Summary:

- Autos have become Qualcomm’s primary growth driver.

- The company is now a free cash flow growth story.

- The market may potentially undervalue the stock based on price-to-free cash flow.

JHVEPhoto

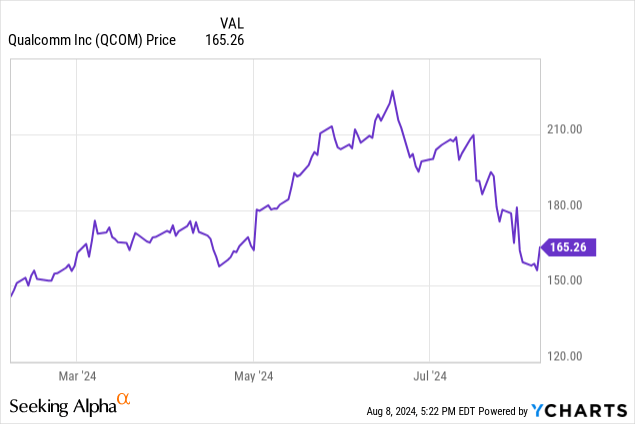

When I recommended QUALCOMM (QCOM) on April 1 and May 14 this year, it looked like a well-timed decision for a few months. The stock reached a 52-week high of $230.63 on June 18, up 34.30% over my April buy recommendation and 25% over my May recommendation. It has been mostly downhill from there, as stocks perceived as Artificial Intelligence (“AI”) beneficiaries fell out of favor.

Despite investor sentiment turning against the company, the case for investing in Qualcomm remains on track. The company should be a massive beneficiary of AI moving to local devices, a potential refresh cycle in PCs and smartphones providing a tailwind, the opportunity to provide chips to the auto industry increasing, and the company having excellent earnings and free-cash-flow (“FCF”) growth. Additionally, after its +30% drop since June 18, the stock sells at a much better valuation. Thus, I still recommend that growth investors consider buying Qualcomm.

This article will discuss why the stock declined after earnings and why investors should focus on the company’s new growth engines. It will also review the earnings report, the stock’s valuation, and why I still think it’s a buy.

Autos are the company’s new growth engine

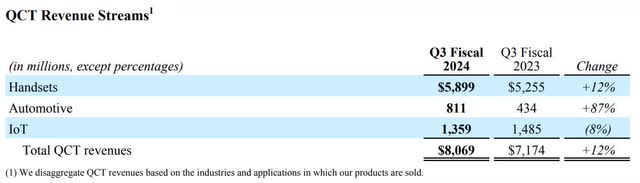

Qualcomm’s traditional handset business is still the company’s most prominent business, ending the third quarter at $5.9 billion. However, as this article will discuss later, the days when the company generated explosive revenue growth in the mobile handset business are probably over. Management started developing additional growth revenue streams several years ago, the first being automotive. Now is the time for investors to start paying attention to the company’s auto business.

By the end of this decade, the handset business may cease being Qualcomm’s most prominent business. Since November 2021, the company has forecast $4 billion in automotive revenue by FY 2026, reaching $9 billion by FY 2031. Management confirmed those numbers in the third quarter FY 2024 earnings call. Chief Executive Officer (“CEO”) Cristiano Amon said, “We expect, given the size of our [automotive] pipeline, we talk about $4 billion in ’26. We talk about $9 billion toward the end of the decade.”

CEO Amon also believes there is an upside to the company’s original automotive projections. He said on the third quarter earnings call:

An upside is what Gen AI is doing in automotive. Gen AI use cases, especially using large language models for audio. It was a great user interface for were behind the wheel. We’re starting to see a lot of interesting use case being developed. That upside to our model, it could be an upgrade of [semiconductor] content in the digital cockpits that we have in.

If the company meets its auto estimates, this revenue stream may be its fastest-growing area for the next several years.

