Summary:

- Qualcomm’s shares have taken a hit despite strong operating performance, mainly due to concerns over Chinese geopolitical risks and Apple’s in-house chip developments.

- The Company’s recent earnings report exceeded expectations, with strong revenue growth driven by Chinese smartphone makers and AI-enabled devices.

- The market’s bearishness on QCOM is overdone, as the company remains well-positioned in the smartphone market and has strong growth prospects, making it a strong buy opportunity.

JHVEPhoto

Investment Thesis

Despite Qualcomm’s (NASDAQ:QCOM) strong performance, as reflected in their recent earnings report, the chipmaker’s shares have taken a hit. Qualcomm, a big hit in the first half of this year as an AI play for investors, has seen their shares retreat 27.9% due to an AI picture for them that now appears less clear on the surface, but I would argue underneath is actually still quite strong.

In May, the San Diego-based company found themselves in the hot seat after the Biden administration (specifically the US Commerce Department) revoked export licenses that allowed the company to supply chips to Huawei. This is part of a broader strategy to curb China’s access to advanced chips, particularly those that could boost their domestic capabilities in sensitive sectors like telecommunications, defense and AI.

Given the selloff in the stock, I think investors appear to be heavily discounting shares to account for the loss of this export license and what that means for Qualcomm overall. What investors should realize is that the Commerce Department revoking export licenses to US chipmakers is not a new strategy and should not be priced as a particularly new risk. Qualcomm has faced the effects of a different export restriction during the Trump administration, but clearly lived to see another day. In essence, this is not an isolated incident but part of broader tensions between the U.S. and China. Qualcomm should be fine in the long run.

While the market is fretting over Qualcomm’s exposure to geopolitical risks, I believe the bearishness is overdone. The company continues to demonstrate strong results, evidenced by their 50% year-over-year revenue growth from Chinese smartphone makers in the April-June quarter, driven by increasing demand for AI-enabled smartphones.

The broader smartphone market is set for a rebound for the rest of this year, with global shipments expected to grow by 4% year-over-year to 1.21 billion units. The smartphone sales recovery is going to be largely fueled by the widespread consumer adoption of AI smartphones through new AI-enabled premium devices, which aligns well with Qualcomm’s strong share in the high-end smartphone market.

While the market might be jittery, I think the underlying business trends suggest a more positive outlook for Qualcomm. The anticipated global rebound in smartphone shipments, plus ongoing adoption of AI, should provide a solid foundation for their continued growth even if an export license is revoked to China. In my view, I think shares are still a strong buy.

Why I’m Doing Follow-Up Coverage

Much like some of my other chips stocks I recently covered, I initially didn’t plan to revisit the company so soon after my last coverage piece. However, the market’s visceral reaction to Qualcomm’s overall solid quarter and broader selloff in shares made me feel like I had to reaffirm where I stand on shares. I think the discrepancy between price action and Qualcomm’s underlying fundamentals is wide.

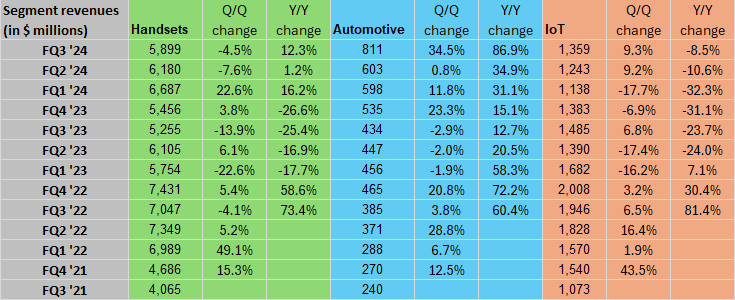

In July, Qualcomm reported fiscal 3Q results that exceeded expectations, driven by a 12% year-over-year increase in handset revenue to $5.9 billion and an 87% surge in automotive sales to a quarterly total of $811 million. Despite this strong performance, the market has really reacted to fears of US-China tensions, particularly those related to Qualcomm’s exposure to the Chinese market.

I really think these fears seem overblown, given Qualcomm’s diversified revenue streams (even within China’s other smartphone makers) and strong positioning in AI-enabled smartphones, which should allow them to push revenue growth in 2025.

Why The China Ban Doesn’t Hurt

I think first and foremost we need to point out that Qualcomm actually issued strong guidance with their recent earnings report, which directly challenges the market’s main concern that their exposure to China will hurt revenues. Despite the Department of Commerce’s retraction of Qualcomm’s export license, the company has managed to exceed expectations. Ironically, a big part of this revenue growth was driven by Chinese smartphone makers in the April-June quarter, primarily through the increased demand for AI-enabled smartphones.

Management highlighted their strong performance across their various business segments, including automotive and IoT, which contributed to the strong revision to guidance, as they dove into on their call.

CEO Cristiano Amon honed in on the robust demand across several segments, particularly highlighting revenue growth from Chinese smartphone makers that was supported by AI-enabled devices.

