Summary:

- QCOM’s entry into the AI chips market seems promising, with MSFT endorsing the ARM-based Snapdragon X Elite CPU chips as the “fastest, most AI-ready PC ever built.”

- This is on top of the promising “performance required for MSFT to make a big push for Windows on Arm,” while offering a direct competition to AAPL’s M3-powered MacBook.

- While AMD and INTC are set to launch competing x86 AI chips, we believe that QCOM’s exclusive partnership with MSFT on the Recall feature may eventually be a key differentiator.

- We maintain our previous conclusion that QCOM is in “a new phase of breakthrough,” thanks to its well diversified offerings across handset, automotive, broadband, AR/VR/ XR, and now, ARM-based AI CPUs.

- While we are maintaining our Buy rating, it comes with the caveat that investors wait for a moderate retracement to the May 2024 support levels of $204s for an improved margin of safety.

xxmmxx/iStock via Getty Images

We previously covered QUALCOMM (NASDAQ:NASDAQ:QCOM) in March 2024, discussing why it remained a Buy, thanks to its growing diversification across different end markets with it also being a beneficiary of the ongoing generative AI boom.

With these opportunities likely to trigger new growth opportunities, we believed that the stock continued to offer an attractive risk/ reward ratio for growth and dividend oriented investors.

Since then, QCOM has rallied by another +34.1% well outperforming the wider market at +4.4%.

Even so, we are reiterating our Buy rating, thanks to the promising launch of the Snapdragon X series in collaboration with Microsoft’s (MSFT) Copilot+, with it directly challenging multiple incumbents, such as Intel (INTC), Advanced Micro Devices (AMD), and Apple (AAPL).

With QCOM still attractively valued compared to its connectivity/ CPU peers, we believe that it continues to offer a compelling investment thesis after a moderate pullback.

QCOM’s Investment Thesis Has Gotten Even Richer, Thanks To Its Promising Snapdragon X Elite CPU

MSFT has recently launched new AI-powered personal computers with QCOM, namely Copilot+ PCs, powered by the latter’s latest ARM-based Snapdragon X Elite CPU chips.

With OpenAI’s multimodal GPT-4o model embedded on these PCs while supposedly boasting faster processing speeds and more efficient batteries than AAPL’s most advanced MacBook Air with the M3 processor, it is unsurprising that MSFT has touted these as the “fastest, most AI-ready PC ever built.”

While these claims have yet to be officially verified, with the Copilot+ PC review units only available from June 18, 2024 onwards and native ARM applications yet to be widely available, early verdicts have been rather promising indeed, with certain reviewers highlighting that QCOM’s AI laptop “absolutely holds up performance-wise” with “a marked difference in its performance and longevity.”

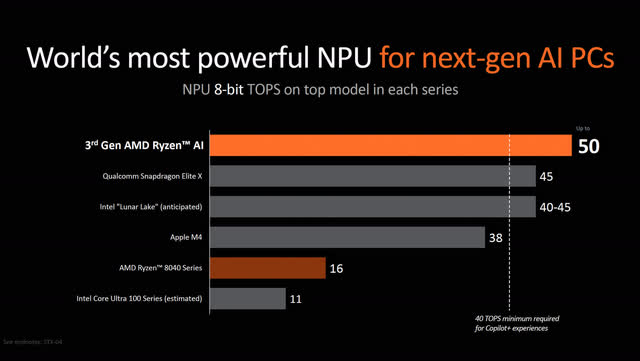

NPU TOPS Performance

AMD

On the other hand, with INTC already looking to launch competing AI CPU chipsets, namely Lunar Lake in Q3’24 and AMD – the Ryzen AI 300 chipsets in July 2024, readers may want to note that it may be a tight three horse race ahead.

For context, the Neural Processing Unit [NPU] is touted to be the key in enhancing AI performance in a PC, given that it simulates the “human brain’s neural network” in processing “large amounts of data in parallel, performing trillions of operations per second.”

For now, QCOM has reported that its Snapdragon X Elite chips will deliver 45 Tera Operations Per Second [TOPS] in processing power, compared to INTC’s Lunar Lake at 40+ TOPS and AMD’s Ryzen 300 at 50 TOPS, effectively placing the former right in the middle.

The only key differentiator may be the fact that MSFT’s Recall feature will only work on QCOM’s Snapdragon X Elite chips, with it offering users the opportunity to “internally track virtually every action done on that PC, including websites visited, communications during live meetings, presentations built, chats, etc.”

Even so, with the feature now delayed due to security issues and set to be “added in a future Windows update,” it may be hard to tell how valuable the Recall feature may eventually be.

At the same time, with price points varying across different laptop manufacturers depending on battery capacity, memory, and GPU bundling, we believe that it may be too early for reviewers to assign a price-to-performance ratio to QCOM’s Snapdragon X Elite compared to its peers, especially since Lunar Lake and Ryzen 300 have yet to be publicly released.

Nonetheless, we believe that QCOM’s attempt to diversify into the CPU market is highly commendable, especially since it opts to debut an ARM-based platform compared to the competitors’ x86 architecture.

This strategy has resulted in the Snapdragon X Elite chips potentially delivering “the performance required for MSFT to make a big push for Windows on Arm,” while offering a direct competition to AAPL’s M3-powered MacBook.

As a result, we maintain our previous conclusion that QCOM is in “a new phase of breakthrough,” thanks to its extremely well diversified offerings across the handset, automotive, fiber broadband carrier, next-gen spatial computing end markets ie: AR/VR/ XR, and now ARM-based AI CPUs.