Company fundamentals

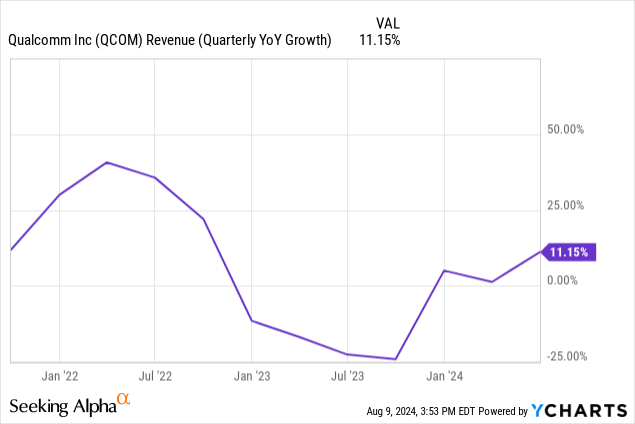

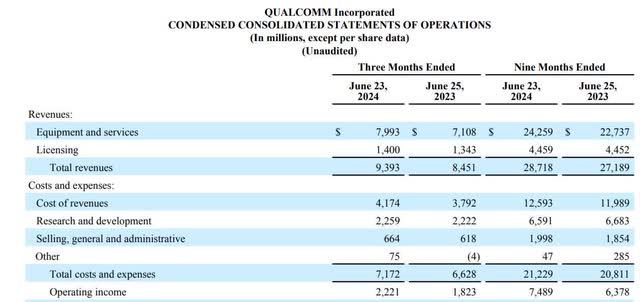

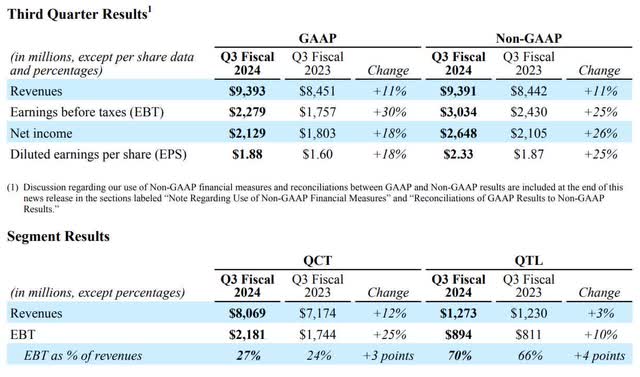

Qualcomm’s total revenue grew 11% year-over-year to $9.39 billion, helped by the smartphone market’s recovery. However, the days of high-octane revenue growth in the smartphone handset market are likely over.

Qualcomm’s annual total revenue has only grown at a 9.6% compound annual growth rate (“CAGR”) over the last five years, mainly due to the smartphone market deteriorating in 2023. Although the revenue growth slowdown in the smartphone business over the previous several years is primarily due to a cyclical downturn, the smartphone market is unlikely to go back to the era of 2000 to around 2013, the transition from 3G to 4G, where Qualcomm was able to generate above-average revenue growth. Some thought the transition between 4G and 5G would rejuvenate growth in the smartphone market, but that has yet to occur. The smartphone market has matured. Almost everyone who wants a smartphone already has one. Consumers have been slower to adopt 5G, likely because its main benefits, such as better latency and speed, have had a slow rollout period. The lower-end version of 5G provides very few additional advantages over 4G. Additionally, Qualcomm hasn’t benefitted as much from the 4G to 5G transition because the smartphone chipset market has become much more competitive.

The company’s overall revenue growth tanked when the smartphone market declined in 2023. The smartphone market only began to show signs of life at the end of 2023, and the market is still recovering. International Data Corporation’s Worldwide Quarterly Mobile Phone Tracker stated in a July 15, 2024 article:

Global smartphone shipments increased 6.5% year-over-year to 285.4 million units in the second quarter of 2024 (2Q24). Although this marks the fourth consecutive quarter of shipment growth and builds the momentum towards the expected recovery this year, demand has yet to come around in full and remains challenged in many markets.

The mobile phone market has yet to recover fully but has grown enough that Qualcomm is benefiting from the tailwinds. The following table shows that the company’s handset revenue grew 12% year-over-year, even with analysts’ consensus estimates. The market was likely unimpressed that the company did not exceed analysts’ expectations, which is one probable reason the stock price was lackluster after earnings.

Qualcomm Third Quarter FY 2024 Earnings Release.

Some investors have yet to adjust to the handset business no longer being the company’s primary growth engine. The new growth engine is automotive, which this article discussed in the previous section. The above table shows that automotive is the fastest growing portion of the company at 87% year-over-year. The best part is that management expects 50% year-over-year revenue growth for FY 2024, which is a solid outlook.

