Summary:

- Qualcomm’s stock got hit due to a license dispute with Arm Holdings.

- The dispute centers on Qualcomm’s acquisition of Nuvia and differing royalty rates, with Qualcomm potentially facing higher fees under a new agreement.

- The financial impact is likely limited; Qualcomm can absorb higher royalty rates and pass costs to customers, maintaining strong earnings and margins.

- The stock trades at just 15x FY25 EPS estimates with AI PC and automotive opportunities outweighing the license dispute risks.

sdecoret

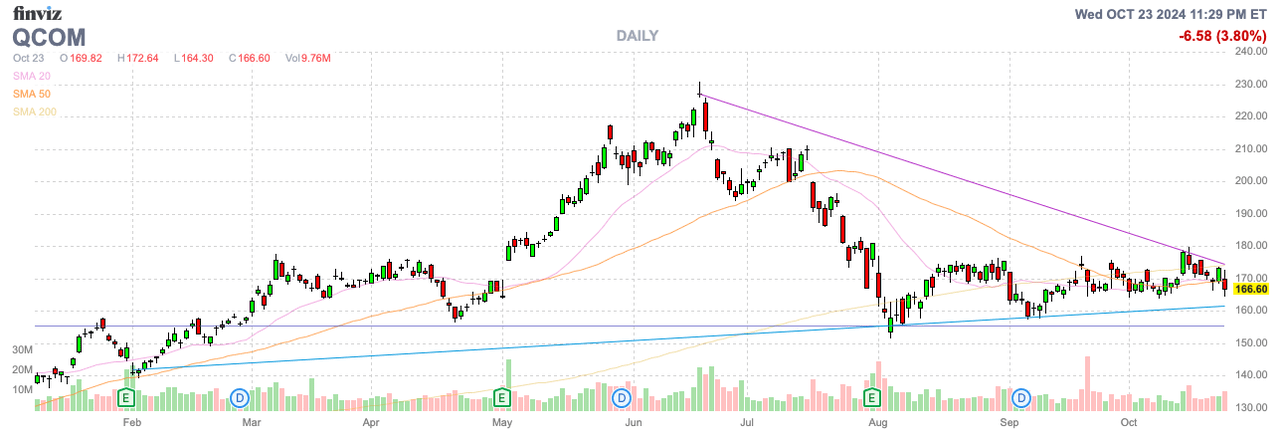

Qualcomm Inc. (NASDAQ:QCOM) slumped following news of an ongoing license dispute with Arm Holdings plc (ARM). Considering the impacts to both companies, the dispute is likely to be resolved making the biggest issue whether Qualcomm will have to pay a higher royalty rate. My investment thesis remains Bullish on the stock with a huge AI opportunity ahead and a cheap valuation for a chip stock.

Source: Finviz

License Dispute

To start the week, Arm announced a mandated 60-day cancellation notice to Qualcomm of the Architectural License Agreement, or ALA, to use the intellectual technology from Arm. The big license dispute started with Qualcomm buying CPU data center chip company Nuvia all the way back in 2021.

Both companies had a license deal with Arm Holdings to utilize the technology to make chips, but the agreements have different royalty rates based on the technology utilized. Qualcomm holds ALA with a substantially lower royalty rate due to the company customizing Arm technology. Nuvia apparently has a Technology License Agreement, or TLA, which uses more off the shelf chip technology.

Arm Holdings apparently cancelled the Nuvia license deal in 2022 and requested any related chips were destroyed. The issue hasn’t really garnered much attention until Qualcomm now has major plans to utilize Oryon chips from Nuvia for both AI PCs and within Snapdragon 8 Elite SoC marking the first entry of Nuvia technology into a mobile phone chipset.

Qualcomm claims the company had the right to roll the Nuvia business into the Qualcomm license. Arm disagrees and gave Qualcomm a 60-day notice to quit using the license despite an upcoming court date in December.

Apparently, Qualcomm is Arm Holdings’ largest customer relying on the chip technology for Snapdragon chips utilized in smartphones. Both companies would be substantially harmed without an agreement making such an outcome a near requirement.

