Summary:

- Qifu Technology Inc. changes its dividend policy to a bi-annual payout and increases its payout ratio from 15-20% to 20-30%.

- The company’s name change from 360 DigiTech has not been explained by management, but it resembles the founder’s other company Qihoo 360.

- The increased dividend policy may reflect a shift in focus from business growth to shareholder capital returns, which could be disappointing for growth-oriented investors while pleasing value investors.

- In all the company is embracing innovation for customer retention and internal use, which is laying the foundation for a better business during these times of loan environment uncertainty.

ronniechua

Introduction

It has now almost been three weeks since Qifu Technology, Inc. (NASDAQ:QFIN) released Q1 earnings. I would like to dedicate this article to explaining the change in the dividend policy, technological updates within the company, the loan environment in China, and finally the decoupling of analyst expectations and actual company performance.

A Governance Quarter

A bunch has happened on the corporate governance front since last quarter. For starters, what was ‘360 DigiTech’ is now officially Qifu Technology Inc. The reason for the name change has not been discussed by management, but the new name closely resembles the founder Zhou Hongyi’s other company Qihoo 360.

Furthermore, and much more importantly, the company has changed its dividend policy with two respects. First, instead of paying a quarterly dividend the company will now pay a bi-annual dividend. Second, the company has increased its payout ratio from 15-20% to 20-30%. Depending on your investing style this could represent either poor or positive news, and I’d say I’m somewhere in-between. First of all, the bi-annual dividend is positive in all respects because the intentions are in line of the shareholder:

“Also to reduce the transaction cost for our shareholders, the new plan approved a semiannual dividend distribution schedule to replace the quarterly dividend schedule of the old plan. The first semiannual dividend payout will be declared in our Q2 earnings release.”

Wu Haisheng, CEO (Q1 Earnings Call)

The increased dividend policy, on the other hand, is a reflection of some positives and negatives. To start with the negative, I have a short reminiscence. Back in 2021, shortly after I began investing in QFIN I saw an investor presentation that claimed the company’s goal of becoming the world’s leading digital consumer credit platform. These ambitions were huge, I thought, and perhaps they will elaborate on these plans in more detail at a later stage. But, I haven’t heard anything about it since. What I mean to say with this is that QFIN seems to be opting for friendly shareholder capital returns instead of business growth. This is disappointing from a growth perspective, especially since the company benefits greatly from scale in its two-sided ecosystem of consumers/SME’s and financial institutions. However, since QFIN is still a young company as well as owner-led it is premature to assume that the company won’t pivot once macro uncertainty within China eases up.

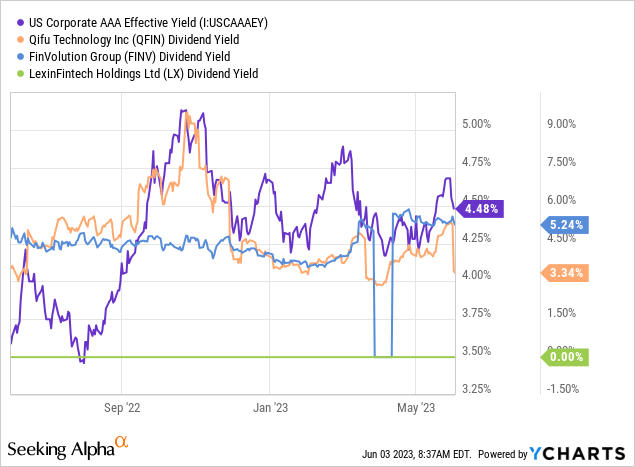

From a value perspective, the increased dividend payout ratio is very welcomed. Let’s look at the company’s dividend yield in comparison to competitors (LexinFintech Holdings Ltd. (LX) and FinVolution Group (FINV) and the AAA Effective Yield:

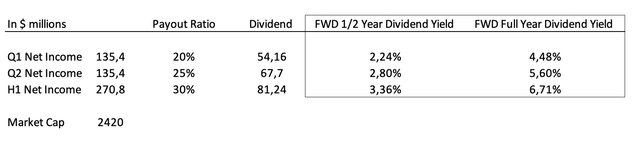

This graph is good to keep in mind as a comparison, but it cannot be trusted completely. The reason for this is that QFIN’s dividend yield will vary significantly depending on the net income it achieves during the half year periods. Below is a very conservative estimate of QFIN’s actual forward dividend yield.