Investors should also look to the IoT (Internet of Things) revenue stream, which will eventually become another growth engine. AI PC revenue will likely be included in the IoT revenue stream. Qualcomm’s IoT revenue declined 8% year-over-year to $1.36 billion. The IoT market is currently in a downturn that it should be coming out of soon. According to IoT Analytics, growth in the IoT market is decelerating this year and should reaccelerate in 2025. If that research is valid, investors should expect revenue growth to pick up in QCT’s (Qualcomm CDMA Technologies’) IoT market in FY 2025. The QCT segment designs and manufactures semiconductors for applications such as smartphones, computers, automotive, and IoT.

However, despite two new growth engines, Qualcomm’s days as a high-revenue growth company are likely over. Analysts expect the company to only grow revenue at an 8.42% compound annual growth rate over the next three years. The thesis for investing in this company has shifted from investors looking for high revenue growth to investors wanting to see high earnings and free cash flow (“FCF”) growth.

Qualcomm Third Quarter FY 2024 Earnings Release

The company spent 2023 in cost-cutting mode, culminating in the layoff of 1,258 employees in California. Third-quarter total costs and expenses grew 8.2% year-over-year, slower than third-quarter revenue growth, resulting in GAAP (Generally Accepted Accounting Principles) operating margin expanding 207 basis points to 23.64%. In the third quarter of FY 2024, operating income grew 21.83% to $2.22 billion.

Qualcomm emphasizes a metric named earnings before taxes (“EBT”) over operating income because the company operates in various global tax jurisdictions. EBT may give investors a better idea of the company’s profitability over operating income because although it eliminates the effect of taxes, it still considers non-cash expenses such as depreciation & amortization (which can reduce taxable income) to provide a broader view of profitability before taxes.

In the third quarter of FY 2024, the total EBT margin was up 347 bps to 24.26%. The QCT EBT margin was up 3 points to 27%, which was at the high end of the company’s guidance range. The automotive revenue stream is mostly driving this QCT margin improvement. The QTL (Qualcomm Technology Licensing) segment EBT margin was up 4 points to 70%. QTL is the company’s intellectual property licensing division.

Qualcomm Third Quarter 2024 Earnings Release

Diluted earnings-per-share (“EPS”) were up 18% year-over-year to $1.88, beating analysts’ estimates by $0.09.

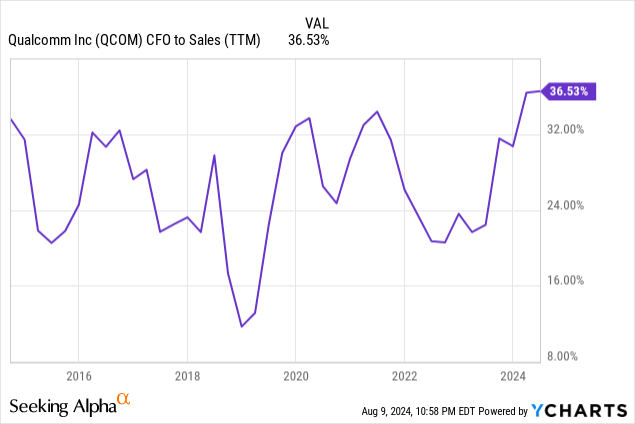

Qualcomm’s cash from operations (“CFO”) to sales ratio was 36.53%, its highest level in ten years. This number means the company converts every $1.00 in sales into $0.37 in cash. The higher this ratio, the greater the potential for generating FCF.

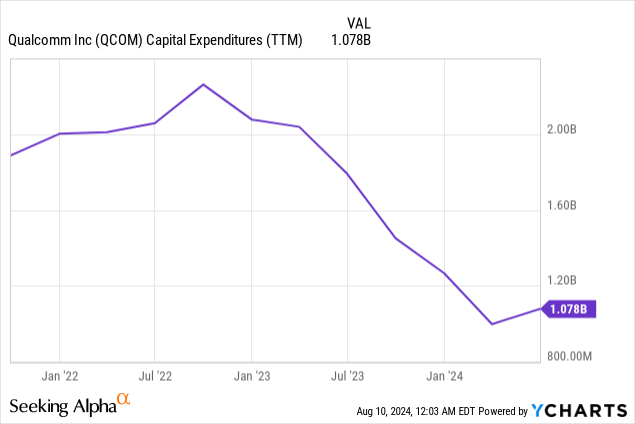

The following chart shows that the company has lowered capital expenditures (“CapEx”) on an absolute basis since the end of 2022. The lower the CapEx spending, the greater the potential for FCF growth.

