Summary:

- Qualcomm remains a strong semiconductor investment, replacing Intel with a conservative IT play due to its high free cash flow, dividend growth, and significant share buybacks.

- Despite a recent dip, Qualcomm’s Q4 earnings beat expectations with an EPS of $2.69 and revenue of $10.24B.

- Qualcomm’s Magic Formula score of 30.9, though lower than 2023, still indicates strong returns on invested capital and earnings yield.

- With fair value at $216/share using an owner-earnings discount, Qualcomm is selling at a 26% discount, making it a buy with continued dividend growth and a pristine balance sheet.

AutumnSkyPhotography

The replacement for Intel in a portfolio

It’s been a while since I updated my opinion on Qualcomm (QCOM). The last article I wrote on the company was in July of 2023. My argument at the time was it being mispriced in a cyclical downturn and was still trading at an attractive earnings yield and a high return on invested capital.

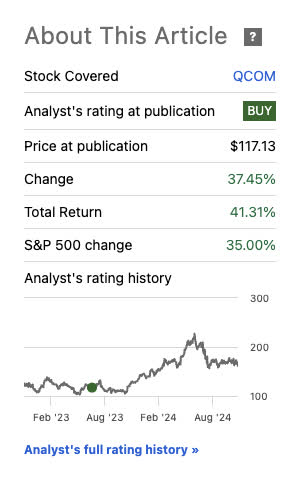

Qualcomm had also gone on to reduce its shares outstanding by 34% in the decade prior to 2023 and now has 20 years of dividend growth to boot. The total return on the stock since that article was published has beaten the market up to this point:

Seeking Alpha

My additional argument for buying Qualcomm as your lead US chip company to replace Intel in your portfolio was that they were still generating lots of free cash flow. At the time [2023], Intel was going into negative free cash flow [where they still remain]. Intel was at one time looked at as a steady and reliable dividend play. That is the case no longer with the mountain of CAPEX that they have taken on trying to build out US semiconductor FABs.

Qualcomm also has a China problem, like many other semiconductor companies do. With 46% of total revenue coming out of the country, this is a risk I’d like to examine that seems more prescient with the incoming administration.

The stock has come back down to earth a bit, which is good news for investors. The market didn’t seem to like both a possible acquisition of Intel (INTC) on the table [probably impossible, but we’ll see] and a seemingly slowing of demand for Apple (AAPL) iPhones. Part of Apple’s demand issue might be the lack of features that would entice an upgrade. Qualcomm is luckily on all fences working with Samsung, LG, and a few other Chinese makers running Android in addition to a deal in place with Apple through 2026.

First things first, let’s compare and measure the data from 2023 and 2024 to see if this is still a buy.

Year to data performance

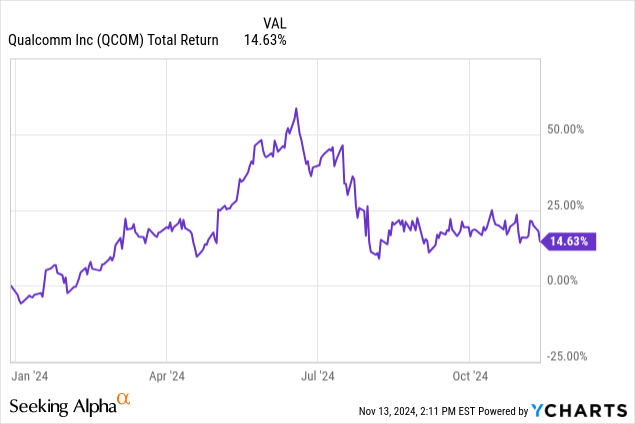

On a total return basis, the stock is still in the positive year to date. It was really soaring in the summer time and has since settled below what the market (SP500) is returning so far this year.

Revenue exposure post Q4 print

Q4 2024 :

EPS of $2.69 beats by $0.12 | Revenue of $10.24B (18.22% Y/Y) beats by $309.46M.