QCOM Is Still Attractively Valued Compared To Its Peers

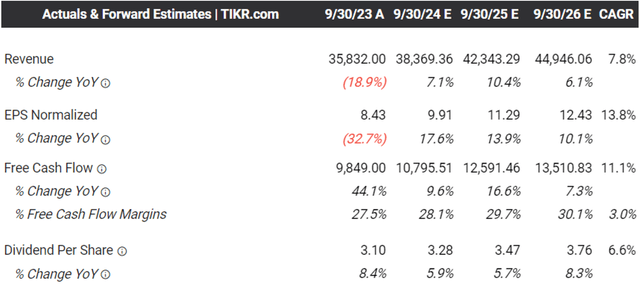

The Consensus Forward Estimates

Tikr Terminal

With QCOM also offering a highly optimistic FQ3’24 revenue guidance of $9.2B (-2% QoQ/ +9% YoY) and adj EPS of $2.25 at the midpoint (-7.7% QoQ/ +20.3% YoY), higher the original consensus estimates of $9.05B (-3.6% QoQ/ +7.2% YoY) and $2.16 (-11.4% QoQ/ +15.5% YoY), we can understand why the consensus has also raised their forward estimates.

For now, QCOM is expected to generate an accelerated top/ bottom line growth at a CAGR of +7.8%/ +13.8% through FY2026, compared to the original estimates of +5.4%/ +8.8% and the historical growth of +6.2%/ +9.6% between FY2016 and FY2023, respectively.

We believe these numbers are not overly aggressive indeed, attributed to the growing partnerships with multiple smartphone makers, such as Samsung (OTCPK:SSNLF), Asus (OTCPK:ASUUY), and XiaoMi (OTCPK:XIACF), amongst others.

This is on top of the partnership with MSFT for the Copilot+ PCs and the top 5 laptop manufacturers for the first generation of ARM-based Windows laptops, with MSFT already projecting up to 50M units of AI PCs sold in 2024 (including other AI PCs featuring INTC’s and AMD’s x86 chipsets).

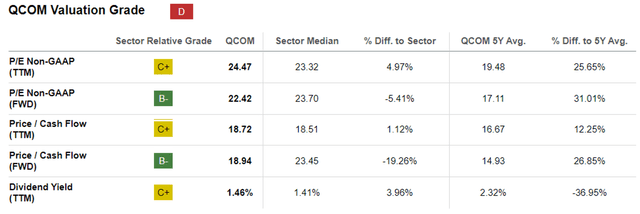

QCOM Valuations

Seeking Alpha

As a result, we believe that QCOM’s upgraded FWD P/E valuations from the previous article at FWD P/E of 17.24x to 22.42x is warranted.

This is especially since it remains relatively reasonable compared to its connectivity semiconductor peers, such as Broadcom (AVGO) 38.31x and ON Semiconductor (ON) at 17.66x, or CPU peers, such as INTC at 28.20x and AMD at 45.07x.

The same is also observed when comparing QCOM’s top/ bottom line growth projections through FY2026, to AVGO’s at +22.1%/ +17.5%, ON at +2.5%/ +4.8%, INTC at +8.2%/ +8.8%, and AMD at +19.3%/ +20.2%, implying that the former is still reasonably valued due to the accelerated growth prospects.

So, Is QCOM Stock A Buy, Sell, or Hold?

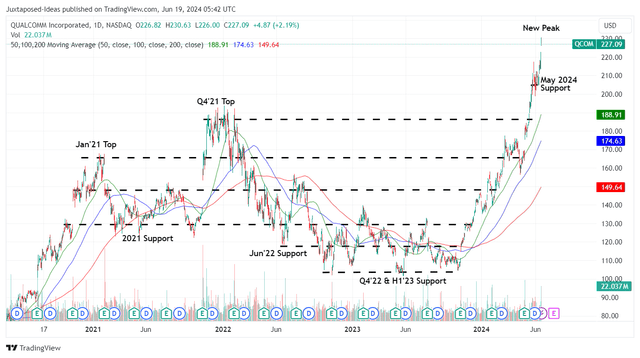

QCOM 4Y Stock Price

Trading View

For now, QCOM has already recorded an impressive recovery of +112.2% since the H1’23 bottom, while charting a new peak of $220s and running away from its 50/ 100/ 200 day moving averages at the time of writing.

For context, we had offered a fair value estimate of $151.50 in our last article, based on the LTM adj EPS of $8.79 and the undervalued FWD P/E valuation of 17.24x.

Since then, with the market rerating the QCOM stock nearer to its connectivity/ CPU peers, as discussed above, our estimated fair value has been raised to $203.50 instead, based on the LTM adj EPS of $9.08 and the upgraded FWD P/E valuations of 22.42x.

While it is apparent that the stock has pulled forward part of its upside potential, we believe that there remains an excellent upside potential of +22.6% to our raised long-term price target of $278.60. This is based on the consensus raised FY2026 adj EPS estimates of $11.30 in the previous article to $12.43 at the time of writing.

Long-term shareholders may also enjoy decent payouts as an added bonus, allowing them to regularly accumulate additional shares on a quarterly basis.

However, the readers must also note that many QCOM insiders have taken this chance to cash out their long-term stock options at these inflated levels, with $19.56M (+131.7% YoY) of insider selling already observed over the past twelve months.

As a result, while we are maintaining our Buy rating, it comes with the caveat the investors observe the stock’s movement for a little longer before adding upon a moderate pull back, preferably at its May 2024 support levels of $204s for an improved margin of safety, with those levels also nearer to our fair value estimates.

Patience may be more prudent here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, INTC, AMD, MSFT, AAPL, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.