Summary:

- Qualcomm Incorporated has a strong growth trajectory as AI-enabled devices are adopted across automotive, PCs, handhelds, and wearables.

- Despite the anticipated flat market for devices and vehicles, Qualcomm can realize significant growth as a result of additional content per device.

- Automotive may become one of Qualcomm’s biggest growth drivers as content per vehicle increases with more advanced digital cockpits and ADAS systems.

BlackJack3D/E+ via Getty Images

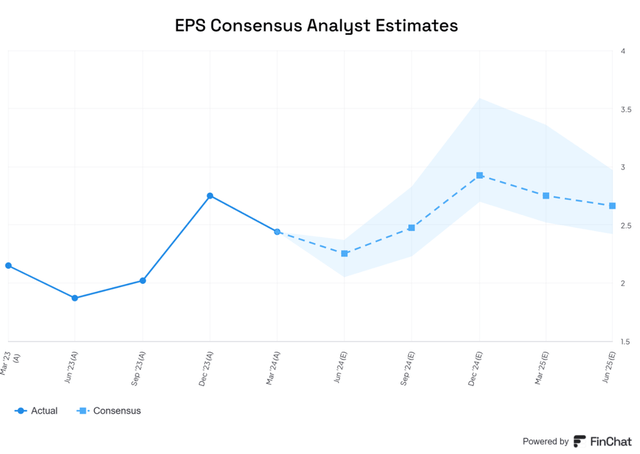

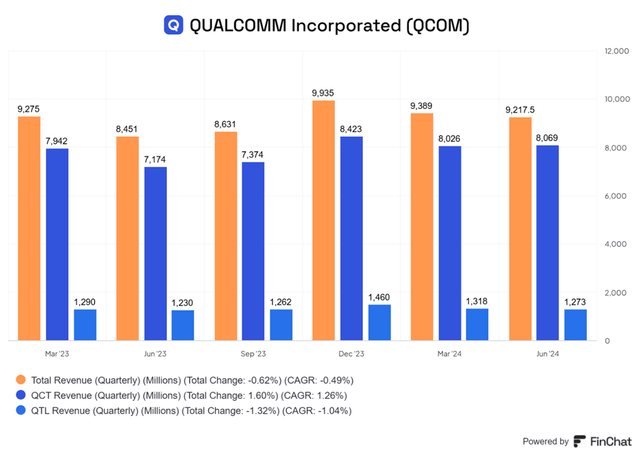

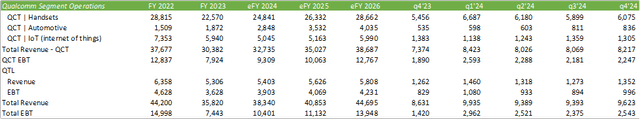

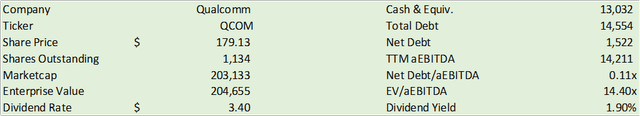

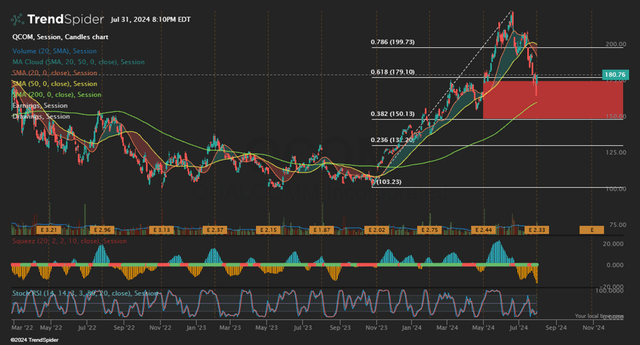

Qualcomm Incorporated (NASDAQ:QCOM) came to play in their q3’24 earnings report with EPS beating consensus estimates of $2.25 with reported adjusted EPS coming in at $2.33/share. This earnings beat is paired with a strong eq4’24 forecast of $2.45-1.65/share, with analysts estimating a range of $2.23-2.83/share. To my surprise, much of the strength in revenue for q3’24 derived from strong handset and automotive revenue in their QCT segment, growing by 87% and 12%, respectively. Given the strong eFY24 forecast and the potential growth going into eFY25, I am upgrading my rating to a BUY for QCOM shares with a price target of $202.80/share at 21.32x eFY25 price/aEarnings.

