Summary:

- I reiterate a ‘Sell’ rating on Qualcomm, citing concerns over Apple’s potential shift to in-house 5G modems, impacting Qualcomm’s future growth.

- Despite Qualcomm’s strong Q4 results and new $15 billion stock repurchase authorization, the risk from Apple’s modem development remains significant.

- Qualcomm’s Snapdragon 8 Elite and AI PC market growth offer potential upside, but I believe Apple’s transition could reduce Qualcomm’s revenue by 3% from FY26 to FY28.

- My DCF model calculates Qualcomm’s fair value at $160 per share, reflecting the potential risks and growth opportunities.

JHVEPhoto

I reiterated my ‘Sell’ rating on QUALCOMM Incorporated (NASDAQ:QCOM) in August 2024, arguing that AI PC and Handsets are unlikely to secure the company’s future. Qualcomm delivered a strong Q4 result with a new $15.0 billion stock repurchase authorization, beating the market expectations. I continue to worry about the potential rollout of Apple’s in-house 5G modem. I reiterate a ‘Sell’ rating with a fair value of $160 per share.

Apple’s First 5G Modem Could Come Soon

As reported by 9to5Mac, the iPhone SE 4 is likely to debut in early 2025, featuring Apple Inc.’s (AAPL) first in-house designed 5G modem, potentially replacing Qualcomm’s chip. The media noted that the new modem, code-named “Centauri”, will drastically reduce battery consumption, particularly in Low Power Mode on the iPhone.

In addition, TF International Securities analyst Ming-Chi Kuo posted a blog on X estimating that Apple’s in-house 5G chip shipments will reach 35-40 million units in 2025, 90-110 million in 2026, and 160-180 million in 2027.

As discussed in my previous articles, Qualcomm’s biggest risk lies in their reliance on Apple, with around 20% of revenue exposure. If Apple begins adopting in-house modem chips, Qualcomm is likely to face structure growth challenges in the near future.

Q4 Results, Valuation

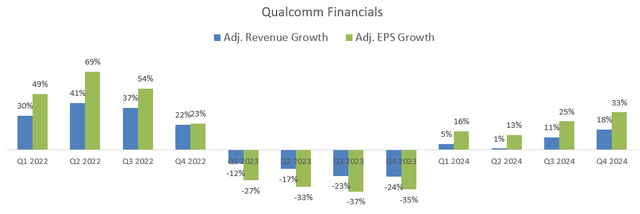

Qualcomm reported its Q4 result on November 6th after the market closed, delivering 18% adjusted revenue growth and 33% adjusted EPS growth, with a new $15.0 billion stock repurchase authorization. It was quite a strong quarter, beating the market expectations. As shown in the chart below, Qualcomm has experienced a strong business recovery over the past four quarters.

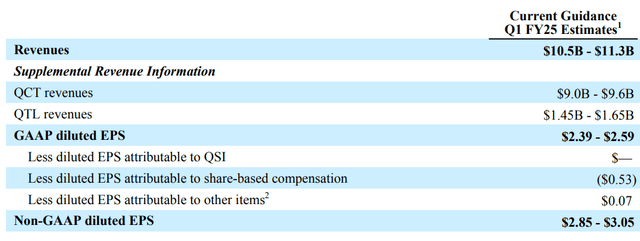

Qualcomm is guiding for $10.5-$11.3 billion in revenue for Q1 FY25, representing around 10% year-over-year growth at the mid-point. I think the key takeaway from the earnings is the management’s strong confidence in their Snapdragon platforms, and the strong guidance implies the industry-wide adoption of their Snapdragon platforms and technologies.

While Apple is developing its own 5G modem chip, it is unclear when the company will broadly implement these chips across its product lines. In addition, even if Apple uses their own modem chip in the iPhone SE 4, I think this move is experimental and the widespread adoption and production might take years. I estimate that Qualcomm’s revenue growth will be impacted by 3% from FY26 to FY28, caused by Apple’s replacement, with the following assumptions:

- Apple represents around 20% of Qualcomm’s revenue.

- From FY26 to FY28, Apple will gradually replace Qualcomm’s 5G modem with an in-house product. I assume Apple will replace 15% of chips each year, leading to an estimated revenue loss of $1 billion + per year from Apple.

In October 2024, Qualcomm unveiled its Snapdragon 8 Elite featuring the world’s leading mobile CPU, aimed at capturing the rapid growth in on-device generative AI. As indicated in the release, leading OEMs and smartphone brands, including ASUS, Honor, iQOO, Motorola, Nubia, OnePlus, OPPO, RedMagic, Redmi, Realme, Samsung, Vivo, Xiaomi, and ZTE, are poised to launch devices powered by Snapdragon 8 Elite. It is evident that Snapdragon 8 Elite will continue to drive Qualcomm’s growth in the coming years.

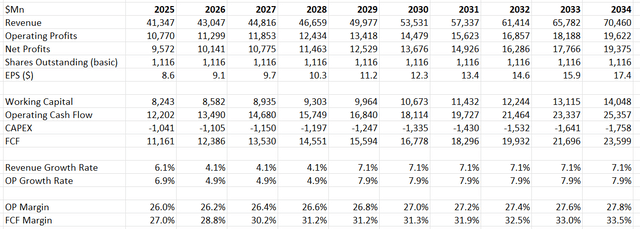

Considering these factors, I continue to forecast Qualcomm’s normalized revenue growth to be around 6%; though its growth will be impacted by Apple from FY26 to FY28 in my view. The 6% of normalized growth comprises 4% growth from the traditional PC and handset chips market, aligned with the mobile device market growth, and an additional 2% growth from new demands from AI, cloud, and data centers.

In addition, I assume the company will allocate 6% of revenue towards M&A, contributing an additional 110bps to the revenue growth.

I forecast a 20bps margin expansion driven by 10bps expansion from Snapdragon 8 Elite adoptions, 10bps from R&D operating leverage, and a reduction in SG&A expenses. I calculate that the total operating expenses will grow by 3.8% from FY26 to FY28 and by 6.8% from FY29 onwards. A higher revenue mix toward Snapdragon 8 could potentially decrease the company’s wafer cost per chip, leading to gross margin expansion.

I have revised the WACC to 11% assuming: a risk-free rate of 3.8%; a beta of 1.72; an equity risk premium of 7%; a cost of debt of 5%; an equity of $21.5 billion; a debt of $15.3 billion; and tax rate of 14%. The DCF can be summarized as follows:

Discounting all the future free cash flow, the fair value is calculated to be $160 per share, according to my DCF model.

Upside Risks

As I reiterate a ‘Sell’ on Qualcomm, I am considering the potential upside catalysts for the company.

Copilot+ PCs, powered exclusively by Snapdragon X Series platforms, have been wildly adopted by consumers. Major industry players, including Microsoft Corporation (MSFT), Dell Technologies Inc. (DELL), HP Inc. (HPQ), Lenovo, Acer, Asus, and Samsung Electronics Co., Ltd. (OTCPK:SSNLF), are promoting Copilot+ PCs to capture the rapid growth in the AI PC market. As noted during the earnings call, Qualcomm expects strong growth driven by the industry-wide transition to Windows 11 and Copilot+ PCs. Qualcomm projects 50% of computers sold will be AI PCs by 2027. The rapid growth in the AI PCs could potentially bolster Qualcomm’s earnings growth in the future.

Conclusion

I remain concerned about Apple’s potential transition to in-house 5G modems, which could pose significant growth challenges for Qualcomm. The stock price has not fully incorporated the potential risk of losing Apple as a customer, in my view. I reiterate a ‘Sell’ rating with a fair value of $160 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.