Summary:

- Media reports suggest the US government has attempted to hinder China’s semiconductor industry by denying hi-tech equipment and placing export restrictions.

- Chinese companies, such as Huawei and Unisoc, are developing their own chips to compete with Qualcomm.

- Qualcomm’s business in China includes selling mobile processors, cellular modems, connectivity solutions, and emerging technologies, but they face competition from Huawei and other domestic companies.

alexsl/iStock via Getty Images

Preamble

Many media outlets have suggested that the US government is attempting to hinder the progress of the semiconductor industry in China. In a nutshell, the US government has requested that manufactures of the hi-tech equipment necessary to produce the most advanced chips are denied to Chinese chip producers.

Furthermore, the government has placed export restrictions on companies such as Nvidia, so that they are unable to sell their most advanced technology in the country. More recently, there have been reports that the current administration may also revoke export licences for Qualcomm Incorporated (NASDAQ:QCOM) technology. Which will doubtless backfire, as Chinese companies will fill the gap created by these restrictions.

Now, the Chinese have not been sitting on their collective derrieres sucking their collective thumbs in the face of such actions. Rather, they have developed their own manufacturing technology, which I have previously covered in my article on SPY. They have also made advances in producing their own chips that compete with the likes of Intel and AMD.

There have been various announcements by the Chinese government which declare that they wish to phase out processors from Intel and AMD by the year 2027; a mere 2.5 years away. Following these proclamations, the stocks of both Intel and AMD fell quite a bit. I have previously covered these developments in my articles on Intel and AMD, so let me not rehash the contents therein.

Frankly, if I were Cristiano Amon, president and CEO of Qualcomm, I would be more than a tad concerned about these recent developments, given that more than 40% of revenues come from China. I’m sure he is anticipating reading an announcement very similar to the ones concerning Intel and AMD in the not-too-distant future. And I very much doubt such an announcement will have a positive impact on Qualcomm’s stock price.

Summary of Qualcomm’s financials

The financial performance of Qualcomm was admirable in the second quarter of 2024. The company exceeded expectations for both earnings per share and revenue. Qualcomm’s key segments, handsets and automotive, performed especially well.

Qualcomm’s profitability was strong in the quarter, with margins also ahead of estimates. The company also generated jolly good free cash flow. Which will easily support the roughly 2% dividend; not bad for a tech stock. Also, for dividend investors, the dividend is greater than the S&P average.

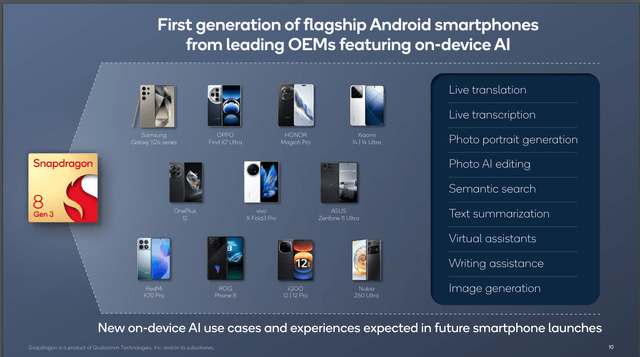

The company also discussed the numerous handsets that are using Snapdragon 8, Gen 3 chips. As you will note, many Chinese companies have incorporated these latest Qualcomm chips into their designs.

Handsets using Snapdragon 8, Gen 3 (Qualcomm quarterly report)

If I may quote from the report; “Revenues from our Chinese OEMs increased by >40% year-over-year in the first half of fiscal ‘24, reflecting our strong competitive positioning and recovery of demand.” Given the recent shenanigans, it is this revenue that is at risk.

Qualcomm’s Business In China

Qualcomm sells a wide range of wireless technology products in China, which in summary include:

Mobile Processors: Qualcomm’s most famous product, Snapdragon SoCs (System on Chips) are the brains behind many smartphones and tablets in China. These chips handle critical tasks like processing information, graphics, and cellular connectivity.

Cellular Modems: Qualcomm’s cellular modems enable smartphones and other devices to connect to mobile networks for voice calls, data transfer, and internet access. They’re essential for the “always-connected” functionality of modern devices.

Connectivity Solutions: Beyond cellular, Qualcomm offers Bluetooth and Wi-Fi technologies that allow devices to connect to each other and the internet wirelessly. This is crucial for features like music streaming, file sharing, and smart home integration.

Emerging Technologies: Qualcomm is also at the forefront of developing solutions for the next generation of connected devices. This includes chips for artificial intelligence, virtual reality (VR), and the Internet of Things (IOT) – which will see everyday objects connecting to the internet.

Qualcomm’s focus in China goes beyond just selling products. The company actively invests in research and development, collaborating with Chinese operators and non-profits to bring wireless technology advancements to underserved areas. This approach has helped solidify their position as a major player in the ever-evolving Chinese tech landscape.

Chinese Competitors

Companies such as Huawei are strong competitors to Qualcomm, particularly in China and where these companies have a presence, such as Russia and the rest of Asia.

