Summary:

- Qualcomm’s underperformance is due to concerns over Chinese revenue exposure, Apple’s in-house 5G modem, and a licensing dispute with Arm, overshadowing its long-term growth potential.

- Q4 results were strong, with 19% YoY revenue growth and 33% EPS growth, driven by robust demand in smartphones, automotive, and IoT segments.

- Qualcomm is well-positioned to capitalize on AI Edge growth, with Snapdragon 8 Elite outperforming Apple’s A18 and significant diversification into automotive and AI PCs.

- Despite risks, Qualcomm’s low valuation, strong profitability, and growth potential in Edge AI and automotive markets present a compelling investment opportunity with significant upside.

JHVEPhoto

Introduction

Qualcomm (NASDAQ:QCOM) shares have underperformed the market this year, shares were up 14.5% YTD, which has underperformed the S&P 500 (SPX) & the NASDAQ 100 (NDX) 23.7% substantially as of mid-November. Since the stock peaked at around $220 in June, Qualcomm has been trading at a range-bound of $160-170 since August.

The sluggish stock performance can be ascribed to several headwinds, including, first, investors’ fear of Qualcomm’s strong Chinese Revenue exposure, which might be adversely affected by a Trump 2.0 administration, alongside Apple’s in-house 5G modem development on the iPhone and the dispute with Arm over licensing agreements.

However, I believe these short-term challenges overshadowed the bigger picture. Qualcomm has been a dominant semiconductor powerhouse in the mobile chip market for years, both in manufacturing smartphone CPU processors and licensing out its valuable wireless patents, including 5G, to generate substantial cash flows for investors.

With Qualcomm actively diversifying its product portfolio across various smartphone Android devices, automotive systems for digital cockpit, ADAS solutions, and IoT, including AI PCs, industrial automation devices, and edge networking products, I believe Qualcomm remains in prime position to benefit from the Edge AI migration trend and establish itself as a connected computing solution provider as we usher in a new hardware upgrade cycle.

That said, I believe Qualcomm is a good blend of value, growth and dividends that the market is currently discounting.

Q4 Overview – Robust Profitability & Cash Flow Generation

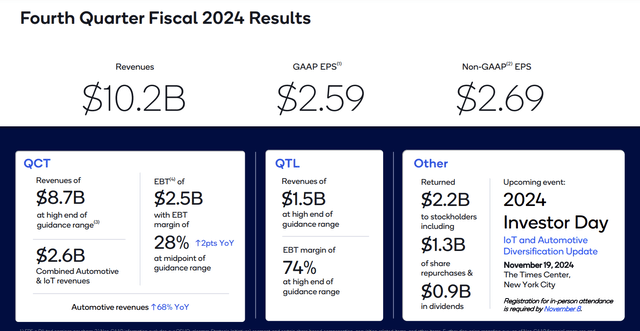

Qualcomm Q4 Earnings (Investors Presentation)

Overall, Q4 has been a fantastic quarter for Qualcomm. Revenue reached $10.2B, up 19% YoY. Non-GAAP EPS reached $2.69, up 33% YoY. For individual segments, Handsets (Smartphone) revenue reached $6.1B (12% YoY growth), Automotive reached $899M (68% YoY growth), and IoT devices hit $1.7B (22% YoY Growth), which suggests resilient demand for Snapdragon chips from high-end Android smartphone markets, Automotive companies and AI PC OEMs.

During the quarter, the management also returned around $2.2B to shareholders via $1.3B in share repurchases and $900M in dividends, underscoring management’s focus on long-term shareholder value creation.