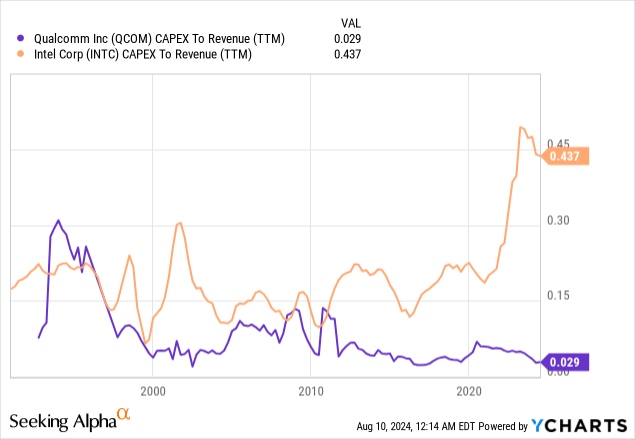

Although Qualcomm has some in-house manufacturing of vital components, it is mainly a fabless chip manufacturer, which means it outsources most of its chip manufacturing to third-party foundries. Therefore, it spends less on CapEx than an integrated device manufacturer such as Intel (INTC), which makes most of its chips within its own foundries. The chart below shows that Qualcomm spends far less on CapEx in relation to revenue than Intel, meaning it has a higher potential for generating FCF.

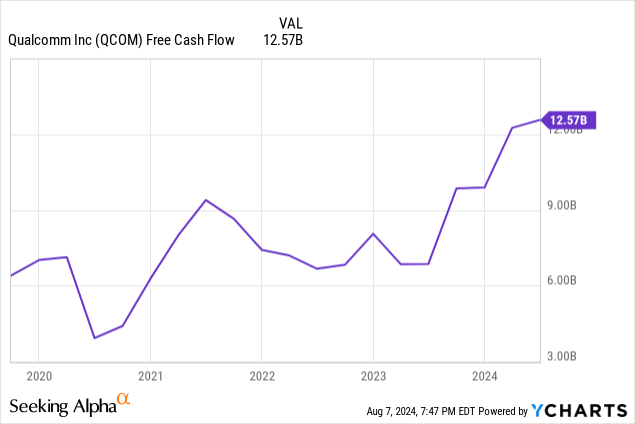

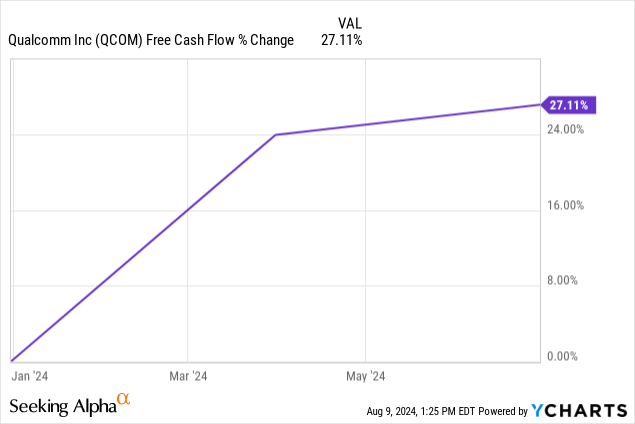

The following chart shows that the company’s FCF growth has exploded higher since July 2023 — exactly what Qualcomm investors want to see. One of the best ways to value a stock is FCF growth, which some consider a better indicator of value than EPS growth, as companies can manipulate EPS through various accounting tactics. FCF represents CFO minus CapEx and is less susceptible for companies to manipulate. The valuation portion of this article focuses more on FCF-based valuation methods than other valuation methods.