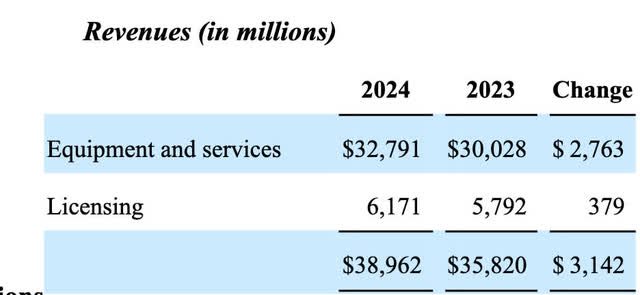

All numbers in millions courtesy of Qualcomm most recent 10K filing:

| QCT revenue segment | revenue | percent of total |

| Handsets | 6100 | 70.12% |

| Automotive | 899 | 10.3% |

| IoT [internet of things] | 1700 | 19.54% |

| total | 8699 |

| Year-over-year growth | growth |

| Handsets | 10% |

| Automotive | 55% |

| IoT [internet of things] | -9% |

How Qualcomm reports revenues:

Revenues. We disaggregate our revenues by segment [Note 6], by products and services [as presented on our condensed consolidated statement of operations], and for our QCT [Qualcomm CDMA Technologies] segment, by revenue stream, which is based on the industry and application in which our products are sold. In certain cases, the determination of QCT revenues by industry and application requires the use of certain assumptions. Substantially all of QCT’s revenues consist of equipment revenues that are recognized at a point in time, and substantially all of QTL’s.

[Qualcomm Technology Licensing] revenues represent licensing revenues that are recognized over time and are principally from royalties generated through our licensees’ sales of mobile handsets.

The largest and most substantial part of the Qualcomm revenue stream is in the QCT segment, making up about 85% of total revenue.

Qualcomm 10K

Here we can see clearly that Qualcomm is a semiconductor equipment and services play, growing that segment at a blended top-line average of 9.2% year over year. Within that segment, handsets make up 73.1% of the total. Qualcomm, for the most part, is a play on handset [cell phone] processors first and foremost and a bet on Android devices versus Apple IOS. While Apple still intends to use Qualcomm chips through 2026, they are also the most aggressive in taking the endeavor in-house.

Measuring the earnings

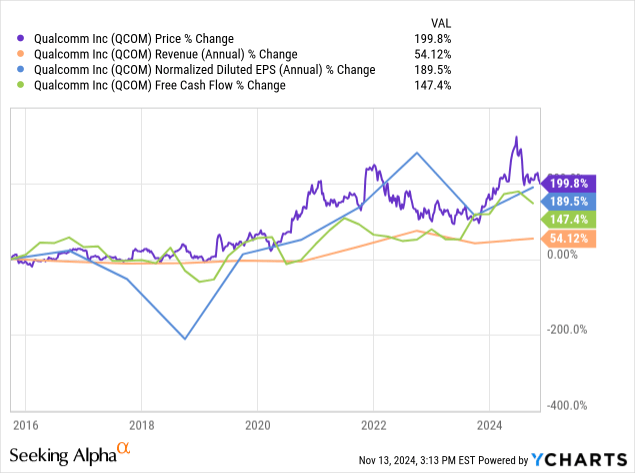

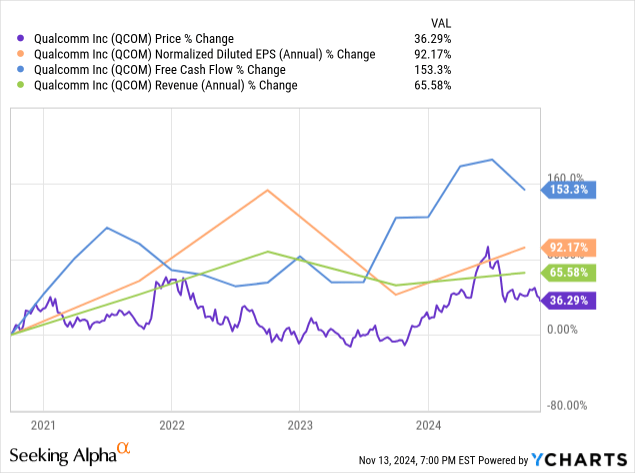

On a ten-year basis, all profitability metrics are now at lower growth rates than share price. Back in late 2022 and early 2023, the share price dipped below 10-year EPS growth, which was a bullish signal. Although the gap between most of these profitability metrics is not huge, we will have to incorporate some more near term growth rate visualizations to see if this is still a buy.

