividend yield of around 5.5%.

Separately, the company has been active with buybacks. In March, the board of directors approved a new $350 million repurchasing authorization. As of May 17, the company has already purchased $65 million in shares within the program. Considering the current $3 billion market cap of the stock, the implied forward buyback yield on the remaining authorization is approximately 1%.

source: company IR

Final Thoughts

Qifu Technologies checks off several boxes for what we would consider a compelling investment opportunity. Steady growth, recurring profitability, a solid balance sheet, and regular dividend payout make the stock one of the more high-quality names out of China in our opinion.

At the same time, the risk here to consider would be the potential scenario where economic conditions deteriorate, forcing a reassessment of the earnings outlook. With China, there is a shadow of regulatory questions that can’t be overlooked given the events in recent years.

That being said, a small position in shares can make sense in the context of a diversified portfolio as a good option for exposure to trends in Chinese consumer credit. We believe the stock is attractive on a risk-adjusted basis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.