Forward Dividend Yield (The Author)

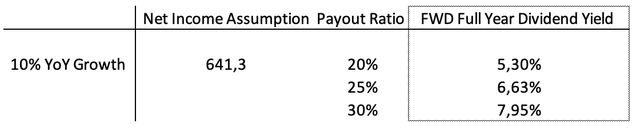

In Q1, the company posted a net income of $135 million and if we conservatively estimate the net income will be the same for Q2, then we get a half year dividend yield range of 2.24-3.36%. I proceed by doubling this range in order to get the full year FWD Yield: 4.48-6.71%. So as we see here, the yield y-charts is understated substantially. Furthermore, I would like to emphasize my assumption here that QFIN delivers $541.6 million in net income or $135 million per quarter for FY 2023. Last year, QFIN generated $583 million in net income (Q4 Earnings Results). Given the potential rebound in China’s credit markets this year, it may be an understatement to assume lower net income YoY. Therefore, I have projected the FWD Full Year dividend yield based on a simple assumption that net income grows with 10%, which is the company’s low-end assumption of loan origination growth for the year. This lends a FWD dividend yield range of 5.30-7.95%.

Additional FWD Yield Estimates (The Author)

It is useful to compare this yield with that of a less risky bond portfolio. Currently AAA corporate bonds are yielding 4.48%, which is not far from the low-end of QFIN’s forward yield range. So the bottom-line is that investors can receive a slightly lower yielding return for significantly less risk in corporate bonds or alternatively treasury bills. But, if investors believe in the long-term potential of QFIN then this can be considered an incredible moment to buy the company as it has a great margin of safety that will be collected bi-annually. Furthermore, long-term owners can play with the thought of a growing dividend over the next ten years. For example, if QFIN grows earnings at a 10% CAGR over the next 10 years, then the dividend will also grow by the same amount, meaning that investors now will retain well over a 10% yield on their original position.

Technological Updates

During the quarterly earnings call, management presented encouraging news about new technology integrations as well as R&D initiatives.

First, the company has expanded its distribution channel by integrating its products in WeChat owned by Tencent (OTCPK:TCEHY), which is the everything app of China. The WeChat integration allows the company to easily interact with existing customers, which is very important as they have a 91.9% repeat borrower contribution (a measure of the principal borrowing amount of existing customers divided by total loan facilitation for a given period). Management stated in the most recent earnings call:

[WeChat] drives user conversion by offering a step-by-step guide through the loan application, drawdown and the submission process. As of today, we have engaged with more than 200,000 existing users.”

Interestingly, this may have already had an effect on the repeat borrower contribution ratio, which was 90.3% in the prior Q4.

The second exciting piece of news from the earnings call is that the company has employed a large language model department with inspiration from the influential ChatGPT. Management sees specific use cases in several areas of its business:

For example, in areas such as intelligent customer service, telemarketing and loan collection. ChatGPT can better understand user emotions and facilitate natural and personalized interaction with users. In risk management, it can derive useful information from credit reports and identify relevant factors for our risk management models.”

As a matter of fact, QFIN has already integrated GPT into its internal processes for semantically analyzing its loan collection and telemarketing process in which they found that different user groups had significant variations in their uptake of company advertisement. As an investor, I’m very glad to see that the company is finding new insights using new technology and that they will be implementing this new technology to further drive operating efficiency and user retention.

The Chinese Loan Environment

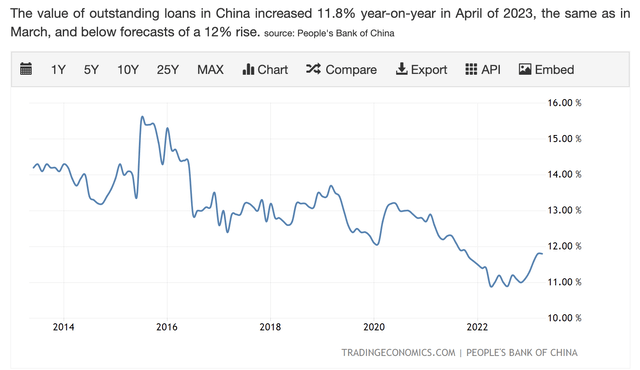

During the first quarter, loan facilitation volumes grew 10.7% – just above the low-end of managements guidance. This suggests to me that the credit environment has still not freed up within China. Another statistic that suggests this is China’s total outstanding yuan growth rate. The graph below outlines loan growth volumes during the past ten years where we can see that growth rates suppressed on a historical level, but have increased since historical lows.

