Summary:

- Qualcomm holds a significant share in the global smartphone chipset market, particularly in the 5G segment, with an expected revenue growth driven by the adoption of 5G and generative AI.

- Qualcomm’s growing market share in the automotive electronics segment and diverse offerings allows it to capitalise on high future growth.

- Qualcomm’s partnership with Microsoft for on-device AI chips in PCs provides Qualcomm with substantial revenue opportunities.

JHVEPhoto

Introduction

Known for its lineup of Snapdragon processors for mobile devices, Qualcomm (NASDAQ:QCOM) also offers a diverse array of automotive and Internet of Things (IoT) products, and more recently, AI chips. Qualcomm’s semiconductor offerings fall under its QCT segment – which derives its revenue from supplying integrated circuits and system software to companies that require semiconductors, like Samsung and Dell.

R&D investments made by the QCT segment allow Qualcomm to maintain its technological edge and constantly come up with patented breakthrough technology. Qualcomm’s QTL segment then grants licenses and provides rights to use portions of the firm’s intellectual property portfolio to other companies. Qualcomm’s patent portfolio primarily consists of technologies used in mobile devices, such as 5G, RF, graphics and Wi-Fi technologies.

Investment Overview

Because of Qualcomm’s technology leadership in the fast-growing automotive and edge AI sectors, and consistent positioning in the smartphone chipset business, I firmly believe that Qualcomm will continue to grow their top and bottom line in their product segments. Therefore, I rate Qualcomm stock a ‘Buy’.

Smartphone Offerings

Qualcomm commands a large market share in the global smartphone chipsets market, accounting for around 20% of global shipments in 2023. With early investments in 5G technology, Qualcomm has also secured a dominant position in the premium 5G chipset market with a 44% share.

The expected CAGR of the total smartphone application processor (AP) market is only in the low single digits due to high smartphone saturation globally. However, the migration to newer 5G cellular devices and on-device generative AI adoption on premium smartphones may spur an upgrading cycle – something already seen in increased demand for MediaTek’s 5G chips. 5G and Gen AI present themselves as tailwinds for Qualcomm’s revenue, given QCOM’s established position supplying 5G modems to premium smartphone manufacturers; I would project Qualcomm’s smartphone chipset revenue to grow at high single digits.

Automotive Expansion

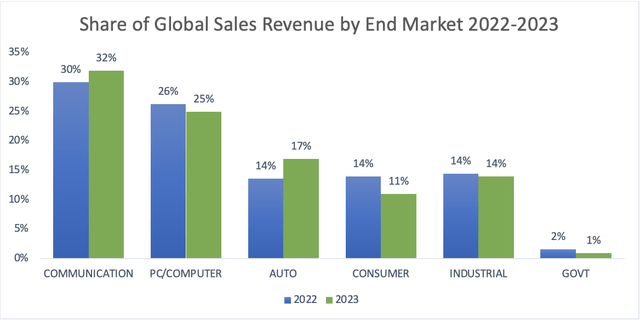

Qualcomm’s bet into the high-end automotive industry appears to be paying off as well. While the smartphone semiconductor market is nearing saturation, the booming automotive semiconductor is seeing high growth, experiencing the largest growth in share of chip sales in 2023.

Breakdown of semiconductor market (semiconductor.org)

I believe that recent trends in the automotive industry will increase the contribution of the automotive segment to Qualcomm’s overall revenue, helping QCOM achieve diversification into more stable, faster-growing sectors.

Semiconductors now take up a substantial portion of the cost of an automotive. Electronics account for nearly 35% of a new vehicle’s total cost and is likely to grow to 50% by the end of this decade, driven by trends like safety, electrification and autonomous driving. Because of this, the global automotive semiconductor market was valued at US$ 59 billion in 2023 with a steady 7% forward CAGR. The sector presents immense potential – India’s growing ADAS market and increased adoption of autonomous driving technology are all themes that could help the automotive semiconductor achieve excess returns, and with that, Qualcomm’s revenues.

