Summary:

- Qualcomm bucks the trend of a tough earnings season with a large pop post-reporting due to double-beat and upbeat guidance.

- The company’s Q2 results show growth in its handsets and automotive segments, with strong gross and operating margins.

- Analysts expect earnings to rise more than 15% this year, with continued growth through 2026.

- I am lifting my price target and I outline additional levels on the technical chart following the robust quarterly report.

JHVEPhoto

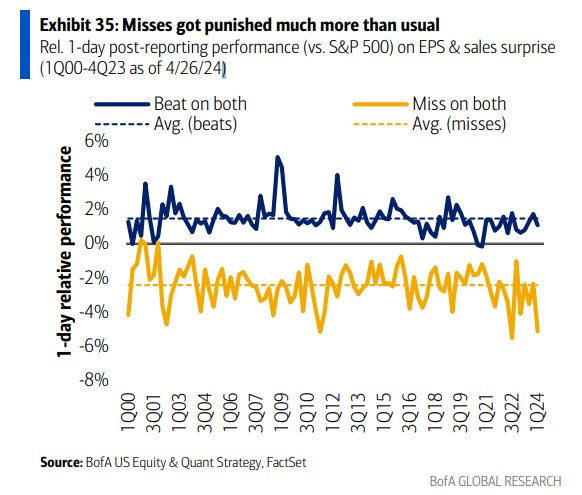

It has been a mixed bag this earnings season. Volatility has been higher than usual in some areas, particularly for firms missing on the bottom line. BofA reports that earnings misses are getting punished much more than the historical average. Companies beating estimates are not getting the usual significant bump-up either. But Qualcomm (NASDAQ:QCOM) appears to be bucking those trends with a large pop post-reporting.

I reiterate a buy rating on the Semiconductor industry stock following a double beat. Shares remain reasonably valued, while technicals continue to look bullish.

A Tough Earnings Season for Misses, Relatively Weak Reward for Beats

BofA Global Research

According to Bank of America Global Research, Qualcomm (QCOM) designs, develops, and supplies semiconductors and collects royalties on wireless handheld devices and infrastructure based on its dominant position in CDMA and other related technology patents. In addition, Qualcomm provides systems software and components to wireless handset vendors and promotes applications and services that run on high-speed wireless networks. The company operates primarily through two segments: CDMA Technologies and Technology Licensing.

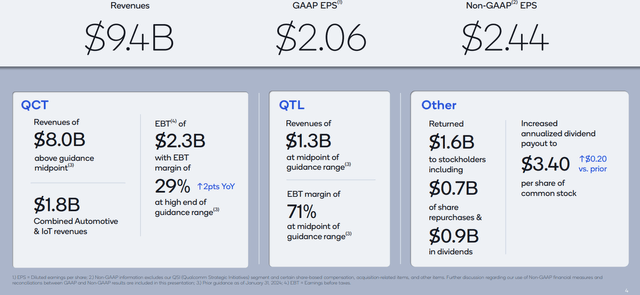

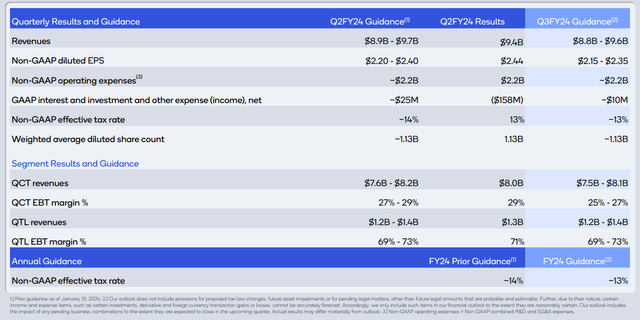

On the afternoon of May 1, Qualcomm reported a very strong Q2 2024 report. Non-GAAP EPS of $2.44 easily topped Wall Street consensus forecasts of $2.42 while revenue of $9.39 billion, up just 1.3% from year-ago levels, was a small beat. A solid Q3 guide helped lift shares 4% higher by the pre-market the following day.

The management team now sees quarterly revenue in the $8.8 billion to $9.6 billion range, versus the consensus of $9.05 billion. Operating EPS is forecast to come in between $2.15 and $2.35 for the current quarter, relative to just a $2.16 consensus estimate.

