Summary:

- QCOM’s AI-PC investment thesis shows promise with strong early sales of Snapdragon X Elite powered notebooks, aided by the growing design wins in handset/ automotive segments.

- ARM-based PC market share remains small compared to x86 platform, but QCOM’s strategic positioning as an ARM-based Windows platform could lead to significant growth opportunities.

- Despite market correction, QCOM’s well-diversified offerings and long-term prospects warrant a Buy rating, with attractive risk/reward ratio for opportunistic investors.

z1b

We previously covered QUALCOMM (NASDAQ:QCOM) in June 2024, discussing its promising entry into the AI chips market, with Microsoft (MSFT) endorsing the ARM-based Snapdragon X Elite CPU chips as the “fastest, most AI-ready PC ever built.”

With the company in “a new phase of breakthrough,” thanks to its well diversified offerings across handset, automotive, broadband, AR/ VR/ XR, and ARM-based AI CPUs, we had reiterated our Buy rating while raising our fair value estimates/ long-term price targets then.

Since then, QCOM has pulled back by -19.2%, well underperforming the wider market at 0%, attributed to the ongoing market correction surrounding high growth/ semiconductor stocks.

Even so, we maintain our long-term optimism surrounding its prospects, especially given the robust early sales of its Snapdragon X Elite powered notebooks and the growing design wins across its handset and automotive segments.

We shall further discuss why we are maintaining our Buy rating.

QCOM’s AI-PC Investment Thesis Appears To Be Rather Promising

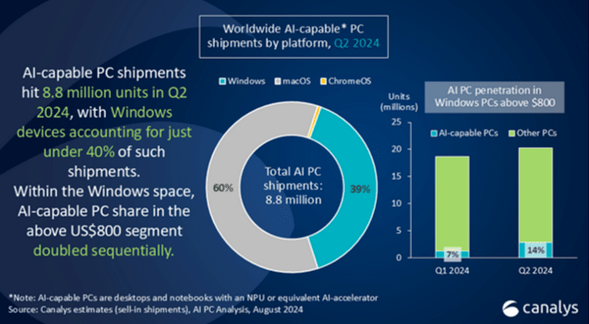

AI PC Shipments In Q2’24

Canalys

For reference, Canalys reported that 8.8M units of AI-capable PCs were shipped in Q2’24, with Windows devices accounting for nearly 40% of the shipment at 3.52M units. Most importantly, AI-capable PCs at the above $800 price tag double sequentially.

These are important developments indeed, since QCOM’s Copilot+ PCs launched in May 2024 and sold from June 18, 2024 onwards, way ahead of its competitors’, namely Intel’s (INTC) Lunar Lake in Q3’24 and Advanced Micro Devices’ (AMD) Ryzen AI 300 chipsets in late July 2024.

Based on this development, it appears that QCOM may be leading the AI-capable PC race, explaining why its QCT IoT segment has recorded robust sequential growth to FQ3’24 revenues of $1.35B (+8.8% QoQ/ -8.7% YoY).

The management has also guided excellent FQ4’24 overall QCT revenues of $8.4B (+4.2% QoQ/ +17.1% YoY), with part of the top-line tailwinds likely attributed to the AI-capable PCs.

Readers must not forget QCOM’s growing design pipeline wins in the automotive segment as well, up from $30B in September 2022 to $45B by FQ3’24. This is on top of the growing total premium handset market share to 31% globally, with the Chinese OEM handsets generating over +50% in growth by volumes in the latest quarter.

It is apparent from these developments that the semiconductor’s ongoing diversification efforts are working out as expected across different segments, with it warranting our upgraded price targets in the previous article.

However, a note of warning here.

Arm Holdings (ARM) has unexpectedly offered a rather soft next quarter revenue guidance of $805M (-14.2% QoQ/ +9.6% YoY) and adj EPS of $0.25 (-37.5% QoQ/ -7.4% YoY) at the midpoint, back tracking the double beat FQ1’25 earning results.

At the same time, ARM lost a fraction of its overall microprocessor unit market share to 9.7% (-1.05 points QoQ) in Q2’24, compared to the gains reported by AMD to 19.2% (+0.68 points QoQ) and INTC to 71.1% (+0.37 points QoQ).

ARM’s loss is most notable in the notebook market to 11.4% (-1.4 points QoQ), as AMD gains to 18% (+1.2 points QoQ) and INTC to 70.6% (+0.23 points QoQ), implying that ARM-based PCs may still be less popular than its x86 peers – with QCOM’s recent gains likely to be minimal for now.

This is especially since MSFT’s on-device AI features, including Cocreator, Windows Studio Effects, and Live Captions with Translation, have not proven to be useful to users yet, with the Recall feature also not released.

With the perceived benefit only being a longer battery life, we can understand why ARM-based AI-capable PCs have yet to gain traction, worsened by the poor x86 emulation and a lack of Arm64 versions of commonly used developer software.