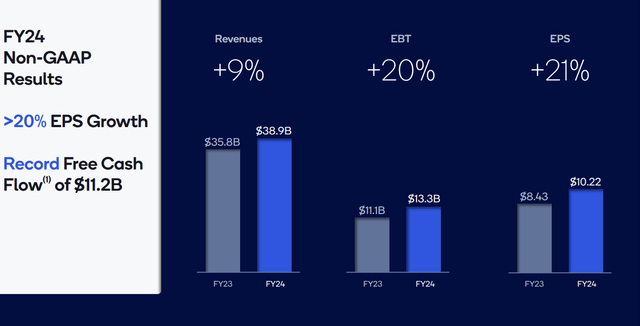

Qualcomm FY24 Financials (Investors Presentation)

From an FY24 perspective, Qualcomm delivered 9% YoY revenue growth to $38.9B and an impressive 21% EPS growth to $10.22.

For individual segments, QCT revenue reached $33.2B (up 9% YoY) and an operating margin of 28.6% (FY23: 26.0%), whereas QTL revenue reached $5.6B (up 5% YoY) and an operating margin of 71.4% (FY23: 67.9%). This was supported by more substantial operating leverage, cost controls, Snapdragon product leadership, and robust automotive segment growth (55% YoY growth) despite a challenging auto environment.

During the year, QCOM also generated an eye-watering FCF of $11.2B, with an impressive FCF yield of 6.3%, which is quite high for tech companies in my opinion. With current total debt at just $15.4B, they could simply pay off all their debt with their FCF in just over a year.

Overall, I believe that Qualcomm is a highly well-managed cash cow with a pristine balance sheet, strong profitability, and cash flow churn, which could support greater shareholder returns in the future (i.e. newly authorized share buybacks of $15B, alongside existing $1B of shares, could effectively erase 9% of shares outstanding at current price!)

The next growth trend is AI Edge – Diversification Efforts open Huge Potential for Qualcomm

Wall Street & Main Street are currently focusing on AI Data Centres development, for LLM Inferencing & Training, which has benefited first-mover companies like Nvidia and Broadcom. Nevertheless, as AI continues to diffuse across applications, I believe the next wave of growth would come from AI Edge (i.e. the hardware upgrade cycle incorporating AI Smartphones, PCs, and Software Cars), which create substantial demand for CPUs/NPUs for inferencing & computation at their local devices that would benefit Qualcomm.

As the strong pace of AI innovation continues, On-device AI provides context and enables personalization while providing privacy and security compared to cloud usage. Gen AI-enabled smartphone & PC devices and applications are evolving to understand natural language, images, sound, and billions of data & parameters, driving a new generation of AI-first experiences. This creates a new cycle of semiconductor innovation, which requires CPUs and NPUs to process billions of parameters to run AI applications on local devices. Qualcomm is well-positioned to capitalize on this opportunity across devices at the edge based on its product portfolio.

Qualcomm Snapdragon 8 Elite is beating Apple’s A18 in Performance

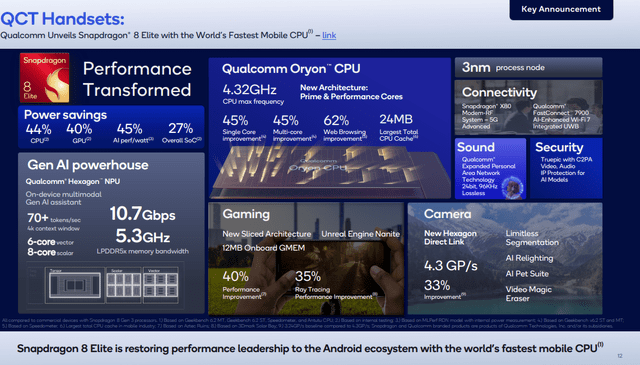

Snapdragon 8 Elite CPU (Investors Presentation)

Qualcomm has long been under Apple’s shadow since Apple launched its M4 SoC. However, the paradigm has shifted when Qualcomm recently unveiled the Snapdragon 8 Elite CPUs. These CPUs feature Qualcomm’s next-gen Oryon CPU and TSMC 3nm technology. They offer two prime cores with a peak clock speed of up to 4.32 GHz, the highest on any mobile chip, accompanied by six performance cores at 3.53 GHz.

The CPU offers up to 45% performance improvement and 44% power savings compared to the previous Snapdragon 8 Gen 3 series, which can seamlessly handle the complexities of multi-modal Gen AI while prioritizing privacy.