Second Quarter Fiscal 2024 Results

Qualcomm IR

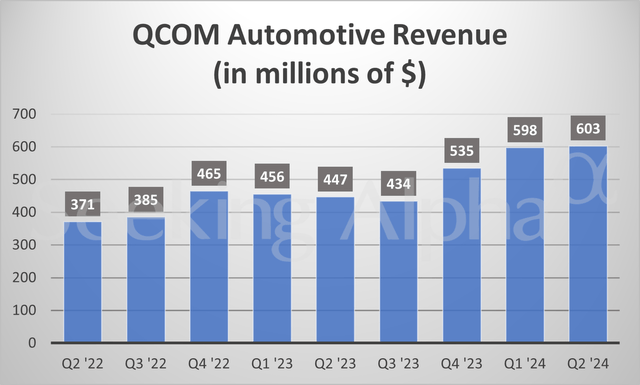

QCOM appears focused on long-term growth, and over the Q2 period, its handsets and automotive segments shined – it was the company’s third consecutive quarter of record auto revenues. QCT (semiconductors) revenue inched up 1% while QTL (licensing) rose 2.2% from the same period a year earlier.

While those are seemingly paltry bumps up, the firm’s gross and operating margins were above street estimates, helping to drive the $2.44 per-share profit figure. Management now expects 9% YoY top-line growth for Q3, with a massive 40% advance in 1H24 China handset semiconductor net sales.

Looking ahead, $2.16 of non-GAAP EPS is expected in Q3, according to the latest Seeking Alpha consensus data, though I would expect that number to increase once the sellside has time to digest the robust Q2 that was just reported.

Financial Results and Guidance

Qualcomm IR

Another Robust Auto Revenue Quarter

Seeking Alpha

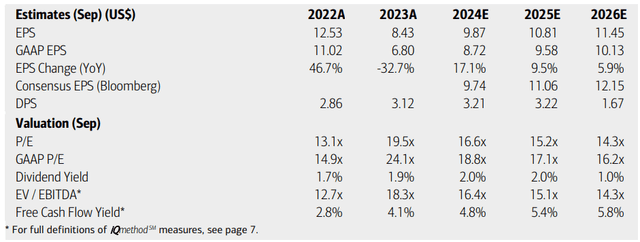

On valuation, analysts at BofA see earnings rising a strong 17% this year, with continued high-single-digit growth in the out year. Operating EPS is then expected to top $11 by 2026. The current Seeking Alpha consensus figures show 16% bottom-line growth in 2024, easing to just 8% by ‘26 while revenue growth ranges from 6% to 9%.

Dividends, meanwhile, are not seen increasing very much, but shares do carry a more than 2% yield, about 60 basis points above that of the S&P 500. With an EV/EBITDA ratio that is not far from the market’s average and with healthy free cash flow gains lately and in the forecast, shares appear at least reasonably valued.

Qualcomm: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

If we assume $10.30 of non-GAAP EPS over the coming 12 months and apply the stock’s 5-year average operating earnings multiple of 17.1, then QCOM should trade near $176. But given QCOM’s proven profitability strength and ability to grow earnings at a solid clip, I assert that a market multiple may be warranted right now. If we do that, then we are talking about a $205 stock.

So, I feel comfortable raising my intrinsic value target closer to $200 today, given the company’s execution strength and solid fundamentals.

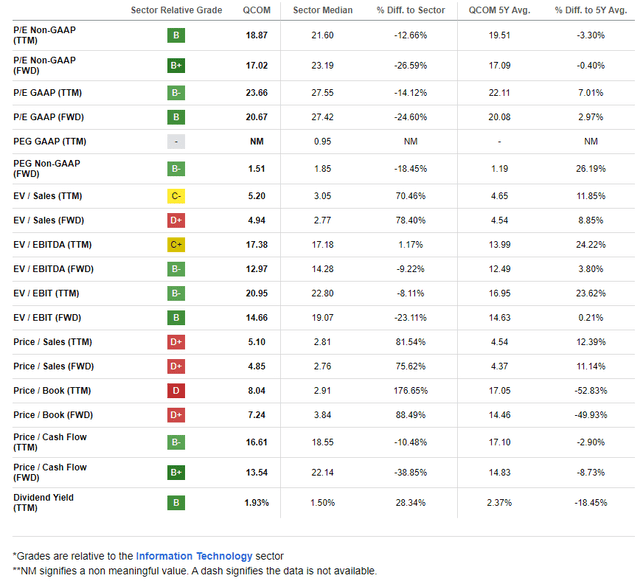

QCOM Still Somewhat Cheap on Earnings

Seeking Alpha

Compared to its peers, QCOM features a weak valuation rating, but that is largely due to its somewhat lofty price-to-sales multiple. I also take issue with the poor growth rating, as it is becoming increasingly clear that the firm is producing robust earnings and free cash flow with sustained elevated margins.

