Summary:

- Qualcomm is looking at potentially taking over Intel or buying parts of its business. I believe that if this is executed strategically, it could be highly beneficial to both parties.

- Capital raised by Intel could be used to strengthen its position in Western foundries, improving the global economic stability in relation to the balance of manufacturing power.

- Consensus estimates for Intel’s EPS and revenue growth show great improvement on the horizon for FY25. As a result, I expect we could see a 30%+ 12-month return from now.

- Over the long term, annual returns are likely to be more moderate as a result of a protracted, difficult challenge on management’s hands amid TSMC competition and current contractions.

Sergo2

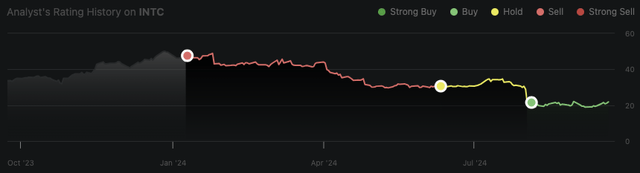

My history of rating Intel (NASDAQ:INTC) has been strong. In January 2024, I put out a Sell rating on the premises of overvaluation. The stock has lost 53.50% in price since that analysis. In June 2024, I put out a Hold rating once I considered the stock to be more reasonably valued. It was only after its poor Q2 results and reports of its foundry weakness that I issued a Buy rating on the premises of undervaluation. Since then, the investment has shown some light, with a total return of 11.80% in under two months.

Oliver Rodzianko’s Performance (Seeking Alpha)

Now, there are reports that Qualcomm (QCOM) is considering a takeover of Intel. While the outcome of this is somewhat speculative, it is worth remembering that there are only two viable options here for the continued strengthening of Western chip manufacturing interests. The first is that Intel recovers, and its 18A strategy allows it to compete with TSMC (TSM). The second is that Qualcomm, or another major chip player, does acquire Intel, and the merger capitalizes on Intel’s infrastructure to embed it in a more unified and cash-flow-positive business model. What I believe will not be allowed to happen, nor should it, is for Intel’s business to enter a long-term decline.

Recent news of Amazon’s (AMZN) partnership with Intel shows further support on the horizon. Amazon clearly has strategic interests in supporting domestic manufacturing and aligning with U.S. government policies, considering that approximately 70% of its revenue is sourced from the United States alone. AWS will benefit from Intel’s manufacturing and chip design competencies; initiatives such as Intel’s 18A process nodes should allow AWS to stay competitive in the AI and cloud computing markets.

The Low-Probability Reality of the Qualcomm Total Acquisition Offer

The first major inhibition to the effective execution of Qualcomm’s acquisition of Intel would be the significant regulatory controls. Antitrust scrutiny, which is already high across the board in big tech right now, means that the U.S. government might not approve such a deal. That being said, enough pressure from the private sector community could change this. I do not think such a merger is completely unlikely, especially considering the weakness at the moment in Western macroeconomics and the growing emergence of China.

Despite the possibility, the odds are still on the lower end. While the deal would allow Qualcomm to become a vertically integrated chip company across PC and server processors as well as mobile and communication processors, there would be several operational difficulties and likely near-term downsides related to share dilution and free cash flow contraction for Qualcomm.

Furthermore, Qualcomm is particularly interested in Intel’s PC design unit and possibly other specific business segments rather than its entire foundry business. As I explain below, I consider partial acquisitions to be the stronger strategy for both parties.

Qualcomm Buying Non-Foundry Segments From Intel Could Bolster Intel’s Moat in Manufacturing