Given the current technical trends, I anticipate shares to continue their downward trend to ~$150/share before returning to growth.

Be sure to review my previous coverage of Qualcomm here:

Qualcomm May Not Experience As Strong Of An AI Wave As Competitors.

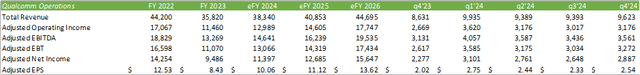

Qualcomm Operations

Working down the segments, management remains optimistic within the handset segment, as sales for premium smartphones continue to outpace the rest of the handheld market. Though management forecasts a relatively flat handheld market going forward, Qualcomm may benefit from more content per device plus more advanced chips being utilized on premium smartphones. The technology drivers are the addition of embedded AI features across premium handhelds, which is expected to drive a certain degree of growth in a relatively flat market.

Not all smartphone sales are equal. Management anticipates lower revenue from Android as Qualcomm launches their premium Snapdragon 8 Gen 3 for the devices. These chips will bring GenAI to the next wave of smartphones and further enable on-device AI capabilities. Though AI applications are relatively limited for handhelds, management anticipates an expansion of features, as did applications across the first generation of smartphone devices.

In addition to this, Qualcomm extended their licensing agreement with Apple (AAPL) through 2027. Like Android devices, Apple is introducing their series of AI-enabled devices, the iPhone 15, iPads, and MacBooks with Apple Intelligence that will be supported on iOS 18, iPadOS 18, and macOS 15 Sequoia.

The automotive segment experienced a strong improvement in q3’24 with revenue growing 87% year-over-year driven by additional content across all digital platforms on the vehicle, including the digital cockpit and ADAS. As vehicles become more digitally connected, whether ICE or EV, content per vehicle is expected to scale across sensors, the infotainment system, and telematics. Even in a flat-to-down automotive market, management anticipates this segment to grow to $4b in revenue in 2026 given the growth in content/vehicle. Looking to the duration of eFY24, management anticipates automotive to remain relatively flat.

Automotive has the ability to become a heavy hitter for Qualcomm’s growth as vehicles become more advanced, comparable to mobile handheld devices over the years. Digital experiences in the vehicle are expected to include GenAI features for personalized in-car assistance, voice control, and adaptive interfaces. In addition to this, more vehicles are connected to the cloud with real-time data transmission, as seen in Ford (F) Pro-enabled vehicles. Digital tracking features assist fleets with navigation, fuel & charging, preemptive maintenance, and roadside assistance. As of q3’24, Qualcomm added 10 new design wins to their pipeline.

Industrial IoT is expected to experience low double-digit growth going forward. Qualcomm has partnered with Aramco to develop advanced end-to-end IoT solutions for Saudi Arabia. This includes the development of industrial 4G/5G and a non-terrestrial networks ecosystem to connect intelligent edge devices.

Management is expecting AI-enabled PCs to experience strong growth in the coming years as consumers and enterprises refresh their devices with Windows 11 and Copilot, reaching 50% of computers sold in 2027. As of q3’24, 20 AI-enabled models have been launched on Qualcomm’s Snapdragon X-series platform. This on-device platform allows for users to create AI applications directly on their devices. On the wearables platform, Snapdragon XR is exceeding management’s expectations on the Meta Ray Ban smart glasses. Despite the innovative growth within the segment, IoT revenue declined by -8% in the quarter.