Under an unfavorable license agreement with higher royalty rates, Qualcomm would probably look towards a future solution to avoid Arm technology, if at all possible, such as with RISC-V technology. Right now, Arm has royalty rates for new Armv9 technology at double the previous generation Armv8.

The big question in the dispute is whether the current Nuvia based chips actually use off the shelf IP from Arm requiring a TLA license. Also, Arm claims Nuvia had no right to transfer licenses to Qualcomm, which seems bizarre that the technology would not automatically transfer to a company acquiring the business.

Limited Financial Impact

The different royalty rates for any chip can have substantial financial impacts. SemiAnalysis has estimated Qualcomm pays a roughly 50 cent royalty rate for Arm based chips while RCR Wireless placed the estimate closer to just pennies.

Arm only produced $467 million in royalty revenue in the last quarter. The market ships some 7+ billion chips based on the Arm technology on a quarterly basis amounting to a similar royalty rate for the whole business as estimated by SemiAnalysis.

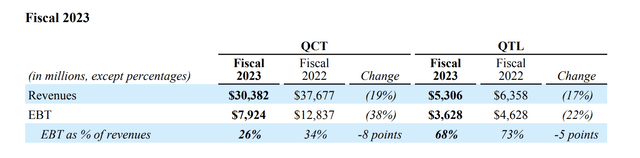

Qualcomm currently obtains the substantial portion of revenues based on chip sales, but a large portion of the profits comes from licensing wireless modem technology. For the last couple of fiscal years, the wireless chip company produced the following revenues and margins based on each business unit:

Source: Qualcomm FQ4’23 earnings release

The QTL license business has produced ~$4 billion in EBT annually with a 70% margin while the chip business produces $10 billion in EBT at 30% margins. The chip sales have far lower margins, but the volumes add up to substantially more revenues and profits now.

Even at 1 billion handset units, Qualcomm is only paying Arm ~$500 million based on the above royalty rate. At double the rate, Qualcomm would pay another $500 million in royalty fees.

The company has at least $10 billion in EBT from the QCT group alone and $14 billion for the whole business, so higher royalty rates can be absorbed. Not to mention, Qualcomm would likely pass on higher expenses to end customers.

Arm is only forecasted to produce $4 billion in revenues this year with approximately half of revenues from royalties. With the company only looking for 20% growth, Arm clearly isn’t expecting a $500 million windfall from Qualcomm alone. Arm sales would jump another 12.5% from just those higher revenues.

Who wins the lawsuit is difficult to derive without being a license contract expert. What is known is that neither company wants to interrupt the business to where Qualcomm can no longer make smartphone chips and the business disappears leading to Arm losing the royalty revenue without any chips being sold.

The pressure facing Qualcomm is how their wireless tech extracts higher royalty rates from smartphone companies based on the value of the phone. The dynamics for the chips used in smartphones has Qualcomm only collecting an estimated $25 from a customer like Apple (AAPL). A royalty rate higher than $0.50 to $1 would vastly change the cost dynamics, whereas Qualcomm created wireless technology supporting the whole smartphone and collects an estimated royalty rate of $13 from Apple for using the wireless patents.

Due to the vastly different financials dynamics, a much higher license rate is highly unlikely. Qualcomm won’t want to pay a higher rate, especially with the ALA in place, but an amount material to Arm isn’t going to impact the wireless giant.

The company is forecast to produce an $11+ EPS in FY25 and the stock only trades at 15x this target. Qualcomm has 1.1 billion shares outstanding, so any royalty hit limited to a few hundred million dollars wouldn’t greatly impact the financials of the company at a hit of anywhere from $0.10 to $0.20.

The stock should trade more based on the excitement for the AI PC chips utilizing Nuvia technology to capture a large portion of the market due to promising performance from Microsoft (MSFT) Copilot PCs than any threats from a higher royalty rate. Naturally, any actual cancellation of the licensing agreement causing Qualcomm to pull chips from the market would be very damaging to the stock and business, even if just in the short term.

Takeaway

The key investor takeaway is that Qualcomm remains one of the cheaper chip stocks. The company has a huge opportunity in AI PCs and automotive with massive design wins already in place and royalty dispute is unlikely to alter the ultimately plans.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.