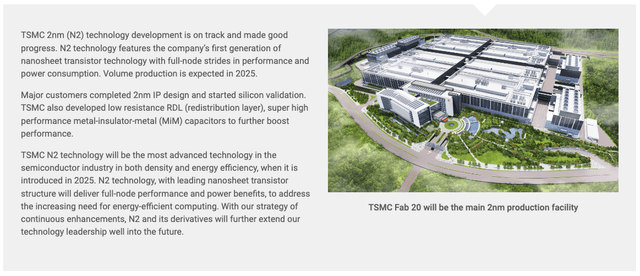

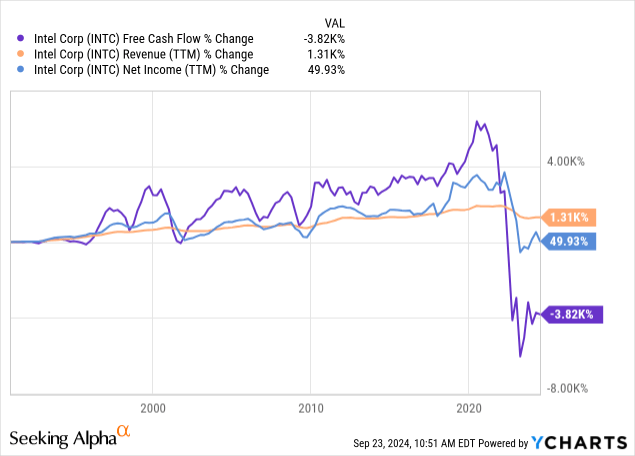

Intel’s partnership with Amazon is certainly one bullish catalyst indicating long-term sustenance, but this is unlikely to significantly strengthen Intel’s free cash flow in the near term. Instead, the company is facing technological threats from TSMC’s new 2nm technology, which is now in development. This is an indisputable threat to Intel’s 18A, which was meant to leapfrog TSMC’s technological capabilities, a strategy that now seems redundant to me.

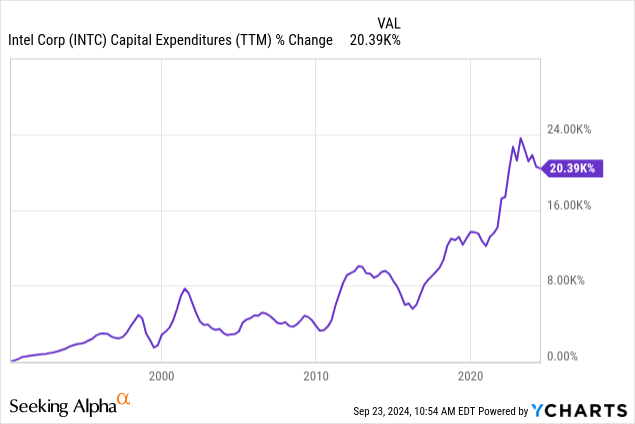

Intel is currently weak in free cash flow, and that is understandable given the significant investments it is making in its foundry infrastructure. In my opinion, the notion that Intel’s long-term manufacturing strategy is completely redundant after the recent weak financial report in Q2 is not entirely valid. The real question here is how long it will take for Intel to get a decent free cash flow return on investment from its high levels of capital expenditure over recent years.

Another consideration for Intel’s management at the moment is whether the company should continue to focus as aggressively on chip design, given competition from Nvidia (NVDA) and AMD (AMD), and instead take the riskier but perhaps stronger long-term position of focusing more intently on foundry operations to support Western manufacturing interests and a more diverse global manufacturing economy alongside the predominant force of TSMC in Taiwan. It is conceivable to me that, in this case, selling some of the design and other non-foundry related segments to Qualcomm, which reports indicate are what Qualcomm is primarily interested in, could be a strategic long-term move to raise capital for Intel to invest more heavily in a Western chip manufacturing moat. The sale of segments of its business is also likely to be more viable for Qualcomm financially and be more accretive to both parties in the near term, while also benefiting from less regulatory control and antitrust scrutiny.

Is Intel a Buy, Hold, or Sell Amid Acquisition Rumors?

I consider Intel to be undervalued right now, and while it faces weakness in growth, the stock will likely deliver a strong return over the next 12 months. The first critical element to note is that Intel is expected on consensus to deliver a YoY normalized EPS contraction of 75% in FY24 but a much more significant 357% growth in FY25. For FY26, growth estimates moderate down to 58%. Therefore, I believe there is a significant likelihood of a high near-term upside here.