Nearer term 5-year data:

With the above chart, I am being mindful that growth rates for Qualcomm have picked up a lot recently [last 5 years] versus the last 10 years. This is a company that was not doing well at one time and was almost taken over by Broadcom (AVGO) in 2018. If we look at the 5-year growth rates versus price, Qualcomm’s price action has actually lagged the growth in profitability. A good signal.

Although free cash flow growth has dipped down a bit, as has basic EPS [not normalized], we can hopefully expect a return to free cash flow growth with analyst expectations for increases in GAAP net earnings for full year 2025 and full year 2026.

Magic formula score 2023 vs 2024

The Magic formula is a great indicator for highly cyclical stocks like semiconductors, as return on invested capital [ROIC] is a big component of the score. This scoring system, popularized by Joel Greenblatt, adds together the earnings yield [using EBIT/EV] plus the ROIC. The higher the score the better, with earnings yield representing the “cheapness” of a stock and ROIC representing the quality of management [getting the best returns on capital].

In 2023, I estimated that Qualcomm had a score of 37.4. This comprised a 9% earnings yield and a 28.4% ROIC. I’ll run the same calculations today to see where we stand. First, I’ll start with ROIC:

NOPAT (net operating income after taxes)/total LT + ST borrowings + total equity, aka “invested capital”.

- NOPAT = TTM EBIT of 10,253 X (1-2.2%)= 10,027

- Short-term debt= 4,196

- Long-term debt = 13,270

- Total equity capital= 26,274

- Total invested capital= 43,740

- NOPAT (10,027)/Invested capital (43,740)= 22.9% ROIC

Next we’ll look at the earnings yield, which by definition here we are using EBIT/EV [the inverse of EV/EBIT to produce a yield]. With a current FWD EV/EBIT of 12.56 X, this equates to an earnings yield of 8% [7.96% to be exact] by inverting this multiple [1/12.56].

The total score today is 8+22.9= 30.9.

This is still a great score but 7.4 points lower than 2023with lower returns on capital and lower net operating income after taxes. The score was propped up a bit by some debt pay down.

I noted in the last article that these cyclical companies are well evaluated by looking at their earnings yield and ROIC to see both at what point they are in the cycle [falling or rising] and to see if they are cheap enough on an earnings yield basis to make up for falling returns on capital if that is the case. Magic Formula scores of 20 or higher are generally considered good, but a falling score trend year over year is still worth taking note of.

Valuation

While this is in a “growth” area of the market, Qualcomm itself is not a growth stock, but they have grown EPS on a 5-year basis. If we take into consideration full-year 2024 EPS of $10.2 a share, 2021 to 2024 would have the following compounded annual growth rate [CAGR]:

| Start year | End year | ||

| 2021 | 2024 | 5 Year CAGR | |

| EPS | $8 | $10.20 | 4.97% |

So we can take PEG ratio analysis out of the equation. This is more of a dividend-paying, steady Stalwart than a fast-growing NVIDIA-like company at this time. Yes, on a year-over-year basis [2023 to 2024] EPS is up 21%, but this is simply getting back in line with the high top cycle EPS numbers of 2022 where Qualcomm printed $11.52/share in EPS. This is an example of cyclicality, long-term growth is expected, but it comes in waves up and down.

Using an owner-earnings discount is more appropriate. In this case, we will discount “owner earnings” [defined as TTM net income + depreciation and amortization – TTM CAPEX] by the risk-free rate of return [10-year Treasury rate]. Since Qualcomm has earnings growth expectations for the next two years, a purchase of a stock with an earnings yield higher than the risk-free rate after CAPEX requirements plus growth in the future pipeline is a better deal than the risk-free alternative:

All numbers in millions of USD

- TTM Net Income: 10,142

- TTM Depreciation and Amortization: 1,706

- TTM CAPEX: 1,041

- Equals “owner earnings” of: [[10,142+1706]-1,041]= 10,807

- Discounted by risk-free rate [4.45%] : $240,155 fair market cap

- Per-share fair price: $240,155/1111= $216/share fair value

- Selling at a 26% discount to fair value

Typically, we would like an entry point with a discount of 20% to fair value using this metric. Qualcomm still fits in this parameter. Let’s compare this to Wall St. estimates:

Seeking Alpha

Here we can see that my estimate of $216 sits right in the middle of Wall St. estimates. If we discount this amount by 20%, we’d get to $172.8/share. That is my low end and the point at which I would downgrade Qualcomm from a buy to a hold once it crosses this price. Looks like this pull back gives us another buying opportunity.