Mobile Processors: Huawei’s Kirin SoCs directly compete with Qualcomm’s Snapdragon line. While Qualcomm might hold an edge in high-end performance, Huawei SoCs are known for being more budget-friendly and often power mid-range phones popular in China.

Cellular Modems: Similar to processors, Huawei develops its own cellular modems called Balong via their subsidiary HiSilicon These modems are integrated into Huawei phones, reducing dependence on Qualcomm. Additionally, Huawei is a major supplier of 5G technology, a crucial battleground for both companies. Indeed, there was a moment in time when Apple considered using 5G Balong chipsets.

Others: Chinese companies go beyond replicating Qualcomm’s products. Unisoc, for example, focuses on low-cost chips for budget phones, catering to a different market segment. This fragmentation creates a competitive landscape where companies specialize and cater to specific price points.

Unisoc

Unisoc is a Chinese fabless semiconductor company headquartered in Shanghai. They design chips specifically for mobile devices, but not necessarily the high-end ones you might associate with Qualcomm.

Focus on affordability: Unisoc primarily designs chipsets for budget-friendly smartphones, tablets, and wearables. Their chips may not be the fastest, but they prioritize keeping costs low for manufacturers, which translates to lower prices for consumers.

Market reach: Unisoc’s chips are used by a surprising number of companies, including some big names like Samsung, Motorola, and ZTE. You’ll likely find Unisoc chips in more affordable phone models from these brands.

5G capabilities: While they started with simpler technologies, Unisoc is now venturing into 5G chip development. Their 5G offerings aim to make 5G connectivity accessible in more affordable devices, potentially eating Qualcomm’s lunch.

Innovation beyond phones: Unisoc isn’t limited to just smartphones. They’re also designing chips for other applications like smart home devices, smart wearables, and even finance and logistics applications and IoT. The company also has an AIoT platform, which is likely to compete head on with Qualcomm. Let us not forget that some of Qualcomm’s research into AI takes place in China, and the company continues to fight for local talent.

Catching up and surpassing: While Unisoc caters to a different market segment currently, they surely have ambitions to move up the value chain. Strong R&D can help them bridge the gap with Qualcomm in terms of performance and features, allowing them to compete for higher-end phone contracts.

Huawei

US actions were meant to slow companies such as Huawei. The plan hasn’t worked. Huawei’s latest flagship phone uses a Chinese-made processor although, it still relies on a few Western components. Also, the Pura 70 is not a cheap phone, the retail cost is around $1,300 similar to the price of a new Apple phone.

A recent Reuters article reported on a breakdown of the components that make up the Pura 70 and below is a summary. While not featuring the latest Qualcomm chip, it demonstrates China’s progress in chip development.

Processor: The Pura 70 uses an improved version of the chip found in the Mate 60. It’s made by a Chinese company (SMIC) using a fairly recent manufacturing process.

Memory: The RAM chip comes from South Korea, but the storage chip is different. Huawei likely made it themselves and it holds a massive amount of data (1 terabyte!). This chip is impressive and competes with similar products from foreign companies.

Other Chinese parts: Huawei designed several other key parts for the Pura 70, like the Wi-Fi and Bluetooth pieces. Some other parts, like sound and camera flash components, come from other Chinese companies.

Western parts: The phone still uses some foreign parts, like the battery charger from Taiwan and a sensor from Germany. Experts are surprised Huawei didn’t use a similar sensor from China since they’re likely available.

Geekbench results indicate a performance improvement of just under 10% for the chipset, but it still lags behind by over 30% compared to a Snapdragon 8 Gen 3, as seen in the latest Android flagships.

Harmony

In a further move away from Western technology, the operating system for Huawei phones is called Harmony OS. The Huawei operating system offers some unique features. It boasts a seamless user experience across devices, allowing users to control various gadgets, such as vacuum cleaners, from a phone.

However, Harmony OS is still a young contender in the mobile OS market and App availability is limited, although Huawei do have an equivalent in its Huawei App Gallery.

Fortunately, Harmony is compatible with Qualcomm chips.

Slumping Sales Of Western Brands

In January, Reuters has reported that Apple was facing sluggish sales in China, and so they took the unexpected step of discounting iPhones. Apple is facing pressure to buoy up sales. This was the first time Apple had discounted iPhones in China in years, and it comes after they didn’t raise prices for the new models as expected.

The drop in sales is likely reflects growing competition from domestic phone makers like Huawei and Xiaomi. Analysts forecast a slight drop in China due to competition and consumer hesitation to upgrade.

Given that Qualcomm’s chips are found in Apple, it’s reasonable to expect a corresponding decline in orders from Apple.

On The Other Hand

Qualcomm could expand business in alternative markets, such as AIoT, to compensate for any lost revenues in China.

Summary

Overall, the US-China tech war and the rise of domestic competitors create a challenging environment for Qualcomm in China. Their future success hinges on navigating these complexities and adapting to the evolving market.

It seems to me that China will, at some stage, insist indigenous corporations sever links completely with Western chip manufacturers, including Qualcomm. When this happens, there will most likely be a slide in Qualcomm’s share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.