Summary:

- Qifu Technology has shown strong performance with a 140% YoY stock return, driven by its capital-light platform services and improved profitability.

- The company’s Q3 2024 results exceeded expectations, with significant growth in net income, ROE and user acquisition, highlighting its operational efficiency and strategic focus.

- QFIN’s low P/E ratio and aggressive share buyback strategy still make it an undervalued stock with strong potential for future earnings growth, despite macro and regulatory risks.

- The company’s fintech innovations, including AI and large language models, enhance its competitive position, making QFIN a solid “Buy” for investors interested in China’s fintech sector.

J Studios

Intro & Thesis

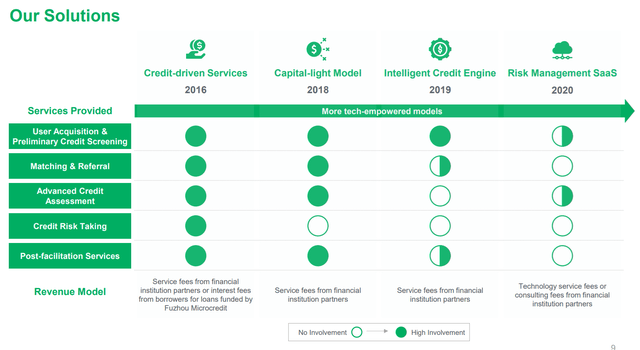

Qifu Technology (NASDAQ:QFIN), headquartered in Shanghai, China, operates a credit-tech platform under the 360 Jietiao brand, providing credit-based services such as borrower-lender matching, credit verification, risk management, and post-loan facilitation services to different financial institutions. The firm also provides platform services, including loan creation, referral, and risk management software-as-a-service.

QFIN’s IR materials

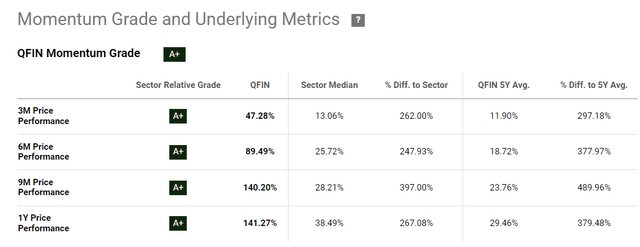

While the iShares China Large-Cap ETF (FXI) is up 18% year-over-year, QFIN stock has delivered a phenomenal return of over 140%. While FXI has fallen in recent weeks – it’s now trading 17% below its 2024 peak – QFIN continues to rise (47%-plus for the past three months):

Seeking Alpha, QFIN’s momentum factor

Despite this brisk growth, I don’t think QFIN’s rally should stop any time soon. A “Buy” rating seems to be justified given the stock’s cheap valuation and solid prospects for the firm’s net take rates improvements (and hence earnings improvements).

Why Do I Think So?

As I usually do in my articles, I suggest starting with a review of the company’s latest financials (Q3 2024 data released on Nov. 19, 2024).