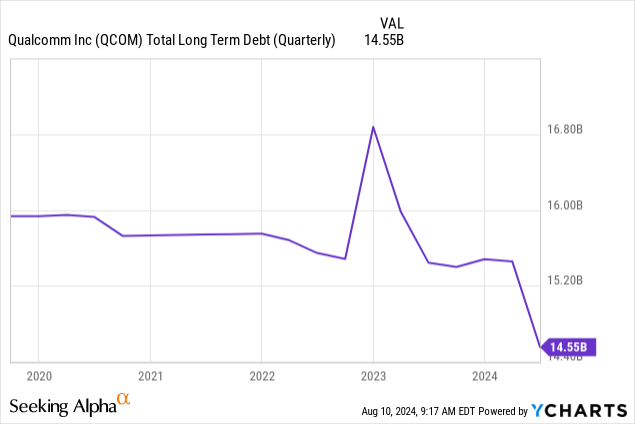

Qualcomm used some of its growing FCF to repurchase 7 million shares of stock for $1.3 billion during the June quarter and paid $949 million in dividends. It also reduced its long-term debt. The chart below shows that Qualcomm has reduced its debt from over $16.8 billion at the beginning of 2023 to $14.55 billion at the end of its June 2024 quarter.

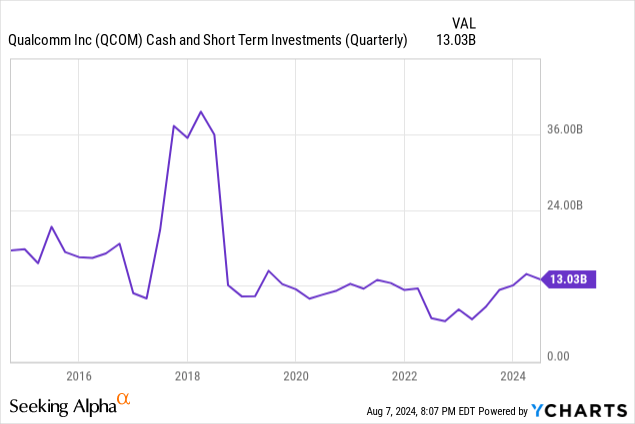

The following chart shows that the company’s cash stockpile has dropped significantly from over $36 billion in 2018, as the company first used the cash to pay down long-term debt and repurchase stock that year. Later, in 2023, the company used some of its cash stockpiles to help it survive the downturn in the smartphone and IoT markets. The company is now using some of its growing FCF to rebuild its cash stockpile, which now sits at $13.03 billion at the end of the June quarter.

At the end of the June quarter, the company had a net debt of $1.522 billion and a TTM EBITDA of 11.565 billion. Its net debt-to-EBITDA ratio was 0.13, meaning it had the resources to cover its debt obligations.

Risks and potential reasons the stock dropped post-earnings

Although the company topped analysts’ consensus forecasts for revenue and adjusted EPS and exceeded forecasts for guidance, the stock dropped 9% the day after earnings.

The biggest issue Qualcomm had going into its third-quarter earnings was the growing consensus among the media, analysts, and investors that the amount invested in AI infrastructure is outpacing the revenue that companies are generating from AI applications. It’s what Sequoia first described in 2023 as the $200 billion question and later updated in June 2024 as the $600 billion question. In other words, some believe that the investment in AI infrastructure has formed a bubble, a massive headwind against Qualcomm’s stock rising after earnings since it is a potential beneficiary of the AI infrastructure build-out. The company would have had to turn in a perfect quarter for the stock to increase, but it did not.

The earnings report brought up some company-specific risks the market became concerned about, including a lower-than-expected outlook for the company’s December quarter. Some analysts went into earnings with high expectations for revenue growth in the company’s December quarter, and when the company’s revenue guidance came in much lighter than analysts’ forecasts, enthusiasm for the stock waned. Investor’s Business Daily stated, “JPMorgan analyst Samik Chatterjee said investors had been primed for double-digit revenue growth in the December quarter. But Qualcomm predicted mid-single-digit growth in the quarter, its fiscal Q1, on flat smartphone growth, he said in a client note.”

Management didn’t actually forecast “mid-single-digit growth in the [December] quarter,” however, the Chief Financial Officer (“CFO”) Akash Palkhiwala did say in the company’s third quarter FY 2024 earnings call, “Consistent with our long-term financial planning assumption of largely flat handset units, we continue to estimate global 3G/4G 5G units in calendar ’24 to be flat to slightly up on a year-over-year basis,” which implies a lackluster December quarter.