I think the new Snapdragon 8 Elite Chip will seriously challenge Apple’s M4 chip dominance. It offers 2 more cores than the A18 Pro and performs 33% better in frames per second (40.68FPS vs. 30.6FPS).

The CPU advancement is bearing fruits. Leading OEMs and smartphone brands, including Chinese OEMs Xiaomi, Honor, Oppo, and Vivo, have seen successful launches of the Snapdragon 8 Elite CPU, and additional launches of Samsung S25 series and ASUS are expected next year as well. I expect Qualcomm to harness around 15% growth next year from its mobile devices, as represented through Qualcomm’s expectations for 40% growth y/y with Chinese smartphone OEMs in F1Q25, despite the loss of Huawei revenue.

Overall, Qualcomm remains extremely well-positioned to compete against MediaTek and Apple in the mobile chip segment, which is expected to grow at double-digits thanks to the growth of AI smartphones and premium android smartphone markets.

Qualcomm Snapdragon Diversification Efforts to Automotive & PCs are Bearing Dividends & Creating Synergies

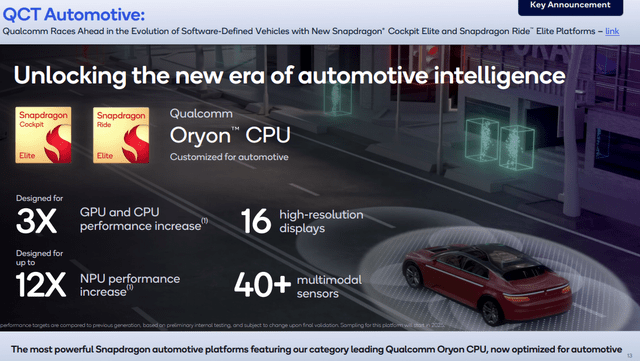

Snapdragon Cockpit Elite (Investors Presentation)

Aside from its mobile chip revenue, I think another growth catalyst for Qualcomm in the future would be from its automotive segment, which has seen revenue surging 55% YoY to around $2.9 billion in FY24 (FY23: $1.8 billion), despite cyclical downturn of the automotive segment this year. This is primarily due to the launch of the Snapdragon Cockpit and Drive Elite Platform, which features Oryon CPU and NPUs, used for current and future advanced navigation with 3D mapping, advanced driving assistance system (ADAS) and integration of Gen AI experience in software cars.

With future development of robotaxi and software cars, the global ADAS market size is projected to grow from 334 million units in 2024 to 655 million units by 2030 at a CAGR of 11.9%, driven by increasing demand for autonomous vehicles, which requires sensors, LiDAR and Radar applications, thus creating substantial demand for ADAS systems, which requires advanced CPUs/NPUs to quickly processes real-time street & traffic data, which, I believe, would benefit Qualcomm substantially.

Qualcomm has entered partnerships with various car manufacturers, including Li Auto, Great Wall Motor, BMW, and Mercedes-Benz, to adopt Snapdragon Elite automotive platforms for their future software-defined vehicles. I believe that Qualcomm is leading the race in the automotive platform industry, which is now taking up 67% of the market share, far outpacing competitors like Nvidia and Intel.

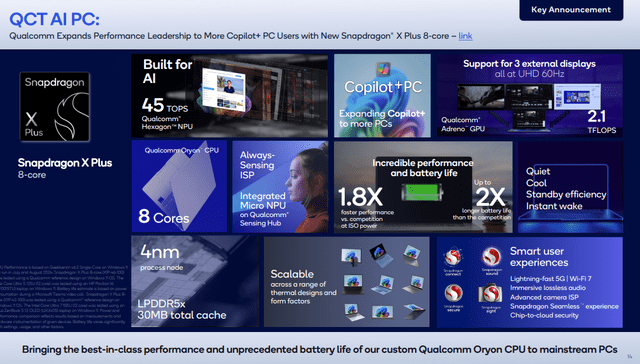

Snapdragon X Elite for AI PC (Investors Presentation)

Finally, as a newcomer to the AI PC market, I think Qualcomm is seriously challenging AMD and Intel’s traditional duopoly in the PC market. Since May, Qualcomm launched its Snapdragon X Elite / X Plus on PCs, which offers 8 cores CPUs and around 45 TOPS (Trillion of Operations per second) on NPUs and can be used to power Microsoft CoPilot PC+ (requiring a minimum of 40+ TOPS). This supports Arm-based architecture on Windows, compared to AMD & Intel’s x86.

