Summary:

- Qualcomm Incorporated delivered strong Q4 earnings, beating estimates and showing revenue growth, particularly in the QCT segment, with improved EBIT margins and raised guidance.

- Despite positive earnings, Qualcomm remains undervalued due to headwinds from Apple’s in-house chip plans and potential trade issues with China.

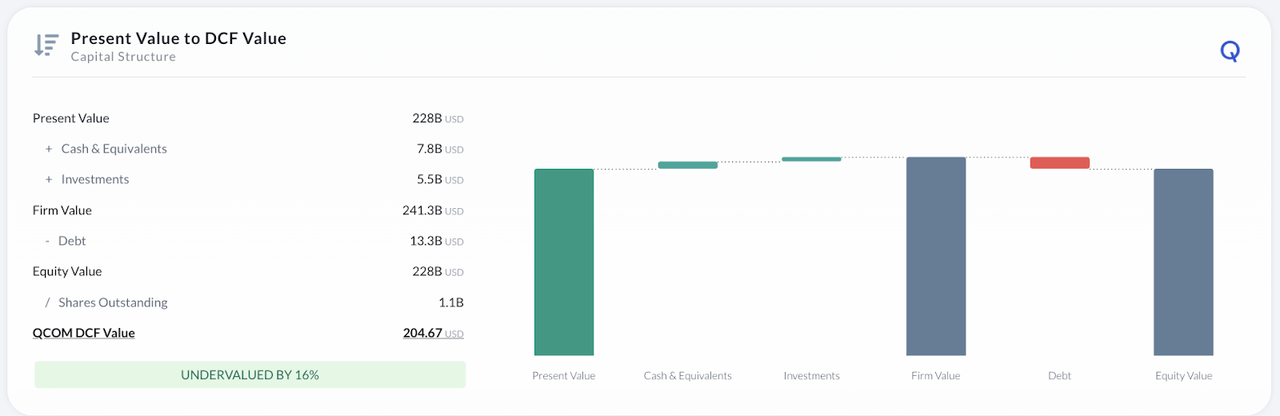

- A conservative DCF analysis suggests QCOM is undervalued by 16%, with potential for significant upside if Apple delays its chip plans or automotive revenues accelerate.

- Technically speaking, QCOM shows limited downside and potential for a fast upward move, making it a buy, though not a strong buy, in my view.

J Studios

Thesis Summary

Qualcomm Incorporated (NASDAQ:QCOM) just delivered solid fiscal Q4 Earnings, and the stock rose over 7% following the announcement.

Despite having had a good week so far, QCOM is down significantly from its all-time high. Why has sentiment been so poor?

In my opinion, the latest earnings prove that QCOM is undervalued at today’s price and show some encouraging catalysts.

However, the headwinds from Apple (AAPL) and China loom over the stock, and it likely will continue to trade discounted.

Based on a simple discounted cash flow, or DCF, analysis, I believe QCOM’s stock could double from here.

I outlined QCOM as a Strong Buy a few months ago, but I am moving to a Buy rating after the earnings. This is a profitable company that will continue to reward investors in the long term, though we can’t deny that there are a couple of risk factors at play.