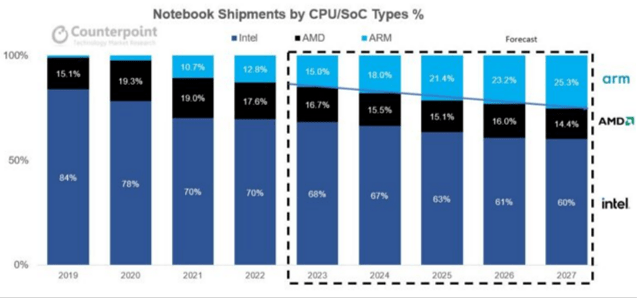

Notebook Shipments By CPU/ SoC Types

Toms Hardware

On the other hand, market analysts already expect ARM-based PCs to continue growing in market share from 15% in 2023 to over 25% of all SoC types by 2027, thanks to the “lower overall power consumption and customization enabling richer features and higher performance.”

While the projected ARM-based market share remains small compared to the x86 platform, we believe that QCOM’s prospects are very bright indeed.

With the other ARM-based platform being Apple’s (AAPL) notebooks at over 90% in market share, we believe that there may be great headways for QCOM, seeing that the latter is the very first company to introduce ARM-based Window platform.

QCOM has iterated a desire to command 50% of the PC market by 2029 through the ARM-based platform, with some notebook OEMs projecting ARM-based market share of up to 60% of its sales within the next three years.

We believe that these numbers are not overly aggressive as well, with INTC already expecting 80% of all PCs to be AI-capable PCs by 2028, with it further cementing QCOM’s strategic positioning as an ARM-based Window platform.

As a result of these tailwinds, we believe that QCOM may very well be a PC/ CPU powerhouse over the next few years – triggering further tailwinds to its stock valuations/ prices.

So, Is QCOM Stock A Buy, Sell, or Hold?

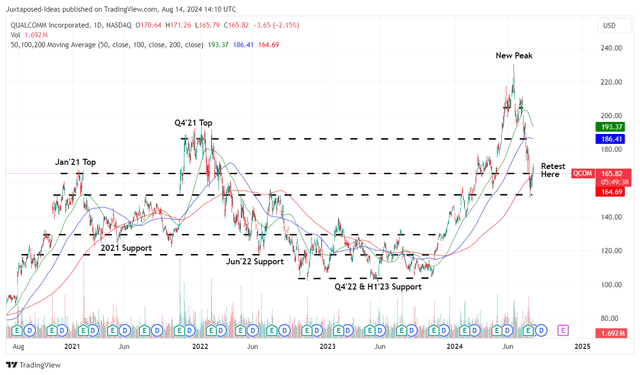

QCOM 4Y Stock Price

Trading View

For context, we had offered a fair value estimate of $203.50 in our last article, based on QCOM’s LTM adj EPS of $9.08 ending FQ2’24 and the upgraded FWD P/E valuations of 22.42x. This is on top of the long-term price target of $278.60, based on the consensus FY2026 adj EPS estimates of $12.43.

Since then, the ongoing market carnage has undoubtedly impacted QCOM’s stock prices, with the drastic -27.1% pullback causing the stock to retest the previous support levels of $153s while trading at its 200 day moving averages.

QCOM’s Valuations

Tikr Terminal

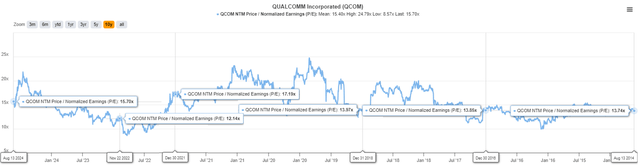

The same moderation has also been observed in QCOM’s FWD P/E valuations to 15.70x by the time of writing, compared to the previous article at 22.42x, its 1Y mean of 15.91x, and its 10Y mean of 15.40x.

This is despite the consensus robust forward estimates, with QCOM expected to generate an excellent adj EPS growth at a CAGR of +14% through FY2026.

When compared to QCOM’s connectivity/ CPU semiconductor peers, such as Broadcom (AVGO) FWD P/E valuations of 32.88x/ +18.5%, ON Semiconductor (ON) at 18.23x/ +5.2%, INTC at 78.12x/ +21.8%, and AMD at 41.78x/ +40.2%, respectively, it is apparent that the former remains overly discounted at current levels.

Therefore, we shall continue to stand by our raised fair value estimates and long-term price targets, since QCOM remains well positioned to grow its ARM-based Window PC market share moving forward.

This is significantly aided by the growing Handset, Automotive, and XR opportunities moving forward, thanks to the growing OEM partnerships and design wins, with it implying the semiconductor company’s bright long-term prospects.

As a result of the highly attractive risk/ reward ratio, we are maintaining our Buy rating for the QCOM stock here, with us recommending investors to buy the dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.