Profitability trends are indeed impressive, about the best in its industry, while share-price momentum has been stout in the past handful of months after breaking a key downtrend line – I will detail that later in the article. Lastly, EPS revisions continue to run to the upgrade side, and I see that continuing following the recent bottom-line beat.

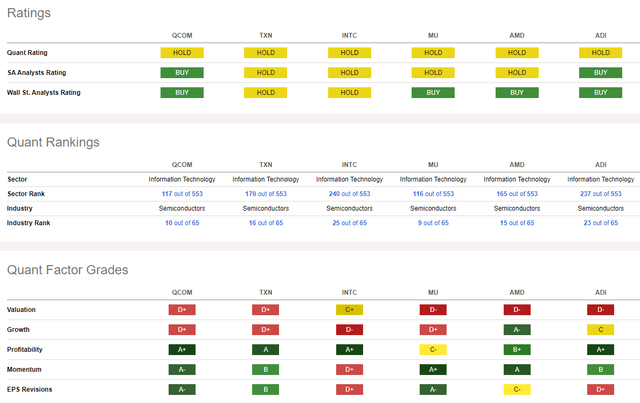

Competitor Analysis

Seeking Alpha

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2024 earnings date of Thursday, August 1. Before that, shares trade ex a $0.85 dividend on Thursday, May 30. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

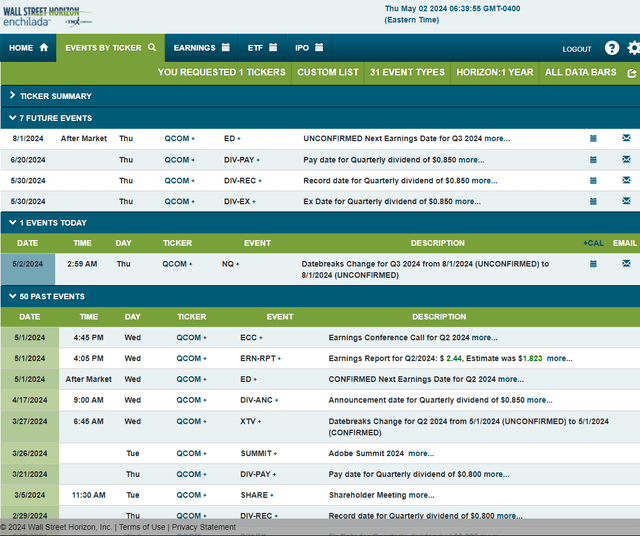

The Technical Take

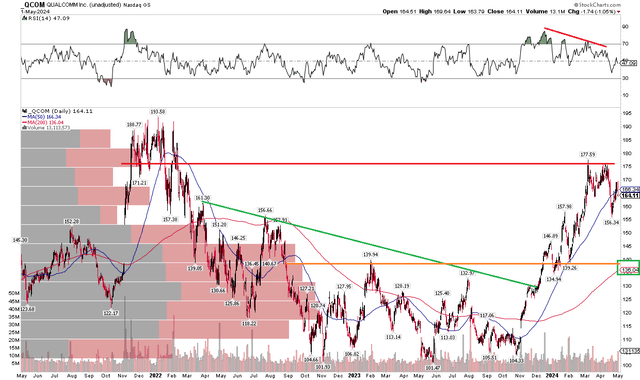

With solid earnings and an appealing valuation, QCOM’s momentum has recently been taking a breather. Notice in the chart below that the RSI momentum oscillator at the top of the graph had been on the decline dating back to December 2023. The trend lower came as price was on the increase – a notable bearish divergence. QCOM indeed topped out above $177 in March before pulling back by more than $20 to its April low, under the rising 50-day moving average. In the pre-market today, the stock trades north of $172, reclaiming the 50dma, which I like to see.

Bigger picture, the long-term 200-day moving average is way down at $136, and I see a key support line from 2023 and earlier this year. Following the bullish upside breakout from a downtrend line that began in 2022, QCOM was able to explode higher. That makes the recent price consolidation healthy in my view. The bulls will still have to contend with resistance in the mid to high $170s – an area I pointed out back in early January.

Overall, a broad uptrend is intact, and shares appear poised for further gains after retreating in March and April.

QCOM: Shares Pause at Resistance, But Momentum Could Break Higher Post-Earnings

Seeking Alpha

The Bottom Line

I reiterate a buy rating on Qualcomm. I see the tech stock as undervalued today following an impressive second-quarter report, while its technicals remain positive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.