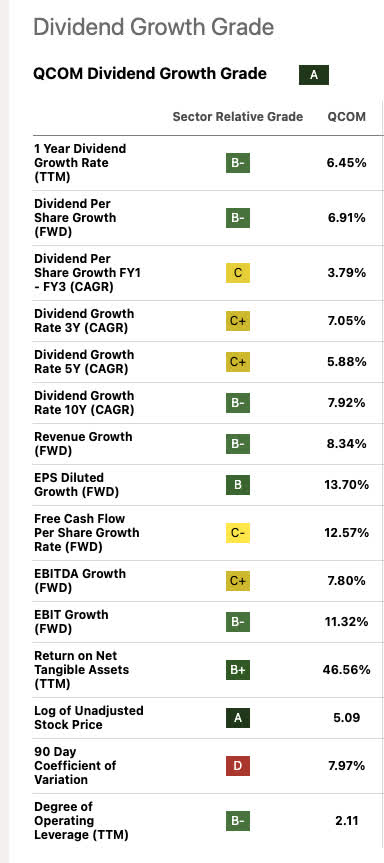

Dividend yield 2023 vs 2024

- July 2023 FWD dividend [$3.2]: 2.72% with a 28.28% payout ratio.

- November 2024 FWD dividend [$3.4]: 2.08% with a 32.32% payout ratio.

Good to see that we have continued dividend growth, with a 1 year growth rate of 6.45% and a 10-year growth rate of 7.92%.

Again, a worse deal than 2023, but not bad for the IT sector.

Seeking Alpha

Growth catalysts

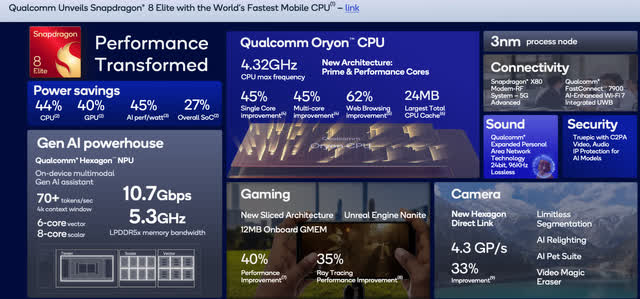

Qualcomm 2024 Annual Presentation

First and foremost, this is a cell phone chipset play. Qualcomm has the highest revenue exposure to this segment. Qualcomm now claims that the Snapdragon 8 Elite is the world’s fastest mobile CPU. With R&D spending seemingly paying off here, these new rates of speed and power saving can hopefully keep Apple at the table longer than 2026. With Siri and other questionably “intelligent” aspects of the iPhone lacking, they may want to reconsider trying to do in-house everything. Sometimes you just can’t be the “ruler of all” in your world, it’s good to cooperate.

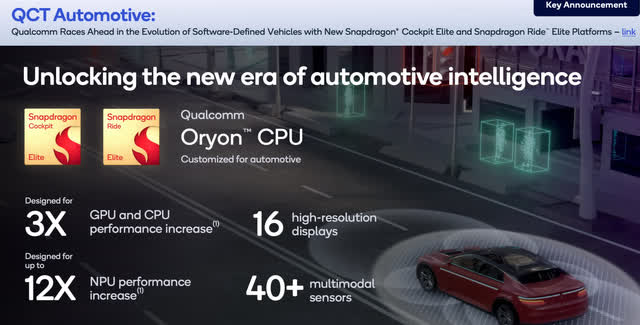

Qualcomm 2024 Annual Presentation

Automotive is the highest growth rate segment for Qualcomm’s earnings and revenue. Qualcomm is the largest automotive chipmaker, and this is a segment that should only skyrocket as more and more ADAS [Advanced Driver Assistance System] systems come to market in conjunction with autonomous driving systems. It is no coincidence that this is the highest growth segment. Cars are the new smart device. I am personally very bullish on this aspect of Qualcomm.