He remains optimistic about the company’s future:

As the industrial sector is transformed by AI, we expect an increase in demand for more complex on-device processing. This trend aligns well with our core capabilities, especially the computing and AI road map we have built for Auto and PC. As high-performance processing and intelligence at the edge becomes critical for the next phase of enterprise digital transformation, we see a unique opportunity to build a leadership position in this space.

In the next few months, we will announce our new dedicated product road map for industrial IoT and including support for multiple operating systems, ability to run multibillion parameter AI models in a comprehensive development platform. -Q3 Call.

Overall earnings performance was strong, with Qualcomm posting $9.39 billion in revenue for the quarter, up 11% year-over-year, and an EPS of $2.33, which exceeded analysts’ expectations by $0.07. Guidance came in at $9.5-10.3 billion, vs. the expectations for a midpoint of $9.70 billion. Non-GAAP EPS guidance beat as well, with the guidance range being $2.45-$2.65 vs estimates of $2.47.

It was all around a solid quarter. Again, in my opinion, is not one we should sell the news. The market did this anyway, I really think this action is misplaced here.

Qualcomm Revenue By Segment (Seeking Alpha)

Valuation

Investors have gone cold on Qualcomm. The chipmakers’ current valuation presents an opportunity. The company’s forward priced earnings (P/E) ratio, which now sits below the sector median, shows how far they’ve fallen since late June as investors have become (in my opinion) overly bearish on the stock. Qualcomm’s forward P/E ratio stands at 16.89, compared to the sector median of 23.08, a -26.82% discount to the sector median. I think at this forward P/E, the market is pricing in a lot more that’s expected to go wrong vs. right, especially given their strong EPS growth prospects over the next 12 months (estimates call for 11.95% YoY EPS growth in the year ending September 2025). If we were to see Qualcomm’s P/E ratio converge on the sector median of 23.08, it would represent roughly 36.65% upside for the stock. Not bad for a company that’s still executing, but the market is punishing shares.

Keep in mind, Qualcomm is going to more than just producing strong EPS growth. The firm’s return on common equity (ROE) shows that management excels at capital allocation, which gives me confidence in their desire to stay in China for their business despite some analysts’ concerns over the stability of their opportunity there. With an ROE of 38.92%, significantly above the sector median of 4.84%, the company continues to show their exceptional efficiency. Strong capital allocators tend to have strong decision-making skills for their firms. I think Qualcomm’s management is no different.

Risks

Outside of concerns of a Qualcomm Chinese chip ban, Apple’s decision to develop their own in-house chips represents a unique risk for Qualcomm, a company that has long been a key supplier of modem chips to the company and Apple continues to be a key part of their revenue base.

Qualcomm’s current agreements with Apple (AAPL) extend through 2026, but beyond that, the opportunity for Qualcomm becomes more opaque. Analysts believe Apple is currently around 20% of Qualcomm’s revenue.

In spite of this, I still believe that Qualcomm is well-positioned to be one of the biggest beneficiaries of the AI revolution in smartphones, offsetting most risks posed by Apple’s in-house developments. The global smartphone market is increasingly leaning towards AI-enabled devices, with features such as on-device AI processing becoming a key differentiator in premium smartphones. With Apple or without Apple, there is a big opportunity here.

Qualcomm’s Snapdragon chips, known for their AI capabilities, have catapulted the company into being a leader in on-device AI solutions. The Snapdragon platform is widely recognized for its performance and efficiency, especially in Android devices, which continue to dominate global smartphone sales by market share.

Qualcomm continues to have strong relationships with leading Android manufacturers like Samsung, Xiaomi, and Oppo. They’re doing a great job to ensure they remain an influential part of the smartphone market, even without Apple.

CEO Amon added during the earnings call:

Snapdragon XR remains the industry platform of choice, and we are engaged with major ecosystem players, including Meta, Google, Microsoft, and others. Most recently, at the Augmented World Expo will showcase 2 of the latest XR devices, NTT’s augmented reality glasses and Sony’s upcoming head-mounted mixed reality device -Q3 Call.

Along with the strong Android base, we have to keep in mind Qualcomm’s management is likely going to have some forewarning if Apple decides to phase out any use of their model chips (they just signed a contract last year until 2026).

The fact that Qualcomm recently raised their guidance tells me the company is confident in their growth prospects, despite the risks associated with Apple’s in-house developments.

Qualcomm has a strong setup, despite market fears. I think investors continue to discount that too much, meaning there is real opportunity here to play the difference between price action and the true fundamentals.

Bottom Line

Since my last coverage piece in June, Qualcomm’s stock has been seriously impacted by concerns around Chinese geopolitical risks and rumors about Apple’s in-house chip developments. In reality, when we consider the company’s strong performance in non-Apple smartphones, particularly through their Snapdragon chips, and their leadership in AI technology, I think it becomes clear these selloff fears are overdone. The company’s strong guidance and qualitative data points that demand is still holding strong in the right places makes me feel good about their plan and trajectory.

In my view, the company remains a strong buy, as the market’s current discount on their valuation really does not account for Qualcomm’s non-China growth prospects and operational strength even within China as they continue to operate there.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.