Summary:

- Qualcomm reported Q4 earnings last week.

- The company continues to see solid growth and to generate tons of cash.

- While there are risks, the potential benefits make QCOM a Buy.

JHVEPhoto

Qualcomm (NASDAQ:QCOM) reported earnings last week in what appeared to be a blowout quarter, but after an initial jump close to 10%, shares have now fallen back to pre-earnings levels. Despite generating oodles of cash and showing substantial growth, the market seems to remain unconvinced of QCOM’s future potential. I think the pros significantly outweigh the cons and investors could benefit from having the stock in their portfolios.

Qualcomm has been a semiconductor mainstay for years now as its dominant position in the mobile chip market, both in manufacturing custom processors and licensing out its valuable wireless patents, has yielded a venerable cash cow for investors. While the company has often been at the mercy of the ebbs and flows of the smartphone market, it has continued to return capital to shareholders and to turn in impressive operating results, as Q4 2024 earnings showed.

For the fourth quarter, Qualcomm reported revenue of $10.2 billion (+18% YoY/+8% QoQ), non-GAAP EPS of $2.69 (+33% YoY/+15.4% QoQ), and earnings before taxes (“EBT”) margin of 35.1%, a nearly 400 bps increase over Q4 2023. These gains were driven by both the QTL (the licensing business) and QCT (everything else) segments.

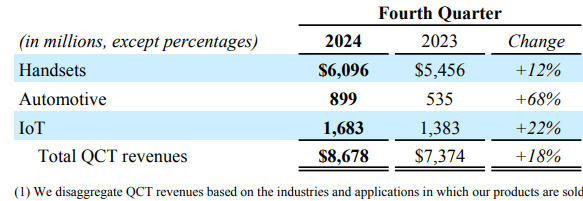

A further breakdown shows across-the-board improvement across all of the company’s QCT revenue streams:

Qualcomm Earnings Release

The primary takeaway from these numbers, in my opinion, is that Qualcomm is reporting perhaps surprising growth for a company that has at times appeared to be in a holding pattern. Automotive and IoT revenues are taking off, which is good from a diversification standpoint as well, and even the handset business, which has been a known quantity for quite a while, is seeing a marked boost. Pair this with increased profitability and the result is record cash flow.

For FY2024, Qualcomm generated FCF of $11.2 billion, which the company used to pay off $914 million in long-term debt, pay $3.7 billion in dividends, and repurchase $4.1 billion in stock. Preparing for more of the same, Qualcomm further announced the authorization of an additional $15 billion in share repurchases for a total of $16 billion (the +$1 billion comes from the previous authorization).

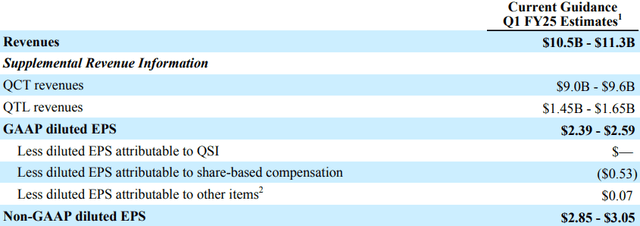

On top of the impressive revenue, earnings, and cash flow performance in Q4, the company also issued upbeat Q1 2025 guidance:

Qualcomm Earnings Release

This would represent, at the midpoint, revenue growth of 9.9% YoY and 6.4% QoQ, and EPS growth of 7.2% YoY 9.6% QoQ, both of which came in significantly higher than analyst consensus estimates. I think it’s apparent from the most recent quarter and Q1 2025 outlook that Qualcomm’s dominant market position in handsets, as well as the success of ongoing diversification efforts into automotive and IoT, are providing strong results that don’t appear to be in danger of fading any time soon.

Of the catalysts going forward, the company expects AI on the edge (i.e. on devices and not in the cloud) to provide the biggest boost to sales numbers and average selling price (“ASP”) of smartphones and AI-enabled PCs. As far as how much of an impact that will have on the overall business of consumer devices, I’m not as bullish as some, though I do think there’s a case to be made that new advancements in AI might renew the trend of buying the latest and greatest smartphone. Everyone used to line up in droves to buy the newest iPhone, but nowadays, people seem content to hold on to their years-old device for a while.