Fiscal Q4 Earnings

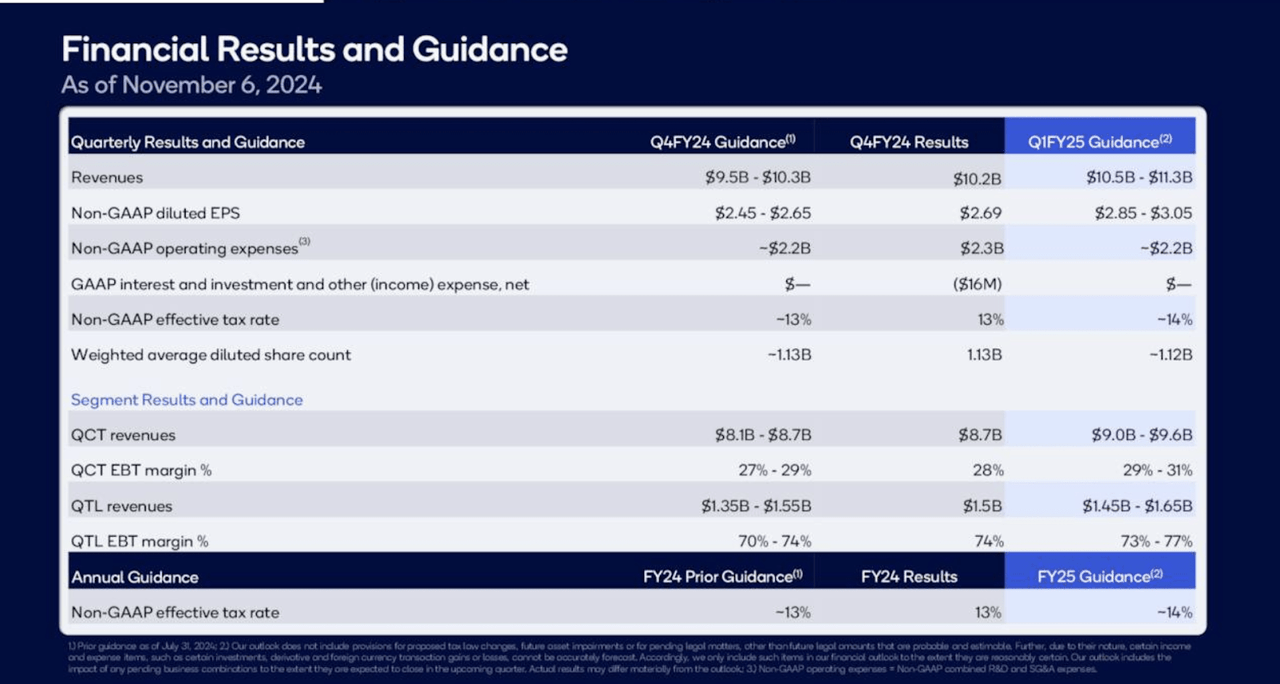

Qualcomm beat estimates and delivered revenues and earnings on the high end of its guidance.

Financial Results and Guidance (Investor Slides)

Revenues came in at $10.2 billion, most of which came from the QCT segment. The company also improved its EBIT margin on both QCT and QTL and raised its guidance for the next quarter.

Revenues for QCT are expected to grow up to 10% QoQ and the margin is expected to expand even further and that can also be seen in the EPS projections.

QCOM also returned $2.2 billion to investors during the quarter through buybacks and dividends, and the board just approved a further $15 billion in buybacks.

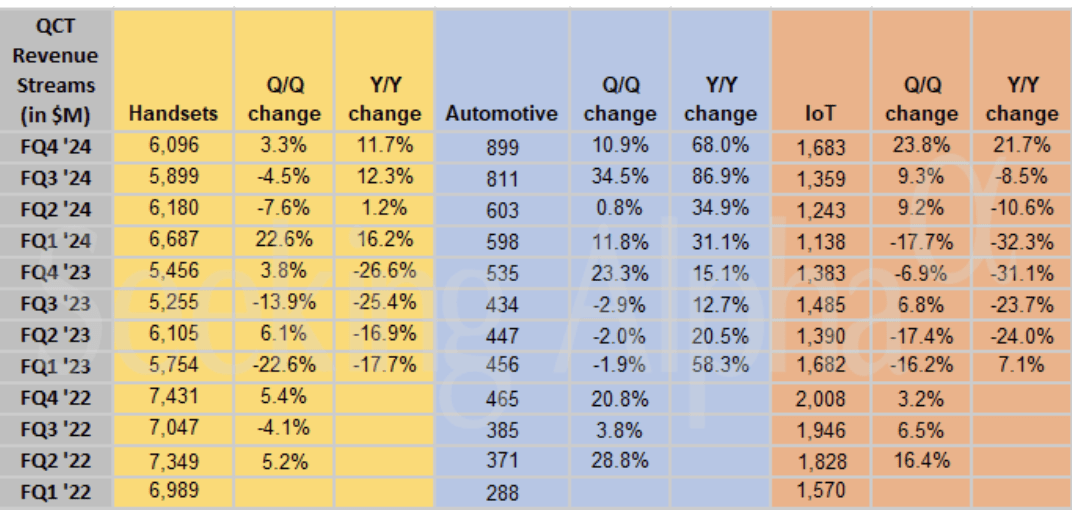

Now, let’s look at the breakdown of revenues within the QCT segment.

QCOM Revenue Breakdown (SA)

After two straight quarters of falling revenues in headsets, the company posted some growth in fiscal Q4. We also saw great growth in Automotive revenues, which some investors are excited about.

Automotive Revenues

QCOM recently announced the Snapdragon Cockpit Elite, which is powered by the Oryon CPU.