While Qualcomm’s Snapdragon X Elite (45 TOPS) is lagging both Intel Lunar Lake (48 TOPS for NPUs) and AMD Ryzen AI 9000 (Peak 50 TOPS) in terms of performance capabilities, Snapdragon is still seeing pervasive adoption among its AI OEM customers, including Microsoft Surface Pro, Dell XPS series, Lenovo, Asus and HP etc. Since the launch in May, the number of Snapdragon platforms has nearly tripled 3x, from 20 to 58 platforms as of Nov 2024.

Qualcomm is introducing its latest Snapdragon X Plus, targeting AI PCs with price points below $700. This opens more opportunities and possibilities for the adoption of AI PCs, which has already gained the significant attraction of different OEMs.

According to Canalys, AI-capable PC shipments are projected to surpass 100 million in 2025, accounting for 40% of all PC shipments. In 2028, shipments will reach 205 million AI-capable PCs, representing a staggering CAGR of 44% between 2024 and 2028. I think this creates a substantial market for Qualcomm to harness over the next few years as we approach the new AI PC upcycle again.

On balance, leveraging multiple growth tailwinds, including AI PC adoption, software cars development with ADAS capabilities, collaboration with META on the development of XR/AR devices (Ray-Ban Meta Glasses), alongside Qualcomm’s resurgence in technological leadership in the Android smartphone market, I trust Qualcomm management’s execution capabilities. I think Mr Market is now sleeping on Qualcomm by deeply discounting Qualcomm’s future growth potential.

Risks To Thesis

Right now, the market is hating Qualcomm due to the following reasons: 1) Mr Market is worried about Qualcomm losing its legal litigation with Arm, 2) Investors are worried about Apple’s substitution of Qualcomm on 5G Modem, and 3) Qualcomm’s heavy revenue exposure to Chinese OEMs, which are prone to Trump’s 2.0 Administration.

However, I believe that these fears are excessively exaggerated by investors, here’s why.

Arm license dispute

Arm has now issued a 60-day notice informing Qualcomm that it will cancel its license to use Arm’s chip architecture should Qualcomm fail to raise its license payment fees to Arm before the December litigation trial.

The story happened when Qualcomm acquired Nuvia in 2021 when the latter initially had licensed agreements with Arm. Qualcomm argued the right to incorporate Nuvia’s Arm-based CPU architecture designs into Qualcomm’s. Still, Arm believes that Qualcomm does not possess the right to utilize Arm chip IPs without their consent. Subsequently, Arm demanded the renegotiation of the contract, which would effectively double the licensing fees Qualcomm is currently paying to Arm by billions.

However, I believe that Qualcomm stands a higher chance of winning the litigation next month, as I believe that:

1) There is no point in Qualcomm double paying for the exact licensing services to Arm

2) Should Arm win the litigation, Qualcomm would have to pull off its Nuvia CPU architectural designs, which would be a double loss for both Arm & Qualcomm as OEMs would likely shift back their focus on x86 (i.e. AMD/Intel)

3) Qualcomm has a strong legal team and a historical track record of winning licensing disputes with Apple, and management is confident about doing so again in the latest Q4 earnings call.

Furthermore, Qualcomm is gradually reducing its reliance on Arm. Unlike the previous generation Qualcomm mobile chip, the Snapdragon 8 Gen 3, which used ARM’s custom Cortex cores, all six CPU cores on the Snapdragon 8 Elite are designed using Qualcomm’s custom second-generation propriety Oryon CPU architecture.