As we can see, QFIN’s loan growth facilitation was actually lower than that of the country in total. Although it is lower by a small margin, this is a figure that investors should watch going forward. In my opinion, investors would like to see QFIN growing facilitations at a faster rate than the national average.

Decoupling Analyst Expectations From Company Results

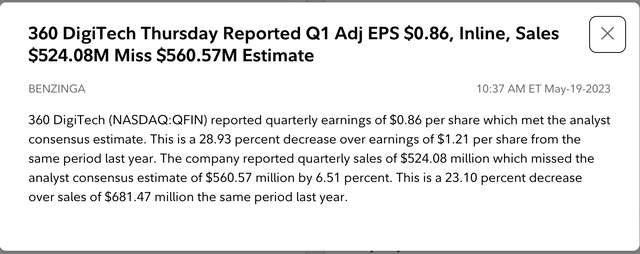

I would like to dedicate this final section to something I noticed after the latest earnings release: A complete mix between QFIN completely missing expectations, but also performing in line with expectations. As an example, Benzinga reported that quarterly earnings were in line with analyst expectations, while revenue missed by $36 million.

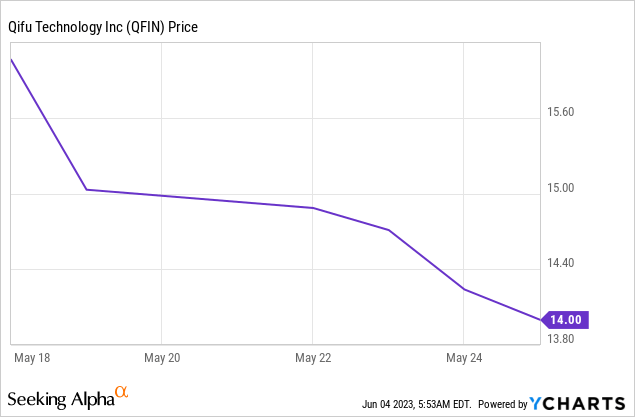

However, Seeking Alpha news reported an EPS miss of $0.48 and a revenue miss of $39.46 million (source). The unreliability of earnings estimates is most likely due to the few number of analysts that offer estimates. Currently seeking alpha reports five analysts offering estimates for earnings and ten offering estimates for revenue. Fidelity, as a comparison, offers six analyst expectations for both earnings and revenue. So, similar to any stock that is relatively under covered an investor must take estimates with a grain of salt. I believe that the negative stock price reaction on the day of the earnings was due to the decoupling of analyst expectations and actual company expectations. Another issue that further exacerbates this problem is that QFIN does not offer guidance on earnings or revenue, but rather only on loan facilitation.

Released on May 19, earnings created a cascade of selling for several days. The sell-off is not completely irrational for the chief reason that loan facilitation growth was at the bottom-end of guidance. I believe that if/when the loan environment in China recovers, investors will be pleased. But, for the time being it is important to be patient. This is because the most important thesis for QFIN’s growth is China’s long-term success, that is, 10-15 year performance rather than 1-2 year performance.

Concluding Remarks

As opposed to the general market perception, I consider 2023 Q1 for QFIN very encouraging. During this time of relative uncertainty, the company is delivering a cushion of safety for investors by distributing a larger portion of their cash position to shareholders while striving to efficiently operate its business. Furthermore, innovation has not halted for a second. I find the company’s integration of GPT in their internal operations as well as establishing a specific department for developing large language models a promising sign that will drive higher customer retention. Although the loan environment is not as strong as we may wish for, a recovery of confidence can take years and it should be treated with patience – just recollect how long it took the U.S to recover confidence in the markets after The Great Financial Crisis. China has only been freed from rigorous lockdowns for six months! In all, I would like to encourage investors to be patient and critical of future earnings consensus reports – the fruits of this investment may lie many years ahead, and the seeds are just being sown.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.