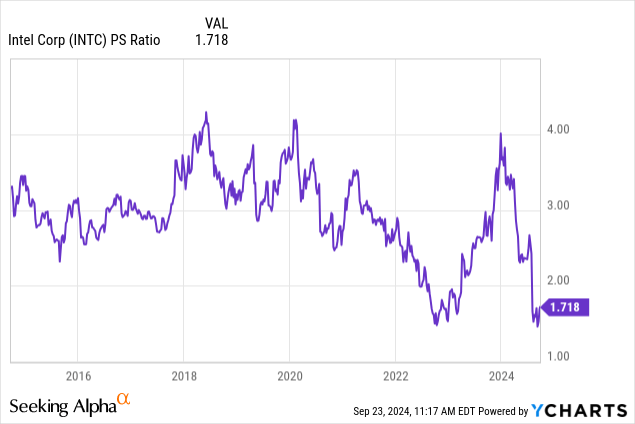

This is especially supported by the fact that the company has a P/S ratio far lower than historical levels. I believe the current low valuation and fear from the investing community about Intel’s free cash flow and growth prospects, especially related to the viability of its foundry market position, opens up a risk-on investment opportunity. This is undeniably an investment to be cautious about because much of its future success depends on management’s ability to execute from a currently hostile and vulnerable market position, and competition from TSMC is fierce and arguably unbeatable. However, with growing interest from Western governments and corporations in supporting domestic U.S. manufacturing, Intel appears to be the only viable candidate to be able to execute this at scale. Therefore, I think many more government initiatives and corporate partnerships are on the horizon to support Intel. If Intel were to sell non-foundry businesses to Qualcomm, I believe this would further support Intel’s ability to invest more heavily in developing a moat in chip manufacturing. However, as much of this outcome is speculative and dependent on management’s foresight and mindset, an allocation of less than 3% of a portfolio seems right to me as a long-term holding, with the most substantial alpha to be had in the next 12 months.

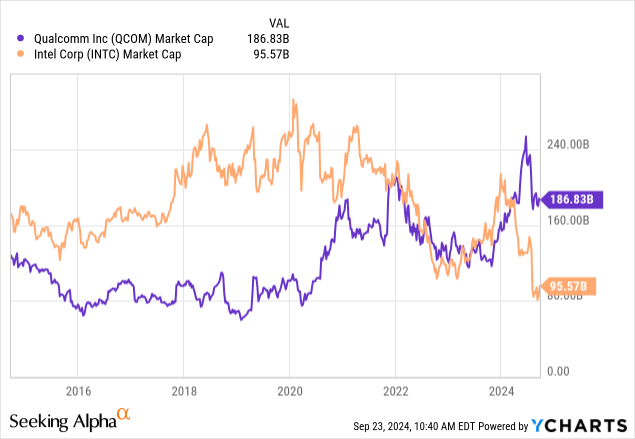

In my last analysis of Intel, I estimated that in 2025, the company’s P/S ratio could expand to 2.5. Typically, when a company is acquired, it is bought at a premium, suggesting a strong upside for investors who bought at the point of my initial Buy rating. If certain elements of Intel’s business are acquired, however, it is likely that the stock will enter a medium-term expansion in valuation multiples, primarily a result of the fact that it would have less revenue after divesting some of its core income-producing segments. The benefits to its cash position, balance sheet, and future strategic capabilities would be notable, but I would expect a short-term loss in investor sentiment, opening up a further value opportunity and arguably warranting a larger allocation for long-term prospects related to its manufacturing capabilities. As it stands, without any acquisitions proceeding, I estimate that Intel’s P/S ratio will rise to 2.25 in 2025, with revenues of $56.80 billion, as indicated on consensus by Wall Street. Therefore, in late 2025, we could be looking at a market cap of $128 billion, indicating an increase of 37% from the current market cap of $93.40 billion.

Risks Recap

- Intel could have parts of its business acquired, but this could significantly reduce the near-term revenue potential of the company and create near-term stock price declines and operational vulnerability.

- Intel could struggle long-term to continue to gain ground in its chip manufacturing position. Competitors like TSMC could continue to outperform, and Western manufacturing interests could fail to expand.

- Intel suffers from relatively weak growth and current negative market sentiment. In FY25, I expect this to improve. However, any further weak performance in quarterly reports could create stock price stagnation, even at the current low valuation.

Conclusion

In my opinion, Intel is currently a Buy. However, it remains a risky allocation because its future success largely depends on management’s foresight and ability to adapt the business to fit new operational strengths, including the necessity for the company to strategically improve its foundry segment to support Western interests. I believe Qualcomm acquiring parts of Intel’s business that are non-foundry related could act as much-needed support during this time of free cash flow weakness and operational vulnerability. The path forward for Intel is still uncertain, but given its currently incredibly low valuation, I believe there could be high near-term returns in FY25, although I expect returns to be more moderate following this.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.