Qualcomm’s automotive business has been doing better than its competitors, with its automotive solutions being better received and quicker growth. Comparing Qualcomm’s automotive portfolio to its competitors like Nvidia and Mobileye, Qualcomm’s serviceable addressable market and pipeline is significantly larger ($45 billion compared to Nvidia’s $14 billion) due to its diversified products, including chips for digital cockpit devices, infotainment, and connectivity. While competitors only offer specific solutions like ADAS and self-driving, Qualcomm’s diversified products allow it to capture a greater revenue share and more importantly, to establish stronger industry partnerships by working with car manufacturers in horizontal integration with other electronic systems in the car.

Speaking of industry partnerships, Qualcomm has also established strong industry relationships to give its products an edge over competitors. For instance, it has partnered with SalesForce to deliver a personalized user experience through data analytics, and collaborates widely with other suppliers in the automotive electronic industry to develop new products, such as Bosch and Innoviz. Over time, this gives Qualcomm both a technological edge and improves its ability to handle supply chain risks, which is crucial in dealing with exogenous disruptions in the highly vulnerable semiconductor industry. Of course, Qualcomm already supplies chips to luxury car brands like BMW and Mercedes, and it has even co-developed ADAS systems with BMW in a strategic relationship.

Shifting consumer sentiment towards ADAS features further underscores the reach that ADAS has achieved. This, combined with the trickle-down effect – where automotive technology trickles down from the luxury vehicle segment to the volume passenger vehicle market – will significantly shape the adoption of ADAS in the broader automotive market. While ADAS integration in luxury vehicles stands notably high at 53% as of 2023, penetration in mass-market vehicles remains comparatively modest, currently at 12%. The nascent market potential for ADAS features in mass-market cars represents a compelling growth opportunity for Qualcomm.

While there is certainly the potential threat of new entrants, semiconductor technologies must undergo a long qualification cycle due to regulations and the needs of the industry. This presents itself as an inherent barrier to entry for new competitors, and the longer Qualcomm is in the automotive semiconductor market, the more familiar it will be with the regulations and the constant changes.

The combined effect of all these factors gives Qualcomm a significant edge over its competitors. Looking at the current market share for automotive chips, Qualcomm dominates the market with over 80% of the market share. I am comfortable with a long-term share of 60%, and combined with a projected CAGR of the automotive chips market of 40%, Qualcomm’s automotive segment will likely see similar growth rates. The projection revenue is slightly above Qualcomm’s forecasted >$4 billion in 2026, reaching >$5 billion in 2026, but I am confident that Qualcomm’s established position in this high barrier-to-entry industry justifies this optimism.

Growth Prospects in AI

The burgeoning narrative around Qualcomm is about AI PCs. Qualcomm’s recent partnership with Microsoft to provide on-device AI chips (Snapdragon X) for Microsoft’s new Surface laptop lineup has greatly improved their growth prospects.

Qualcomm’s partnership with Microsoft (Qualcomm)

I expect revenue from the PC-related market with Qualcomm’s AI chips to only hit Qualcomm’s income statement in 2025, as expectations of sales of such “AI PCs” will only start to rise significantly over the next three years.

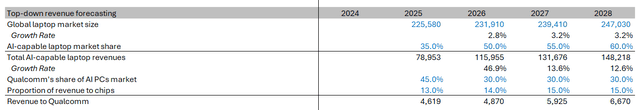

Using a top-down revenue model, I start with global laptop revenues. To project the market share of AI-capable laptops, I reference forward projections from industry; HP estimates about 50% of shipments in 2027 to be AI-capable, while IDC forecasts AI PCs capturing nearly 60% of the global PC market share in 2027. Qualcomm is estimated to own about 25% of the AI PC market by 2026 based on projections from JPMorgan Chase, however, with the premium pricing on laptops with Qualcomm products, Qualcomm may end up with a higher market share in terms of revenue. Assuming Qualcomm takes around 14% of the revenue of each laptop, I obtain Qualcomm’s AI-related revenue.