Part of the reason for that, in my opinion, is the lack of new features. The experience has been refined to the point where, outside a processor upgrade that has minimal actual impact on how most average folks use a smartphone, for example, there isn’t much about the phone that changes from model to model. But AI has the potential to flip the calculus because it has applicable use cases for your typical device user and is processor-dependent. With the increasing energy consumption and processing power required to run AI workloads, old devices will become outdated much faster, though this depends on how widely adopted AI features become by the general public.

Regardless, Qualcomm is in position to benefit whichever way the mobile market trends and is capitalizing on that ongoing success to return capital to shareholders:

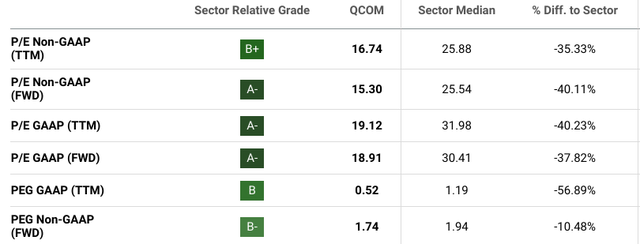

While it’s not yet a dividend growth blue chip, QCOM offers investors a solid payout with cash flow that shows no signs of letting up and is, in fact, at record highs. From a valuation standpoint, the stock looks cheap relative to the broader market, but especially in comparison to other semiconductor stocks, which can often have highly inflated metrics:

Seeking Alpha

QCOM is also trading at 13.2x forward cash flow, which is significantly under the sector median of 23 and is just a fraction of high-flying cash cows like Broadcom (AVGO) and NVIDIA (NVDA). But while operating results and valuation metrics look good, there are some risks here for investors to consider.

First and foremost is something shareholders have heard about non-stop for the last few years: Apple (AAPL) building an in-house 5G-enabled modem for its smartphones. We don’t have an exact number, but estimates put Apple at about 20% of Qualcomm’s revenue, so losing that business would be a significant blow. I don’t think this risk is particularly daunting for Qualcomm for a few reasons:

1) Apple has been working on this modem project for years and has run into countless delays, leading to the extension of a supply deal with Qualcomm until 2027. Apple had originally hoped to kick Qualcomm to the curb by this year, 2024, but as it turns out, modems are a bit more complicated than the company might have expected.

2) Even if Apple did roll out its own modem, it would likely only be able to use it in lower-end devices until it was performant enough to match Qualcomm’s leading-edge chip, which could take a while.

3) Qualcomm has already made great strides in diversifying away from Apple, so, while it would be a blow to lose Apple’s business, the company has other avenues.

4) The stock’s undervaluation indicates that this Apple exit is at least partially baked into the share price as investors wait for the hammer to drop. Uncertainty about bad news is usually worse than the bad news itself, in my experience.

In addition to that risk, Qualcomm is in the midst of a dispute with Arm Holdings (ARM) over licensing that allows the former to build its mobile chips. The details are a bit out of the scope of this article, but for a few reasons, the main one being that Qualcomm is Arm’s largest customer, I expect this dispute to be settled quickly and in a way that’s amenable for both sides (you can read this article by my fellow Seeking Alpha analyst Stone Fox Capital which pretty closely represents my thoughts on the matter).

Investor Takeaway

Qualcomm’s latest earnings report demonstrates continued success both in the core handset segment and in diversification efforts into automotive and IoT applications. The company generated record FCF in FY2024 and returned a fair amount of cash flow to shareholders: guidance for the first quarter of the next fiscal year indicates this is likely to remain the case going forward. AI-related catalysts could further give the smartphone market a boost, to Qualcomm’s benefit.

While there are risks regarding Apple developing its own modem to replace Qualcomm and Arm terminating an important license agreement, I think the benefits here outweigh the potential downsides for investors. For those with a long-term investing horizon, I think QCOM represents a Buy at current price levels.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.