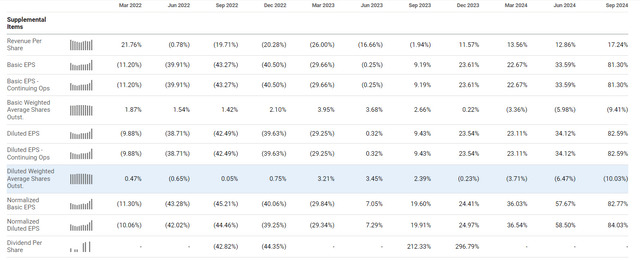

Qifu Technology topped consensus Q3 2024 estimates in terms of both revenue and EPS, demonstrating strength and flexibility in the face of macro volatility. The firm made total net revenue of RMB 4.37 billion, up modestly sequentially from RMB 4.16 billion and slightly year-on-year growth from RMB 4.28 billion in Q3 2023. As the press release explained, the growth was led mainly by the Platform Services (capital-light) division, with revenue rising to RMB 1.47 billion – up 17.6% QoQ and 21.5% YoY. The Credit Driven Services unit, however, saw a decrease, as revenues decreased to RMB 2.9 billion from RMB 3.07 billion in the prior year as a result of the transition to a less capital-intensive model. This move is in keeping with Qifu’s commitment to lower risk exposure and increase operational efficiency, which was one of the main reasons behind its increased profitability – despite the top-line contraction for the period, the firm’s opex declined even more (-28% YoY), leading to the bottom line’s expansion to RMB 1.83 billion (+29.1% QoQ and 54.5% YoY). As a result, QFIN’s non-GAAP net income per diluted ADS rose 34.8% in Q3 and 71.5% YoY due to share buybacks and enhanced profitability. Qifu also scored an ROE of 32.2%, way better than its rivals in China’s financial services and internet industries.

Qifu also announced that it’s going to increase the buyback volumes significantly next year, launching another $450 million share repurchase plan:

Seeking Alpha, QFIN

As far as I see, QFIN’s capital-light platform services segment remained the most prominent growth driver segment as it accounted for 55% of total loan facilitation and origination volume in Q3, compared to 45% in the same quarter last year – this move aligns with the company’s focus on a platform approach that focuses on long-term user retention and risk reduction. In the embedded finance channel, a component of the platform services segment, the loan volume increased by 85% YoY thanks to better user profiling and operational efficiency. This channel also accounted for a 60-basis-point rise in ROA compared to the previous quarter. The capital-intensive part, though still important, is gradually being shed as Qifu tries to make a compromise between risk and return.

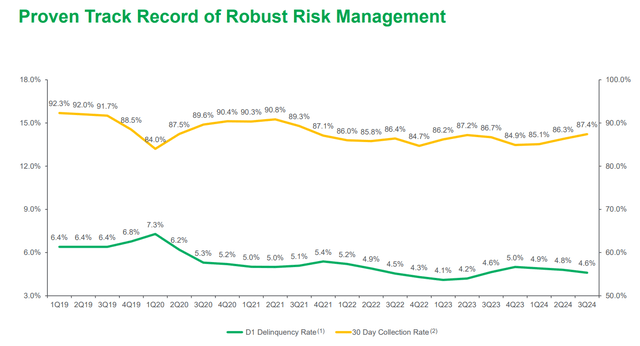

The asset quality was an important aspect of Q3 as the D1 delinquency rate fell by 0.2% over time, while the 30-day collection rate rose by 1.1% to its highest level since 2022. The 90-day default rate also improved from 3.4% in the second quarter to 2.7% in Q3. QFIN also reduced funding costs by 30 basis points per quarter and more than 150 basis points per year, “supported by high liquidity in the system and an upturn in ABS issuance.” ABS issuance reached RMB 13.4 billion in the first three quarters of 2024, up 23% YoY, further stabilizing Qifu’s funding infrastructure.

QFIN’s IR materials

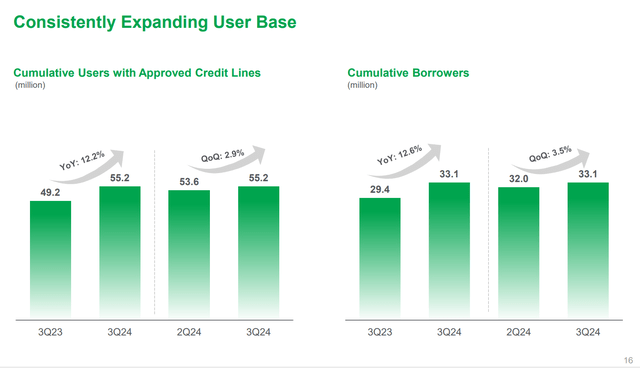

They also prioritized user acquisition, with new credit line users growing sequentially by 23.8% in Q3. The median unit acquisition cost was down by 7.4% due to higher user acquisition channel efficiency. The firm also reported 11.6% sequential growth in log-in conversions through differentiated user segmentation and VIP programs for high-value users. Not only have these measures increased engagement, but they also helped maintain the ongoing growth in the number of users who completed a successful loan drawdown, which increased roughly 12% month-over-month average over the last quarter.