Overall, should Qualcomm settle the dispute with Arm after Dec 16, I think Qualcomm’s valuation multiple could re-rate to a higher level.

Apple 5G Modem Concerns

Another concern for Qualcomm is that QCOM is currently building modem chips for Apple (AAPL) on its iPhones. However, starting from FY26-28, Apple’s move to develop its 5G modem would substantially blow QCOM’s future revenue.

However, Apple’s modem project has suffered numerous setbacks over the past few years. There have been problems with performance and overheating, and Apple has been forced to push back the modem’s debut. The rollout is expected to take place gradually, taking a few years to complete. In a sign of this slow transition, Apple extended its supplier agreement with Qualcomm through March 2027.

By 2027, I believe Qualcomm would have already established significant diversified revenue generation capabilities from its Android OEM smartphone customers, AI PC OEM customers, and automotive customers, which would have a limited impact on the overall revenue contribution to QCOM for Apple’s termination of the contract.

China Chip Ban

Another concern is that China remains Qualcomm’s largest market, and new smartphone releases from brands like Xiaomi, Oppo, and Vivo drive the company’s recent momentum. As of Q424, Qualcomm derived 46% of its revenue in its most recent fiscal year from customers with headquarters in China, which would be vulnerable to any chip bans by the White House or Trump’s plans to impose a 60% tariff on Chinese goods.

However, QCOM CEO Cristiano Amon seems to be playing down concerns about the impact of US-China tensions on the chip business. Amon said that his company’s and other companies’ connections with their Chinese counterparts could serve as a stabilizing factor in the US-China relationship.

Valuation

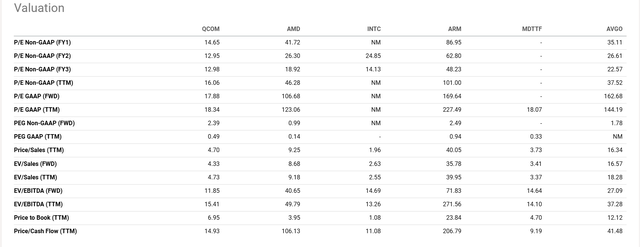

QCOM Multiple Valuation (Investors Presentation)

Right now, these risks have been baked into Qualcomm’s share price, causing QCOM to be traded at a forward FY26 P/E of just 12.95x as of mid-November, which is significantly lower than counterparts like AMD (26.3x) and Intel (24.8x), and MediaTek (around 17-18x), suggesting huge re-rating potential.

The average consensus EPS for QCOM in 2025/26 is around $11.2/$12.4, which suggests QCOM is only expected to grow its EPS by just 10% CAGR for the next 2 years. I think this is an understatement, considering QCOM’s strong growth potential, driven by Edge AI Smartphones/PCs and ADAS adoption. I personally think QCOM could at least propel an EPS CAGR of around 15%, thanks to its additional boost from the share buyback program.

Should QCOM be re-rated to a forward FY26 P/E of around 18x, which, I think, is a fair multiple, this would imply a target price of around $220/share, leaving a potential over 35% upside over the next few years that could potentially outperform the market.

The forward dividend yield of around 2% also provides more room for future dividend hikes, given Qualcomm’s robust free cash flow generation capabilities.

Conclusion

Overall, I think Qualcomm offers an asymmetrical return-to-risk opportunity. Given its low valuation multiple, the downside risk should be floored, whereas further upside could be supported by QCOM’s diversification into Edge AI solutions for smartphones, PCs, Automotive, and IoT devices, alongside Snapdragon’s product leadership.

Furthermore, Qualcomm’s future accelerated revenue growth, strong profitability, clean balance sheet, robust free cash flow generation, and relatively attractive valuation make it a quality value stock for investors.

Right now, I am planning to build a small position in Qualcomm for my portfolio, and I won’t mind, under any circumstances, adding more shares should Qualcomm continue to drop, which I think offers a better value play than Intel, AMD and Broadcom at current moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.