Top-down revenue model (HP, IDC, JPM)

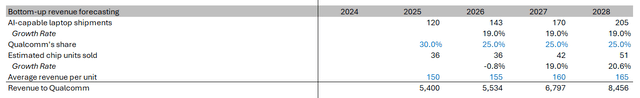

Using a bottom-up revenue forecasting model gives a similar conclusion. To forecast the volume of AI chips sold, I estimate the total quantity of AI-capable laptop shipments using market research from Canalys, which puts the quantity of shipments at more than 100 million in 2025, eventually reaching 205 million in 2028. This is corroborated by IDC’s projection of 167 million shipments in 2027. Already by Q4 2024, shipments of AI-capable PCs are expected to rise to around 20 million units, capturing over 25% of global PC shipments, which further makes me comfortable with projecting a high 120 million shipments starting in 2025 alone. With an estimated per unit cost of USD$150, I arrived at Qualcomm’s AI-related revenues.

Bottom-up revenue model (Canalys, IDC)

Taking the average of the revenue from these two models gives Qualcomm’s revenue from its AI chip offerings in laptops.

Revenue Forecasting

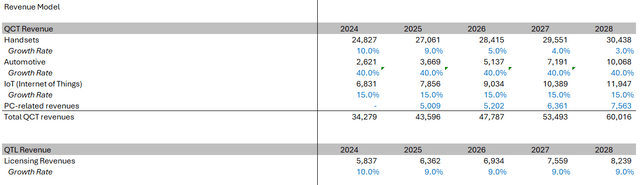

I forecasted Qualcomm’s future revenues by breaking down Qualcomm’s revenues by component.

Starting with Qualcomm’s handset revenue, I model the growth rates at single digits CAGR due to the thesis described in the above sections, and similarly for the automotive and AI PC segment. For the IoT segment, I expect Qualcomm’s revenue to grow in line with the wider market at 15% CAGR.

QTL is expected to maintain its current revenue scale and margin profile for the QTL segment. I expect QTL revenues to remain largely dependent on the performance of the overall smartphone market, as Qualcomm’s patent and IP portfolio is still largely orientated around smartphone technology. Hence I model QTL revenues to largely follow revenue growth of the smartphone segment.

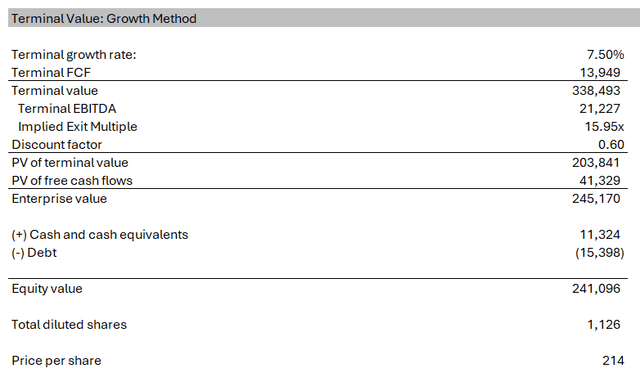

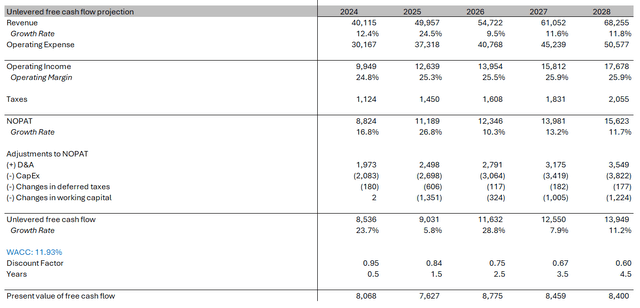

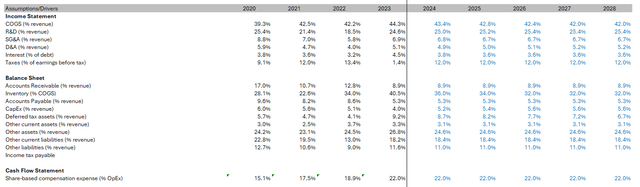

Historical operating margins for Qualcomm have been around 26%. Considering that pent-up pandemic demand drove margins to a high of 35.6% in 2022 and the smartphone market downturn in 2023 which caused a low 20% margin, I would expect a gradual return to a 26% margin, assisted by management’s cost-cutting efforts. Using a WACC of 11.93% according to GuruFocus, I discount cash flows.