Looking ahead to q4’24 guidance, management forecasts total revenue to be in the range of $9.5-10.3b, up 10-19% on a year-over-year basis, and adjusted EPS between $2.45-2.65/share. This compares to analysts’ revenue range of $9-10b in revenue, with consensus coming in at $9.7b and EPS in the range of $2.33-2.83/share.

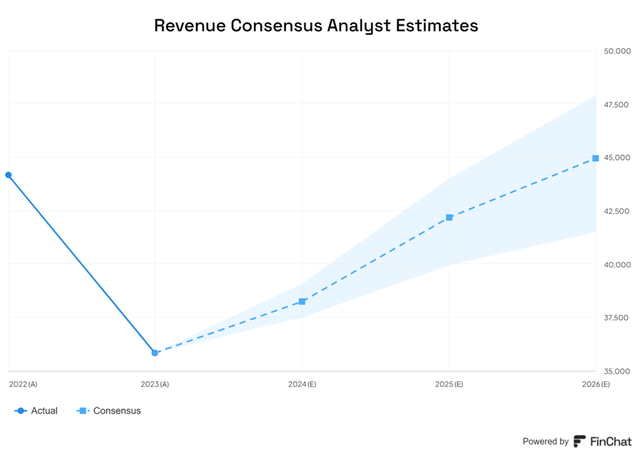

I forecast Qualcomm to generate $9.6b in revenue and adjusted EPS of $2.54/share. This will provide Qualcomm with $38.34b in revenue and adjusted EPS of $10.06/share for eFY24. I anticipate the growth drivers for the firm to remain in automotive as more content is added to the next generation of vehicles, smartphone content, and AI-PCs and advanced network communications infrastructure to support AI workloads.

Though I anticipate a challenging market for automotive, smartphones, and PCs in the coming year, I believe Qualcomm can still benefit from additional content per device as well as regional expansion. In handheld devices, management anticipates low-single-digit growth driven by AI-enabled premium-tier smartphone devices. Management also anticipates experiencing 50% growth in the Chinese market as they signed two new long-term sales agreements with China’s mobile OEMs. This growth is expected to offset the decline in business as their contract with Huawei rolls off.

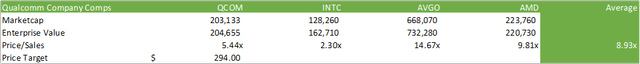

Valuation & Shareholder Value

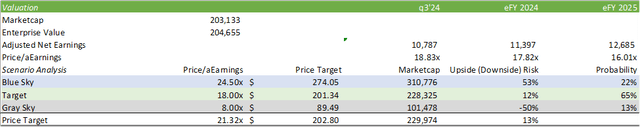

Looking at valuation, QCOM trades at a relatively lower multiple when compared to its advanced chip-designing peers. This may be the result of the firm’s limitations as it pertains to endpoint devices rather than server and networking equipment, as seen in Advanced Micro Devices’ (AMD) or Nvidia’s (NVDA) series of chips. This feature may be considered a limiting factor when considering the firm’s growth trajectory in the near-term as AI applications remain in the early stages of training, which primarily takes place within the data center. Qualcomm may see their day of higher growth as AI-enabled PCs and workstations are adopted at the enterprise level; however, I do not anticipate this stage in AI adoption to occur until late-CY25 as the macroeconomic environment remains relatively murky.

Using an internal valuation method, I believe QCOM shares can realize significant upside as the firm grows their market share across devices and automotive OEMs. Using the firm’s historical trading multiples and weighing them based on the firm’s expected growth trajectory, I value QCOM shares at $202.80/share at 21.32x eFY25 price/aEarnings and upgrade my rating to a BUY.

Looking at QCOM shares from a tactical perspective, the stock will likely continue its retracement trend in the near-term and will likely touch the $150 mark before returning to growth. I believe this sell-off will open up a strong buying opportunity for those seeking to enter into a position or average in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.