Summary:

- QFIN’s third quarter bottom-line growth prospects are favorable, taking into account expectations of provision write-backs and lower operating costs.

- Qifu Technology’s potential shareholder yield for fiscal 2024 is estimated to be in the mid-teens percentage range.

- I stick to a Buy rating for QFIN; the stock is still trading at a depressed mid-single digit P/E ratio despite its positive bottom-line outlook and enticing shareholder yield.

fizkes/iStock via Getty Images

I leave my existing Buy investment rating for Qifu Technology, Inc. (NASDAQ:QFIN) stock unchanged. QFIN’s Q3 FY 2024 bottom line growth prospects are favorable, as the company’s third quarter performance is likely to benefit from provision write-backs and lower operating expenses like what it did in Q2. Also, the stock offers a potential FY 2024 shareholder yield at the mid-teens percentage level.

My previous write-up published on June 4, 2024 analyzed Qifu Technology’s financial and operating metrics for the first quarter of the current year. This article touches on QFIN’s most recent Q2 2024 financial performance and its shareholder capital return prospects.

Second Quarter Bottom Line Performance Was Better Than Prior Guidance

QFIN registered a normalized net profit of RMB1,413.4 million in the second quarter of 2024 as disclosed in its earnings press release. The company’s actual Q2 2024 non-GAAP adjusted earnings turned out to be +13% above the mid-point of its earlier bottom line guidance at RMB1,250 million. The company had also achieved a +23% YoY growth in non-GAAP net income for the latest quarter.

Qifu Technology’s good Q2 2024 bottom line performance was driven by a substantial provision write-back and a significant decrease in operating costs.

The company revealed at its recent quarterly earnings call that it had recognized a RMB480 billion in “write-backs of previous provisions” for Q2 2024.

QFIN’s key asset quality metrics have gotten better, which justified the significant provision write-back. As indicated in the company’s earnings release, QFIN’s 30-day collection rate went up by +1.2 percentage points QoQ from 85.1% for the first quarter of 2024 to 86.3% in the second quarter of 2024. On the other hand, Qifu Technology’s Day-1 delinquency rate declined by -0.1 percentage points QoQ from 4.9% in Q1 2024 to 4.8% for Q2 2024.

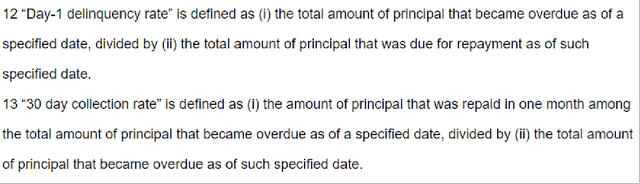

Definition Of Qifu Technology’s Key Asset Quality Metrics

QFIN’s Q2 2024 Earnings Press Release

Qifu Technology’s bottom line for the recent quarter was also boosted by lower operating expenses.

The company’s total operating costs decreased by -20% YoY from RMB2,732.8 million for Q2 2023 to RMB2175.1 million in Q2 2024. During the same time period, QFIN’s Selling & Marketing or S&M expenses contracted by -16% YoY to RMB366.4 million, while its General & Administrative or G&A costs also declined by -16% YoY to RMB95.1 million. In its Q2 2024 earnings press release, QFIN credited the lower S&M costs and G&A expenses for the recent quarter to “a more prudent customer acquisition approach” and its “continued effort to improve operational efficiency”, respectively.

Moving beyond the second quarter, QFIN anticipates that its normalized earnings can grow by +36% YoY to RMB1.60 billion in Q3 2024 according to the mid-point of its guidance.

I take the view that Qifu Technology’s actual Q3 2024 financial results will be as good as what it guided for. This is because the key Q2 2024 earnings growth drivers will most probably boost QFIN’s third quarter bottom line as well.

At its Q2 2024 earnings briefing, QFIN emphasized that it sees “additional (provision) write-backs in the coming quarters” as “overall portfolio risk metrics” get better. Qifu Technology also indicated at its latest quarterly results briefing that it “will continue to make timely adjustment to the pace of the new user acquisition based on macro environment from time-to-time.”

In other words, Qifu Technology’s bottom line for Q3 2024 is likely to benefit from further provision write-backs supported by asset quality improvement, and S&M cost optimization driven by a disciplined client acquisition approach.

Shareholder Capital Return Outlook Is Favorable

Qifu Technology boasts favorable shareholder capital return prospects, on top of its good Q2 2024 bottom line performance.

The company noted its intention of sustaining a “very active pace (of buybacks) in the market” and concluding “the current (share repurchase) program ahead of the time schedule” at its second quarter earnings call. Notably, QFIN spent $211 million on share repurchases between April 1 and August 13 this year. This implies that Qifu Technology has already executed on 60% of its one-year $350 million buyback plan which expires on April 1, 2025.

QFIN’s forward FY 2024 buyback yield is 9.5% based on the assumption that the $350 million share repurchase program is completed within this year. This seems very likely based on its actual buybacks and management commentary.

Separately, Qifu Technology increased its semi-annual dividend distribution by +3% from $0.58 per ADS (American Depositary Share) in 1H 2023 to $0.60 per ADS for 1H 2024. The consensus full-year FY 2024 dividend forecast for QFIN is $1.35 per ADS which translates into a forward FY 2024 dividend yield of 5.7%.

To sum things up, QFIN’s potential FY 2024 shareholder yield (buyback yield plus dividend yield) is an appealing 15.2% (9.5%+5.7%).

Key Risks

There are three risks to watch for Qifu Technology.

Firstly, a failure to improve asset quality in the quarters ahead could imply that QFIN’s future provision write-backs come in below expectations.

Secondly, an aggressive approach to client acquisition might lead to higher-than-expected S&M expenses.

Thirdly, Qifu Technology will be a less attractive shareholder capital return play in the scenario that QFIN pauses buybacks or cuts its dividend.

Final Thoughts

QFIN remains an attractive investment candidate deserving of a Buy rating. Qifu Technology is now trading at an undemanding 4.6 times (source: S&P Capital IQ) consensus next twelve months’ normalized P/E. As a comparison, the company’s consensus FY 2023-2026 normalized earnings CAGR is +12.1% according to S&P Capital IQ data. Considering its above-expectations Q2 earnings, favorable Q3 bottom line guidance, and enticing shareholder yield, it will be realistic to see QFIN’s P/E multiple re-rate to the high-single digit level at the very least.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!