With our strongest performing compute, graphics, and AI capabilities, coupled with industry leading power efficiency and cutting edge software enablement for digital cockpits and automated driving, these new Elite Snapdragon automotive platforms address the industry’s needs for higher compute levels, empowering automakers to redefine automotive experiences for their customers.

Source: Qualcomm executive Nakul Duggal.

However, the company expects flat growth in this segment sequentially. Starting next year, we could see some acceleration as the newest Snapdragon offerings hit the market. There’s definitely a large addressable market here with Auto and IoT, but it’s still early days.

Why So Undervalued?

Interestingly, QCOM opened up over 7% after earnings but has since given up all its gains. The truth is, the stock continues to be quite undervalued compared to its peers, and there are a couple of reasons why.

Firstly, there’s the overhang from Apple, which is looking to make its own chips in-house. According to Bernstein analysts, Apple represented 22% of QCOM’s revenues in Q1 of 2024, and a large part of this income could disappear by 2026.

I think this is a pretty accelerated timeline, but ultimately, it’s a reality we have to deal with.

The other issue is that around 50% of revenues came from China in Q4. QCOM is actually doing well in China, but this could end too if the trade war intensifies, something that the new President seems to be intent on.

Is QCOM A Buy?

But is QCOM a buy at these prices? The overhang from the Apple revenues is still putting a dampener on the valuation. But in my opinion, even accounting for little growth, QCOM looks undervalued here.

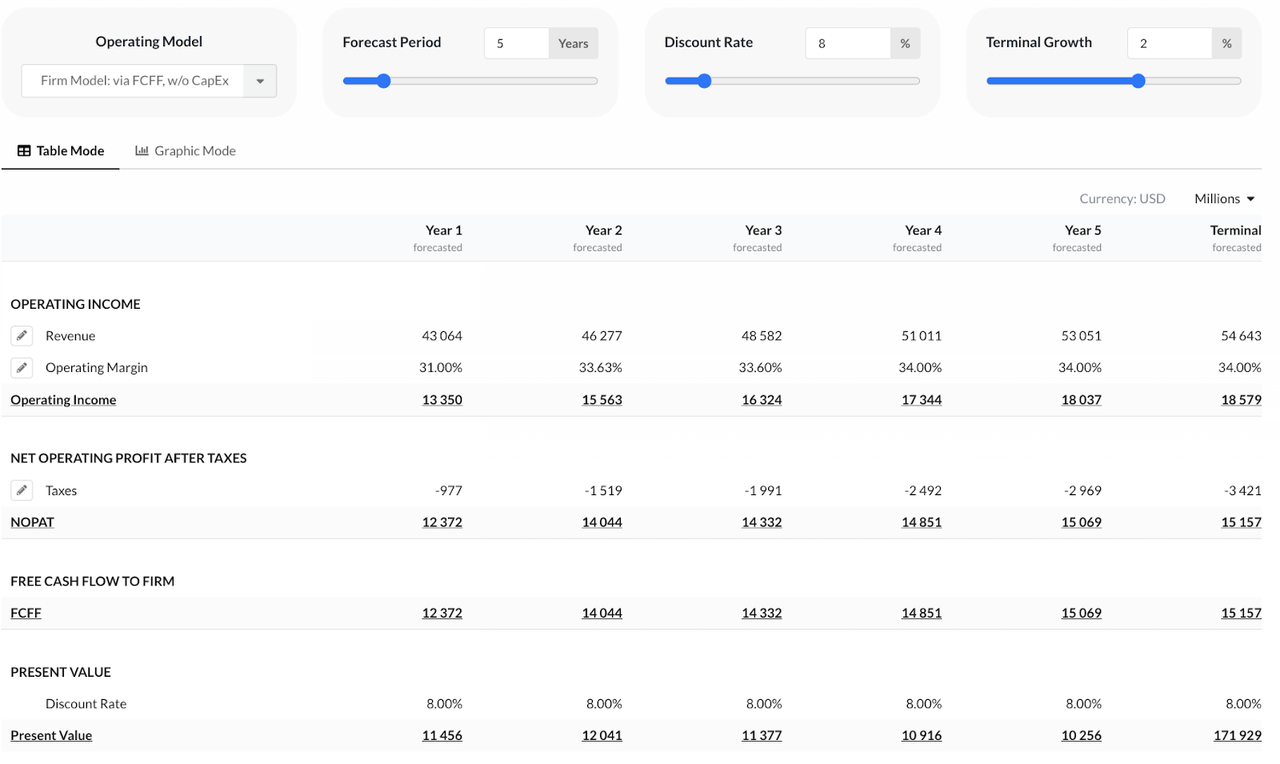

I’ve taken analyst revenue estimates over a period of five years and applied a discount rate of 8% and a terminal growth rate of 2%. Margins I’ve projected to slightly increase to 34%, which makes sense given the recent trajectory.