Qualcomm’s discounted cash flows

Qualcomm has a high long-term growth rate of 7.5%, considering the possibility of long-term growth in the automotive market and further 6G upgrading cycles. This puts Qualcomm’s exit multiple in line with its 5Y average EV/EBITDA of 16.0x. Summing terminal value and phase 1 cash flows to get the enterprise value, I take away net debt to obtain the equity value and an implied share price of $214.

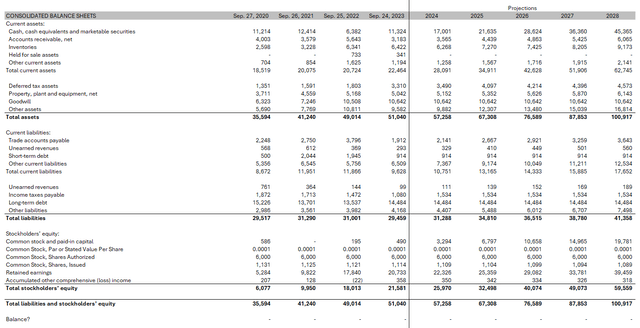

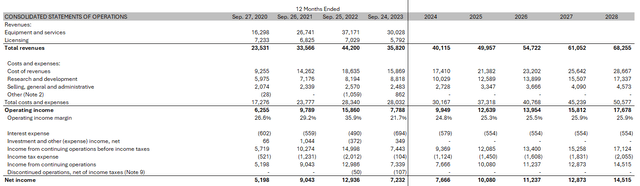

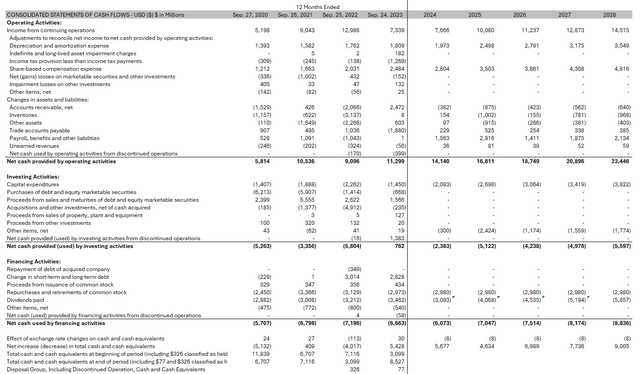

I have also included forecasts of Qualcomm’s 3 financial statements below.

Qualcomm’s balance sheet Qualcomm’s income statement Qualcomm’s statement of cash flows Assumptions/Drivers

Risks

Arm is suing Qualcomm over the right to make certain chips with its technology after Qualcomm acquired CPU company Nuvia in 2021, and with it, Nuvia’s Arm license. While it is likely that the two companies will reach a settlement before the trial, there is still a real risk that a protracted legal battle would dispute the entry of these AI laptops into the market. I would keep an eye out for any potential developments that would either reaffirm the legal viability of these products or impact the smooth sales of Microsoft’s AI laptops.

Final Words

Contrary to the opinion that Qualcomm’s business is a low-moat business, I feel that there are considerable barriers to entry in the business that Qualcomm operates in. It takes a prolonged amount of investment and considerable technology accumulation to establish a position in the highly competitive market – Huawei’s struggle to make a dent in the market share is an illustration of this, despite support from the Chinese government in its HiSilicon chips unit, and the struggles of semiconductor companies in the automotive space shows the industry know-how required to do well in automotive electronics.

I give QCOM a BUY rating with a TP of USD214 per share, pegged at ~10x P/BV, slightly lower than its 5-year median of 15.84. With the recovery in the smartphone market and Qualcomm’s strong pipeline of AI-related offerings and automotive integration, I am confident in their prospects. I believe that Qualcomm will continue to gain share in these growing markets and is reasonably valued relative to the potential for significantly higher earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.