Qualcomm 2024 Annual Presentation

Finally, we come to the one shrinking segment year over year, IoT. This is also the second-largest revenue segment. Although this area is not Qualcomm’s strong point, more and more on-shoring expected in this second Trump administration could see an increase in demand for industrial chip applications.

A “shot gun” wedding in bound?

The Intel conundrum should continue to swirl. A more favorable FTC should allow for more mergers. However, this may also require China regulatory approval:

The merger of the two tech giants would inevitably attract significant scrutiny from antitrust regulators globally, which includes China, as it is a crucial market for both, Bloomberg suggests. Therefore, it is understood that Qualcomm informally consulted with antitrust regulators in China to assess their position on any possible deal in September, though no response has been received, according to the report.

President-elect Trump is a deal-maker. He may have to personally make a deal with China if he believes this is in the best interest of the country. This could be a critical step to secure the US Chip supply chain and hedge bets against future uncertainty over Taiwan. I would have brushed this one-off if Harris had won, but now anything is on the table in my opinion. Intel needs a capable operator and their current management seems to be flailing. Intel is a US national security interest along the same lines as Boeing (BA).

Balance sheet checkup

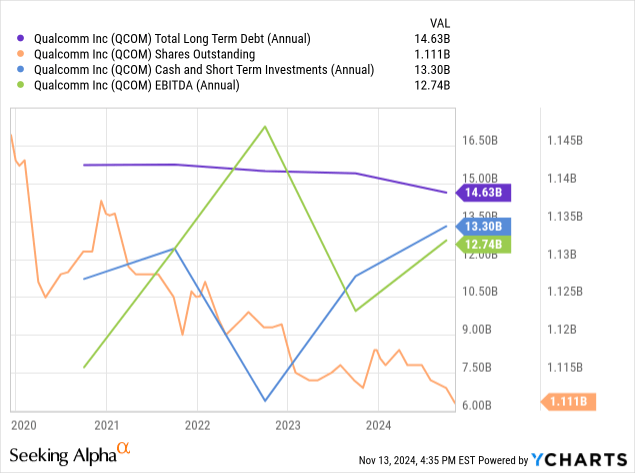

Qualcomm still has a beautiful balance sheet, as it did in 2023. Cash and short-term investments almost equal to long-term debt. Long-term debt is only 1.14 X EBITDA. Shares outstanding are down and to the right.

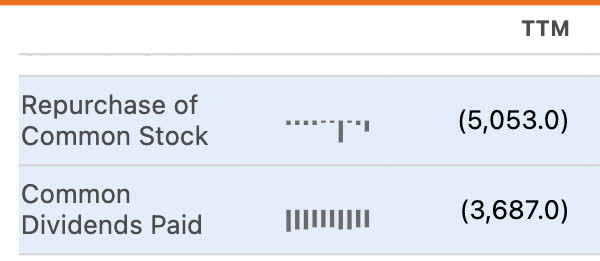

Seeking Alpha

On a TTM basis, Qualcomm has now returned $8.74 Billion to shareholders in a combination of share repurchases and dividends. This equates to $7.86 a share, or a shareholder yield of 4.9% for both the dividend yield and buybacks over the TTM. If we want to take debt pay-down into consideration, the yield is even better.

Risks and summary

Qualcomm, like NVIDIA, has a China problem. While Qualcomm’s chip applications seem like a safer item to not be restricted since most chips are used for phones and vehicles versus having possible weapons applications, they are still reliant on China. With 46% of revenue coming from the country with a lot of important handset makers.

As per Reuters on the most recent November earnings call:

The company shot down a question on a post-earnings call on whether the surge in China sales were prompted by concerns over possible tariffs that could be put in place by Donald Trump, who was re-elected as U.S. president on Tuesday.

This is the biggest issue surrounding a lot of the semi-industry. The company also relies on several foreign FABs to produce their chips. All of these are risks that are incalculable.

The stock still looks undervalued to me after this pullback. On a 5-year basis, profitability growth is markedly higher than share price growth. The stock still has a Magic Formula score above 30, a dividend yield over 2% with a low payout ratio, a pristine balance sheet, and trades under fair value on an owner-earnings discount basis. Automotive systems are my favorite catalyst,

and the Snap Dragon 8 looks to be the most advanced handset chip in the world. Qualcomm is still a buy, not as strong as 2023, but a buy nonetheless.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, AAPL, INTC, BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.