Using these rather conservative numbers, QCOM still seems undervalued by 16%. The Apple discount seems overdone, and plenty of investors seem to be overlooking that QCOM does have other clients, and some other meaningful avenues to increase revenues, such as the Automotive segment.

The worst is priced in, but QCOM could stage a strong rally if, for example, Apple walks back its decision on in-house chips, or if QCOM can quickly accelerate auto revenues next year.

At worst, investors are left with a profitable business in a growing industry which also makes a point of giving money back to investors.

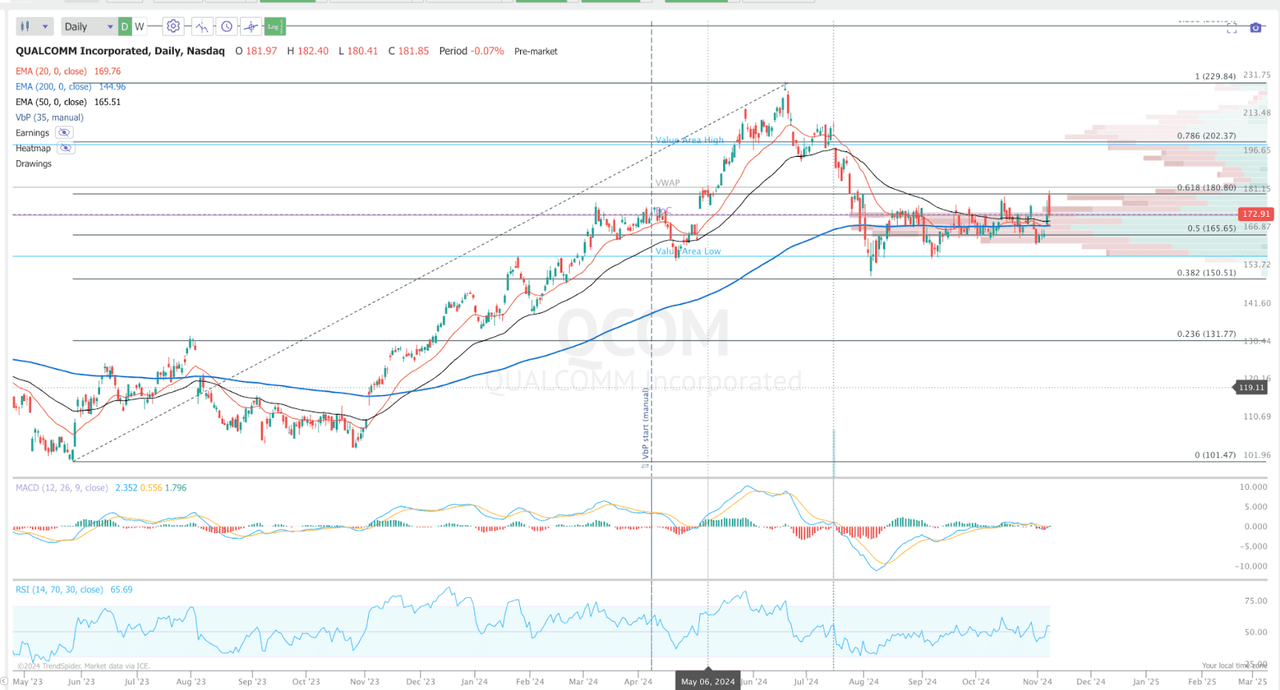

Technical Analysis

From a technical perspective, I like the fact that QCOM sold-off to the 61.8% retracement and then reversed. Since then, we’ve been range-bound, but making higher highs and lows. The MACD looks ready to flip bullish on the daily, and we are above the key EMAs.

I see the downside as limited here, with a chance for a fast move up at some point, as we don’t have much resistance from $180 to $200.

Final Thoughts

In conclusion, while Qualcomm Incorporated has some issues, I remain bullish on the stock. Perhaps not a Strong Buy anymore, but at the very least a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!