Flat smartphone growth ignited existing fears about the potential loss of Apple (AAPL) as a customer and Chinese smartphone manufacturers potentially reducing their reliance on Qualcomm over the next several years. Some investors are also anxious about when AI Personal Computer (“PC”) revenue growth will appear in the company’s results. During the earnings call, one analyst asked how many AI PC units the company would sell in the holiday period. CEO Amon said about the AI computer during the third quarter earnings call (Emphasis added):

It’s a new version of Windows, the Copilot+ is a new architecture with an ARM compatible. We expect that, that will ramp over a period of time. But what we have seen in the market right now with the 20 models that can launch is exceeding our internal targets. Some models, as I mentioned in my prepared remarks, had sold out. And I think we should expect that will continue to be a crescendo, slow and steady, as the market transitions.

The company only launched this business in June, and investors should not expect meaningful revenue to appear for a few quarters. When the AI PC business is fully up and running, management expects it to be its second most potent growth driver.

Valuation

The following table shows Qualcomm’s EPS estimate, estimated EPS growth rate, and forward price-to-earnings (P/E) ratio.

One simple way to value a stock is to compare its analysts’ EPS estimated growth rate to its forward P/E ratio. If the two numbers match, the market fairly values the stock. It would be like the company had a forward Price-to-Earnings-to-Growth (“PEG”) ratio of one, which many consider fairly valued.

If the EPS estimate growth rate exceeds the forward P/E, the market undervalues the stock’s potential earnings growth. If the EPS estimated growth is lower than the forward P/E, the market overvalues its potential earnings growth. According to those rules, Qualcomm looks undervalued based on FY 2024 metrics and would have a forward PEG ratio of 0.86. If the stock hits its EPS estimate of 10.03 at the end of the September quarter, which would be a 19.04% EPS growth rate, its fair value would be $190.97, up 16% above the August 8 closing price.

Let’s consider Qualcomm’s reverse discounted cash flow (“DCF”). The terminal growth rate, the rate at which I expect company’s FCF to grow in perpetuity, is also an expectation of the company’s growth rate. I use a terminal growth rate of 2%, meaning I believe that the company will grow at a similar rate as the U.S. gross domestic product over the long haul. I use a discount rate of 10% because I consider Qualcomm’s risk normal. A higher discount rate would mean that I consider the risk higher than normal. A lower discount rate would mean that I believe the risk was lower than normal. I also use the company’s levered FCF in the following reverse DCF.

Qualcomm Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$12,567 |

| Terminal growth rate | 2% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 3.7% |

| Stock Price (August 12, 2024 closing price) | $162.89 |

| Terminal FCF value | $18.434 billion |

| Discounted Terminal Value | $88.839 billion |

| FCF margin | 33.65% |

According to the assumptions I used in the above reverse DCF, Qualcomm would only need to grow FCF at a 2.8% annual growth rate to justify the current stock price. However, it’s doubtful that the company will maintain an average FCF margin of 33.65% over the next ten years. The stock is cyclical, and despite the company now growing new revenue outside the highly cyclical smartphone market, FCF should still exhibit cyclicality in the IoT and auto market over time. The stock has had a median levered FCF margin of 22.57% over the last ten years. Assuming it can maintain an average FCF margin of 23% over the next ten years, it would need revenue to grow 9% annually over the next ten years to justify the current price.

Assuming that its AI chip business helps it generate an average FCF margin of 25% over the next ten years, it would need revenue to grow 7.8% annually over the next ten years, which is feasible for this mature company entering new growth markets. As stated earlier in the article, Qualcomm only grew revenue at a 9.63% CAGR over the last five years. I expect that handset revenue may deteriorate and become a drag on the higher-growing revenue streams. The revenue growth rate should settle at around 7 to 8% annually over the next ten years. According to this analysis, the current stock price is near fair value.

Be cautious about fully accepting the assumptions I made in the above reverse DCF of Qualcomm because reverse DCF and DCF analysis on cyclical stocks can often be highly inaccurate. There is high uncertainty about what the AI opportunity will do to Qualcomm’s revenue growth, FCF margin, and FCF growth over time. Additionally, there is high uncertainty over how fast and when handset revenue might drop off. Over the next one to two years, FCF should continue growing as the adoption of AI PCs boosts the PC refresh cycle, the company continues capturing business in autos, the IoT business returns to growth, and people begin buying new AI-enabled smartphones.