QFIN’s IR materials

Qifu’s Total Technology Solution segment likewise continued to move forward with the company signing on to nine new financial institutions in Q3 bringing the total to 14. This vertical, which provides full-service technology solutions to banks, experienced a 14% compound monthly growth rate in the loan volume over the first nine months of 2024. Management said that incorporating AI and LLMs in the company’s operations has also improved efficiency, particularly in collection and SME borrower research.

At the same time, Qifu’s balance sheet continues to be strong with total cash and cash equivalents and short-term investments rising to RMB 9.77 billion in Q3 from RMB 8.78 billion in Q2. The leverage ratio – risk-based loan exposure divided by shareholders’ equity – was at an all-time low of 2.3x by the end of the latest reporting quarter. Qifu produced RMB 2.37 billion in operating cash flow in the quarter, compared with RMB 1.96 billion in Q2, further demonstrating its cash-producing potential (this cash is being used to drive the share repurchase program that is expected to reach 100% of QFIN’s 2023 net income by the end of 2024).

I like that QFIN keeps holding its net take rate above 5.9%. I think the firm has the potential to get even higher net take rates in the future because compared to Western peers like LendingClub (LC) or Upstart (UPST), whose take rates are now around ~10.5%, QFIN’s metric still looks lagging far behind (while its business model hints that it can show more). So the profitability is likely to expand further, in my opinion. In the short term, Qifu’s management forecasted that non-GAAP net income in Q4 2024 would be between RMB 1.8 and RMB 1.9 billion, representing an increase of 57-65% YoY. The company is cautiously optimistic for FY2025 as well, focusing on an uncomplicated business-planning strategy with ongoing macro and geopolitical risks.

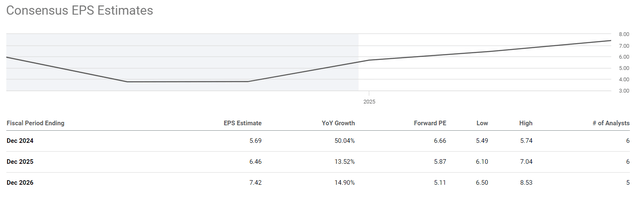

On a TTM basis, the diluted EPS has risen by 47.88% YoY, according to Seeking Alpha data, so today’s market consensus seems to underestimate the potential increase of QFIN’s EPS for Q4 and beyond in my understanding (given that the management’s guidance is right):

SA, QFIN

SA, QFIN

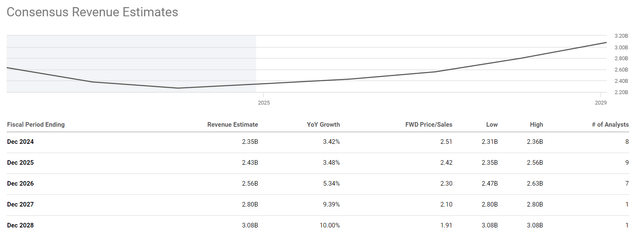

Considering that the company’s net take rate continues to grow, especially when compared to its Western counterparts, I believe the growth in EPS next year will be much stronger than current forecasts suggest. This higher growth won’t only be driven by the potential for improving individual unit economics metrics but also by the company’s aggressive share repurchase strategy. In Q3 2024, the company reduced its outstanding shares by over 10% YoY, which is a very significant move and the latest program expansion will likely further enhance shareholder value.

Seeking Alpha, QFIN

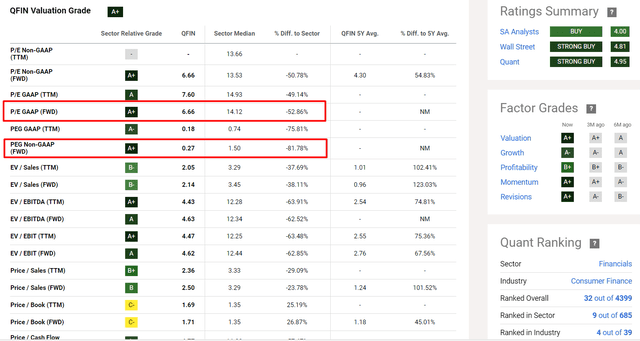

I think this underestimation by the consensus is largely responsible for how undervalued the company’s shares are today. Looking at the key valuation metrics, QFIN’s price-to-earnings ratio of just 6.66x amid the median for the sector of more than double I see the stock looks insanely cheap right away. The PEG ratio is showing even deeper discount on the forwarding basis:

Seeking Alpha, QFIN’s Valuation

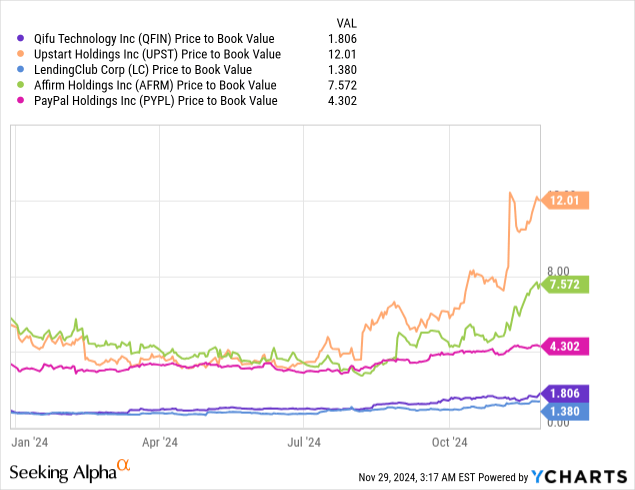

Looking at the price-to-book ratio, Qifu Technology appears slightly overvalued (by 20%+), but is still very cheap compared to its main competitors in the financial niche. Overall, the company is trading at a significant discount, which makes it an attractive opportunity at the moment.

Considering that the consensus projections for QFIN’s EPS (and likely sales as well) probably underestimate the actual potential for higher net take rates in the future, QFIN’s current valuation seems too low to me, even if the “China risk” is going to keep driving today’s discount for some time.

So that’s why I think a “Buy” rating is the most appropriate rating for QFIN today.

Where Can I Be Wrong?

The biggest weakness of my today’s bullish thesis on Qifu is that I presume higher net take rates look inevitable and will bring in future earnings growth. To date, QFIN’s take rate is lower than its Western peers (I looked at LendingClub and Upstart), but that metric may be an imperfect proxy for the differences in markets and regulations. In China, regulatory scrutiny of fintech players – especially in the areas of fees and lending – may actually prevent QFIN from raising take rates without causing compliance problems or losing market share. Also, the company’s move to a capital-light environment, while mitigating risk, may inherently limit take rate growth as platform services typically generate lower margins than capital-intensive lending.

Another area that could be broken in my thesis is the way in which valuations and share repurchases serve as justification for the upside of the stock. While QFIN’s low P/E ratio and buyback frenzy are appealing, the continued “China discount” caused by geopolitical, macro, and investor doubts about Chinese stocks in general may keep valuations under pressure for longer. Qifu’s share repurchases can drive up EPS, but not lead to meaningful stock price gains if market conditions are negative. Additionally, any slowdown in China’s economy or resumption of regulatory risk will impact QFIN’s growth prospects and would weaken my bullish argument.

The Bottom Line

Despite the above risks, I think Qifu Technology’s fintech innovation of the past few quarters – AI and large language models implementation – should further strengthen the company’s competitive position in China and lead to higher net take rates eventually (comparable to those of its Western peers). While macro uncertainties and competition from banks and other fintechs remain a concern, I think Qifu’s strong cash flow and pivot toward a capital-light approach show that the company is flexible and ready to expand. The company’s strong balance sheet, enhanced asset quality, and aggressive share buyback strategy further underscore its long-term value proposition. As a result of its 140% YoY stock price return, QFIN still seems to be undervalued in comparison to the rest of the industry, boasting a very low P/E ratio and ample room for earnings growth, which is still not expected by the market consensus. For all of these reasons, I consider Qifu Technology to be a solid “Buy” for investors looking to get exposure to China’s fintech industry.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in QFIN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!