Summary:

- Qualcomm Incorporated faces risks from Apple’s potential use of in-house 5G chips and export restrictions to Huawei in China.

- Management is optimistic about growth in the AI PC and handset markets, but potential downside risks remain.

- Despite solid Q3 earnings, uncertainties surrounding Apple and China pose significant risks for Qualcomm’s future growth.

JHVEPhoto

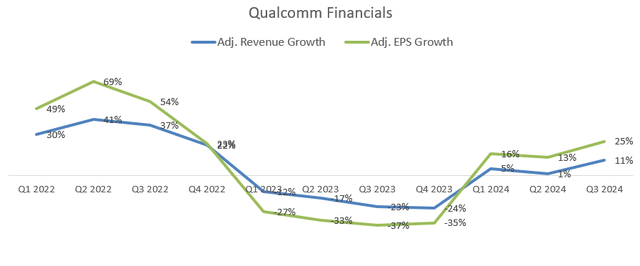

I published my “Sell” thesis on QUALCOMM Incorporated (NASDAQ:QCOM) in my previous coverage published in December 2023, expressing my concerns about Huawei’s 7-nanometer processor and Apple Inc.’s (AAPL) ongoing development of its own 5G modem chip. Qualcomm released its fiscal Q3 earnings on July 31st after the market close, with 11% growth in revenue and 25% growth in adjusted EPS growth. I don’t think AI PC and Handsets can ensure the company’s future growth, and Qualcomm has significant risks from Apple and export restrictions to China. I reiterate a “Sell” rating with a fair value of $150 per share.

Apple and Export Restriction to China

Although Qualcomm extended its long-term contract with Apple to supply 5G chips until at least 2026, Apple has not stopped their internal development of their own 5G modem chip. As reported by the media recently, two new iPhone models will ditch Qualcomm’s 5G chips and adopt Apple’s in-house 5G chips in 2025. It is unclear whether the news is true or not; however, I think it is quite possible that Apple will gradually use their in-house chips in the company’s handsets. If that happens in 2025, it will pose significant downside risks for Qualcomm’s stock price.

On May 8th, Reuters reported that the U.S. government revoked Qualcomm’s export licenses to sell laptop and handset chips to Huawei. During the earnings call, the management confirmed that the company’s license to export to Huawei was revoked on May 7th, and the change will impact their financials for the first quarter of FY25.

As discussed in my previous article, China and Apple are critical customers/markets for Qualcomm. The potential risks of losing Apple as a customer and facing export restrictions could significantly harm the company’s growth rate in FY25, in my view.

AI PC & Handsets Opportunities

There are many questions regarding AI PC and handsets over the earnings call. The management showed strong confidence in Qualcomm’s growth potential in AI PC and handsets markets. The management forecasts that more than 50% of computers sold in 2017 will be AI PCs. I agree with the management that AI PC and handset will gradually replace current PCs and handsets, as enterprise customers and hyperscalers are embracing AI training and inference projects currently. When the market enters the AI inference stage, there will be an upgrade demand for AI interfaces, including PCs and handsets. At that time, Qualcomm’s chip business could potentially benefit from AI markets; however, the PC and handset markets are still driven by the replacement cycle. I don’t expect a significant demand increase for PCs and handsets. Qualcomm might see some benefit from a price increase, as AI chips require higher computing power.

Outlook and Valuation

In Q3, Qualcomm delivered 11% growth in revenue and 25% growth in adjusted EPS, as depicted in the chart below.

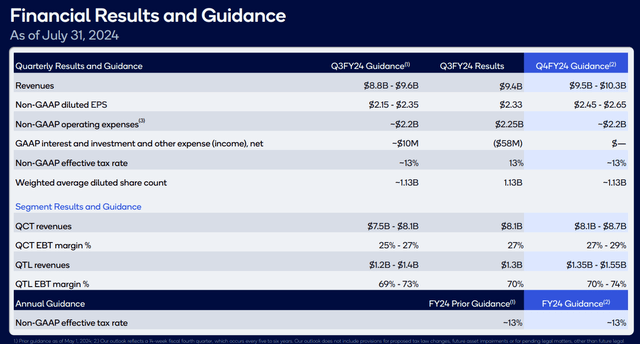

In addition, the company guides $9.5-$10.3 billion of revenue for Q4. Given the company’s clear view of its backlog and pipeline, I don’t expect any big surprises for its Q4 results. As such, I forecast the company will grow its revenue by 7.5% in FY24.

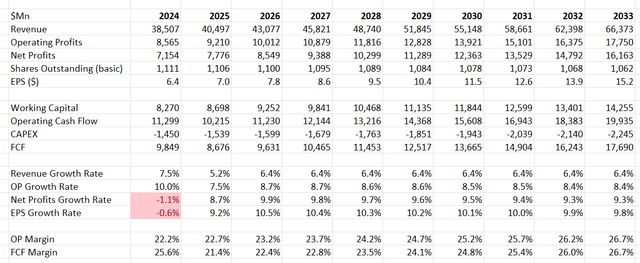

I am considering the following factors for their FY25’s growth:

- Huawei Impact: The management has not quantified the financial impact of Huawei for FY25. Assuming the impact will be $150 million per quarter, I estimate the restriction will affect 1.2% of revenue growth for FY25.

- Qualcomm’s growth will be driven by the replacement cycle of the PC and handset market. I assume their core business will grow by 4% annually from the PC and handset chips market.

- As discussed earlier, I believe AI PCs and handsets could potentially contribute additional growth to the overall topline. I forecast these new demands from AI could add 2% growth to the revenue.

As such, I estimate the revenue will grow by 4.8% organically in FY25, then accelerate to 6% from FY26 onwards when Huawei’s impact will disappear. In addition, I assume the company will allocate 2% of total revenue towards acquisitions, contributing 40 bps to the top line.

I forecast a 50 bps annual margin expansion, assuming:

- 20 bps margin expansion from gross profits, driven by new products and AI chips

- 10 bps operating leverage from R&D

- 10 bps operating leverage from SG&A.

The DCF summary is as follows:

The WACC is calculated to be 11.9% assuming: a risk-free rate of 4.2% (US 10Y Treasury); a beta of 1.72 (SA); an equity risk premium of 7%; a cost of debt of 7%; equity balance $21.5 billion; debt balance $15.3 billion and tax rate 14%.

The fair value of Qualcomm’s stock price is estimated to be $150 per share, discounting all the future free cash flow, according to my calculations.

Upside Risks

As I give Qualcomm a “Sell” rating, I think about the upside risks here:

- Apple might not be able to successfully develop its own high-performance 5G modems in the near future. In that scenario, Apple might have to extend the supply contract with Qualcomm for a longer term.

- The geopolitical tension between the U.S. and China might ease in the future. In that case, Qualcomm might grow faster in the Chinese market. Qualcomm has been investing in China for many years, earlier than my U.S.-based semiconductor companies.

Conclusion

I believe Qualcomm faces significant risks in China and with its supply contract with Apple, and suggest investors avoid investing in the company until these uncertainties fade. I reiterate a “Sell” rating with a fair value of $150 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.