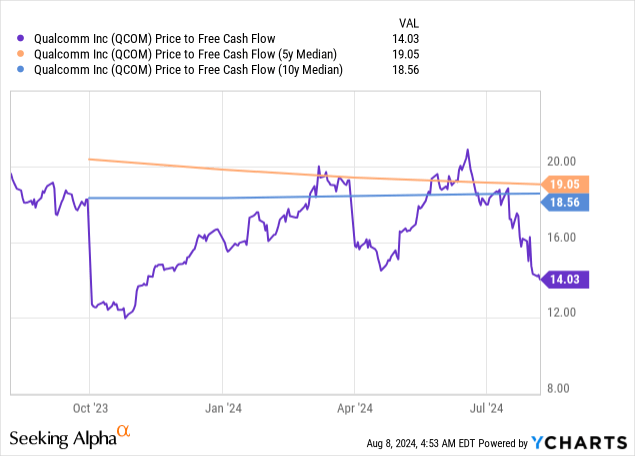

Qualcomm’s price-to-FCF is 14.03, well below its five- and ten-year median of 19.05 and 18.56, respectively. If the company traded at its ten-year median, the stock price would be $206.57, up 32.31% above the August 7 closing stock price of $156.12. If the stock traded at its five-year median, it would be $212.03, up 35.8% above the August 7 stock price.

The following chart shows the company grew trailing 12-month FCF by 27.11% since the start of 2024.

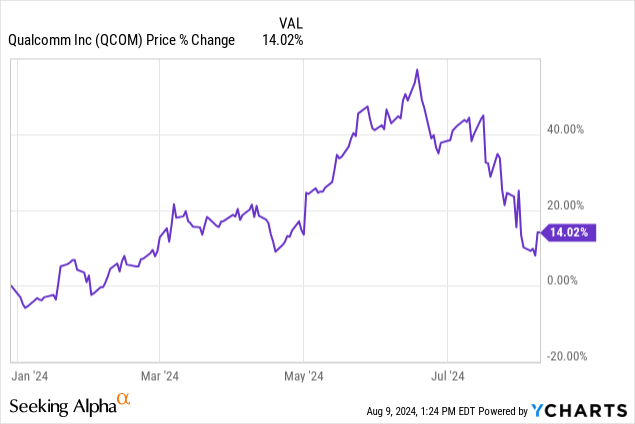

The following chart shows that the stock price only grew 14% over the same period.

Suppose FCF maintains a solid double-digit growth rate, and the macroeconomy doesn’t deteriorate further. In that case, the market will likely soon respond by driving the stock price higher until it reaches its median price-to-FCF. This scenario is likely if the Federal Reserve follows through on its expectation that it will reduce interest rates in September.

Qualcomm remains a buy

Although investors rightly worry about Chinese smartphone revenue because it makes up around 40% of the company’s revenue, things might not be as bad as it seems. This worry about a loss of Chinese revenue has been around for a few years. Yet, Qualcomm’s figures in the third quarter suggest that investors hold off on doomsday scenarios of massive revenue loss in China happening any time soon. CFO Palkhiwala said during the third quarter earnings call that Qualcomm has “greater than 50% year-over-year growth in revenues from Chinese OEMs.” Chinese OEMs may take quite a while to find alternatives to Qualcomm chips because Chinese semiconductor manufacturers like SMIC are disadvantaged by not having access to the latest chip technology from companies like ASML Holding (ASML). Perhaps one day, Chinese chip manufacturing technology will catch up, but it may take several years or more for a Chinese company to manufacture chips at the same level or better than Qualcomm.

The worries over the loss of Apple revenue may be overblown, too. For a while now, the company hasn’t included Apple revenue outside of its existing agreements in its guidance. CEO Amon said in this quarter’s earnings call (emphasis added):

As it relates to our business with Apple, we still operate with the framework that we provided to you all. I think when we extended the chipset agreement, and we expect to be operating within that. We have no new update to provide it everything above what we said before is an upside. So, we don’t have that in our financial planning assumptions above what we had disclosure.

Investors who understand that AI and Qualcomm’s new automotive and IoT growth engines will drive margin expansion, revenue, and FCF growth moving forward should consider investing in the stock. The company’s growing FCF should allow it to reduce debt, repurchase shares, and increase its dividends, thereby increasing its value over time. The recent decline in the stock price gives investors a decent entry point. I reiterate my buy recommendation for Qualcomm.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.